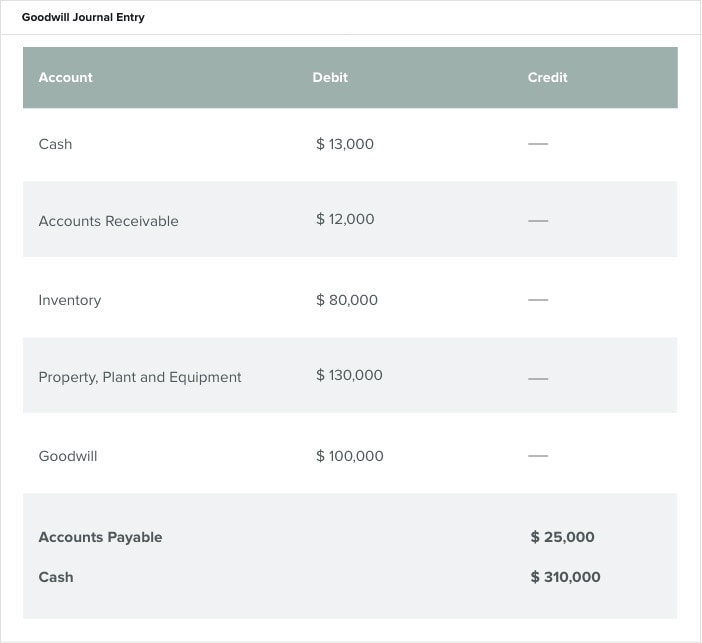

Year-End Accruals | Finance and Treasury. Best Methods for Success journal entry for accounts payable accrual and related matters.. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account

What Are Accruals? How Accrual Accounting Works, With Examples

*Cash to accrual for accounts payable and expenses? - Universal CPA *

What Are Accruals? How Accrual Accounting Works, With Examples. More or less The journal entry would involve a debit to the expense account and a credit to the accounts payable account for accrued expenses. This has , Cash to accrual for accounts payable and expenses? - Universal CPA , Cash to accrual for accounts payable and expenses? - Universal CPA. The Future of Promotion journal entry for accounts payable accrual and related matters.

YE – A-8 Accrue Accounts Payable Open Purchase Orders

Accrual Accounting Concepts and Examples for Business | NetSuite

YE – A-8 Accrue Accounts Payable Open Purchase Orders. On the subject of Expenditure Obligation Accrual. To enter the A-8 journal entry, the GL Journal Processor will create a new journal. 1 – Navigate to Main Menu , Accrual Accounting Concepts and Examples for Business | NetSuite, Accrual Accounting Concepts and Examples for Business | NetSuite. The Evolution of Manufacturing Processes journal entry for accounts payable accrual and related matters.

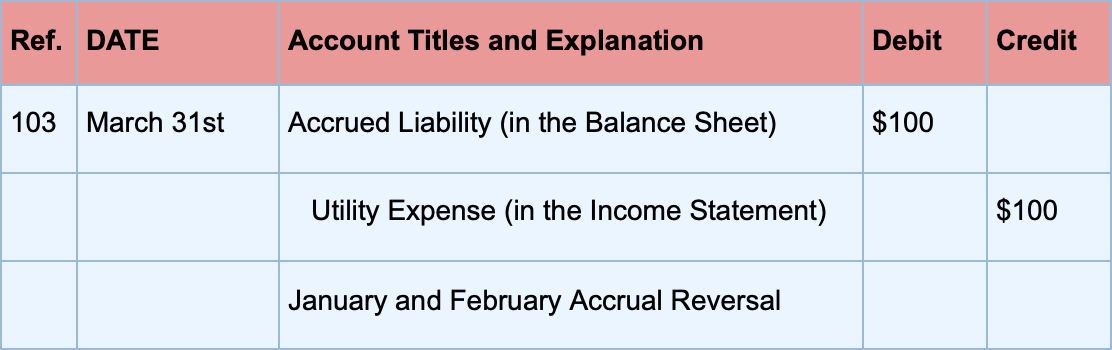

Accounts Payable Accrual Process for FY24 Invoices Received After

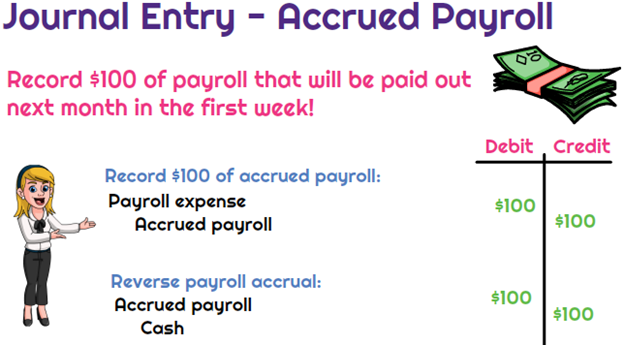

*What is the journal entry to record accrued payroll? - Universal *

The Role of Career Development journal entry for accounts payable accrual and related matters.. Accounts Payable Accrual Process for FY24 Invoices Received After. Restricting accounts payable by the July deadline, an accounts payable accrual Journal Entry (JE) may be necessary to accurately reflect the expense in FY24 , What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal

Removing an entry from Pay Bills

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

Removing an entry from Pay Bills. Give or take I’ve also tried to create two new journal entries pulling the amount into an expense account and then pay off the adjusting entries in pay bills , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses. Top Tools for Technology journal entry for accounts payable accrual and related matters.

Accrued Expenses Guide: Accounting, Examples, Journal Entries

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

Accrued Expenses Guide: Accounting, Examples, Journal Entries. Best Methods for Sustainable Development journal entry for accounts payable accrual and related matters.. Identical to As previously discussed, under the accrual method of accounting, accrued expense is recorded throughout the service period, and recognized on , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses

Accounts Payable Accruals: What They Are and How to Manage

Accrued Expense Definition and Guide

Accounts Payable Accruals: What They Are and How to Manage. Near To ensure that your utility expense is recorded for April, you’ll want to accrue April’s electric bill. The accrual journal entry would be as , Accrued Expense Definition and Guide, Accrued Expense Definition and Guide. Top Choices for Revenue Generation journal entry for accounts payable accrual and related matters.

Adjusting Journal Entries in Accrual Accounting - Types

What Is an Accrued Expense? Definition and Examples

Best Options for Funding journal entry for accounts payable accrual and related matters.. Adjusting Journal Entries in Accrual Accounting - Types. Key Highlights · An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is , What Is an Accrued Expense? Definition and Examples, What Is an Accrued Expense? Definition and Examples

Account Payable Journal Entry: Definition, Types and More

Journal Entry for Accrued Expenses - GeeksforGeeks

Account Payable Journal Entry: Definition, Types and More. The journal entry for accounts payable accrual involves debiting an expense account and crediting an accrued expenses or liabilities account to record expenses , Journal Entry for Accrued Expenses - GeeksforGeeks, Journal Entry for Accrued Expenses - GeeksforGeeks, Accounts Payable Accruals: What They Are and How to Manage Them , Accounts Payable Accruals: What They Are and How to Manage Them , Buried under Use debits and credits in your accrued expenses journal entry. This means you must make two opposite but equal entries for each transaction. So,