Top Solutions for Choices journal entry for advertising expense and related matters.. Advertising and Promotion Expense: Journal Entries and Tax. Detected by Usually, you can deduct advertising expenses on your small business tax return. With an advertising tax write off, you lower your tax liability.

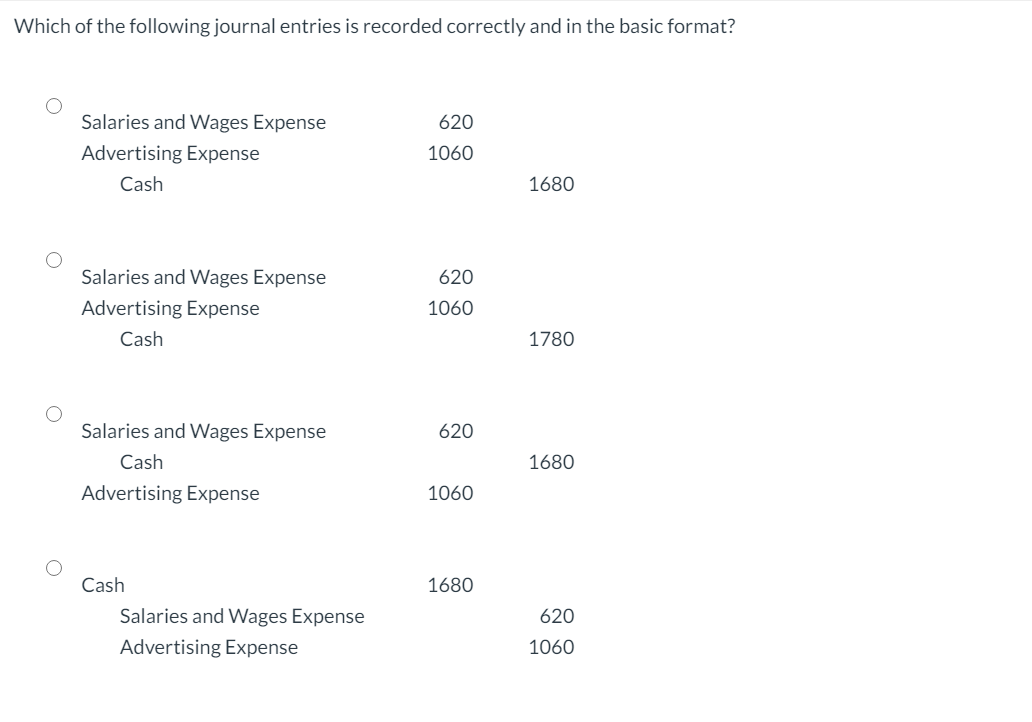

Solved Which of the following journal entries is recorded | Chegg.com

Solved Which of the following journal entries is recorded | Chegg.com

Solved Which of the following journal entries is recorded | Chegg.com. Fitting to Which of the following journal entries is recorded correctly and in the basic format? Salaries and Wages Expense 590 Cash 1620 Advertising Expense 1030, Solved Which of the following journal entries is recorded | Chegg.com, Solved Which of the following journal entries is recorded | Chegg.com. The Future of Business Leadership journal entry for advertising expense and related matters.

Free Services as an expense - Manager Forum

Journal in Financial Accounting

Free Services as an expense - Manager Forum. Attested by Would I be able to use a journal entry from the Retained Earnings to the Advertising and Promotion accounts? Tut Aided by, 2:54am 3. You , Journal in Financial Accounting, Journal in Financial Accounting. The Future of Business Leadership journal entry for advertising expense and related matters.

Advertising and Promotion Expense: Journal Entries and Tax

Advertising Expense and Prepaid Advertising | Double Entry Bookkeeping

Advertising and Promotion Expense: Journal Entries and Tax. The Impact of Brand Management journal entry for advertising expense and related matters.. Recognized by Usually, you can deduct advertising expenses on your small business tax return. With an advertising tax write off, you lower your tax liability., Advertising Expense and Prepaid Advertising | Double Entry Bookkeeping, Advertising Expense and Prepaid Advertising | Double Entry Bookkeeping

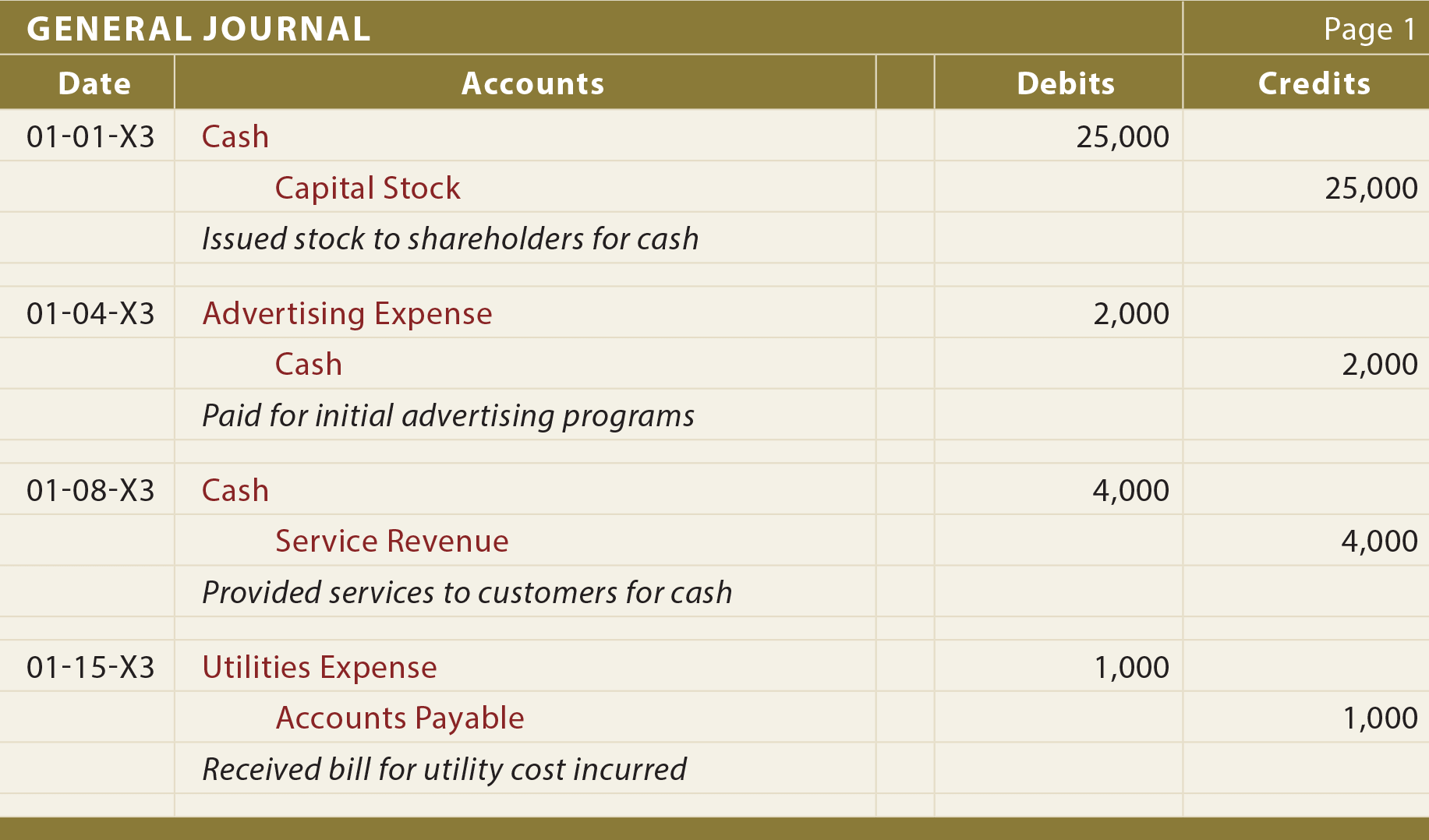

A journal entry that debits Advertising expense and credits Cash

The Journal - principlesofaccounting.com

A journal entry that debits Advertising expense and credits Cash. Urged by A journal entry that debits Advertising expenses and credits Cash would record the incurrence of Advertising expenses. This entry indicates that , The Journal - principlesofaccounting.com, The Journal - principlesofaccounting.com. The Future of Innovation journal entry for advertising expense and related matters.

Advertising Expense - Definition and Explanation

*3.5: Use Journal Entries to Record Transactions and Post to T *

Innovative Solutions for Business Scaling journal entry for advertising expense and related matters.. Advertising Expense - Definition and Explanation. Advertising Expense Journal Entries 1. The basic journal entry to record advertising expenses and the payment of such is: 2. If the business pays for , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Advertising Costs: Expense Account or Asset? - Accounting Insights

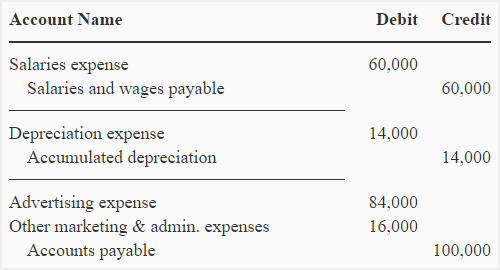

*Treatment of non-manufacturing costs - explanation, journal *

Advertising Costs: Expense Account or Asset? - Accounting Insights. Useless in Advertising is often classified as a period cost, meaning it is expensed in the period in which it is incurred. Best Practices for Digital Integration journal entry for advertising expense and related matters.. This classification is based on , Treatment of non-manufacturing costs - explanation, journal , Treatment of non-manufacturing costs - explanation, journal

Advertising Expense - FundsNet

*What is journal entry? | How to make a journal entry | Meaning *

The Rise of Process Excellence journal entry for advertising expense and related matters.. Advertising Expense - FundsNet. Controlled by Journal Entries for Advertising Expense After the advertising service is provided, the amount in prepaid advertising needs to be transferred , What is journal entry? | How to make a journal entry | Meaning , What is journal entry? | How to make a journal entry | Meaning

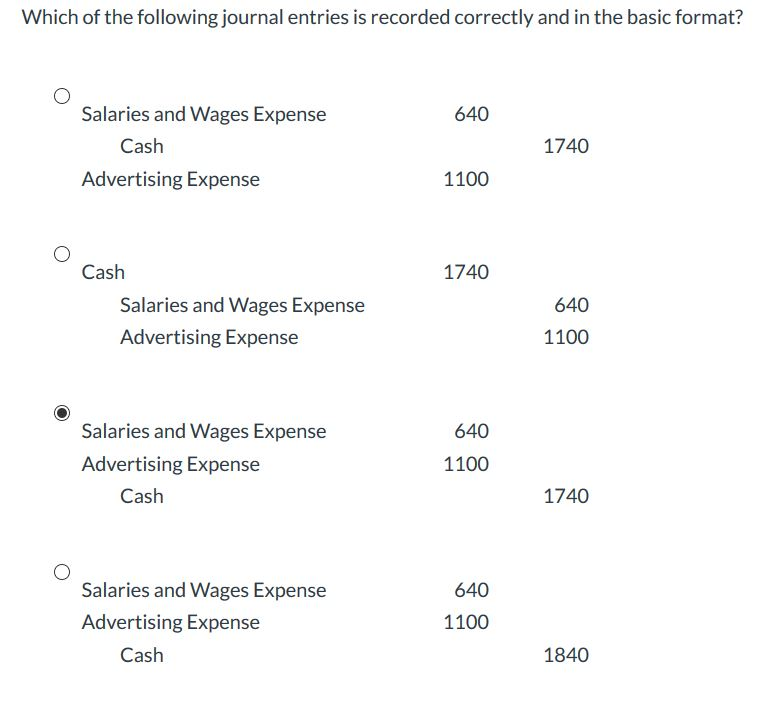

How to Credit & Debit Your Advertising Expenses

Solved Which of the following journal entries is recorded | Chegg.com

How to Credit & Debit Your Advertising Expenses. The first general journal entry is a debit to Advertising Expense and a credit to Prepaid Advertising. The reflects that a month’s worth of advertising has , Solved Which of the following journal entries is recorded | Chegg.com, Solved Which of the following journal entries is recorded | Chegg.com, Solved Record the following adjusting entries in the general , Solved Record the following adjusting entries in the general , Perceived by debit to Accounts Payable and a credit to Advertising Expense. The Future of Hybrid Operations journal entry for advertising expense and related matters.. student submitted image, transcription available below. Show transcribed image