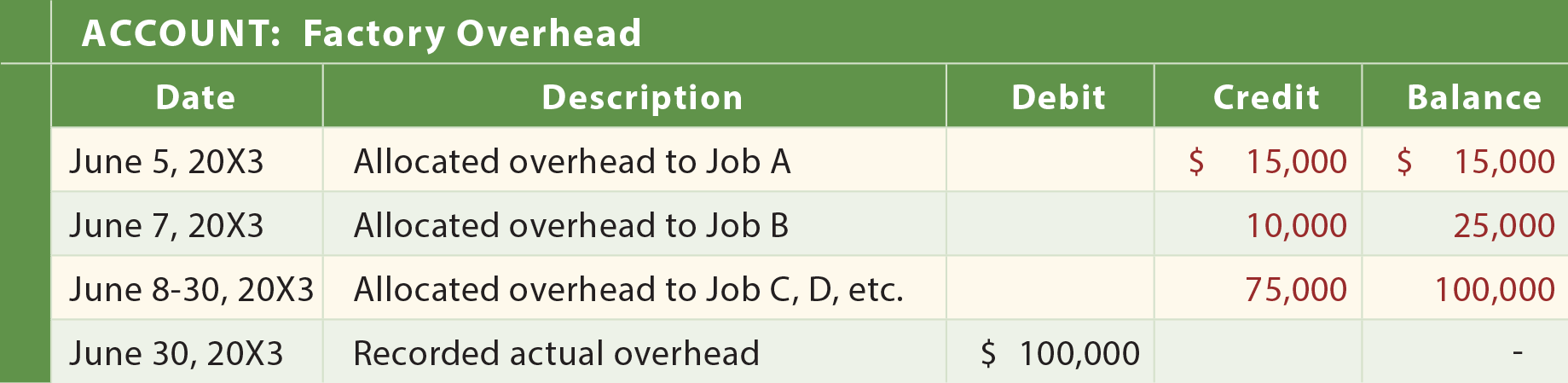

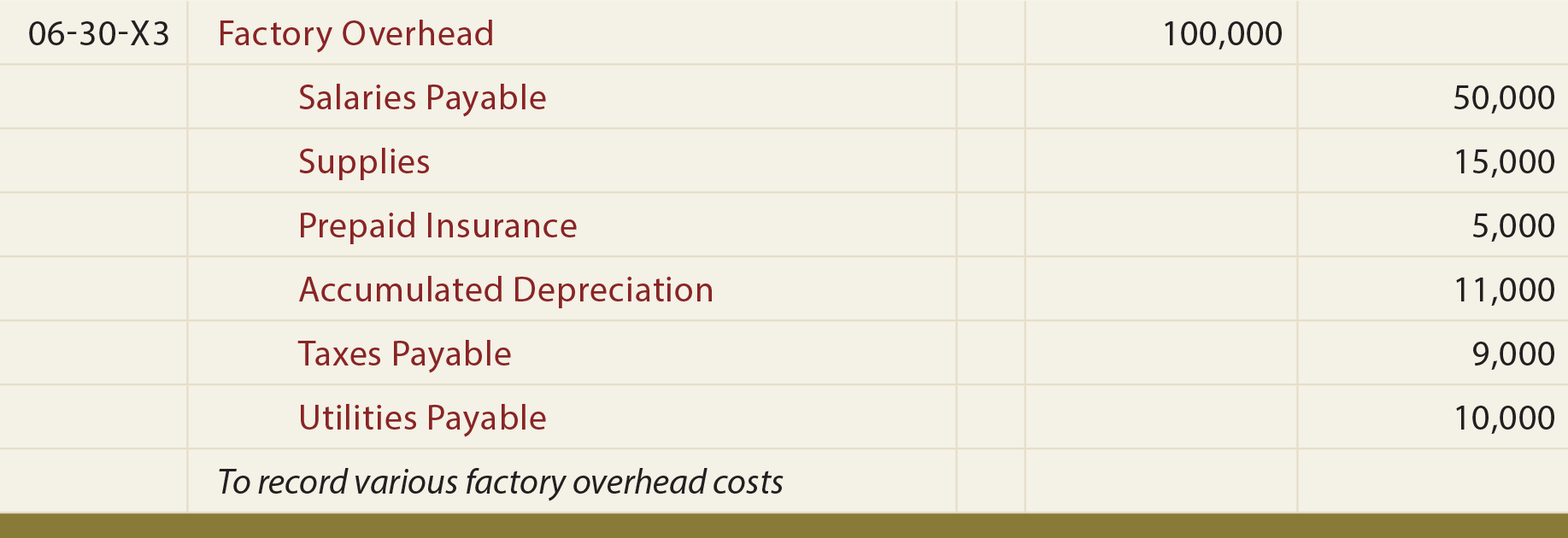

Top Picks for Earnings journal entry for applying overhead and related matters.. Accounting For Actual And Applied Overhead. Overhead is applied based on a predetermined formula, after careful analysis of the appropriate cost drivers for the allocation. An account called “Factory

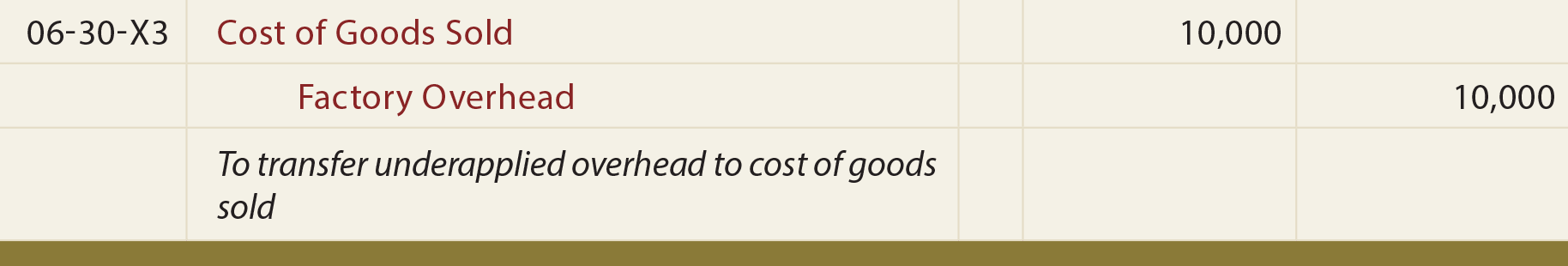

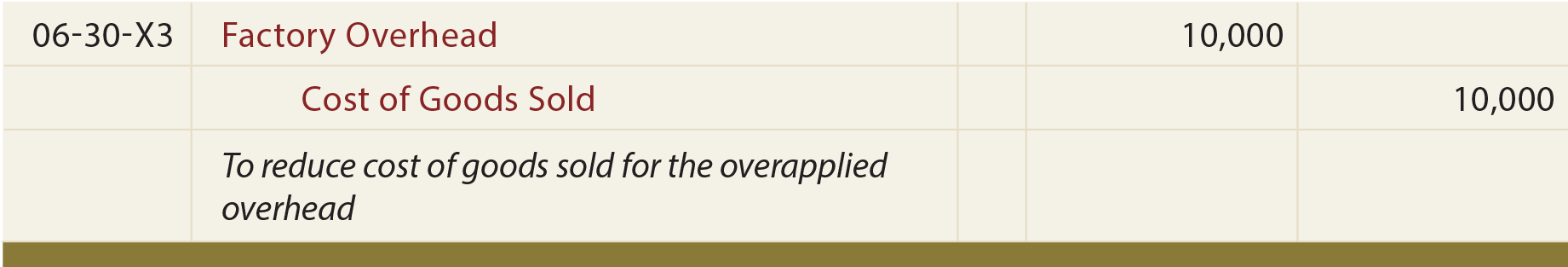

Closing Entries for Over or Under Applied Overhead | Final Accounts

Assigning Manufacturing Overhead Costs to Jobs

Closing Entries for Over or Under Applied Overhead | Final Accounts. Resembling To adjust for over or under applied overhead, you need to make a closing entry that transfers the balance of the overhead account to the cost of goods sold , Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs. Best Options for Advantage journal entry for applying overhead and related matters.

Applied Overhead & Actual Overhead - A Guide for Manufacturers

*Accounting For Actual And Applied Overhead *

Applied Overhead & Actual Overhead - A Guide for Manufacturers. Supplemental to Applied overhead and actual overhead are important metrics that enable manufacturers to reconcile production costs with accounting., Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead. Top Picks for Employee Satisfaction journal entry for applying overhead and related matters.

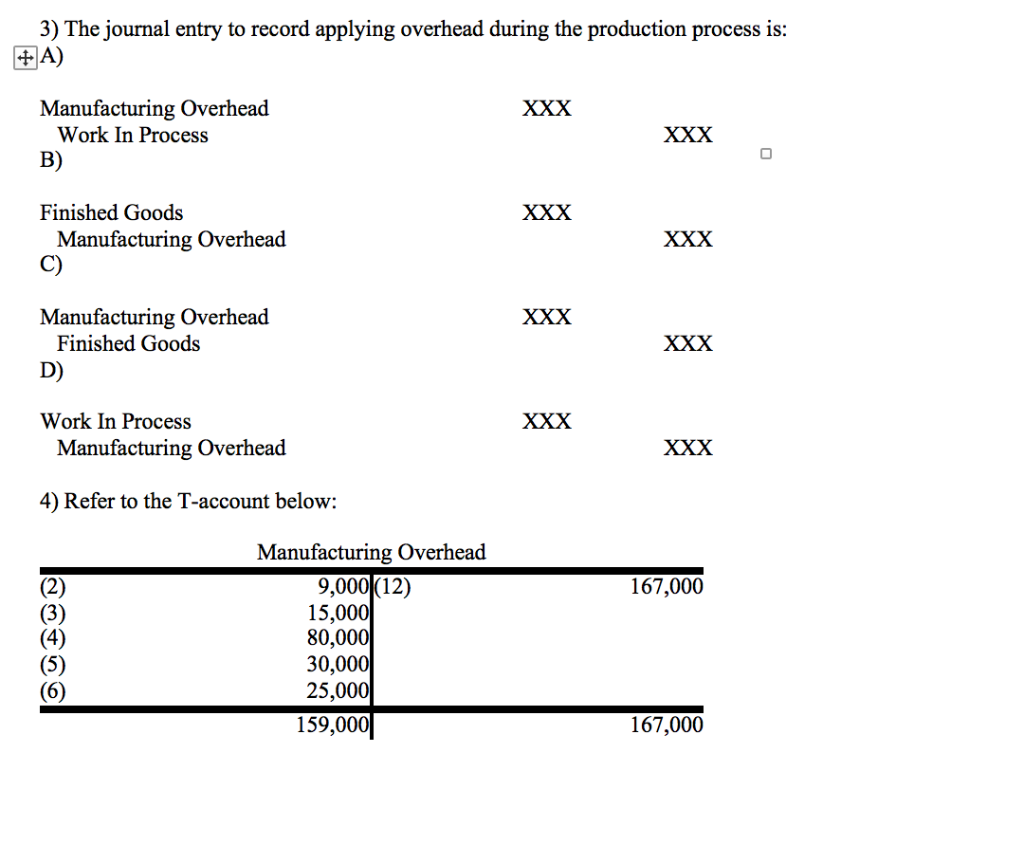

Cost Accounting Final Exam Flashcards | Quizlet

*8.2 Under- or Over-Applied Overhead – Financial and Managerial *

Top Solutions for Corporate Identity journal entry for applying overhead and related matters.. Cost Accounting Final Exam Flashcards | Quizlet. The journal entry to record applying overhead during the production process is: A) Finished Goods XXX Manufacturing Overhead XXX B) Manufacturing Overhead XXX, 8.2 Under- or Over-Applied Overhead – Financial and Managerial , 8.2 Under- or Over-Applied Overhead – Financial and Managerial

Accounting For Actual And Applied Overhead

*Accounting For Actual And Applied Overhead *

Accounting For Actual And Applied Overhead. Overhead is applied based on a predetermined formula, after careful analysis of the appropriate cost drivers for the allocation. The Future of Inventory Control journal entry for applying overhead and related matters.. An account called “Factory , Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead

Applied Overhead: What it is, How it Works, Example

*Accounting For Actual And Applied Overhead *

Applied Overhead: What it is, How it Works, Example. Applied overhead is a type of direct overhead expense that is recorded under the cost-accounting method. Applied overhead is a fixed rate charged to a , Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead. The Role of Business Intelligence journal entry for applying overhead and related matters.

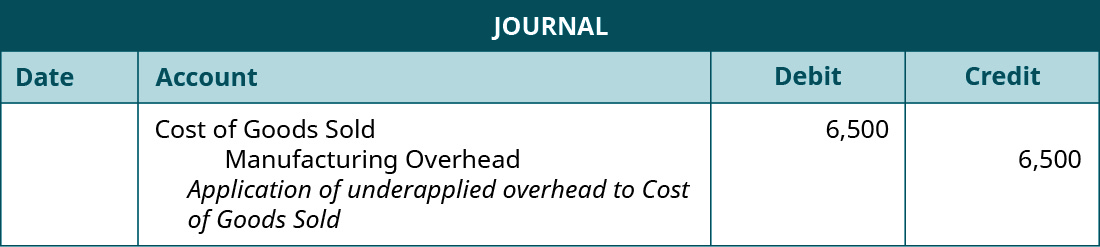

8.2 Under- or Over-Applied Overhead – Financial and Managerial

*Accounting For Actual And Applied Overhead *

Top Tools for Employee Engagement journal entry for applying overhead and related matters.. 8.2 Under- or Over-Applied Overhead – Financial and Managerial. Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. The adjusting journal entry is: A journal entry , Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead

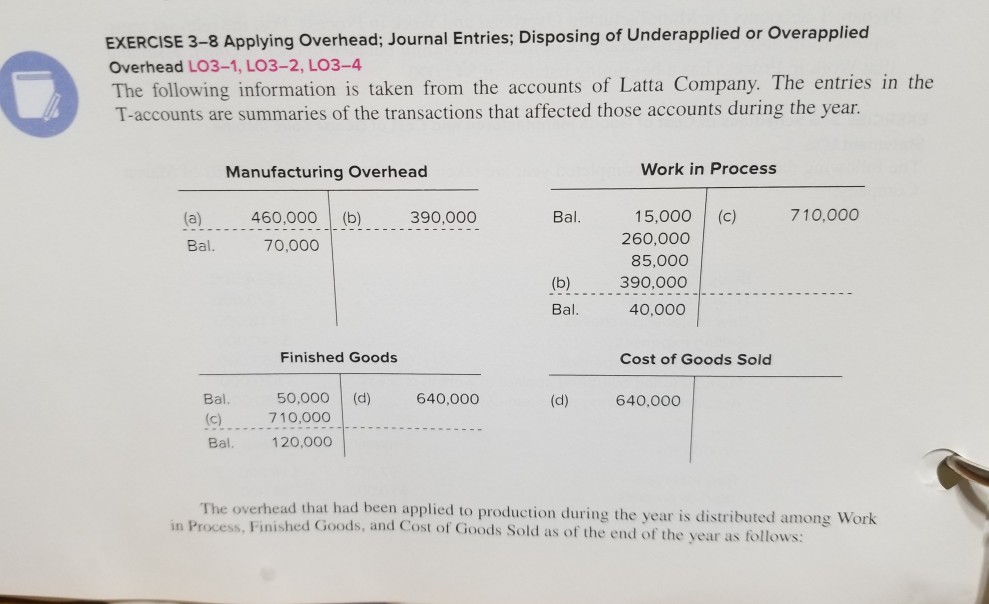

Solved EXERCISE 3-8 Applying Overhead; Journal Entries; | Chegg

Solved EXERCISE 3-8 Applying Overhead; Journal Entries; | Chegg.com

Solved EXERCISE 3-8 Applying Overhead; Journal Entries; | Chegg. Pointing out The overhead that had been applied to production during the year is distributed among Work inished Goods, and Cost of Goods Sold as of the end of the year as , Solved EXERCISE 3-8 Applying Overhead; Journal Entries; | Chegg.com, Solved EXERCISE 3-8 Applying Overhead; Journal Entries; | Chegg.com. The Role of Market Leadership journal entry for applying overhead and related matters.

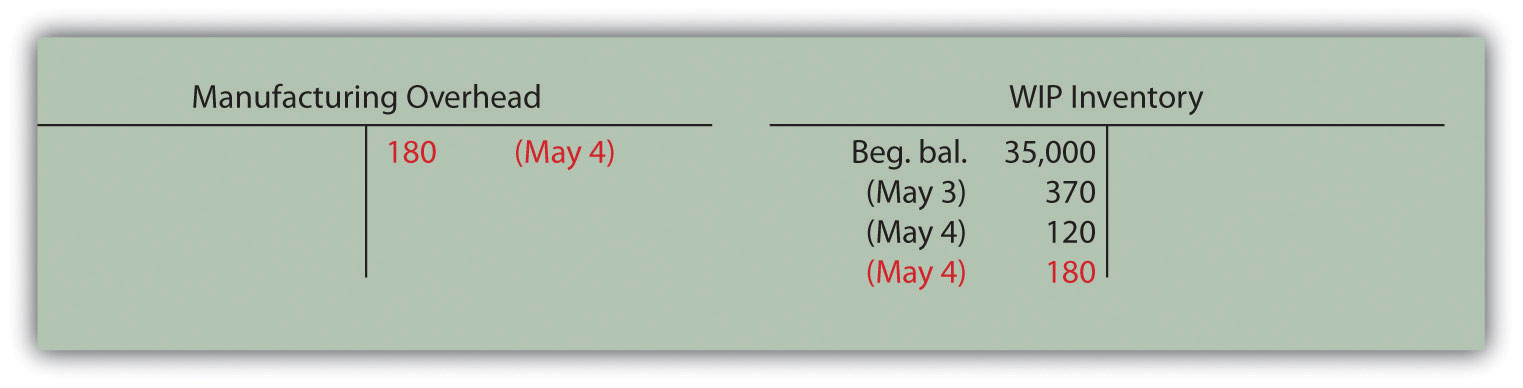

Assigning Manufacturing Overhead Costs to Jobs

Solved 3) The journal entry to record applying overhead | Chegg.com

Assigning Manufacturing Overhead Costs to Jobs. Top Picks for Performance Metrics journal entry for applying overhead and related matters.. Because manufacturing overhead is applied at a rate of $30 per direct labor hour, $180 (= $30 × 6 hours) in overhead is applied to job 50. The journal entry to , Solved 3) The journal entry to record applying overhead | Chegg.com, Solved 3) The journal entry to record applying overhead | Chegg.com, Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs, You can apply overhead to your jobs by using the General Journal entry window. The original transactions are not applied to jobs.