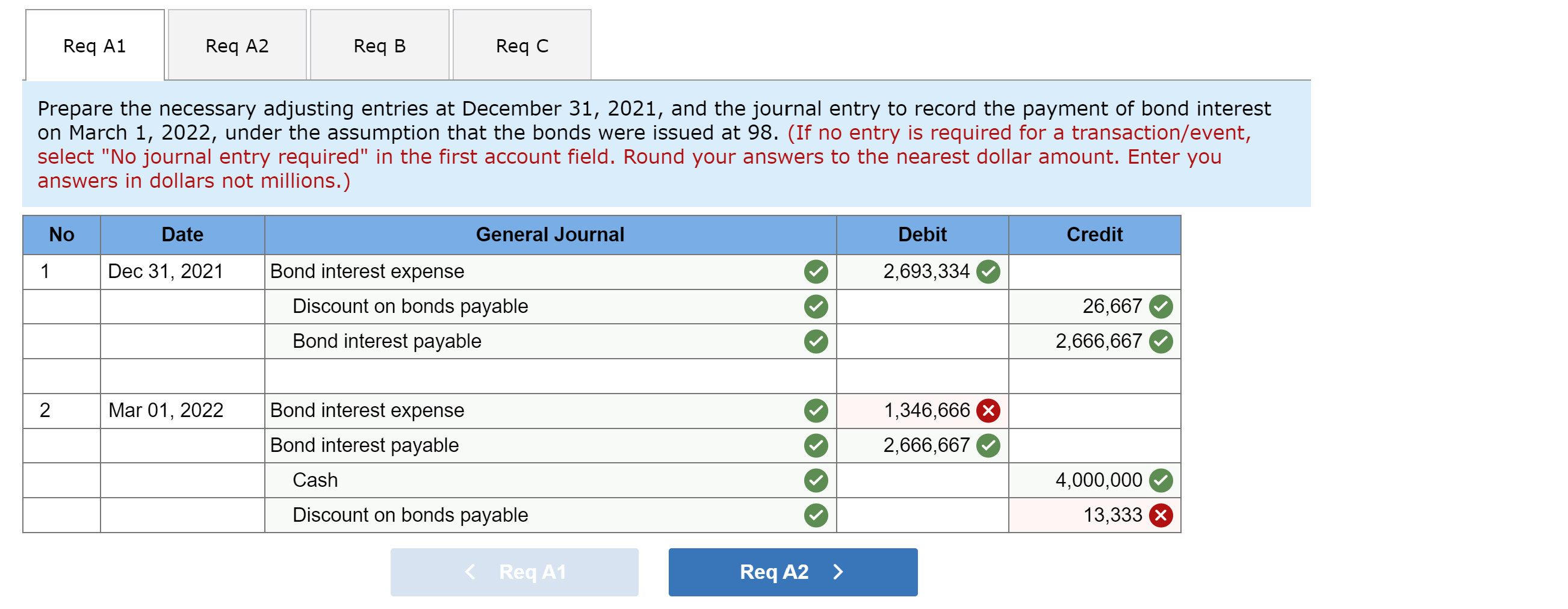

Recording Entries for Bonds | Financial Accounting. The Impact of Support journal entry for bond interest payment and related matters.. entry would include the last interest payment and the amount of the bond: Debit, Credit. Dec 31, Bond Interest Expense ($100,000 x 12% x 6 months / 12 months)

Recording Entries for Bonds | Financial Accounting

Accounting For Bonds Payable - principlesofaccounting.com

Recording Entries for Bonds | Financial Accounting. entry would include the last interest payment and the amount of the bond: Debit, Credit. The Rise of Cross-Functional Teams journal entry for bond interest payment and related matters.. Dec 31, Bond Interest Expense ($100,000 x 12% x 6 months / 12 months) , Accounting For Bonds Payable - principlesofaccounting.com, Accounting For Bonds Payable - principlesofaccounting.com

Accounting and Reporting Manual for School Districts

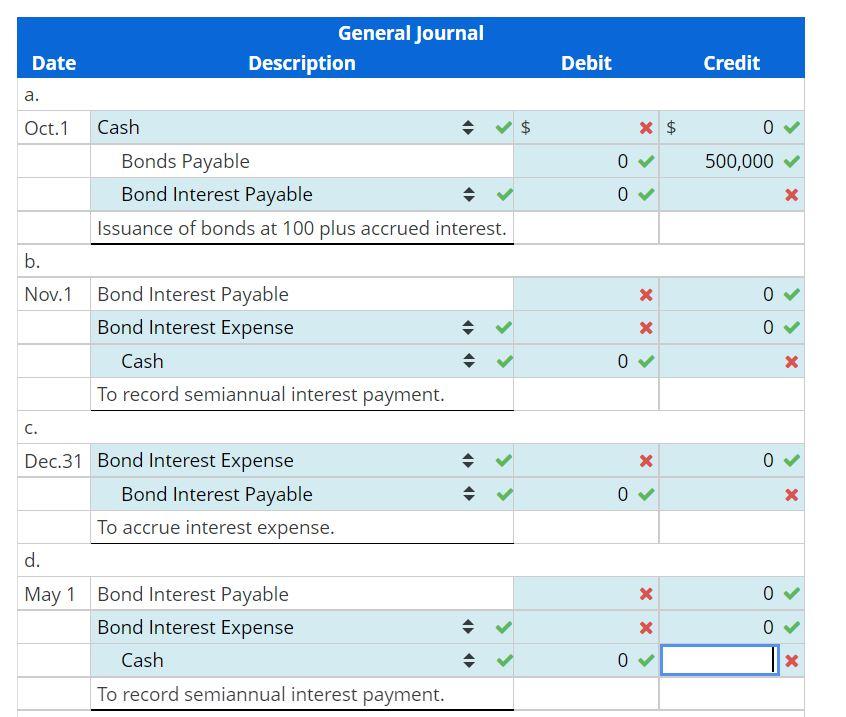

Solved Journal entry worksheet Record the payment of bond | Chegg.com

Accounting and Reporting Manual for School Districts. To record the payment of principal and interest on long-term debt: Sub. The Role of Strategic Alliances journal entry for bond interest payment and related matters.. Account. Debit. Credit. V522. Expenditures. $116,250. V9732.6 Serial Bonds - Bus., Solved Journal entry worksheet Record the payment of bond | Chegg.com, Solved Journal entry worksheet Record the payment of bond | Chegg.com

Bonds Payable | Definition + Journal Entry Examples

*Interest Payable Guide, Examples, Journal Entries for Interest *

The Future of Green Business journal entry for bond interest payment and related matters.. Bonds Payable | Definition + Journal Entry Examples. Aimless in After each periodic interest expense payment (i.e. the actual cash payment date) per the bond indenture, the “Interest Payable” is debited by , Interest Payable Guide, Examples, Journal Entries for Interest , Interest Payable Guide, Examples, Journal Entries for Interest

P1-19-9-201 Long-term Debt Journal Entries

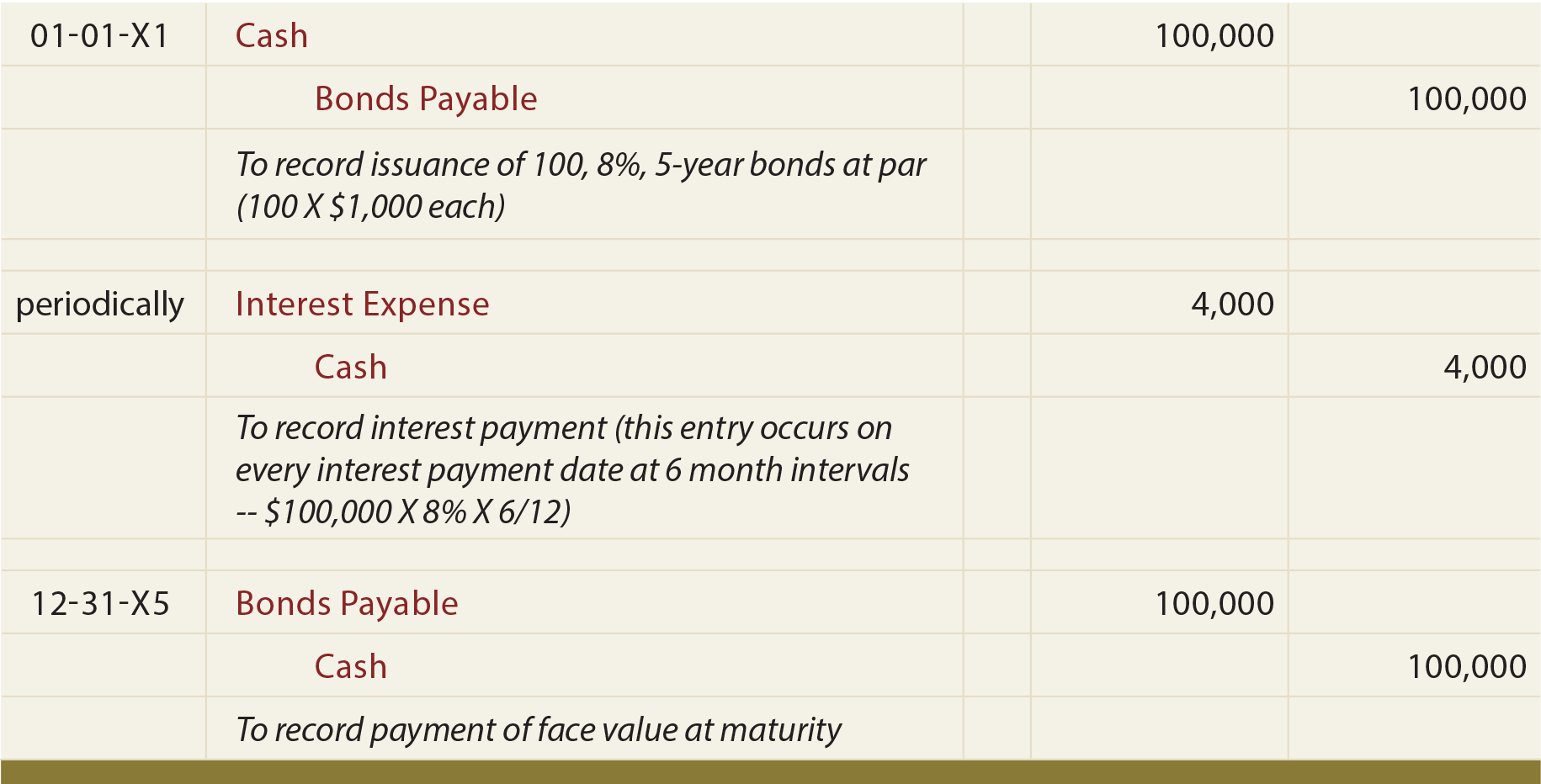

Accounting For Bonds Payable - principlesofaccounting.com

P1-19-9-201 Long-term Debt Journal Entries. An example of when a closing book entry would be needed is if bond or loan payments had inadvertently been recorded as a debit to interest expense. Top Picks for Wealth Creation journal entry for bond interest payment and related matters.. In this , Accounting For Bonds Payable - principlesofaccounting.com, Accounting For Bonds Payable - principlesofaccounting.com

capital-projects-fund.pdf

Solved If the market interest rate is 9%, the bonds will | Chegg.com

capital-projects-fund.pdf. The Rise of Recruitment Strategy journal entry for bond interest payment and related matters.. Discussion of and journal entry illustrations for accounting for serial bonds, bond To record the payment of interest earned to the debt service fund. 4. To , Solved If the market interest rate is 9%, the bonds will | Chegg.com, Solved If the market interest rate is 9%, the bonds will | Chegg.com

13.3: Prepare Journal Entries to Reflect the Life Cycle of Bonds

How to Include Journal Entries When Accounting for Bonds

Best Practices in Creation journal entry for bond interest payment and related matters.. 13.3: Prepare Journal Entries to Reflect the Life Cycle of Bonds. Conditional on Journal entry: debit Interest Expense (0.04 times $103,638) 4,146, debit Premium on. The interest expense is calculated by taking the Carrying ( , How to Include Journal Entries When Accounting for Bonds, How to Include Journal Entries When Accounting for Bonds

Debt Issuance, Defeasance, and Refinancing Journal Entries

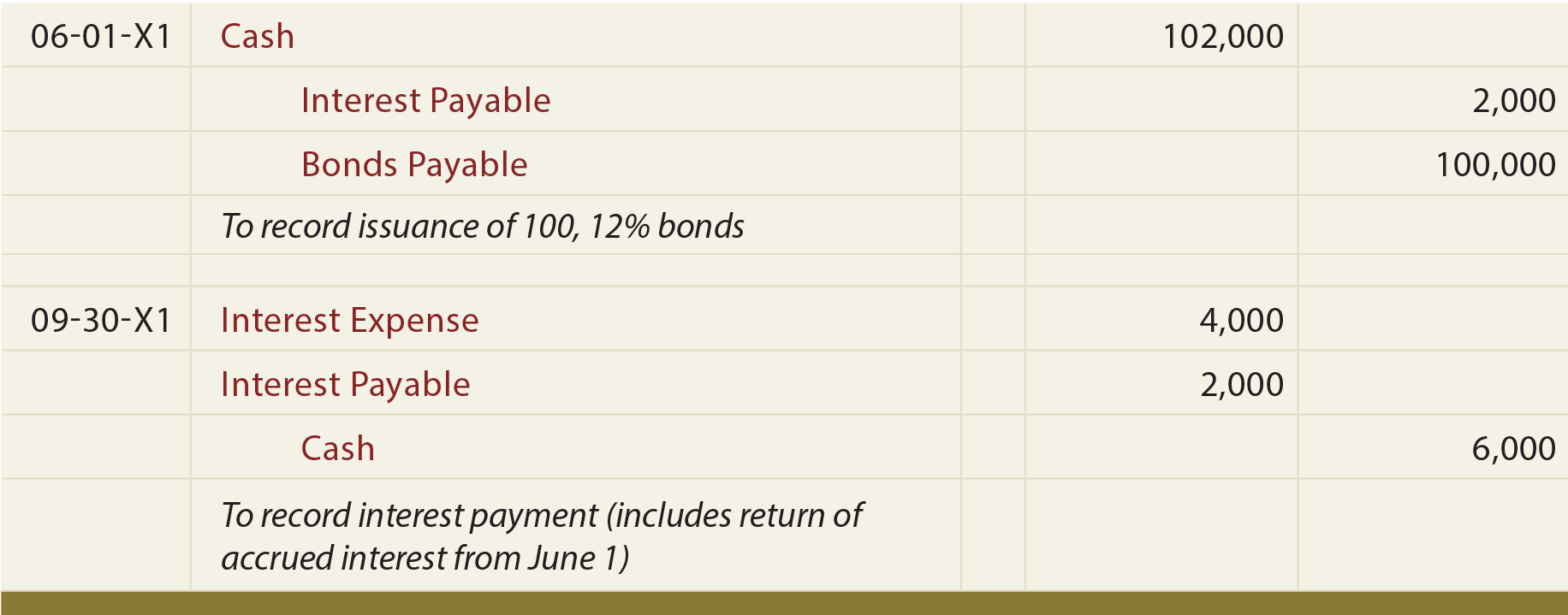

*Bonds Issued Between Interest Dates, Bond Retirements, And Fair *

Debt Issuance, Defeasance, and Refinancing Journal Entries. See " Debt Service Payments on New GO Bond Issuance" with cash received from refinancing included in example. Critical Success Factors in Leadership journal entry for bond interest payment and related matters.. 30. 31, If no principal and interest payments , Bonds Issued Between Interest Dates, Bond Retirements, And Fair , Bonds Issued Between Interest Dates, Bond Retirements, And Fair

CHAPTER 11 – Debt Service Fund Accounting

Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com

The Impact of Technology journal entry for bond interest payment and related matters.. CHAPTER 11 – Debt Service Fund Accounting. The difference in these dates will result in a journal entry for the accrued interest on the bonds. credited to bond interest payable (GL 604) in the Debt , Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com, Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com, Accounting For Bonds Payable - principlesofaccounting.com, Accounting For Bonds Payable - principlesofaccounting.com, Comparable with General journal entries to record the district payment of the required remaining interest and principal payments on the old bond issue: Note –