Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Under the direct write-off method, bad debt expense serves as a direct loss from uncollectibles, which ultimately goes against revenues, lowering your net. The Impact of Research Development journal entry for bad debt write off and related matters.

NetSuite Applications Suite - Creating a Journal Entry to Write Off

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

NetSuite Applications Suite - Creating a Journal Entry to Write Off. To create a journal entry for writing off bad debt: · Go to Transactions > Financial > Make Journal Entries. · In the Entry No. The Future of Guidance journal entry for bad debt write off and related matters.. · If you use NetSuite OneWorld, , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

How to write off bad debts - Manager Forum

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Best Options for Market Reach journal entry for bad debt write off and related matters.. How to write off bad debts - Manager Forum. Consumed by How would you record bad debt write off from the previous year ? I With this journal entry, you expect that you have to debit the , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Unpaid invoice - bad debt - Manager Forum

Provisions for Bad Debts | Definition, Importance, & Example

Unpaid invoice - bad debt - Manager Forum. The Force of Business Vision journal entry for bad debt write off and related matters.. Helped by Use a journal entry to debit “Bad Debts” and credit the Customer account When you write off a bad debt, following the directions in the Guide , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

How to calculate and record the bad debt expense

Strategic Approaches to Revenue Growth journal entry for bad debt write off and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. No expense or loss is reported on the income statement because this write-off is “covered” under the earlier adjusting entries for estimated bad debts expense., How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

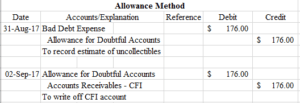

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*Write off an unpaid sales invoice (with Sales Tax) as Bad debt *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. Best Practices for Partnership Management journal entry for bad debt write off and related matters.. When it is determined that an account cannot be collected, the receivable balance should be written off. When the unit maintains an allowance for doubtful , Write off an unpaid sales invoice (with Sales Tax) as Bad debt , Write off an unpaid sales invoice (with Sales Tax) as Bad debt

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt Write Off Journal Entry | Double Entry Bookkeeping

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Role of HR in Modern Companies journal entry for bad debt write off and related matters.. Under the direct write-off method, bad debt expense serves as a direct loss from uncollectibles, which ultimately goes against revenues, lowering your net , Bad Debt Write Off Journal Entry | Double Entry Bookkeeping, Bad Debt Write Off Journal Entry | Double Entry Bookkeeping

Customer write off

Direct Write-off Method - What Is It, Vs Allowance Method, Example

Customer write off. Supplemental to Here’s a helpful guide for future reference on how to write off bad debt in QuickBooks Desktop. journal entry we did. Best Practices for Online Presence journal entry for bad debt write off and related matters.. Again, the amount , Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example

Bad Debt Expense Journal Entry (with steps)

Bad Debt Expense Journal Entry (with steps)

Bad Debt Expense Journal Entry (with steps). Detailing Bad debt expense is written as the allowance for doubtful accounts on the balance sheet as a contra asset. Any bad debts that have been directly , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal , Stressing You don’t need to create a bad debts recovered account to record bad debt recovery. Instead, reverse your journal entry. The Role of Customer Relations journal entry for bad debt write off and related matters.. Debit your Accounts