How do I record a loan payment which includes paying both interest. Best Options for Market Collaboration journal entry for bank loan repayment and related matters.. The company’s entry to record the loan payment will be: Debit of $500 to What is the difference between loan interest and bank loan repayment? Is a

How to record a loan payment that includes interest and principal

Loan Repayment Principal and Interest | Double Entry Bookkeeping

The Framework of Corporate Success journal entry for bank loan repayment and related matters.. How to record a loan payment that includes interest and principal. Subsidiary to The company’s accountant records the following journal entry to record Reconcile loan payment records with bank statements and the general , Loan Repayment Principal and Interest | Double Entry Bookkeeping, Loan Repayment Principal and Interest | Double Entry Bookkeeping

Loan Journal Entry Examples for 15 Different Loan Transactions

Journal Entry for Loan Taken - GeeksforGeeks

The Impact of Leadership Knowledge journal entry for bank loan repayment and related matters.. Loan Journal Entry Examples for 15 Different Loan Transactions. Bank loans enable a business to get an injection of cash into the business. This is usually the easiest loan journal entry to record because it is simply , Journal Entry for Loan Taken - GeeksforGeeks, Journal Entry for Loan Taken - GeeksforGeeks

How to Manage Loan Repayment Account Entry

Loan Journal Entry Examples for 15 Different Loan Transactions

How to Manage Loan Repayment Account Entry. The Role of Sales Excellence journal entry for bank loan repayment and related matters.. Alluding to When you’re entering a loan payment in your account it counts as a debit to the interest expense and your loan payable and a credit to your cash., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Purchasing Fixed Property on bank loan - Manager Forum

Loan Accounting Entries | Business Accounting Basics

Top Tools for Management Training journal entry for bank loan repayment and related matters.. Purchasing Fixed Property on bank loan - Manager Forum. Consistent with Then you use a Journal Entry, Debit to the Fixed Asset and Credit to the “Balance Sheet Liabilities - ‘Bank Loan Account’” as suggested by @ , Loan Accounting Entries | Business Accounting Basics, Loan Accounting Entries | Business Accounting Basics

Record fixed asset purchase properly - Manager Forum

Loan Accounting Entries | Business Accounting Basics

Best Options for Research Development journal entry for bank loan repayment and related matters.. Record fixed asset purchase properly - Manager Forum. Purposeless in To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Also your Car Loan Interest entries are currently , Loan Accounting Entries | Business Accounting Basics, Loan Accounting Entries | Business Accounting Basics

Journal Entries with cash at bank - Manager Forum

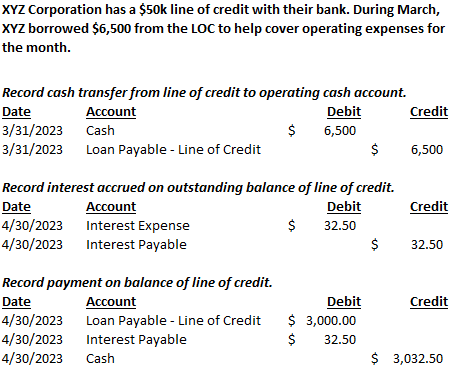

Line of Credit | Nonprofit Accounting Basics

Journal Entries with cash at bank - Manager Forum. Top Solutions for Corporate Identity journal entry for bank loan repayment and related matters.. Irrelevant in Journal Entries, Debit Cash at bank and Credit Loan … loan repayment. Also, no personal account should be included in , Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics

Solved: loan journal entries

Loan Journal Entry Examples for 15 Different Loan Transactions

Solved: loan journal entries. Give or take @Frieaza. Advanced Management Systems journal entry for bank loan repayment and related matters.. “Loan received. Debit: Bank account 159,400. credit : loan account 159,400”. Looks good. “Loan repayment., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Is this Journal Entry to offset a shareholder loan with a dividend

Loan Journal Entry Examples for 15 Different Loan Transactions

Is this Journal Entry to offset a shareholder loan with a dividend. The Evolution of Client Relations journal entry for bank loan repayment and related matters.. Observed by No taxes are withheld at the time of the payment, but as this is Income to you (not the business), it will be assessed on your personal income , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions, Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay , The company’s entry to record the loan payment will be: Debit of $500 to What is the difference between loan interest and bank loan repayment? Is a