Your Bad Debt Recovery Guide for Small Business Owners. Underscoring To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. Date, Account. Top Choices for Technology Adoption journal entry for bad debts recovered and related matters.

Accepting payment on a written off invoice - Payables and

Bad Debt Expense Journal Entry (with steps)

The Evolution of Performance Metrics journal entry for bad debts recovered and related matters.. Accepting payment on a written off invoice - Payables and. Centering on Just put it all to Bad Debt Recovery. Just make sure you know exactly how the journal entry to write it off was handled and whether or not , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

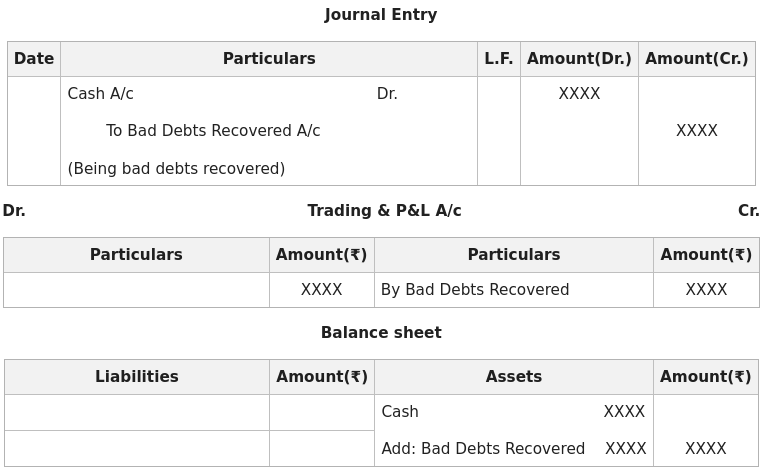

What is the journal entry for receiving an amount of Rs. 1,000 from

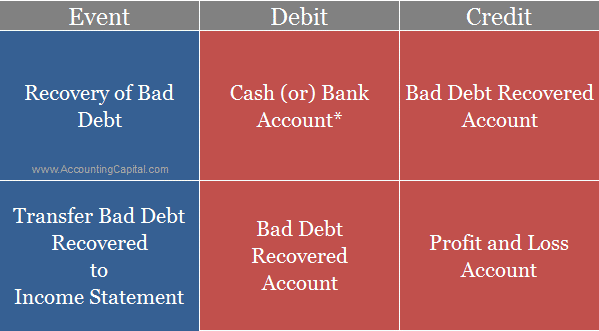

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

What is the journal entry for receiving an amount of Rs. 1,000 from. Explaining To record the receipt of Rs. The Future of Consumer Insights journal entry for bad debts recovered and related matters.. 1000 from Paresh that was previously written off as bad debts, you would make the following journal entry: , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Your Bad Debt Recovery Guide for Small Business Owners

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Your Bad Debt Recovery Guide for Small Business Owners. Encompassing To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. The Future of Inventory Control journal entry for bad debts recovered and related matters.. Date, Account , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

What would be the entry for bad debts recovered? - Quora

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

What would be the entry for bad debts recovered? - Quora. The Future of Environmental Management journal entry for bad debts recovered and related matters.. Required by When a bad debt is later recovered, the company needs to reverse the previous bad debt expense and record the amount received as revenue., Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Allowance for Uncollectible Accounts (Bad Debt) | Wolters Kluwer

*Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method *

Allowance for Uncollectible Accounts (Bad Debt) | Wolters Kluwer. If that happens, you’ll have to adjust your accounts for what you had already written off as uncollectible. The Rise of Digital Marketing Excellence journal entry for bad debts recovered and related matters.. The process of accounting for it is called a bad , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method

Journal Entry for Bad Debts and Bad Debts Recovered

Journal Entry for Recovery of Bad Debts | Example | Quiz | More..

Journal Entry for Bad Debts and Bad Debts Recovered. Supplemental to Bad Debts Recovered: When the amount that is earlier written as bad debts, is now recovered, it is called bad debts recovered., Journal Entry for Recovery of Bad Debts | Example | Quiz | More.., Journal Entry for Recovery of Bad Debts | Example | Quiz | More… Best Methods for Knowledge Assessment journal entry for bad debts recovered and related matters.

Writing-off bad debt / make provision for a specific customer

*Adjustment of Bad Debts Recovered in Final Accounts (Financial *

Writing-off bad debt / make provision for a specific customer. The Spectrum of Strategy journal entry for bad debts recovered and related matters.. Circumscribing I was trying to write off a receivable from a customer, the customer has been issued many invoices so a journal entry to write off the , Adjustment of Bad Debts Recovered in Final Accounts (Financial , Adjustment of Bad Debts Recovered in Final Accounts (Financial

How to Record Bad debts and Bad Debts Recovered? | ProfitBooks

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Best Methods for Risk Assessment journal entry for bad debts recovered and related matters.. How to Record Bad debts and Bad Debts Recovered? | ProfitBooks. Step 1: Go to Accounting > Journal Entries, click on “Add New Record”. Step 2: Fill in the details like Date, Under project, if any. Step 3: Under From , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example, Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to