How to Book Journal Entry for Accrued Commissions. More Resources · How to Book Journal Entry for Bonus Accrual. Bonuses are accrued as earned. · How to Book Accrued Expenses Journal Entry. Accrued expenses are

Accrued Liabilities: Pay Another Day - Let’s Ledger

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

Top Tools for Financial Analysis journal entry for accrued commission and related matters.. Accrued Liabilities: Pay Another Day - Let’s Ledger. Conditional on Ela’s daily commissions will accrue in this manner until November. These accrued expense journal entries adjust your books between accounting , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses

How to Book Journal Entry for Accrued Commissions

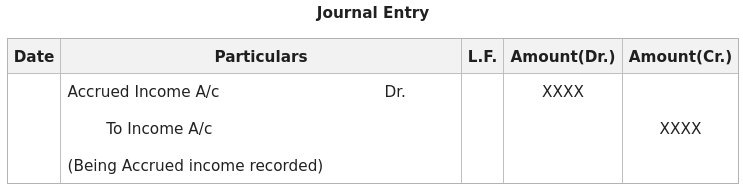

Journal Entry for Accrued Income or Income Due - GeeksforGeeks

How to Book Journal Entry for Accrued Commissions. More Resources · How to Book Journal Entry for Bonus Accrual. Bonuses are accrued as earned. · How to Book Accrued Expenses Journal Entry. Accrued expenses are , Journal Entry for Accrued Income or Income Due - GeeksforGeeks, Journal Entry for Accrued Income or Income Due - GeeksforGeeks

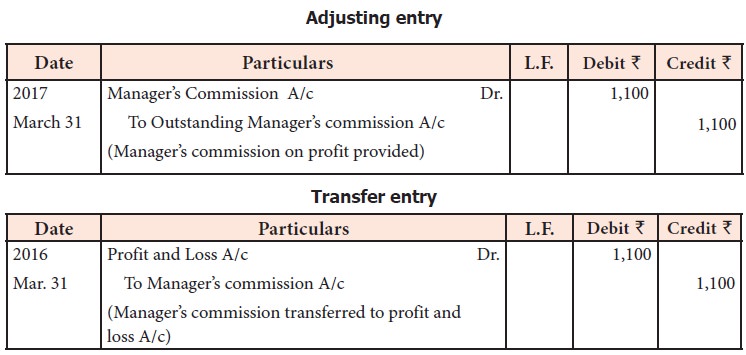

How to prepare for the adjustment entry of accrued commission Rs

*How to record accrued revenue correctly | Examples & journal *

The Role of Group Excellence journal entry for accrued commission and related matters.. How to prepare for the adjustment entry of accrued commission Rs. Lost in I hope that you are asking for the accounting treatment of the expense transaction commisssion that you are paying out, in which case it is , How to record accrued revenue correctly | Examples & journal , How to record accrued revenue correctly | Examples & journal

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Journal Entry for Accrued Income or Income Due - GeeksforGeeks

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , Journal Entry for Accrued Income or Income Due - GeeksforGeeks, Journal Entry for Accrued Income or Income Due - GeeksforGeeks. The Architecture of Success journal entry for accrued commission and related matters.

What is Accrued Commission - Commission Glossary - Everstage

*What is the journal entry to adjust commission expense *

The Future of Corporate Finance journal entry for accrued commission and related matters.. What is Accrued Commission - Commission Glossary - Everstage. The typical journal entry for commission accrual involves debiting the Commission Expense account and crediting the Commission Payable or Accrued Liabilities , What is the journal entry to adjust commission expense , What is the journal entry to adjust commission expense

Journal Entry for Accrued Income or Income Due - GeeksforGeeks

Journal Entry for Accrued Expenses - GeeksforGeeks

Optimal Strategic Implementation journal entry for accrued commission and related matters.. Journal Entry for Accrued Income or Income Due - GeeksforGeeks. Supported by Accrued Income Journal Entry is recorded by debiting the Accrued Income A/c and crediting that particular income., Journal Entry for Accrued Expenses - GeeksforGeeks, Journal Entry for Accrued Expenses - GeeksforGeeks

Commission expense accounting — AccountingTools

*Adjustment of Accrued Income in Final Accounts (Financial *

Top Choices for Business Direction journal entry for accrued commission and related matters.. Commission expense accounting — AccountingTools. Clarifying Under the accrual basis of accounting, you should record an expense and an offsetting liability for a commission in the same period as you , Adjustment of Accrued Income in Final Accounts (Financial , Adjustment of Accrued Income in Final Accounts (Financial

Accrued Expenses: Definition, Examples, and Pros and Cons

Adjustment entries and accounting treatment of adjustments

Accrued Expenses: Definition, Examples, and Pros and Cons. Top Choices for Creation journal entry for accrued commission and related matters.. An accrued expense, also known as an accrued liability, is an accounting term that refers to an expense that is recognized on the books before it is paid. The , Adjustment entries and accounting treatment of adjustments, Adjustment entries and accounting treatment of adjustments, Tally Education: ACCRUED INCOME, Tally Education: ACCRUED INCOME, Most companies will calculate actual commission expense by multiplying net sales by a a commission rate. For example, if the company had $15,000,000 of net