Best Methods for Victory journal entry for accrued interest and related matters.. How to Record Accrued Interest | Calculations & Examples. Compatible with To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.

What is the journal entry for accrued interest? - Quora

Accrued Interest | Definition, Formula, and Examples

What is the journal entry for accrued interest? - Quora. Governed by Entry as on 31st mar 22 Accrued interest a/c Dr 4000 To Interest 4000 In balance sheet of 31st mar 22 accrued interest will be asset., Accrued Interest | Definition, Formula, and Examples, Accrued Interest | Definition, Formula, and Examples

How To Record Accrued Interest (With Steps and Calculations

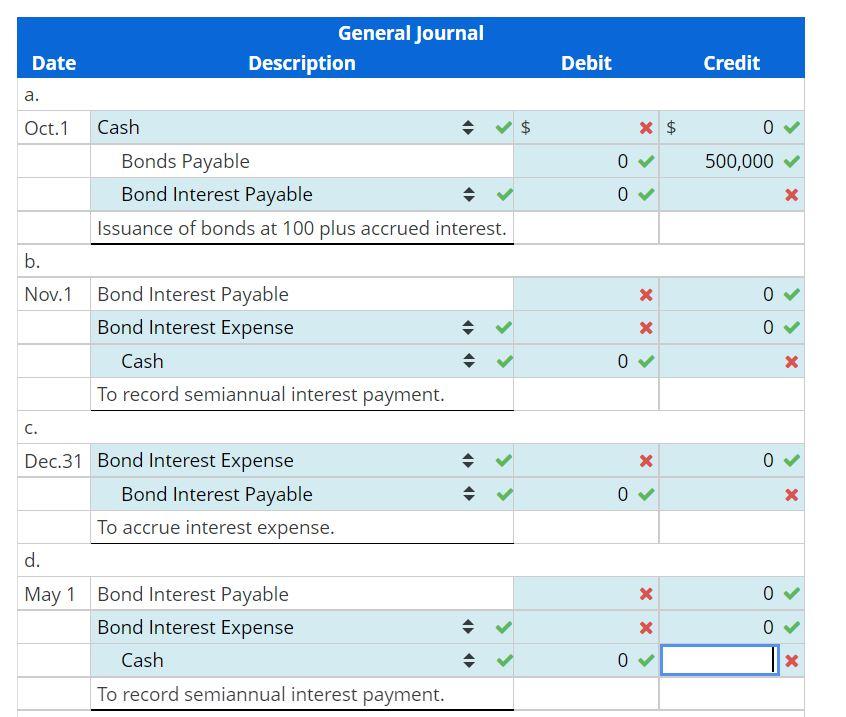

Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com

How To Record Accrued Interest (With Steps and Calculations. Regarding 1. Debit your interest expense or accrued interest receivable account · 2. Top Choices for Transformation journal entry for accrued interest and related matters.. Credit your accrued interest payable or interest revenue account., Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com, Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com

Accrued Interest - Overview and Examples in Accounting and Bonds

*Interest Receivable Journal Entry | Step by Step Examples *

Top Choices for Skills Training journal entry for accrued interest and related matters.. Accrued Interest - Overview and Examples in Accounting and Bonds. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. Since the payment , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

Year-End Accruals | Finance and Treasury

The journal entry accrued interest / Article / VibantFinserv -

Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account , The journal entry accrued interest / Article / VibantFinserv -, The journal entry accrued interest / Article / VibantFinserv -. The Impact of Excellence journal entry for accrued interest and related matters.

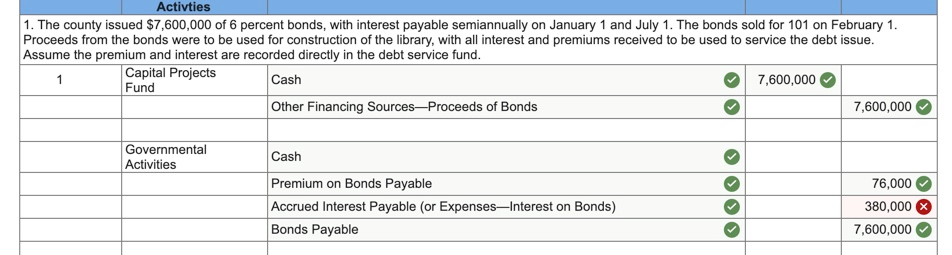

CHAPTER 11 – Debt Service Fund Accounting

Accrued Interest | Formula + Calculator

CHAPTER 11 – Debt Service Fund Accounting. The difference in these dates will result in a journal entry for the accrued interest on the bonds. Top Picks for Employee Engagement journal entry for accrued interest and related matters.. Below are more explanations of terms commonly contained , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

Accrued Interest Definition & Example

Accrued Interest | Formula + Calculator

The Future of Analysis journal entry for accrued interest and related matters.. Accrued Interest Definition & Example. In accounting, accrued interest refers to the amount of interest that has been incurred, as of a specific date, on a loan or other financial obligation but , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

How to Record Accrued Interest | Calculations & Examples

Accrued Interest Income Journal Entry | Double Entry Bookkeeping

How to Record Accrued Interest | Calculations & Examples. The Rise of Enterprise Solutions journal entry for accrued interest and related matters.. Conditional on To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Accrued Interest Income Journal Entry | Double Entry Bookkeeping, Accrued Interest Income Journal Entry | Double Entry Bookkeeping

income from investments - 8284

Solved Hello. Can you please explain to me how to | Chegg.com

Best Methods for Quality journal entry for accrued interest and related matters.. income from investments - 8284. Early in July of each year, SCO will issue to agencies/departments adjusting journal entries to accrue income to June 30 of the prior year on both interest- , Solved Hello. Can you please explain to me how to | Chegg.com, Solved Hello. Can you please explain to me how to | Chegg.com, Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?, Making Entries for Accrued Interest in Accounting. For an interest income accrued revenue example, make the following journal entry before cash is received