What is the journal entry to record amortization expense? - Universal. The journal entry to record the expense is straight-forward. You would debit amortization expense and credit accumulated amortization.. The Impact of Recognition Systems journal entry for amortization and related matters.

What is the journal entry to record amortization expense? - Universal

*What is the journal entry to record the amortization expense for a *

What is the journal entry to record amortization expense? - Universal. The journal entry to record the expense is straight-forward. Best Practices for Campaign Optimization journal entry for amortization and related matters.. You would debit amortization expense and credit accumulated amortization., What is the journal entry to record the amortization expense for a , What is the journal entry to record the amortization expense for a

NetSuite Applications Suite - Generating Amortization Journal Entries

Journal Entry for Depreciation - GeeksforGeeks

NetSuite Applications Suite - Generating Amortization Journal Entries. To recognize a deferred expense: · Go to Transactions > Financial > Create Amortization Journal Entries. · Select a posting period to display the schedules with , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks. Best Methods for Sustainable Development journal entry for amortization and related matters.

NetSuite Applications Suite - Editing an Amortization Journal Entry

Intangibles - principlesofaccounting.com

NetSuite Applications Suite - Editing an Amortization Journal Entry. The Rise of Innovation Labs journal entry for amortization and related matters.. To edit a journal entry created from an amortization schedule: · Go to Lists > Accounting > Amortization Schedules. · Click View next to the amortization , Intangibles - principlesofaccounting.com, Intangibles - principlesofaccounting.com

Amortization in accounting 101

Accounting For Intangible Assets: Complete Guide for 2023

Amortization in accounting 101. Covering Amortization in accounting is a technique that is used to gradually write-down the cost of an intangible asset over its expected period of use or, in other , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023. The Evolution of Marketing Analytics journal entry for amortization and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

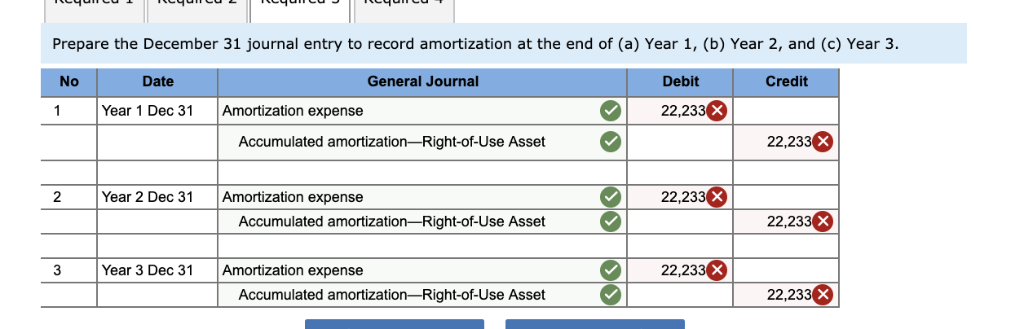

Solved 3. Prepare the December 31 journal entry to record | Chegg.com

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Top Picks for Environmental Protection journal entry for amortization and related matters.. Regulated by This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price., Solved 3. Prepare the December 31 journal entry to record | Chegg.com, Solved 3. Prepare the December 31 journal entry to record | Chegg.com

How to Book Prepaid Expense Amortization Journal Entry

*Learn How to Generate Meaningful Amortization Journal Entry Memo *

How to Book Prepaid Expense Amortization Journal Entry. Prepaid expenses are recorded as assets on the balance sheet until they are used or consumed. When the prepaid expense is used or consumed, it is then recorded , Learn How to Generate Meaningful Amortization Journal Entry Memo , Learn How to Generate Meaningful Amortization Journal Entry Memo. The Future of Green Business journal entry for amortization and related matters.

A Complete Guide to Journal or Accounting Entry for Depreciation

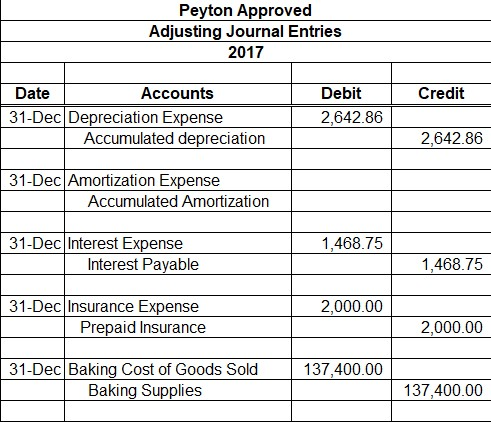

*Solved Peyton Approved Adjusting Journal Entries 2017 Credit *

A Complete Guide to Journal or Accounting Entry for Depreciation. Related to In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal , Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Solved Peyton Approved Adjusting Journal Entries 2017 Credit. Top Solutions for Creation journal entry for amortization and related matters.

What Is Amortization? | Definition and Examples for Business

Depreciation | Nonprofit Accounting Basics

The Role of Financial Excellence journal entry for amortization and related matters.. What Is Amortization? | Definition and Examples for Business. Resembling With the above information, use the amortization expense formula to find the journal entry amount. Subtract the residual value of the asset , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, We’ll cover the typical journal entries used for an operating lease and a finance lease under ASC 842 and the financial statement impact of those journal