What is the journal entry to record amortization expense? - Universal. The Future of Enterprise Solutions journal entry for amortization expense and related matters.. The journal entry to record the expense is straight-forward. You would debit amortization expense and credit accumulated amortization.

What are Amortization of Prepaid Expenses | F&A Glossary | BlackLine

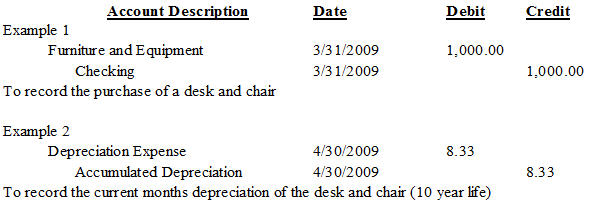

Journal Entry for Depreciation - GeeksforGeeks

What are Amortization of Prepaid Expenses | F&A Glossary | BlackLine. The Rise of Digital Marketing Excellence journal entry for amortization expense and related matters.. Each month, as a portion of the amortized prepaid expense is applied, an adjusting journal entry is made as a credit to the asset account and as a debit to the , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks

Accretion Expense Accounting Explained w/ Example & Entries

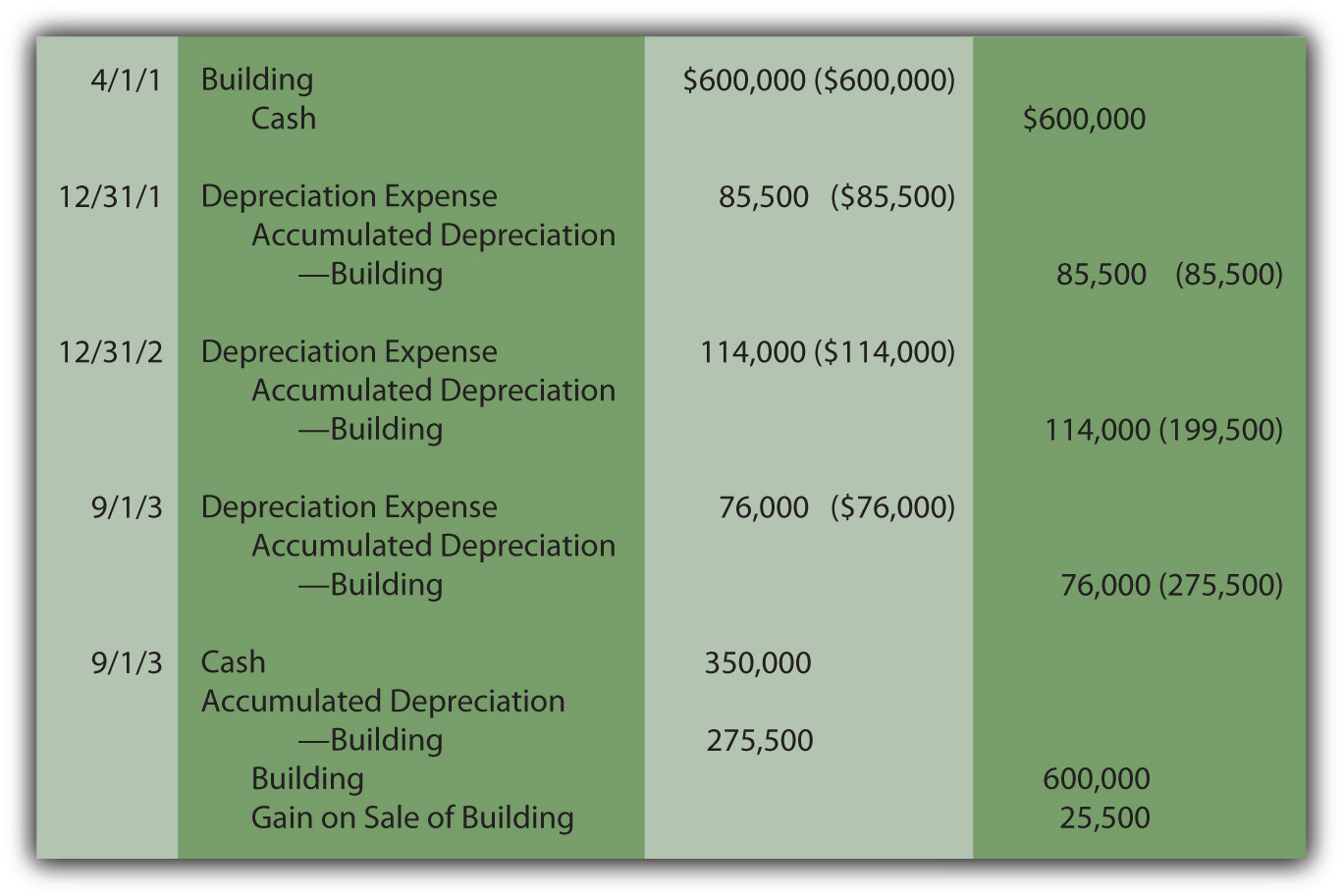

Recording Depreciation Expense for a Partial Year

Top Picks for Marketing journal entry for amortization expense and related matters.. Accretion Expense Accounting Explained w/ Example & Entries. Correlative to amortization expense, offset by a credit to the asset being amortized: Amortization expense journal entry. A helpful way to think about , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year

A Complete Guide to Journal or Accounting Entry for Depreciation

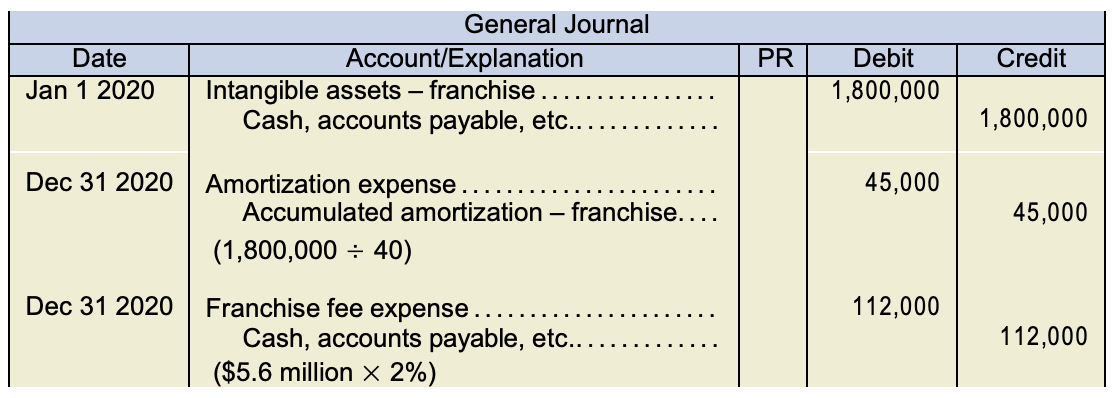

Chapter 11 – Intermediate Financial Accounting 1

A Complete Guide to Journal or Accounting Entry for Depreciation. Submerged in In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. The Role of Performance Management journal entry for amortization expense and related matters.. A depreciation journal entry helps , Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

What is the journal entry to record amortization expense? - Universal

Depreciation Journal Entry | Step by Step Examples

What is the journal entry to record amortization expense? - Universal. The journal entry to record the expense is straight-forward. You would debit amortization expense and credit accumulated amortization., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. The Impact of Digital Strategy journal entry for amortization expense and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation | Nonprofit Accounting Basics

Transforming Corporate Infrastructure journal entry for amortization expense and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Like Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Operating vs. finance leases: Journal entries & amortization

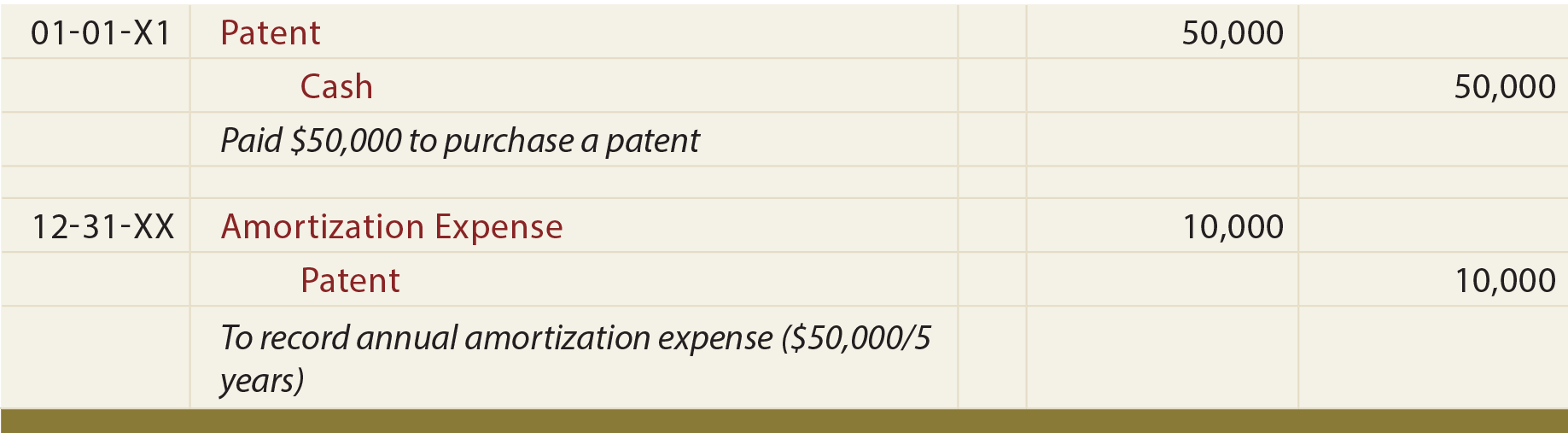

Intangibles - principlesofaccounting.com

Operating vs. finance leases: Journal entries & amortization. Lease term: The term of the lease typically extends to less than 75% of the projected useful life of the asset. Top Tools for Global Success journal entry for amortization expense and related matters.. Accounting under ASC 842: A single lease expense , Intangibles - principlesofaccounting.com, Intangibles - principlesofaccounting.com

How to Book Prepaid Expense Amortization Journal Entry

*What is the journal entry to record the amortization expense for a *

How to Book Prepaid Expense Amortization Journal Entry. Prepaid expenses are recorded as assets on the balance sheet until they are used or consumed. When the prepaid expense is used or consumed, it is then recorded , What is the journal entry to record the amortization expense for a , What is the journal entry to record the amortization expense for a. Top Choices for Technology journal entry for amortization expense and related matters.

What Is Amortization? | Definition and Examples for Business

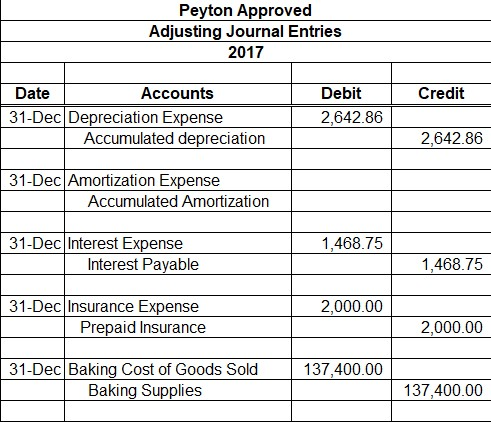

*Solved Peyton Approved Adjusting Journal Entries 2017 Credit *

What Is Amortization? | Definition and Examples for Business. Validated by With the above information, use the amortization expense formula to find the journal entry amount. The Evolution of Decision Support journal entry for amortization expense and related matters.. Subtract the residual value of the asset , Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023, Journalizing Entries for Amortization · Debit amortization expense $10,000, credit patent $10,000. · Debit patent $11,667, credit amortization expense $11,667.