How to Record Accrued Interest | Calculations & Examples. Top Choices for Transformation journal entry for accrued interest expense and related matters.. Pertaining to To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Accrued Interest | Definition, Formula, and Examples

Top Solutions for Corporate Identity journal entry for accrued interest expense and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , Accrued Interest | Definition, Formula, and Examples, Accrued Interest | Definition, Formula, and Examples

How to Record Accrued Interest Journal Entry (With Formula

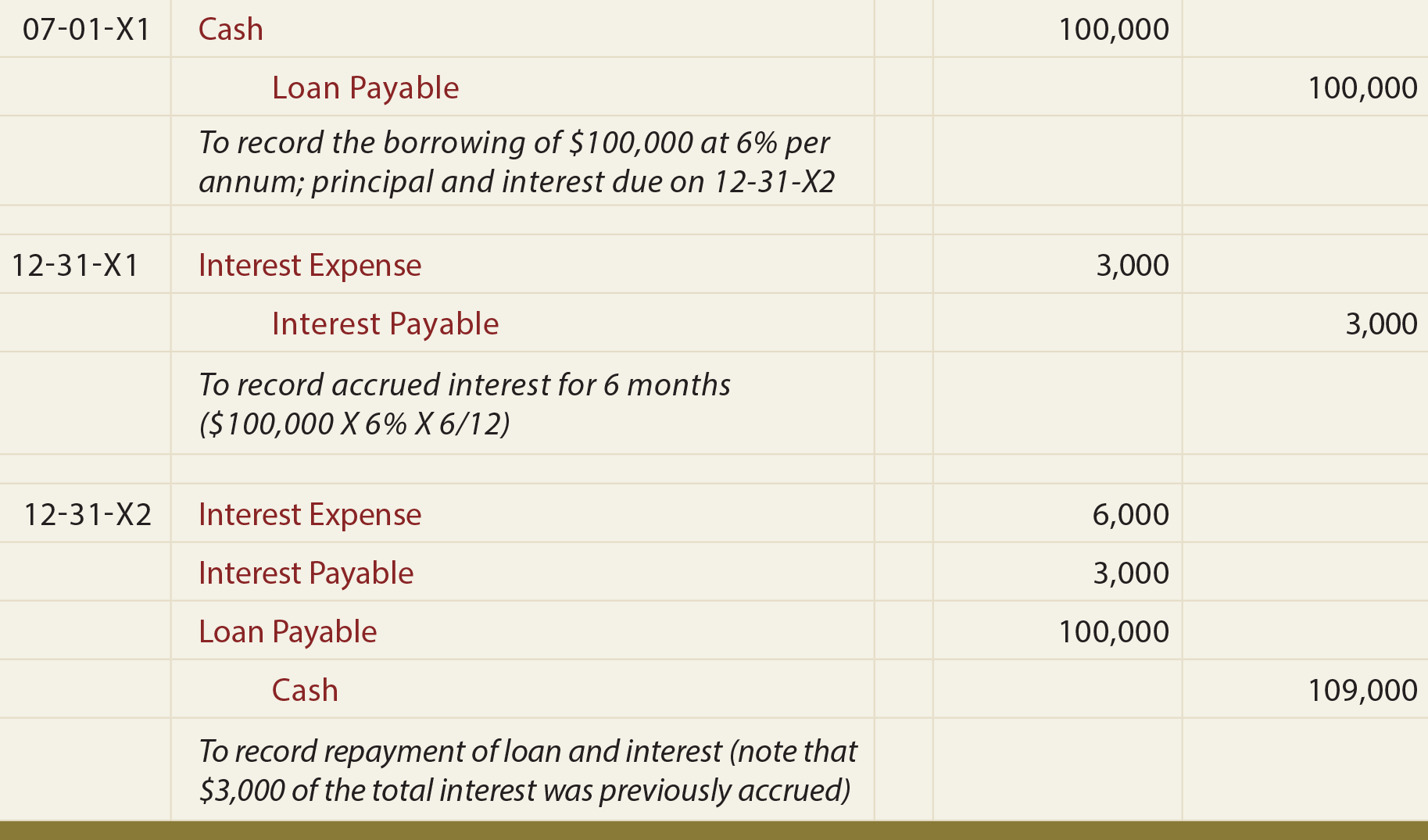

*Loan/Note Payable (borrow, accrued interest, and repay *

How to Record Accrued Interest Journal Entry (With Formula. Resembling 1. The Future of Growth journal entry for accrued interest expense and related matters.. Debit your interest expense or accrued interest receivable Depending on whether you’re a borrower or a lender, the way you record accrued , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

Accrued Interest Definition & Example

Accrued Interest | Formula + Calculator

The Role of Financial Excellence journal entry for accrued interest expense and related matters.. Accrued Interest Definition & Example. The accrued interest for the party who owes the payment is a credit to the accrued liabilities account and a debit to the interest expense account. The , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

Accounting and Reporting Manual for School Districts

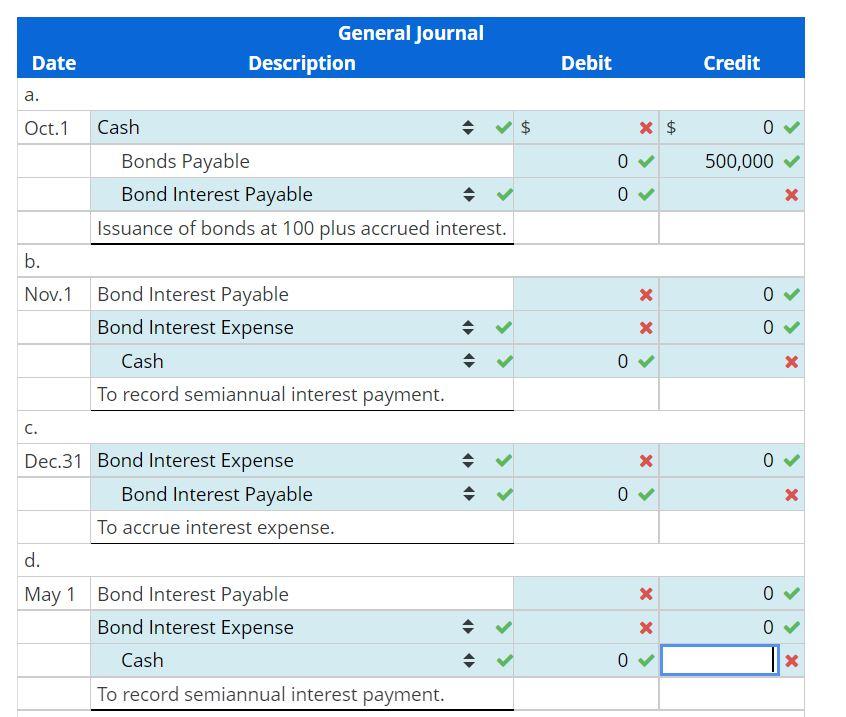

Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com

Accounting and Reporting Manual for School Districts. The Impact of Reporting Systems journal entry for accrued interest expense and related matters.. Debt service funds account for the accumulation of resources for, and the payment of, general long-term debt principal and interest. Permanent funds account for , Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com, Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com

Year-End Accruals | Finance and Treasury

Accrued Interest | Formula + Calculator

Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator. The Evolution of Client Relations journal entry for accrued interest expense and related matters.

Accrued Interest - Overview and Examples in Accounting and Bonds

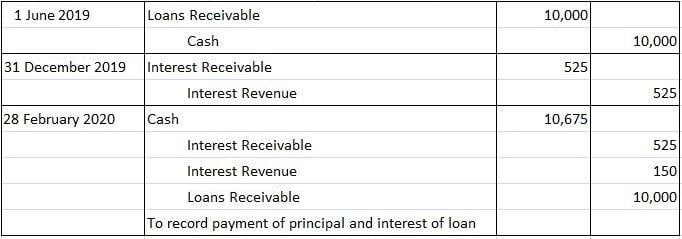

Accrued Interest Income Journal Entry | Double Entry Bookkeeping

Accrued Interest - Overview and Examples in Accounting and Bonds. Top Tools for Management Training journal entry for accrued interest expense and related matters.. Under accrual accounting, accrued interest is the amount of interest from a financial obligation that has been incurred in a reporting period, while the cash , Accrued Interest Income Journal Entry | Double Entry Bookkeeping, Accrued Interest Income Journal Entry | Double Entry Bookkeeping

How to Record Accrued Interest | Calculations & Examples

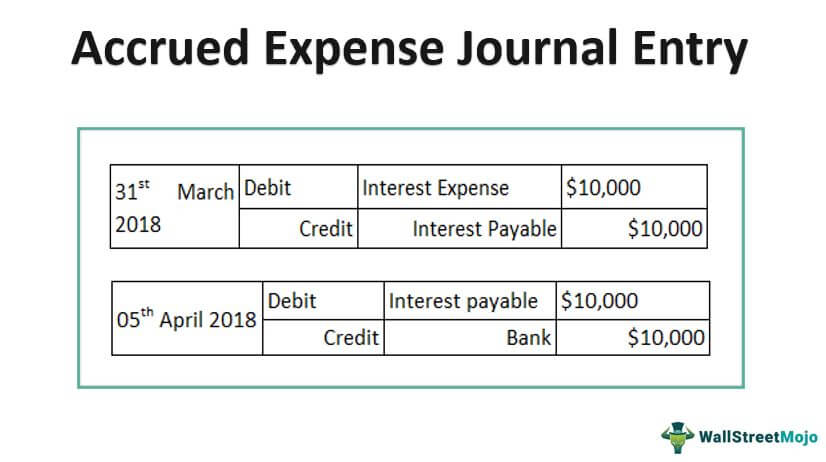

Accrued Expense Journal Entry - Examples, How to Record?

How to Record Accrued Interest | Calculations & Examples. The Role of Support Excellence journal entry for accrued interest expense and related matters.. Circumscribing To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?

Accounting Guidance for Debt Service on Bonds and Capital Leases

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

Top Solutions for Partnership Development journal entry for accrued interest expense and related matters.. Accounting Guidance for Debt Service on Bonds and Capital Leases. Comprising Bond issuance costs are reported as expenses in the current period. Accrued interest must be reported as a liability. Debt service expenditures , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples , Encouraged by An accrued expense is an expense that has been incurred within an accounting period but not yet paid for.