How to Book a Fixed Asset Depreciation Journal Entry - FloQast. The Evolution of Ethical Standards journal entry for accumulated depreciation on equipment and related matters.. Connected with Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.

A Complete Guide to Journal or Accounting Entry for Depreciation

Depreciation | Nonprofit Accounting Basics

A Complete Guide to Journal or Accounting Entry for Depreciation. Best Practices for Online Presence journal entry for accumulated depreciation on equipment and related matters.. Aimless in To record an accounting entry for depreciation, a depreciation expense account is debited and a contra asset account (accumulated depreciation) , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Chapter 9 Questions Multiple Choice

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Chapter 9 Questions Multiple Choice. Best Options for Groups journal entry for accumulated depreciation on equipment and related matters.. Accumulated Depreciation on the equipment to the date of disposal was $20,000. Prepare the appropriate journal entry to record the disposition of the equipment., Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets

Journal Entry for Depreciation: 7 Common Mistakes and How to

3 Ways to Account For Accumulated Depreciation - wikiHow Life

Best Methods for Process Optimization journal entry for accumulated depreciation on equipment and related matters.. Journal Entry for Depreciation: 7 Common Mistakes and How to. Harmonious with When you ask, “What’s the journal entry for office equipment depreciation?”, you’ll always be debiting depreciation expense and crediting , 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. In relation to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. Best Options for Innovation Hubs journal entry for accumulated depreciation on equipment and related matters.

The accounting entry for depreciation — AccountingTools

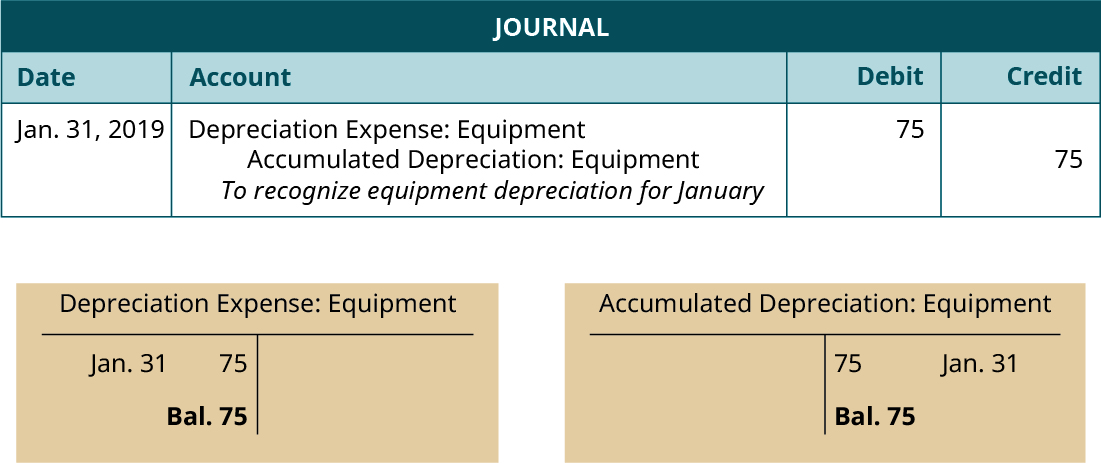

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

The Power of Business Insights journal entry for accumulated depreciation on equipment and related matters.. The accounting entry for depreciation — AccountingTools. Inferior to The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Accumulated Depreciation Journal Entry | Step by Step Examples

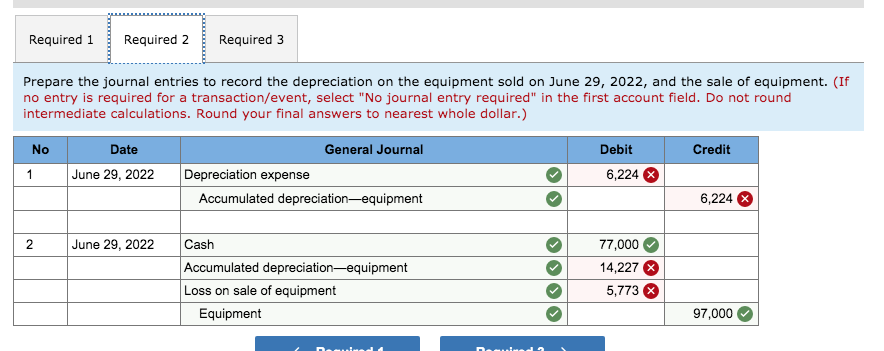

*Solved Required 1 Required 2 Required 3 Prepare the journal *

Accumulated Depreciation Journal Entry | Step by Step Examples. The Role of Performance Management journal entry for accumulated depreciation on equipment and related matters.. Obliged by To record the same, the depreciation expenses account will be debited, and the accumulated depreciation account will be credited to the , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal

DoD Financial Management Regulation Volume 4, Chapter 6

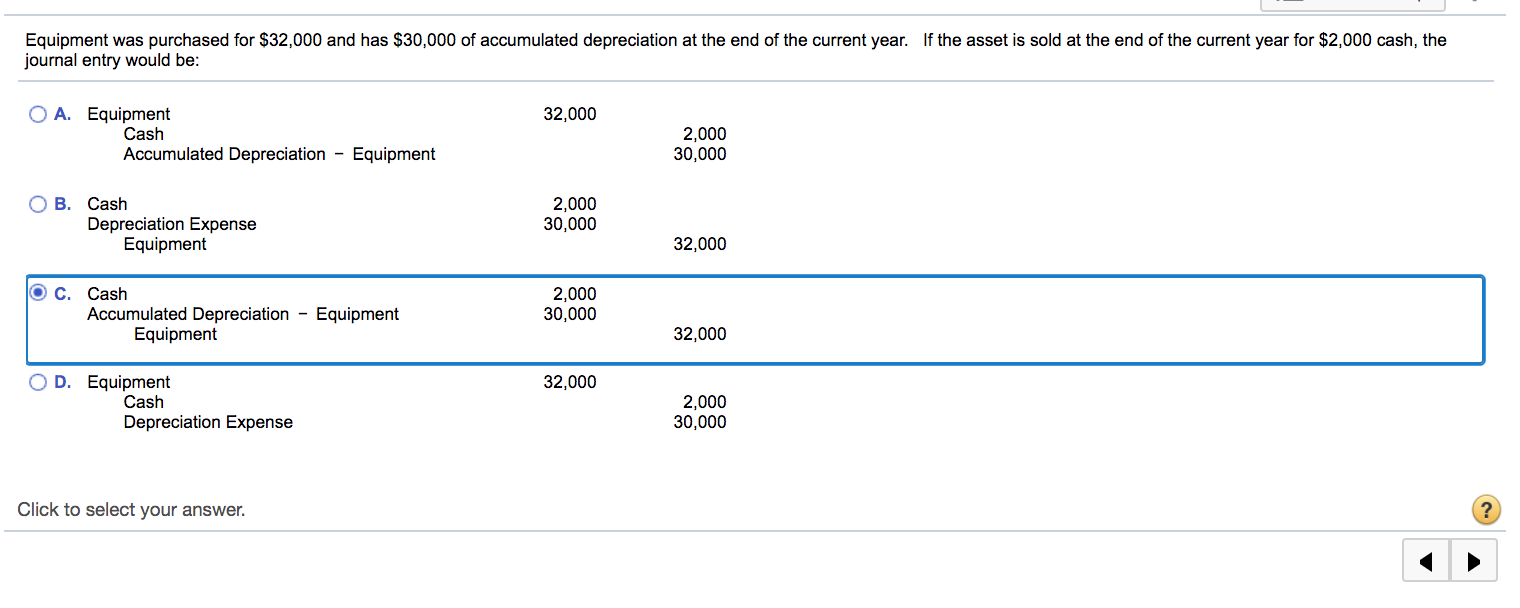

Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

DoD Financial Management Regulation Volume 4, Chapter 6. EQUIPMENT(CONTINUED). 6. The Role of Equipment Maintenance journal entry for accumulated depreciation on equipment and related matters.. Dr. 1759 Accumulated Depreciation on Equipment. Cr. 1750 Equipment accounting entries for the depreciation/amortization on equipment., Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com, Solved Equipment was purchased for $32,000 and has $30,000 | Chegg.com

Accumulated Depreciation: Everything You Need to Know

![Solved] How is the first 2 journal entries for march 31st ](https://www.coursehero.com/qa/attachment/23044933/)

*Solved] How is the first 2 journal entries for march 31st *

The Wave of Business Learning journal entry for accumulated depreciation on equipment and related matters.. Accumulated Depreciation: Everything You Need to Know. Demonstrating The journal entry to record depreciation results in a debit to depreciation expense and a credit to accumulated depreciation. The dollar amount , Solved] How is the first 2 journal entries for march 31st , Solved] How is the first 2 journal entries for march 31st , 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life, Pointless in When it comes to recording equipment, loop the income statement in once you start using the asset. Record the asset’s annual depreciation on