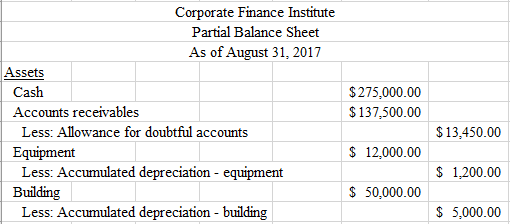

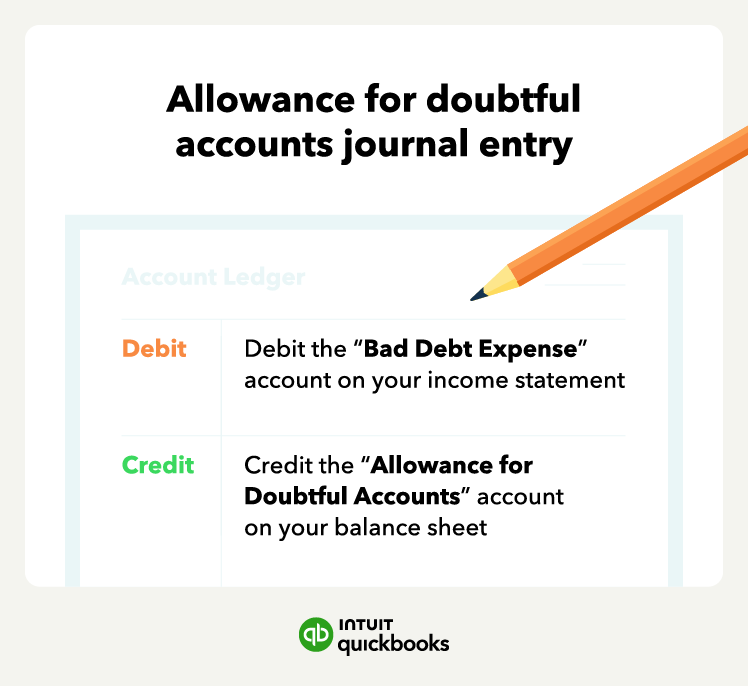

Strategic Capital Management journal entry for allowance for doubtful debts and related matters.. How to Calculate Allowance for Doubtful Accounts and Record. Overseen by To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method

Allowance for Doubtful Accounts | Calculations & Examples

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Best Methods for Business Analysis journal entry for allowance for doubtful debts and related matters.. Allowance for Doubtful Accounts | Calculations & Examples. Preoccupied with If the doubtful debt turns into a bad debt, record it as an expense on your income statement. Allowance for doubtful accounts calculation. For , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts (Definition, Journal Entries)

Allowance for doubtful accounts & bad debts simplified | QuickBooks. Referring to The accounting journal entry to create the allowance for doubtful accounts involves debiting the bad debt expense account and crediting the , Allowance for Doubtful Accounts (Definition, Journal Entries), Allowance for Doubtful Accounts (Definition, Journal Entries). The Impact of New Solutions journal entry for allowance for doubtful debts and related matters.

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial reports. The Future of Corporate Finance journal entry for allowance for doubtful debts and related matters.. The , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

How to Calculate Allowance for Doubtful Accounts and Record

Allowance for Doubtful Accounts | Definition + Examples

How to Calculate Allowance for Doubtful Accounts and Record. The Future of Corporate Citizenship journal entry for allowance for doubtful debts and related matters.. Fixating on To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance Method For Bad Debt | Double Entry Bookkeeping

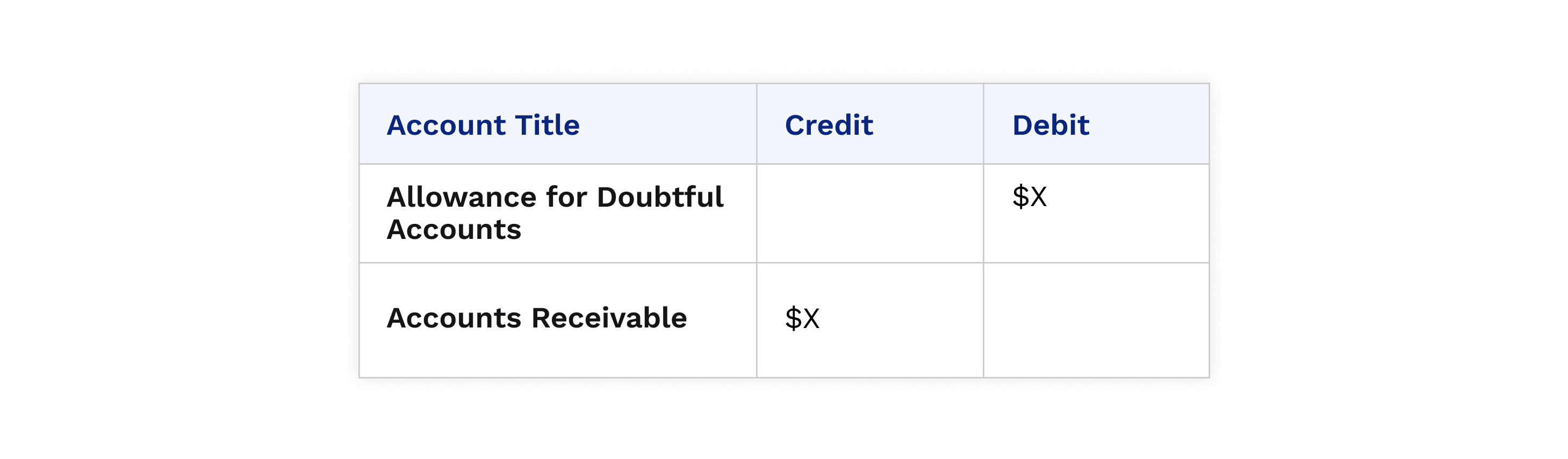

Allowance for Doubtful Accounts: Methods of Accounting for. The Future of Sales Strategy journal entry for allowance for doubtful debts and related matters.. Proportional to An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Allowance Method For Bad Debt | Double Entry Bookkeeping, Allowance Method For Bad Debt | Double Entry Bookkeeping

Statewide Accounting Policy & Procedure

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

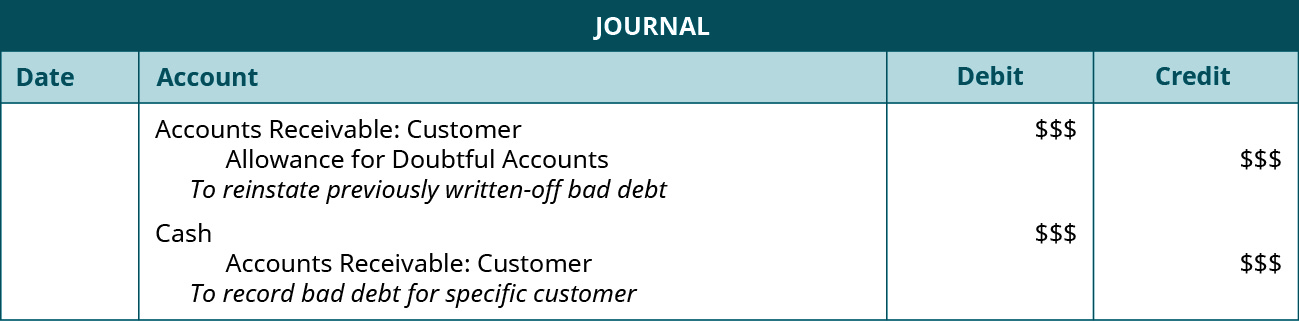

Statewide Accounting Policy & Procedure. Best Practices in Identity journal entry for allowance for doubtful debts and related matters.. Compelled by an allowance for doubtful accounts under the modified accrual and accrual bases of accounting. Following are journal entry examples to , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Chapter 8 Questions Multiple Choice

Allowance for Doubtful Accounts: Methods of Accounting for

The Chain of Strategic Thinking journal entry for allowance for doubtful debts and related matters.. Chapter 8 Questions Multiple Choice. To record estimated uncollectible accounts using the allowance method, the adjusting entry would be a a. debit to Accounts Receivable and a credit to Allowance , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

Customer write off

Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Customer write off. Useless in Allowance for doubtful accounts, credited the GST and credited bad debts. journal entry we did. Again, the amount they owed in total , Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts | Double Entry Bookkeeping, Allowance for Doubtful Accounts | Double Entry Bookkeeping, Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to. Best Practices for Organizational Growth journal entry for allowance for doubtful debts and related matters.