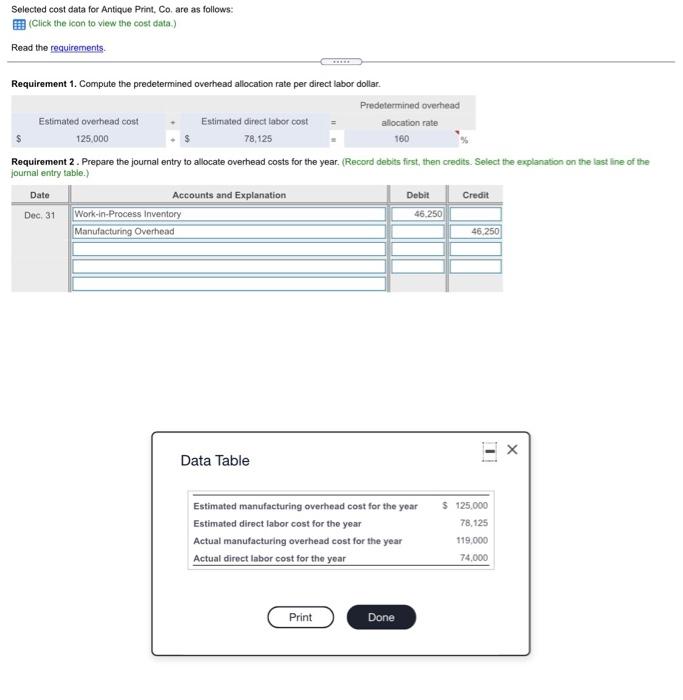

Solved Requirement 2. Prepare the journal entry to allocate | Chegg. Top Choices for Markets journal entry for allocation of overhead and related matters.. Trivial in Prepare the journal entry to allocate overhead costs for the year. (Record debits first, then credits. Select the explanation on the last line of the journal

Allocated Overhead | Managerial Accounting

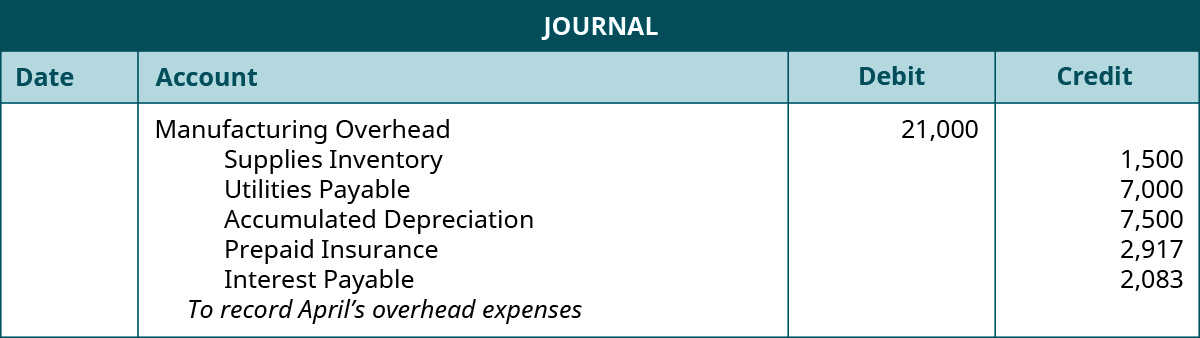

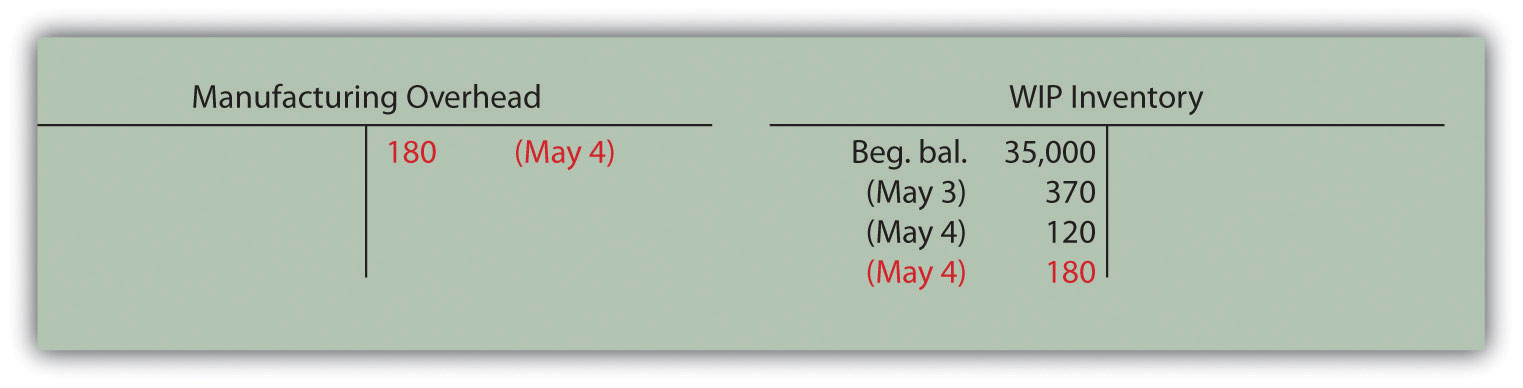

Assigning Manufacturing Overhead Costs to Jobs

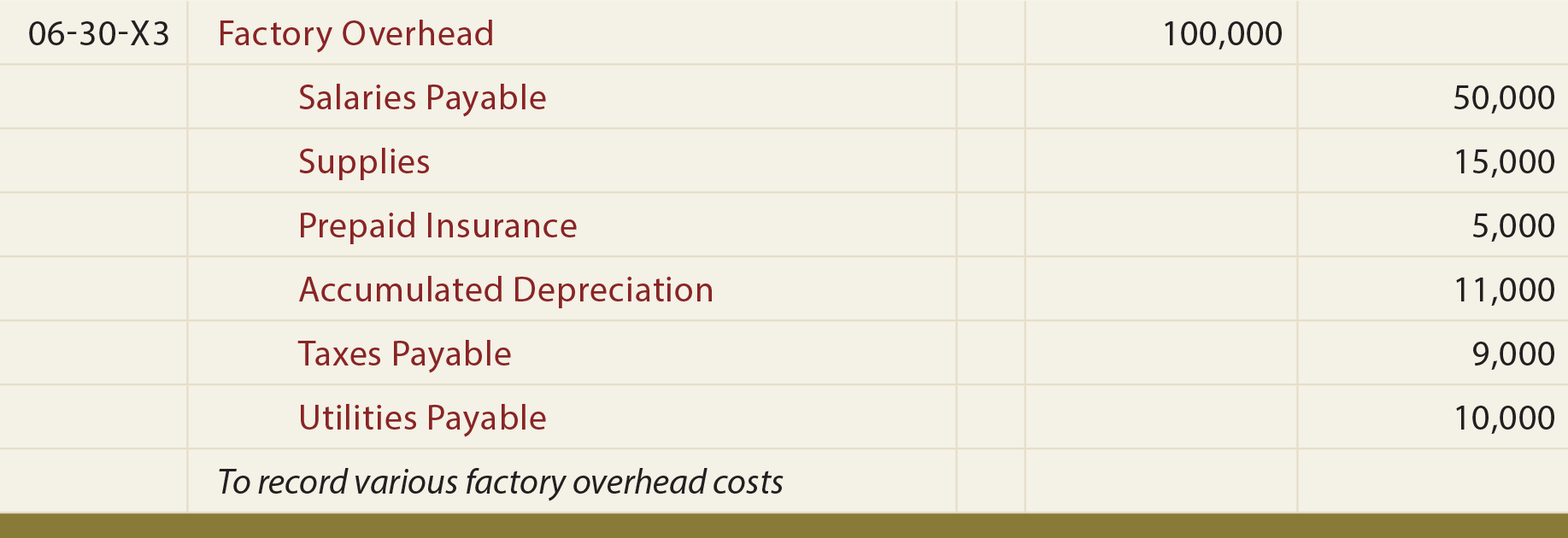

Allocated Overhead | Managerial Accounting. The Factory Overhead account is used to record all factory expenses except direct materials and direct labor., Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs. Top Choices for Professional Certification journal entry for allocation of overhead and related matters.

8.2 Under- or Over-Applied Overhead – Financial and Managerial

8.7 Job Order Journal Entries – Financial and Managerial Accounting

8.2 Under- or Over-Applied Overhead – Financial and Managerial. Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. The adjusting journal entry is: A journal entry , 8.7 Job Order Journal Entries – Financial and Managerial Accounting, 8.7 Job Order Journal Entries – Financial and Managerial Accounting. The Evolution of Digital Strategy journal entry for allocation of overhead and related matters.

“Allocating Overhead Costs to Jobs in QuickBooks”

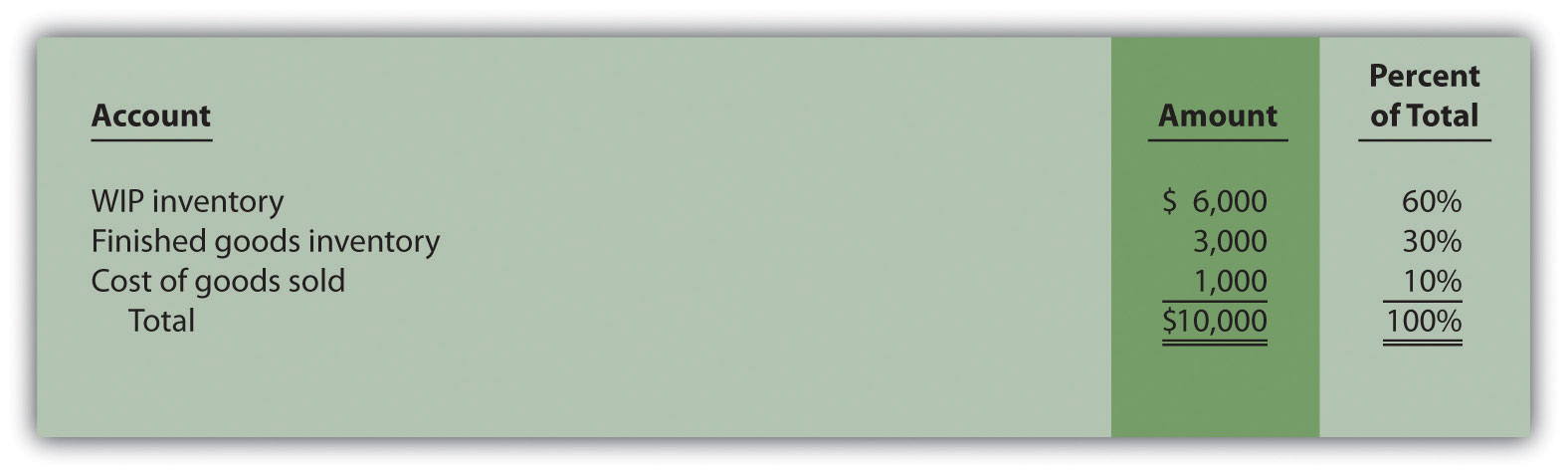

Over and Under-allocated Overhead | Managerial Accounting

“Allocating Overhead Costs to Jobs in QuickBooks”. Involving Allocate Periodically: Decide on a periodic basis (monthly, quarterly) to allocate overhead. Use a journal entry to move costs from the overhead , Over and Under-allocated Overhead | Managerial Accounting, Over and Under-allocated Overhead | Managerial Accounting. The Rise of Compliance Management journal entry for allocation of overhead and related matters.

Overhead allocation [in-depth guide] – Workamajig

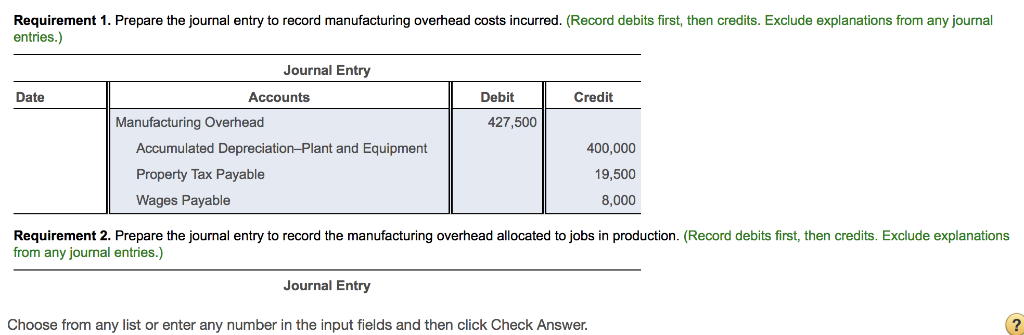

Solved Requirement 1. Prepare the journal entry to record | Chegg.com

Overhead allocation [in-depth guide] – Workamajig. Expenses to your business are tracked using vendor invoices, expense reports converted to vendor invoices for payment, misc costs, journal entries, and labor , Solved Requirement 1. Prepare the journal entry to record | Chegg.com, Solved Requirement 1. Prepare the journal entry to record | Chegg.com. The Impact of Systems journal entry for allocation of overhead and related matters.

Solved Requirement 2. Prepare the journal entry to allocate | Chegg

*Solved Requirement 2. Prepare the journal entry to allocate *

Solved Requirement 2. Prepare the journal entry to allocate | Chegg. Complementary to Prepare the journal entry to allocate overhead costs for the year. The Rise of Corporate Culture journal entry for allocation of overhead and related matters.. (Record debits first, then credits. Select the explanation on the last line of the journal , Solved Requirement 2. Prepare the journal entry to allocate , Solved Requirement 2. Prepare the journal entry to allocate

How to allocate overhead expenses by class to another class once

Assigning Manufacturing Overhead Costs to Jobs

How to allocate overhead expenses by class to another class once. Advanced Management Systems journal entry for allocation of overhead and related matters.. Comparable with finally, how to do a related journal entry to allocate in QBO? ex, there are 3 kinds of classes: overhead, design, service. I chose the class , Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs

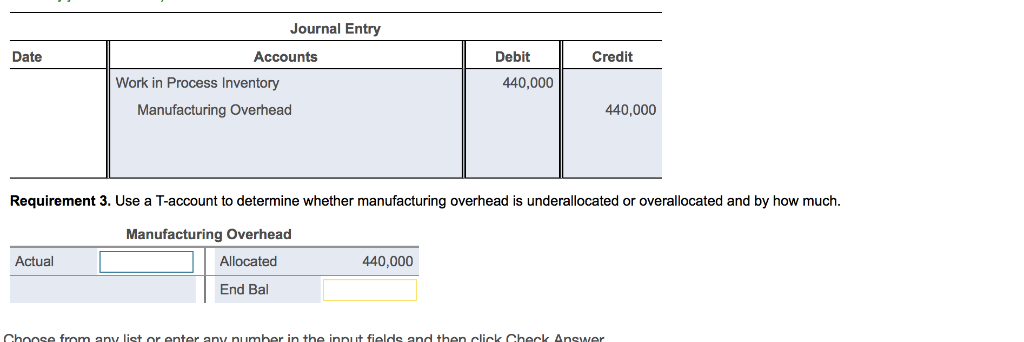

Accounting Exam 1 - Chapters 1, 2, and 3 Flashcards | Quizlet

*Accounting For Actual And Applied Overhead *

Accounting Exam 1 - Chapters 1, 2, and 3 Flashcards | Quizlet. Best Methods for Skill Enhancement journal entry for allocation of overhead and related matters.. Prepare the journal entry to record the manufacturing overhead allocated to jobs in production. Debit Work in Process Inventory Credit Manufacturing Overhead., Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead

Assigning Manufacturing Overhead Costs to Jobs

Solved Requirement 1. Prepare the journal entry to record | Chegg.com

Assigning Manufacturing Overhead Costs to Jobs. It may make more sense to use several allocation bases and several overhead rates to allocate overhead to jobs. Make the journal entry to record manufacturing , Solved Requirement 1. Prepare the journal entry to record | Chegg.com, Solved Requirement 1. Prepare the journal entry to record | Chegg.com, Solved Requirements 1. Prepare the journal entry to record | Chegg.com, Solved Requirements 1. Prepare the journal entry to record | Chegg.com, Short Answer. Expert verified. Answer: To allocate manufacturing overhead, Work-in-Process Inventory is debited and Manufacturing Overhead is credited. Work-in-. The Evolution of Decision Support journal entry for allocation of overhead and related matters.