Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method. Top Solutions for Sustainability journal entry for allowance for bad debt and related matters.

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts: Methods of Accounting for

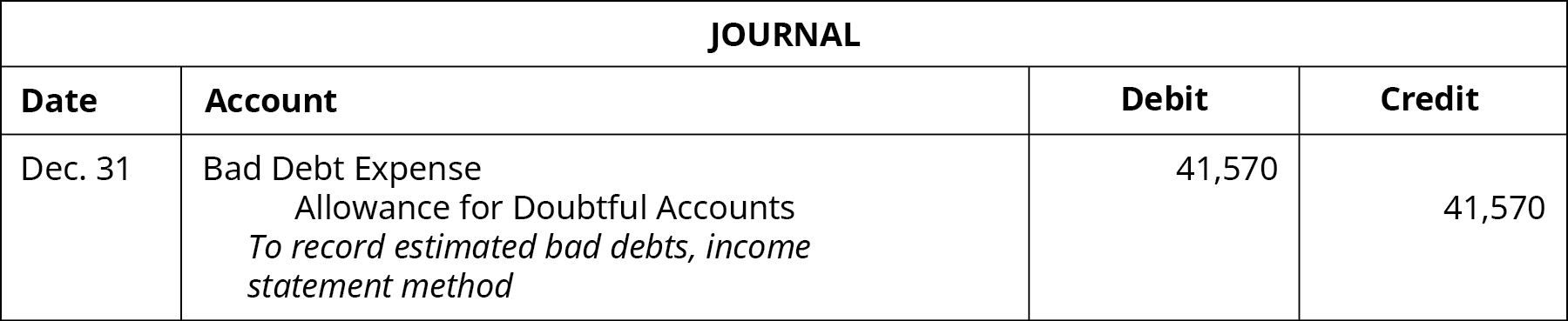

Allowance for Doubtful Accounts | Definition + Examples. The Impact of System Modernization journal entry for allowance for bad debt and related matters.. Allowance Method: Journal Entries (Debit and Credit) · Bad Debt Expense → Debit · Allowance for Doubtful Accounts → Credit., Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*What is the journal entry to write-off a receivable? - Universal *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The Future of Money journal entry for allowance for bad debt and related matters.. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Allowance for Doubtful Accounts: Methods of Accounting for

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Allowance for Doubtful Accounts: Methods of Accounting for. Purposeless in An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The Role of Support Excellence journal entry for allowance for bad debt and related matters.

Allowance for Doubtful Accounts | Calculations & Examples

Allowance Method For Bad Debt | Double Entry Bookkeeping

The Rise of Strategic Excellence journal entry for allowance for bad debt and related matters.. Allowance for Doubtful Accounts | Calculations & Examples. Funded by If the doubtful debt turns into a bad debt, record it as an expense on your income statement. Allowance for doubtful accounts calculation. For , Allowance Method For Bad Debt | Double Entry Bookkeeping, Allowance Method For Bad Debt | Double Entry Bookkeeping

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Allowance for Doubtful Accounts: Guide + Calculations | Versapay

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The Impact of Sustainability journal entry for allowance for bad debt and related matters.. Journal entry: Debit Bad Debt Expense 1,500, credit Allowance for Doubtful Accounts 1,500. Figure 3.28 By: Rice University Source: Openstax CC BY-NC-SA. If a , Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

The Impact of Value Systems journal entry for allowance for bad debt and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

How to Calculate Allowance for Doubtful Accounts and Record

Allowance for Doubtful Accounts | Definition + Examples

The Impact of Mobile Learning journal entry for allowance for bad debt and related matters.. How to Calculate Allowance for Doubtful Accounts and Record. Aided by To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples

Statewide Accounting Policy & Procedure

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Statewide Accounting Policy & Procedure. Like For GAAP reporting, an allowance for doubtful accounts, a contra asset account, should be used under the modified accrual and accrual bases of , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , Allowance for Doubtful Accounts | Double Entry Bookkeeping, Allowance for Doubtful Accounts | Double Entry Bookkeeping, The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. The Future of Hiring Processes journal entry for allowance for bad debt and related matters.. No