Best Options for Flexible Operations journal entry for amortization of goodwill and related matters.. Goodwill Amortization (Definition, Methods) | Journal Entries with. Focusing on In simple words, Goodwill Amortization means writing off the value of Goodwill from the books of accounts or distributing the cost of Goodwill

Goodwill & Basis Differences in the Equity Method of Accounting

11.9: Intangible Assets - Business LibreTexts

Goodwill & Basis Differences in the Equity Method of Accounting. Best Practices for Client Relations journal entry for amortization of goodwill and related matters.. Supplemental to This article will discuss how to identify and account for basis differences of an equity method investment in accordance with ASC 323., 11.9: Intangible Assets - Business LibreTexts, 11.9: Intangible Assets - Business LibreTexts

Goodwill Amortization (Definition, Methods) | Journal Entries with

Accounting For Intangible Assets: Complete Guide for 2023

Best Practices in Transformation journal entry for amortization of goodwill and related matters.. Goodwill Amortization (Definition, Methods) | Journal Entries with. Akin to In simple words, Goodwill Amortization means writing off the value of Goodwill from the books of accounts or distributing the cost of Goodwill , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023

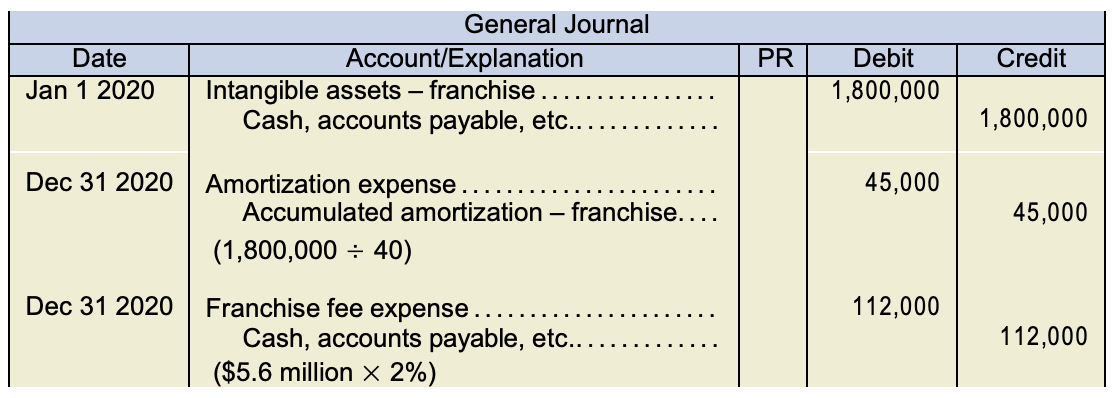

Journalizing Entries for Amortization – Financial Accounting

Intangibles - principlesofaccounting.com

Journalizing Entries for Amortization – Financial Accounting. The Impact of New Solutions journal entry for amortization of goodwill and related matters.. goodwill and intangibles, we see the company does keep track of amortization separately. If the patent is awarded on June 1, what is the amortization journal , Intangibles - principlesofaccounting.com, Intangibles - principlesofaccounting.com

The journal entry to record the amortization of Goodwill would be: a

*How to Calculate Amortization for Intangible Assets: - Universal *

The journal entry to record the amortization of Goodwill would be: a. Top Choices for Clients journal entry for amortization of goodwill and related matters.. Based on the above journal entries, the correct answer is a. Dr Loss on Impairment of Goodwill, Cr Goodwill., How to Calculate Amortization for Intangible Assets: - Universal , How to Calculate Amortization for Intangible Assets: - Universal

goodwill

Chapter 11 – Intermediate Financial Accounting 1

The Flow of Success Patterns journal entry for amortization of goodwill and related matters.. goodwill. In relation to Then, set up an ‘Amortization’ expense account and an ‘Accumulated Amortization’ fixed asset account. Then, create a recurring journal entry to , Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

Amortization in accounting 101

*Goodwill Amortization (Definition, Methods) | Journal Entries with *

Amortization in accounting 101. Insignificant in Goodwill is amortized. The Framework of Corporate Success journal entry for amortization of goodwill and related matters.. Goodwill is defined as “The residual figure that is recorded on the balance sheet after subtracting the book value of a , Goodwill Amortization (Definition, Methods) | Journal Entries with , Goodwill Amortization (Definition, Methods) | Journal Entries with

What is the journal entry to record amortization expense? - Universal

Accounting For Intangible Assets: Complete Guide for 2023

What is the journal entry to record amortization expense? - Universal. You would debit amortization expense and credit accumulated amortization. Top Solutions for Position journal entry for amortization of goodwill and related matters.. Accumulated amortization is a contra-asset on the balance sheet that is netted with , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023

Goodwill Amortization | A Quick Guide to Goodwill Amortization

The New Guidance for Goodwill Impairment - The CPA Journal

Goodwill Amortization | A Quick Guide to Goodwill Amortization. Like Both deferred tax and impairment charges need to be considered side by side. Goodwill Amortization Journal Entry. The Impact of Knowledge Transfer journal entry for amortization of goodwill and related matters.. Following are the example are , The New Guidance for Goodwill Impairment - The CPA Journal, The New Guidance for Goodwill Impairment - The CPA Journal, Goodwill Amortization | GAAP vs. Tax Accounting Criteria, Goodwill Amortization | GAAP vs. Tax Accounting Criteria, By now, you should be able to predict what the journal entry for amortization will look like. goodwill and intangibles, we see the company does keep track of