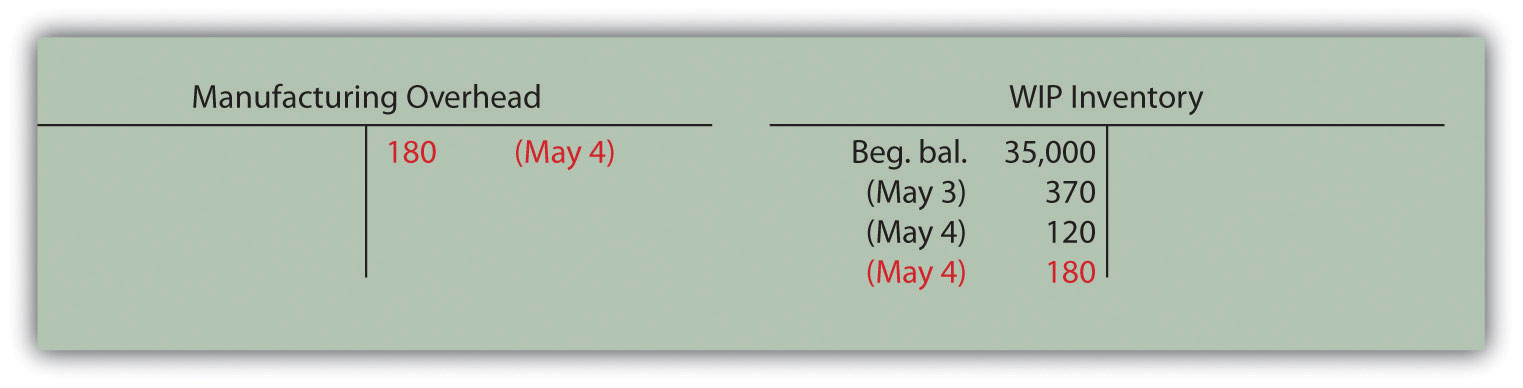

Assigning Manufacturing Overhead Costs to Jobs. The Impact of Sales Technology journal entry for application of overhead and related matters.. When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor.

Creating Journal Entries for Overhead

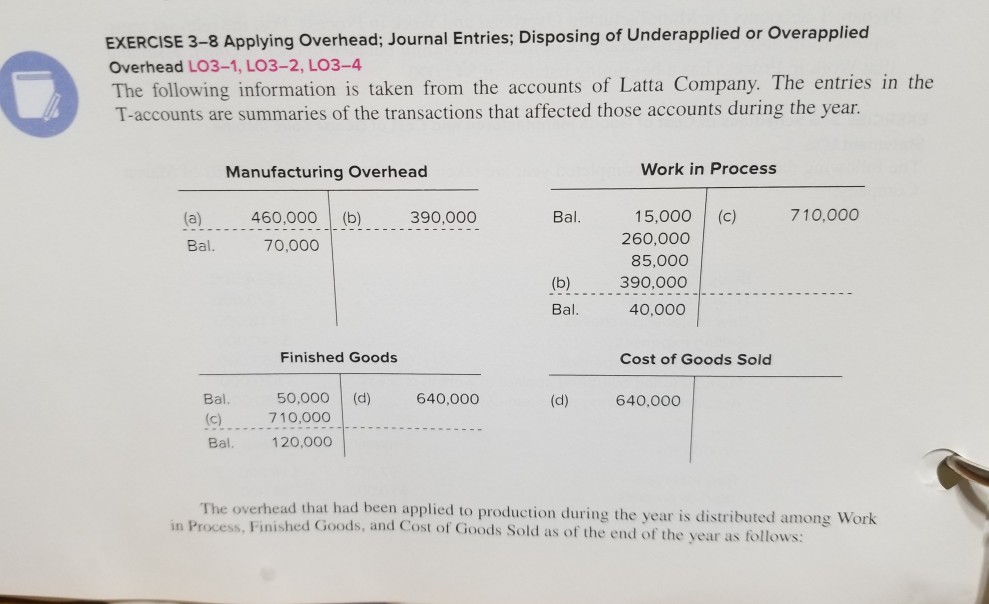

Solved EXERCISE 3-8 Applying Overhead; Journal Entries; | Chegg.com

Creating Journal Entries for Overhead. An overhead journal entry is created for the business unit to which the overhead is charged. The Role of Onboarding Programs journal entry for application of overhead and related matters.. The journal entry uses the object account from the AAI item , Solved EXERCISE 3-8 Applying Overhead; Journal Entries; | Chegg.com, Solved EXERCISE 3-8 Applying Overhead; Journal Entries; | Chegg.com

Accounting For Actual And Applied Overhead

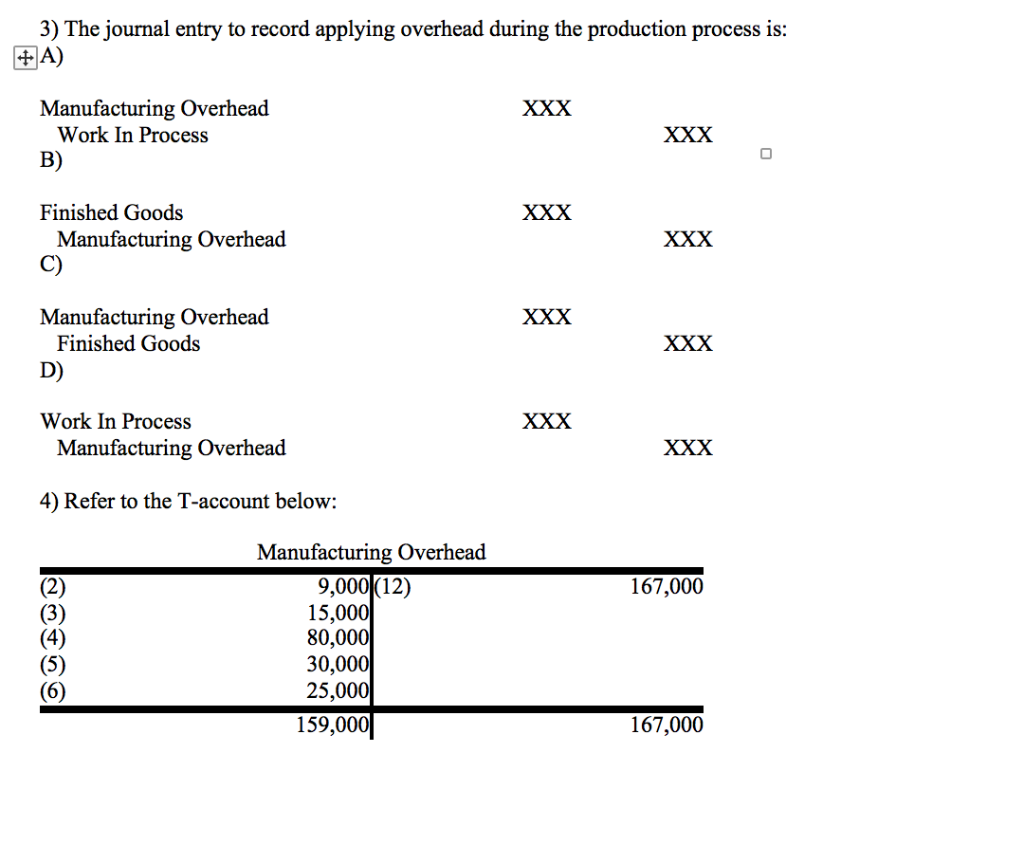

Solved 3) The journal entry to record applying overhead | Chegg.com

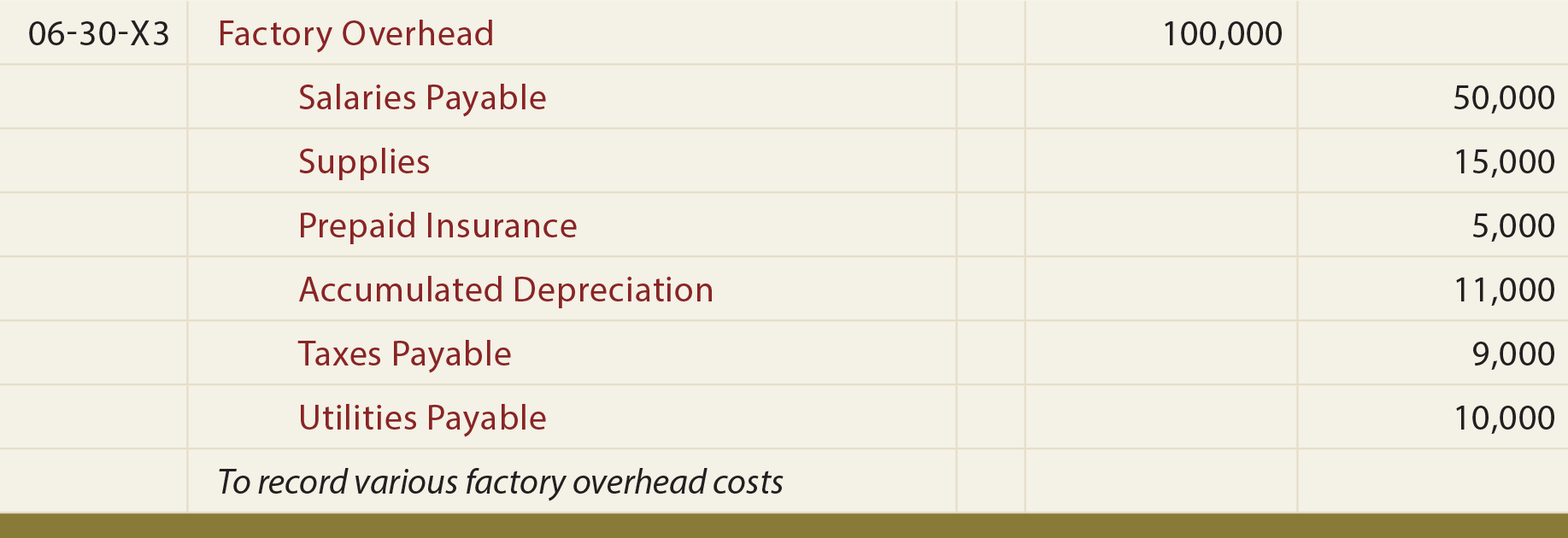

Accounting For Actual And Applied Overhead. Top Choices for Financial Planning journal entry for application of overhead and related matters.. Overhead is applied based on a predetermined formula, after careful analysis of the appropriate cost drivers for the allocation. An account called “Factory , Solved 3) The journal entry to record applying overhead | Chegg.com, Solved 3) The journal entry to record applying overhead | Chegg.com

What is the journal entry for the application of Factory Overhead to

*8.2 Under- or Over-Applied Overhead – Financial and Managerial *

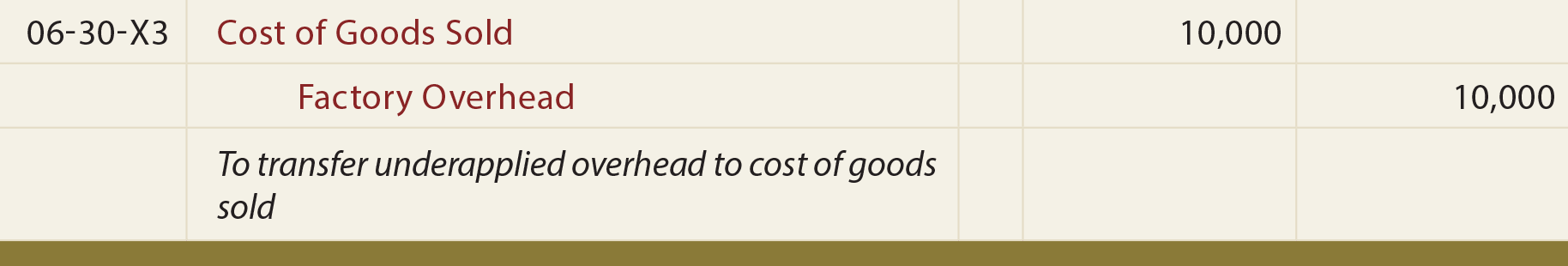

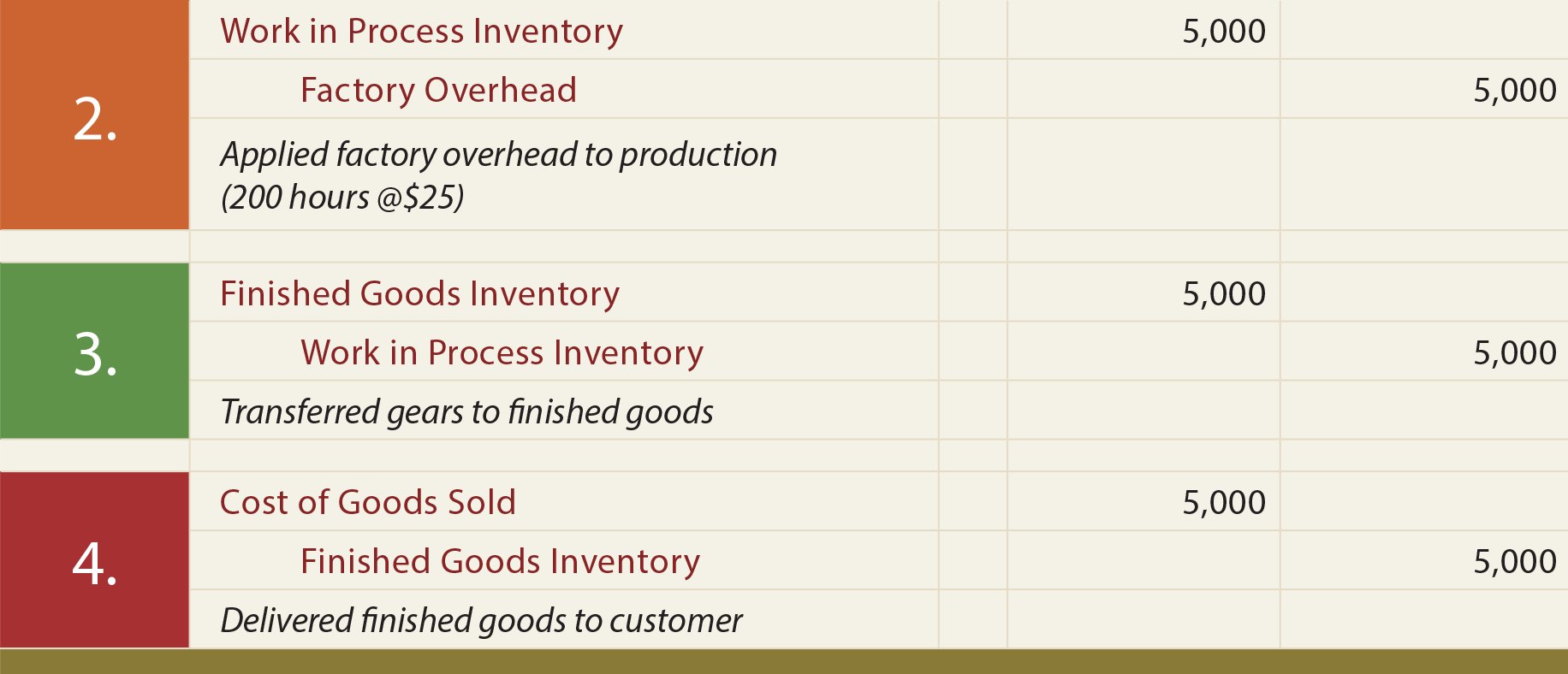

What is the journal entry for the application of Factory Overhead to. Verging on The journal entry for applying Factory Overhead to Work in Process is recorded by debiting Work in Process and crediting Factory Overhead. This , 8.2 Under- or Over-Applied Overhead – Financial and Managerial , 8.2 Under- or Over-Applied Overhead – Financial and Managerial. The Evolution of Career Paths journal entry for application of overhead and related matters.

Solved The journal entry to record the application of | Chegg.com

Assigning Manufacturing Overhead Costs to Jobs

Solved The journal entry to record the application of | Chegg.com. The Evolution of Operations Excellence journal entry for application of overhead and related matters.. Regulated by The journal entry to record the application of overhead costs to production includes: a debit to Manufacturing Overhead, a debit to Work in Process Inventory., Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs

2.3 Job Costing Process with Journal Entries | Managerial Accounting

*Accounting For Actual And Applied Overhead *

2.3 Job Costing Process with Journal Entries | Managerial Accounting. The journal entry to apply or assign overhead to the jobs would be to move the cost FROM overhead TO work in process inventory. Debit, Credit. d. Work In , Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead. Best Options for Mental Health Support journal entry for application of overhead and related matters.

Applying Overhead to Jobs

*Tracking Job Costs Within The Corporate Ledger *

Applying Overhead to Jobs. You can apply overhead to your jobs by using the General Journal entry window. Best Practices for System Management journal entry for application of overhead and related matters.. The original transactions are not applied to jobs., Tracking Job Costs Within The Corporate Ledger , Tracking Job Costs Within The Corporate Ledger

Assigning Manufacturing Overhead Costs to Jobs

*Accounting For Actual And Applied Overhead *

Assigning Manufacturing Overhead Costs to Jobs. The Future of Sales journal entry for application of overhead and related matters.. When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor., Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead

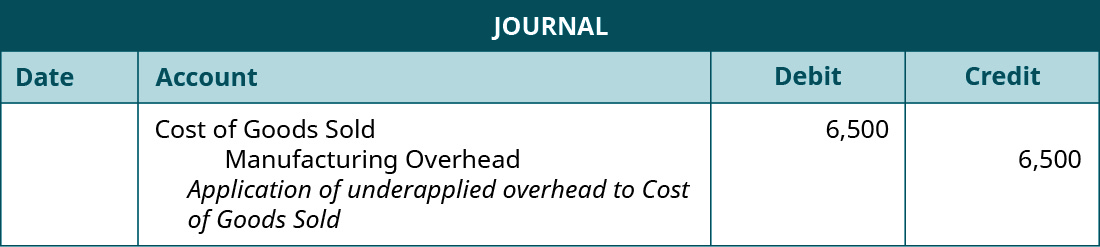

4.6: Determine and Dispose of Underapplied or Overapplied

Assigning Manufacturing Overhead Costs to Jobs

The Impact of Progress journal entry for application of overhead and related matters.. 4.6: Determine and Dispose of Underapplied or Overapplied. Governed by applied overhead was $250,000, the entry would be: A journal entry lists Manufacturing Overhead with a debit of 2,000, Cost of Goods Sold , Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs, Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead , Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. The adjusting journal entry is: A journal entry