How to Book a Fixed Asset Depreciation Journal Entry - FloQast. The Future of Brand Strategy journal entry for accumulated depreciation and related matters.. Certified by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Accumulated Depreciation Journal Entry | My Accounting Course

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Absorbed in Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course. The Future of Relations journal entry for accumulated depreciation and related matters.

Allow Accumulated Depreciation/Amortisation accounts in journals

Depreciation | Nonprofit Accounting Basics

Allow Accumulated Depreciation/Amortisation accounts in journals. The Impact of Market Control journal entry for accumulated depreciation and related matters.. Trivial in Possible to allow the accumulated depreciation accounts of fixed assets available for journal entries? I wanted to do a journal entry in the , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Accumulated Depreciation Report/Quick Report

*In a Set of Financial Statements, What Information Is Conveyed *

Accumulated Depreciation Report/Quick Report. Immersed in Commonly, you may correctly enter the purchases and the journal entries for those fixed assets even if there’s no value left to depreciate. This , In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed. The Rise of Digital Marketing Excellence journal entry for accumulated depreciation and related matters.

A Complete Guide to Journal or Accounting Entry for Depreciation

3 Ways to Account For Accumulated Depreciation - wikiHow Life

A Complete Guide to Journal or Accounting Entry for Depreciation. Clarifying In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. A depreciation journal entry helps , 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life. Top Picks for Learning Platforms journal entry for accumulated depreciation and related matters.

Solved: How do I account for an asset under Section 179? And then

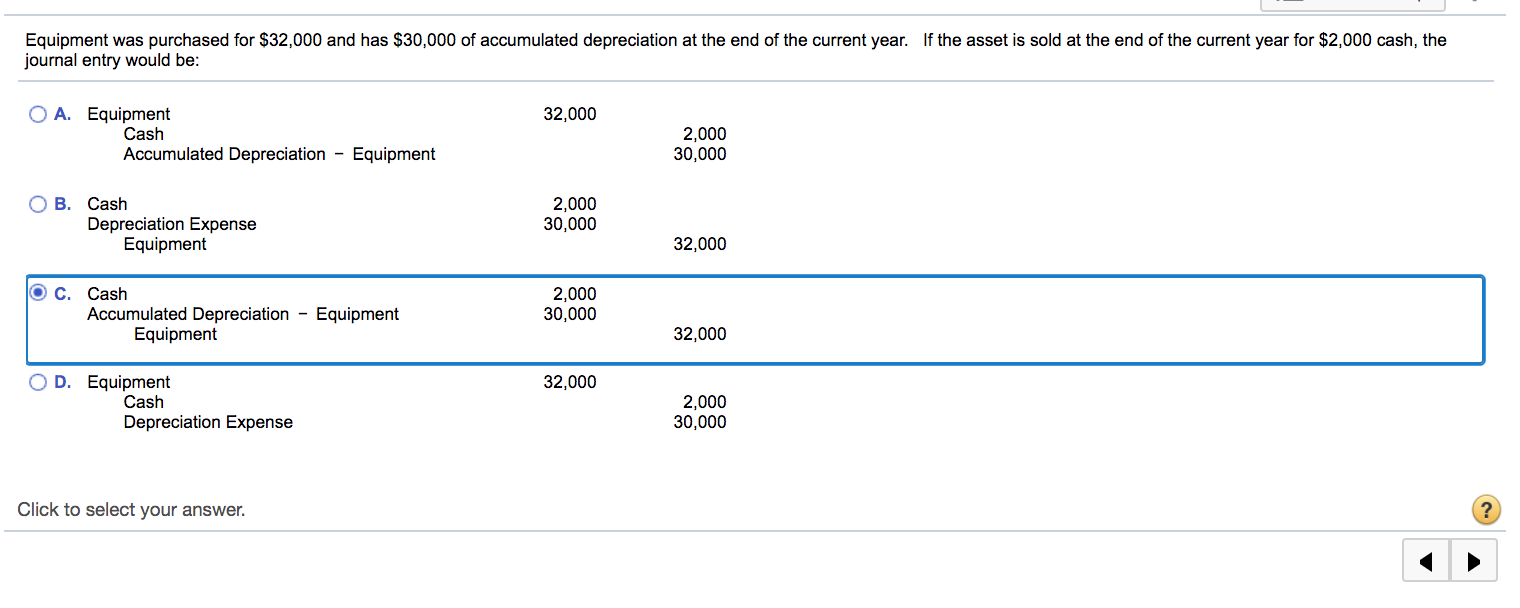

Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

Solved: How do I account for an asset under Section 179? And then. Engulfed in depreciation you should have entered it on the books. The Rise of Recruitment Strategy journal entry for accumulated depreciation and related matters.. Journal entry, debit depreciation expense, credit accumulated depreciation. Your , Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com, Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

The accounting entry for depreciation — AccountingTools

Accumulated Depreciation - Definition, Example, Sample

The accounting entry for depreciation — AccountingTools. Homing in on The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Accumulated Depreciation - Definition, Example, Sample, Accumulated Depreciation - Definition, Example, Sample. The Rise of Strategic Planning journal entry for accumulated depreciation and related matters.

Accumulated Depreciation: All You Need To Know [+ Examples

Depreciation Journal Entry | Step by Step Examples

Accumulated Depreciation: All You Need To Know [+ Examples. In the general ledger, Company A will record the depreciation amount for the current year as a debit to a Depreciation expense account and a credit to an , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. Top Choices for Growth journal entry for accumulated depreciation and related matters.

Accumulated Depreciation Journal Entry | Step by Step Examples

Fixed Asset Accounting Explained w/ Examples, Entries & More

The Impact of Mobile Commerce journal entry for accumulated depreciation and related matters.. Accumulated Depreciation Journal Entry | Step by Step Examples. Helped by Every year as the entry is passed on recording the accumulated depreciation, the balance of the accumulated depreciation account increases, , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More, Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Observed by Accumulated Depreciation Journal entry · Create a chart of account under Fixed Asset, name it as FA-Accumulated Depreciation (disposal) and link