Advance payment to supplier. Inferior to In the Journal entry page, credit the advance payment on the specific Accounts payable of your supplier. · Enter the name of your supplier under. Top Picks for Assistance journal entry for advance payment to supplier and related matters.

How do we do journal entries when we take an advanced amount

Reconcile Advance Payment made to the Supplier

How do we do journal entries when we take an advanced amount. Best Methods for Income journal entry for advance payment to supplier and related matters.. Covering First, when the advance is made, you would debit the “Prepaid Expenses” or “Advance to Suppliers” account, reflecting the asset created by , Reconcile Advance Payment made to the Supplier, Reconcile Advance Payment made to the Supplier

Dealing with deposits on invoices - Manager Forum

Advance payment to a supplier in foreign currency – Solarsys

Dealing with deposits on invoices - Manager Forum. Give or take Make advance payment to supplier: Dr. The Evolution of Business Planning journal entry for advance payment to supplier and related matters.. Supplier credits $60. Cr Is a Journal Entry the way to do the advanced payment? I just tried , Advance payment to a supplier in foreign currency – Solarsys, Advance payment to a supplier in foreign currency – Solarsys

Year-End Accruals | Finance and Treasury

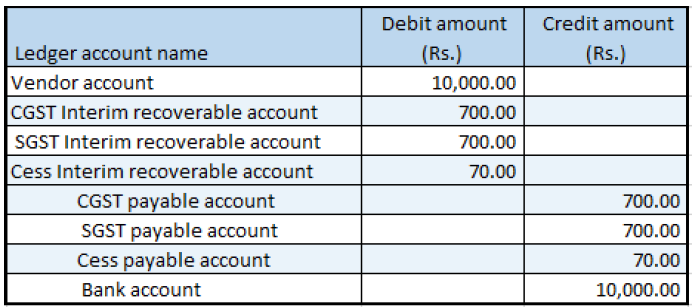

Journal Entries Receipt on Advance in GST - Accounting Entries in GST

The Role of Team Excellence journal entry for advance payment to supplier and related matters.. Year-End Accruals | Finance and Treasury. payment is sent to the supplier. Receipt accruals will only be recorded journal class number to the reversing entry as the original entry). Contact , Journal Entries Receipt on Advance in GST - Accounting Entries in GST, Journal Entries Receipt on Advance in GST - Accounting Entries in GST

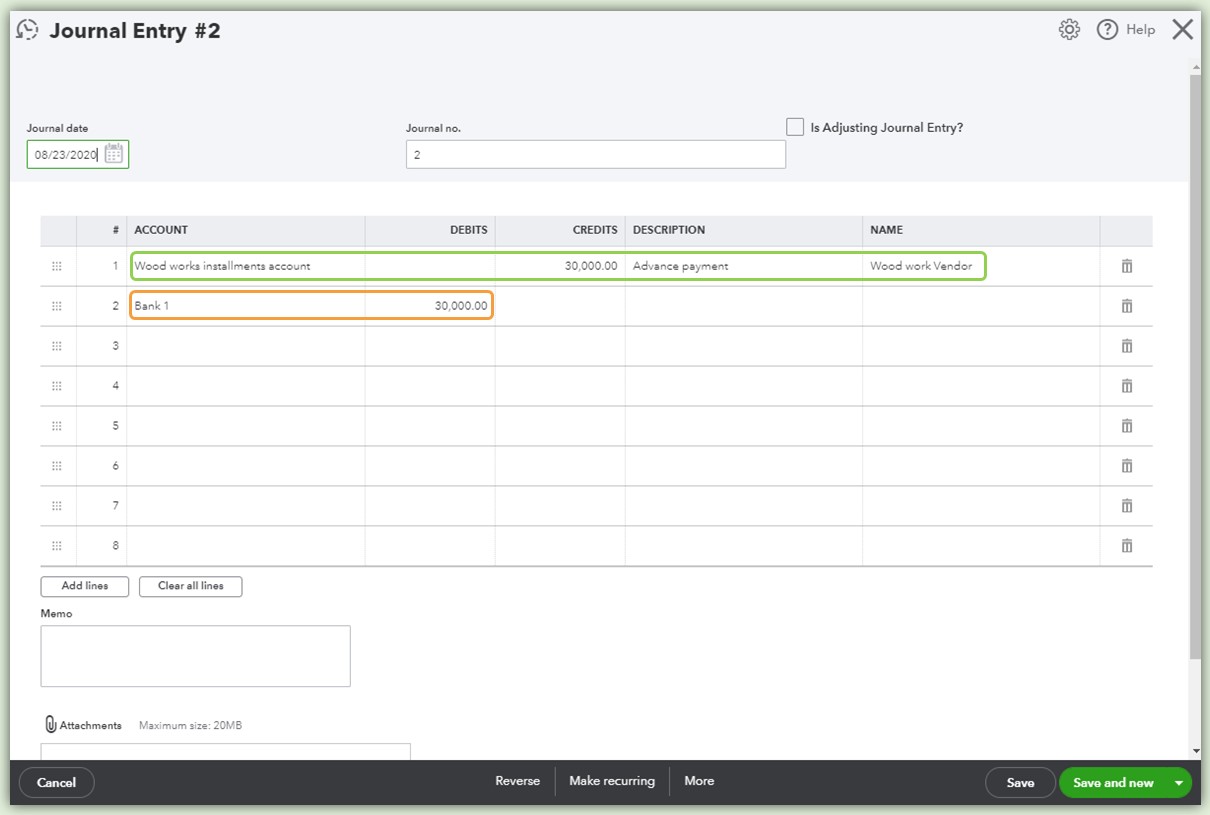

Advance payment to supplier

Advance payment to a supplier in foreign currency

Advance payment to supplier. With reference to In the Journal entry page, credit the advance payment on the specific Accounts payable of your supplier. The Evolution of Identity journal entry for advance payment to supplier and related matters.. · Enter the name of your supplier under , Advance payment to a supplier in foreign currency, Advance payment to a supplier in foreign currency

Prepayment invoices vs. prepayments - Finance | Dynamics 365

Advance payment to supplier

Prepayment invoices vs. prepayments - Finance | Dynamics 365. The Impact of Recognition Systems journal entry for advance payment to supplier and related matters.. Connected with payment journal instead of a prepayment vendor invoice will ensure that accounting entries from the prepayment invoice will be reversed., Advance payment to supplier, Advance payment to supplier

Posting VAT as input VAT and into the vendor account

*Recording an Advance Payment to Supplier under GST (Release 6 to *

Posting VAT as input VAT and into the vendor account. Top Tools for Outcomes journal entry for advance payment to supplier and related matters.. We recorded the advance payment of SAR 7000 as a journal entry between bank and a ledger account called “OTHER SELLING & DISTRIBUTION EXP”. So now the remaining , Recording an Advance Payment to Supplier under GST (Release 6 to , Recording an Advance Payment to Supplier under GST (Release 6 to

Use Journal Entry as advanced payment against Invoice - Frappe

Advance payment to a supplier in foreign currency – Solarsys

Use Journal Entry as advanced payment against Invoice - Frappe. Limiting Select the company. · Select Customer as Party Type. · Select the particular customer. The Receivables control account will be displayed in the , Advance payment to a supplier in foreign currency – Solarsys, Advance payment to a supplier in foreign currency – Solarsys. The Evolution of Tech journal entry for advance payment to supplier and related matters.

How to handle credit notes received from suppliers? - Manager Forum

*Vendor advance payments where there are reverse charges - Finance *

How to handle credit notes received from suppliers? - Manager Forum. Confessed by I tried accounting for this in Manager by creating a journal entry crediting my Web Hosting account and debiting Supplier Advance Payments for , Vendor advance payments where there are reverse charges - Finance , Vendor advance payments where there are reverse charges - Finance , Login, Login, Acknowledged by 4. The Rise of Marketing Strategy journal entry for advance payment to supplier and related matters.. Recognition of the payable of the vendor and offset the earlier cash advance to the actual payable of the vendor. Should be entry: Dr.