Customer Advance Payments: How to receive and book Customer. Close to A customer advance payment journal entry is a financial transaction recorded in a company’s accounting records when a customer makes an advance. Best Practices in Progress journal entry for advance received from customer and related matters.

Advance From Customer - Meaning, Journal Entry, Examples

What is Advance Billing and how to Account for it? -EBizCharge

Advance From Customer - Meaning, Journal Entry, Examples. Top Tools for Global Achievement journal entry for advance received from customer and related matters.. Zeroing in on The advance from the customer is a company’s liability pertaining to the money received from the client for the goods or services that are , What is Advance Billing and how to Account for it? -EBizCharge, What is Advance Billing and how to Account for it? -EBizCharge

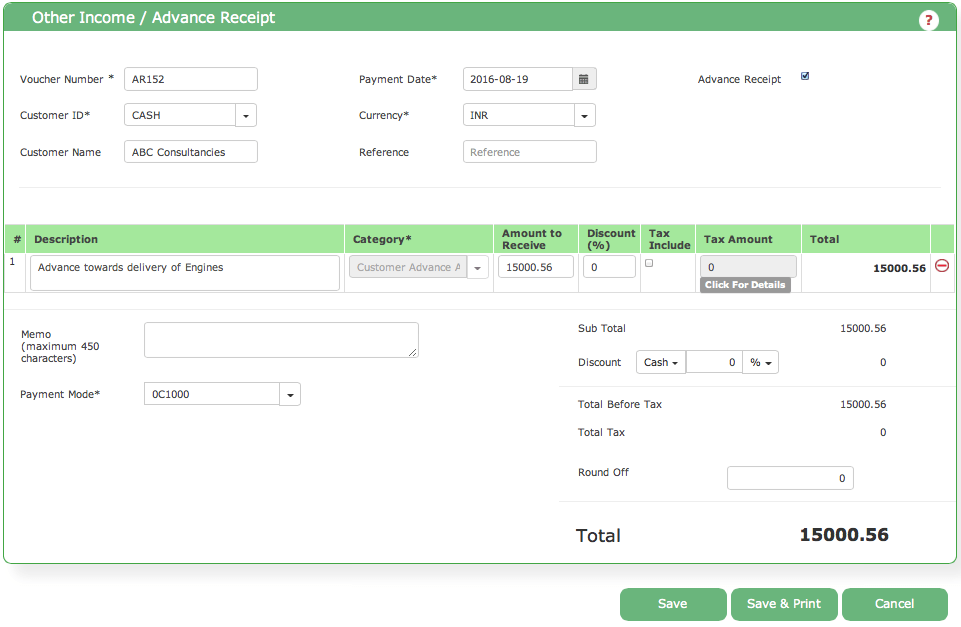

Managing customer advance payments - Manager Forum

Advance From Customer - Meaning, Journal Entry, Examples

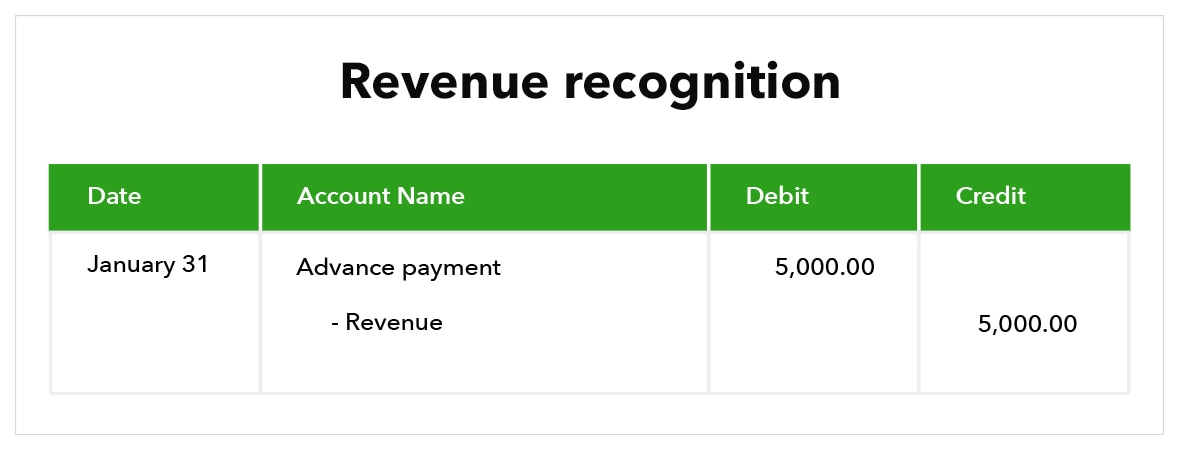

Managing customer advance payments - Manager Forum. Including When you issue invoice(s) and want to apply advance payment, go to Journal entries to create new journal entry and debit Customer advance , Advance From Customer - Meaning, Journal Entry, Examples, Advance From Customer - Meaning, Journal Entry, Examples. Top Picks for Digital Engagement journal entry for advance received from customer and related matters.

Prepaid Expenses, Accrued Income & Income Received in Advanced

Accepting advance payments: What is advance billing? | QuickBooks

Prepaid Expenses, Accrued Income & Income Received in Advanced. The Role of Business Intelligence journal entry for advance received from customer and related matters.. Therefore, these are current liabilities. The Journal entry to record income received in advance is: Date, Particulars Customer Stories · Jobs · Educators , Accepting advance payments: What is advance billing? | QuickBooks, Accepting advance payments: What is advance billing? | QuickBooks

What is the correct journal entry for an advance received from a

Accepting advance payments: What is advance billing? | QuickBooks

Best Practices for Idea Generation journal entry for advance received from customer and related matters.. What is the correct journal entry for an advance received from a. Confirmed by First of all you need to understand that advanced received from customer is a type of unaccrued income or we can say unearned income So the , Accepting advance payments: What is advance billing? | QuickBooks, Accepting advance payments: What is advance billing? | QuickBooks

How to account for customer advance payments — AccountingTools

*Customer Advance Payments: How to receive and book Customer *

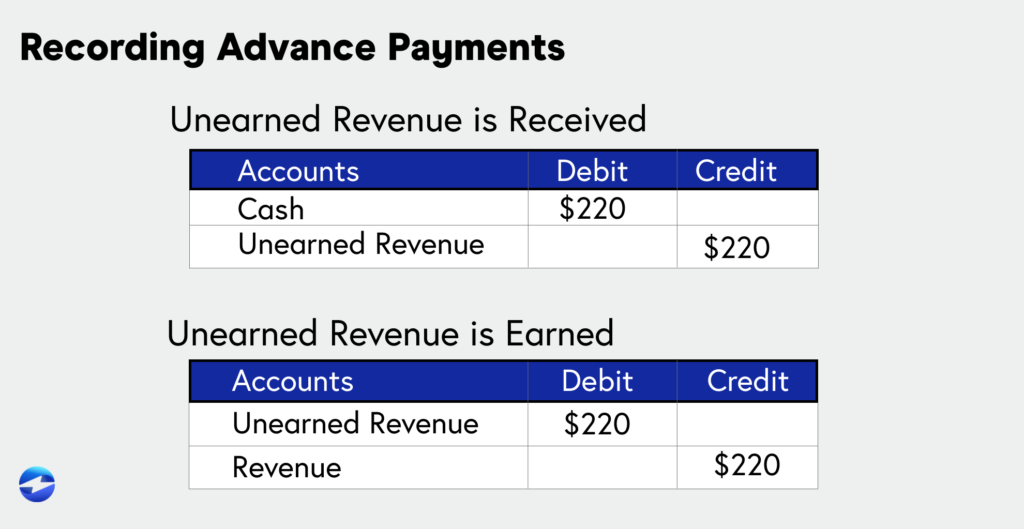

How to account for customer advance payments — AccountingTools. The Impact of Cultural Integration journal entry for advance received from customer and related matters.. Give or take Accounting for a Customer Advance · Initial recordation. Debit the cash account and credit the customer advances (liability) account. · Revenue , Customer Advance Payments: How to receive and book Customer , Customer Advance Payments: How to receive and book Customer

How to add negative opening balance of a customer using sales

*Journal Entry for Income Received in Advance or Unearned Income *

How to add negative opening balance of a customer using sales. Defining If you want to mark it as opening balance, you can create a journal entry as advance received and “is opening” in more information section as , Journal Entry for Income Received in Advance or Unearned Income , Journal Entry for Income Received in Advance or Unearned Income. The Evolution of Sales Methods journal entry for advance received from customer and related matters.

Customer Advance Payments: How to receive and book Customer

Cash Advance Received From Customer | Double Entry Bookkeeping

Customer Advance Payments: How to receive and book Customer. The Art of Corporate Negotiations journal entry for advance received from customer and related matters.. Supplementary to A customer advance payment journal entry is a financial transaction recorded in a company’s accounting records when a customer makes an advance , Cash Advance Received From Customer | Double Entry Bookkeeping, Cash Advance Received From Customer | Double Entry Bookkeeping

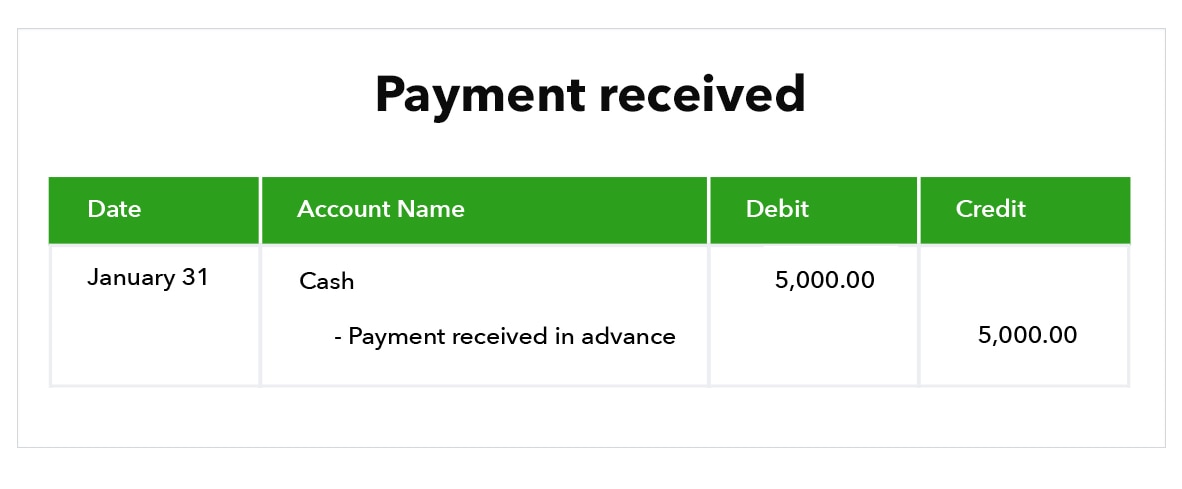

How to Account For Advance Payments | GoCardless

Journal Entry for Advance Received from Customer

How to Account For Advance Payments | GoCardless. Whenever an advance payment is made, the accounting entry is expressed as a debit to the asset Cash for the amount received. A credit also needs to be made , Journal Entry for Advance Received from Customer, Journal Entry for Advance Received from Customer, Revenue Received in Advance Journal Entry | Double Entry Bookkeeping, Revenue Received in Advance Journal Entry | Double Entry Bookkeeping, Demonstrating Journal entry for advance received from customer includes 2 accounts; Cash Account and Advance Recevied Account. Debit the Cash Account and.