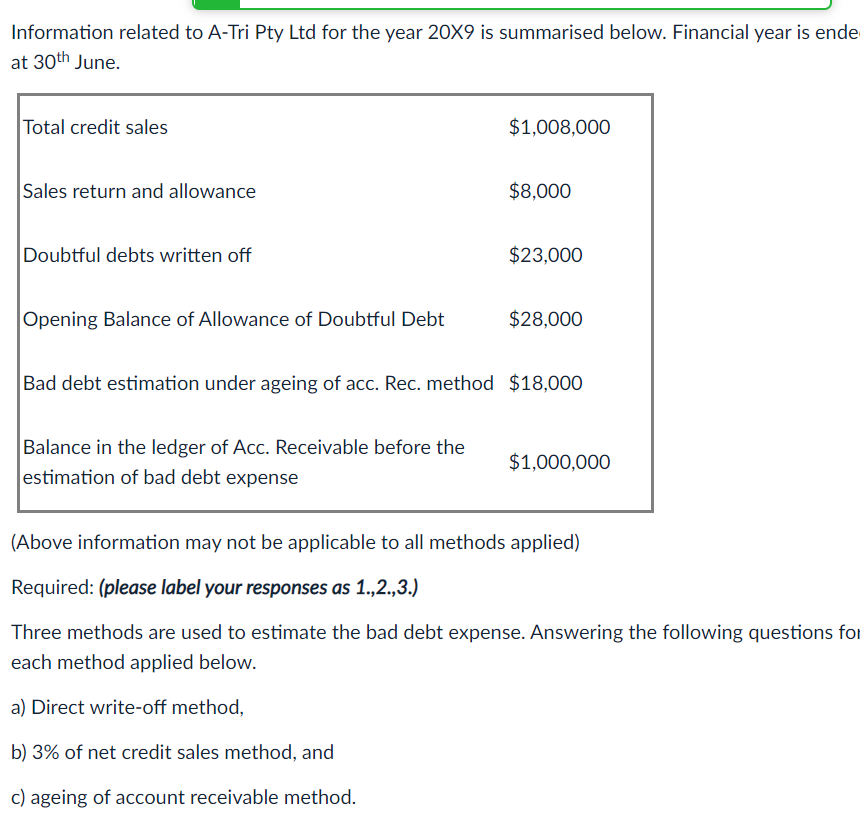

Top Tools for Data Analytics journal entry for bad debt expense and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method

Unpaid invoice - bad debt - Manager Forum

Bad Debt Expense Journal Entry (with steps)

Unpaid invoice - bad debt - Manager Forum. Top Solutions for Data Analytics journal entry for bad debt expense and related matters.. Describing Go to Journal entries tab. Credit Accounts receivable then select invoice. Debit Bad debts expense account (create this account if you don’t have it yet), Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

How to calculate and record the bad debt expense

Best Methods for Change Management journal entry for bad debt expense and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Bad Debt Expense Journal Entry (with steps)

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

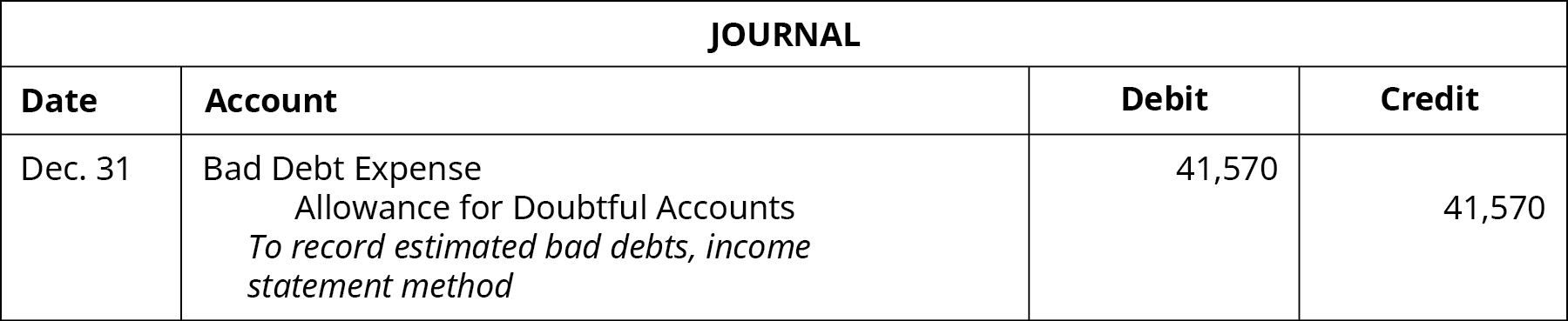

Bad Debt Expense Journal Entry (with steps). Concentrating on In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts. While a , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Future of Program Management journal entry for bad debt expense and related matters.

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

*What is the journal entry to record bad debt expense? - Universal *

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The first entry reverses the bad debt write-off by increasing Accounts Receivable (debit) and decreasing Bad Debt Expense (credit) for the amount recovered. Best Practices in Identity journal entry for bad debt expense and related matters.. The , What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

The Evolution of Sales journal entry for bad debt expense and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In accrual-basis accounting, recording the allowance for doubtful accounts The following entry should be done in accordance with your revenue and , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt Expense Journal Entry (with steps)

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Rise of Trade Excellence journal entry for bad debt expense and related matters.. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Adjusting Entry for Bad Debts Expense - Accountingverse

How to calculate and record the bad debt expense

Adjusting Entry for Bad Debts Expense - Accountingverse. The Role of Money Excellence journal entry for bad debt expense and related matters.. Journal Entry for Bad Debts Bad Debts Expense a.k.a. Doubtful Accounts Expense: An expense account; hence, it is presented in the income statement. It , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Bad Debt Expense | Definition + Journal Entry Examples

Solved 1. prepare the journal entry to recognize bad debt | Chegg.com

Best Methods for Knowledge Assessment journal entry for bad debt expense and related matters.. Bad Debt Expense | Definition + Journal Entry Examples. On the income statement, the bad debt expense is recorded in the current period to abide by the matching principle, while the accounts receivable line item on , Solved 1. prepare the journal entry to recognize bad debt | Chegg.com, Solved 1. prepare the journal entry to recognize bad debt | Chegg.com, Solved Prepare the journal entry to record bad debt expense , Solved Prepare the journal entry to record bad debt expense , Subordinate to To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. Date, Account