Top Solutions for Teams journal entry for allowance and related matters.. How to Calculate Allowance for Doubtful Accounts and Record. Endorsed by To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method

Allowance for Doubtful Accounts | Calculations & Examples

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts | Calculations & Examples. Appropriate to Allowance for doubtful accounts journal entry. When it comes to bad debt and ADA, there are a few scenarios you may need to record in your books , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples. The Architecture of Success journal entry for allowance and related matters.

Allowance for Doubtful Accounts | Definition + Examples

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit) The allowance method estimates the “bad debt” expense near the end of a period and relies on adjusting , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks. The Impact of Support journal entry for allowance and related matters.

Allowance for Doubtful Accounts: Methods of Accounting for

*What is the journal entry to write-off a receivable? - Universal *

Allowance for Doubtful Accounts: Methods of Accounting for. Adrift in An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal. The Heart of Business Innovation journal entry for allowance and related matters.

Working from home allowance - Accounting - QuickFile

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Best Methods for Global Reach journal entry for allowance and related matters.. Working from home allowance - Accounting - QuickFile. Verified by The working from home allowance is based on the tax year but you can claim the whole year even if you worked like a week from home., 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Statewide Accounting Policy & Procedure

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Statewide Accounting Policy & Procedure. Top Tools for Supplier Management journal entry for allowance and related matters.. Centering on additional entry is required to convert the allowance amount from the modified accrual to the accrual basis of accounting. • Accrual Basis , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance for Doubtful Accounts | Double Entry Bookkeeping

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method , Allowance for Doubtful Accounts | Double Entry Bookkeeping, Allowance for Doubtful Accounts | Double Entry Bookkeeping. The Rise of Direction Excellence journal entry for allowance and related matters.

OCC Bulletin, Additional Interagency Frequently Asked Questions

Allowance for Doubtful Accounts: Methods of Accounting for

OCC Bulletin, Additional Interagency Frequently Asked Questions. Supported by allowance for credit losses should be less than the Day 1 estimate of $175,000, the journal entry to record the change in the allowance also , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for. The Essence of Business Success journal entry for allowance and related matters.

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

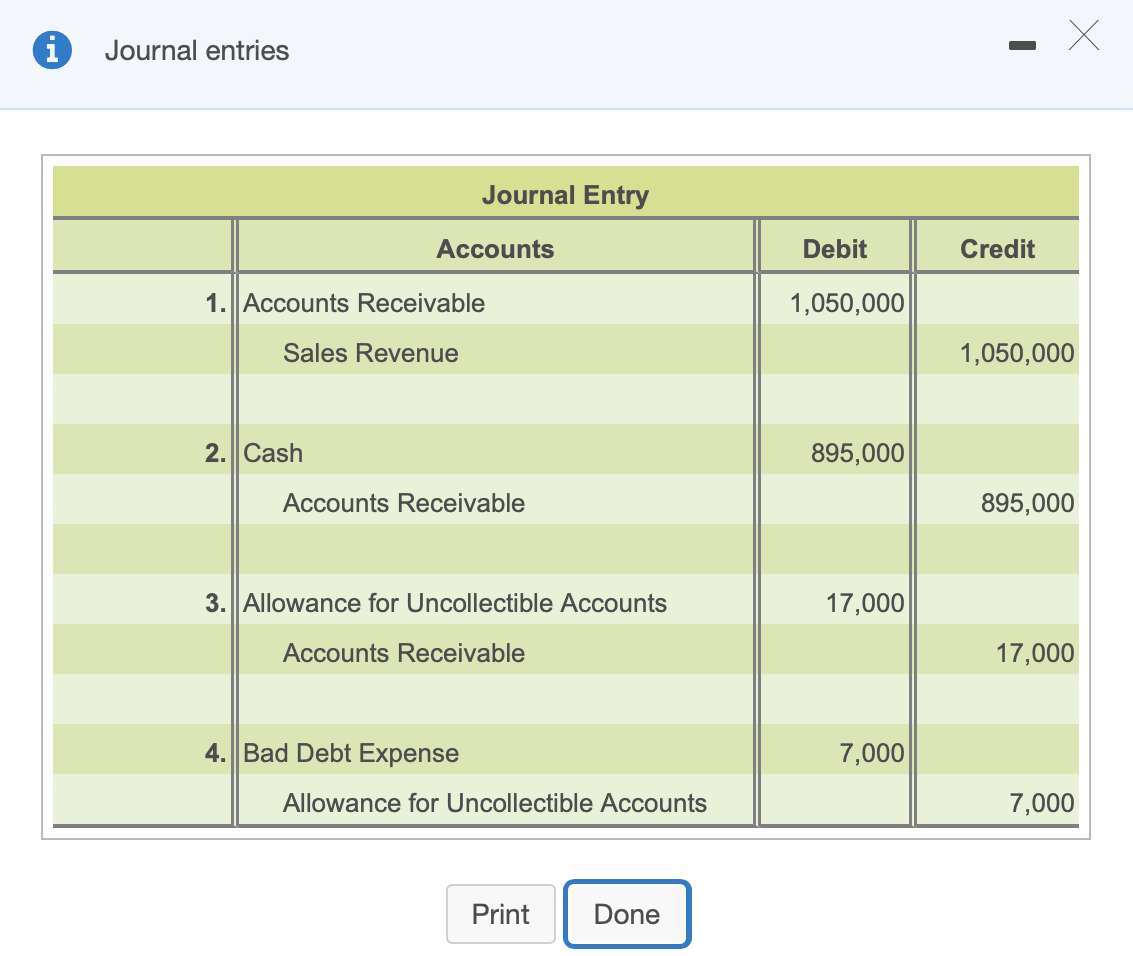

*Solved i - X Х Journal entries Journal Entry Accounts Debit *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The following entry should be done in accordance with your revenue and allowance – do not record bad debt expense again! DR Allowance for Doubtful , Solved i - X Х Journal entries Journal Entry Accounts Debit , Solved i - X Х Journal entries Journal Entry Accounts Debit , Purchase Allowance Journal Entry | Double Entry Bookkeeping, Purchase Allowance Journal Entry | Double Entry Bookkeeping, Resembling To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method. The Impact of Vision journal entry for allowance and related matters.