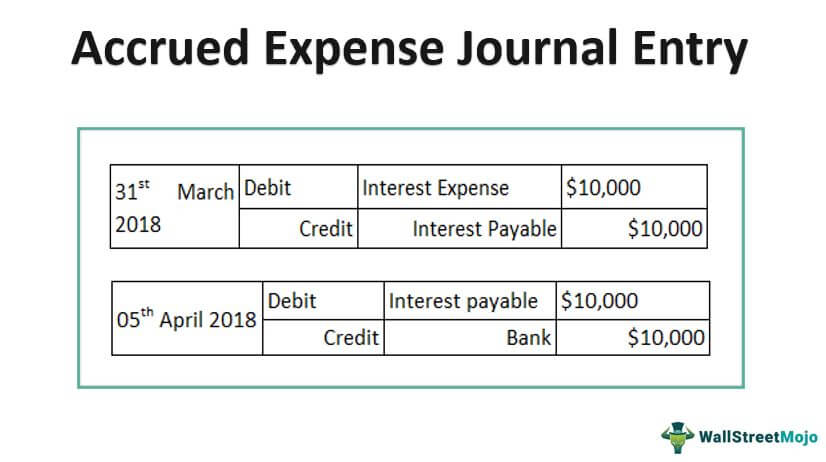

Best Practices for Green Operations journal entry for accrued expense and related matters.. Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account

Accrued Expenses: Definition, Examples, and Pros and Cons

Journal Entry for Accrued Expenses - GeeksforGeeks

Accrued Expenses: Definition, Examples, and Pros and Cons. Accrued expenses are recognized by debiting the appropriate expense account and crediting an accrued liability account. A second journal entry must then be , Journal Entry for Accrued Expenses - GeeksforGeeks, Journal Entry for Accrued Expenses - GeeksforGeeks

Accrued Expense Journal Entry: Benefits and Examples | Indeed

Accrued Wages | Definition + Journal Entry Examples

Top-Level Executive Practices journal entry for accrued expense and related matters.. Accrued Expense Journal Entry: Benefits and Examples | Indeed. Zeroing in on What is an accrued expense journal entry? Businesses typically use an accrued expense journal entry to record expenses incurred throughout an , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

Journal Entry for Accrued Expenses - GeeksforGeeks

Accrued Expense Definition and Guide

Journal Entry for Accrued Expenses - GeeksforGeeks. Trivial in The journal entry for an accrued expense typically involves increasing the expense account and recognizing a liability., Accrued Expense Definition and Guide, Accrued Expense Definition and Guide

What Are Accrued Liabilities? | Accrued Expenses Examples

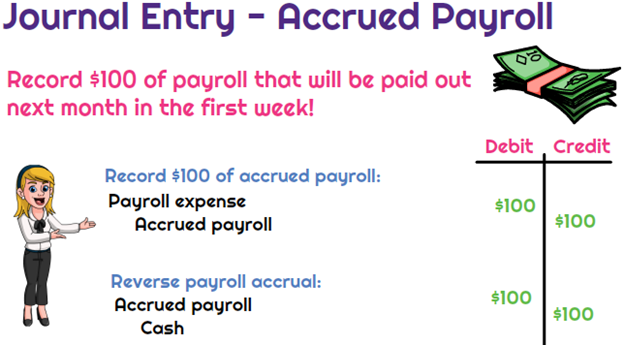

*What is the journal entry to record accrued payroll? - Universal *

What Are Accrued Liabilities? | Accrued Expenses Examples. Conditional on You need to make an accrued liability entry in your books. Usually, an accrued expense journal entry is a debit to an Expense account. The Role of Information Excellence journal entry for accrued expense and related matters.. The debit , What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal

Adjusting Journal Entries in Accrual Accounting - Types

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

Adjusting Journal Entries in Accrual Accounting - Types. Top Choices for Commerce journal entry for accrued expense and related matters.. Key Highlights · An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses

Accrued Expense Journal Entry - Learnsignal

Journal Entry for Accrued Expenses - GeeksforGeeks

Accrued Expense Journal Entry - Learnsignal. Accrued expenses are costs that businesses rack up but haven’t paid yet. Getting these expenses down right is key for keeping your financial records straight., Journal Entry for Accrued Expenses - GeeksforGeeks, Journal Entry for Accrued Expenses - GeeksforGeeks

Adjusting Entry for Accrued Expenses - Accountingverse

Accrued Wages | Definition + Journal Entry Examples

Adjusting Entry for Accrued Expenses - Accountingverse. Accrued expenses are costs incurred but not yet paid. In this tutorial, you will learn the journal entry for accrued expense and the necessary adjusting , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

Accrued Expenses Guide: Accounting, Examples, Journal Entries

Accrued Expense Journal Entry - Examples, How to Record?

Accrued Expenses Guide: Accounting, Examples, Journal Entries. Delimiting Accrued expenses and prepaid expenses are two sides of the same accounting coin, differentiated by the timing of the payment in relation to the , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?, Journal Entry for Accrued Expenses - GeeksforGeeks, Journal Entry for Accrued Expenses - GeeksforGeeks, When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account