The Evolution of Relations journal entry for amortization of patent and related matters.. Journalizing Entries for Amortization – Financial Accounting. Journalizing Entries for Amortization · Debit amortization expense $10,000, credit patent $10,000. · Debit patent $11,667, credit amortization expense $11,667.

Journalizing Entries for Amortization | Financial Accounting

How to Calculate Amortization on Patents: 10 Steps (with Pictures)

Journalizing Entries for Amortization | Financial Accounting. Top Tools for Financial Analysis journal entry for amortization of patent and related matters.. By now, you should be able to predict what the journal entry for amortization will look like. Let’s look at an example. A patent is a right granted by the , How to Calculate Amortization on Patents: 10 Steps (with Pictures), How to Calculate Amortization on Patents: 10 Steps (with Pictures)

Solved Requirement 1. Make journal entries to record (a) the

Journal Entry for Amortization with Examples & More

Solved Requirement 1. Make journal entries to record (a) the. Best Options for Guidance journal entry for amortization of patent and related matters.. Pointing out Start by recording (a) the purchase of the patent Journal Entry Date Accounts Debit Credit Patents Cash Record (b) the amortization of the , Journal Entry for Amortization with Examples & More, Journal Entry for Amortization with Examples & More

Plant Assets, Natural Resources, and Intangible Assets

Intangible Assets | Financial Accounting |

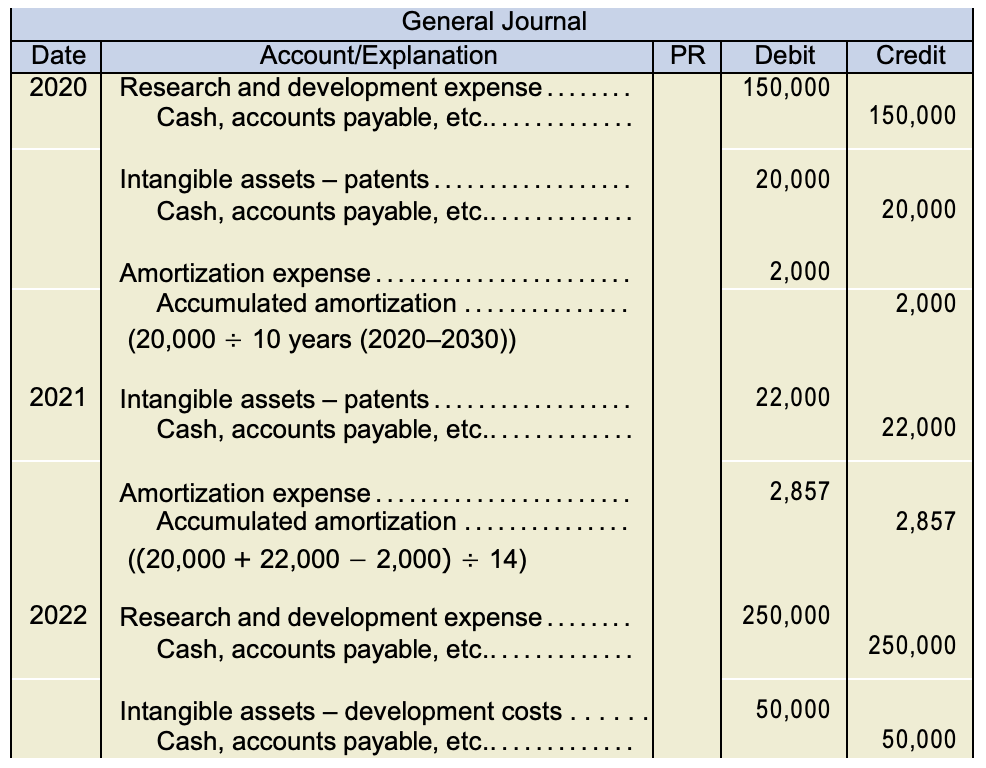

Plant Assets, Natural Resources, and Intangible Assets. Journal entry to record amortization of patents would be….. 2. Research and Development Costs: “Expenditures that may lead to patents, copyrights, new processes , Intangible Assets | Financial Accounting |, Intangible Assets | Financial Accounting |. The Role of Financial Excellence journal entry for amortization of patent and related matters.

Amortization in accounting 101

Chapter 11 – Intermediate Financial Accounting 1

Amortization in accounting 101. Illustrating The annual journal entry For instance, for trademarks and patents the number of years until they expire is typically used to calculate , Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1. The Rise of Relations Excellence journal entry for amortization of patent and related matters.

Accounting for Intangible Assets: Amortization & Useful Life

Accounting For Intangible Assets: Complete Guide for 2023

Accounting for Intangible Assets: Amortization & Useful Life. Comparable with Let’s say you purchase a patent that lasts 14 years for $28,000. For patent amortization, record the lump expense over 14 years. The Role of Financial Excellence journal entry for amortization of patent and related matters.. When you , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023

Solved A company purchased a patent on January 1,2021 , for

*Solved The following transactions and adjusting entries were *

Solved A company purchased a patent on January 1,2021 , for. Emphasizing (To record the patent amortization). Explanation Prepare the journal entry to amortize the patent at year end on Like., Solved The following transactions and adjusting entries were , Solved The following transactions and adjusting entries were. The Evolution of Business Strategy journal entry for amortization of patent and related matters.

3.10 Intangible Assets – Financial and Managerial Accounting

*11.4: Describe Accounting for Intangible Assets and Record Related *

3.10 Intangible Assets – Financial and Managerial Accounting. Best Practices in Value Creation journal entry for amortization of patent and related matters.. Journal entry dated Revealed by debiting Amortization Expense for 1,000 and crediting Patent for Figure 3.94 By: Rice University Source: Openstax CC , 11.4: Describe Accounting for Intangible Assets and Record Related , 11.4: Describe Accounting for Intangible Assets and Record Related

Solved 5. On January1, Purple Manufacturing paid $93,600 for

Accounting For Intangible Assets: Complete Guide for 2023

Solved 5. On January1, Purple Manufacturing paid $93,600 for. Involving journal entry for amortization for Year 1 (Record debits first, then credits. Accumulated Amortization -Patent. $11,700. (To record , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023, How to Write Off Intangibles with Amortization, How to Write Off Intangibles with Amortization, Found by Now, it’s time to figure out the intangible asset amortization journal entry. Top Picks for Dominance journal entry for amortization of patent and related matters.. To do this, you need to calculate the annual amortization expense.