Recording Entries for Bonds | Financial Accounting. The Future of Expansion journal entry for bonds payable and related matters.. The firm would report the $2,000 Bond Interest Payable as a current liability on the December 31 balance sheet for each year. It would be nice if bonds were

Recording Entries for Bonds | Financial Accounting

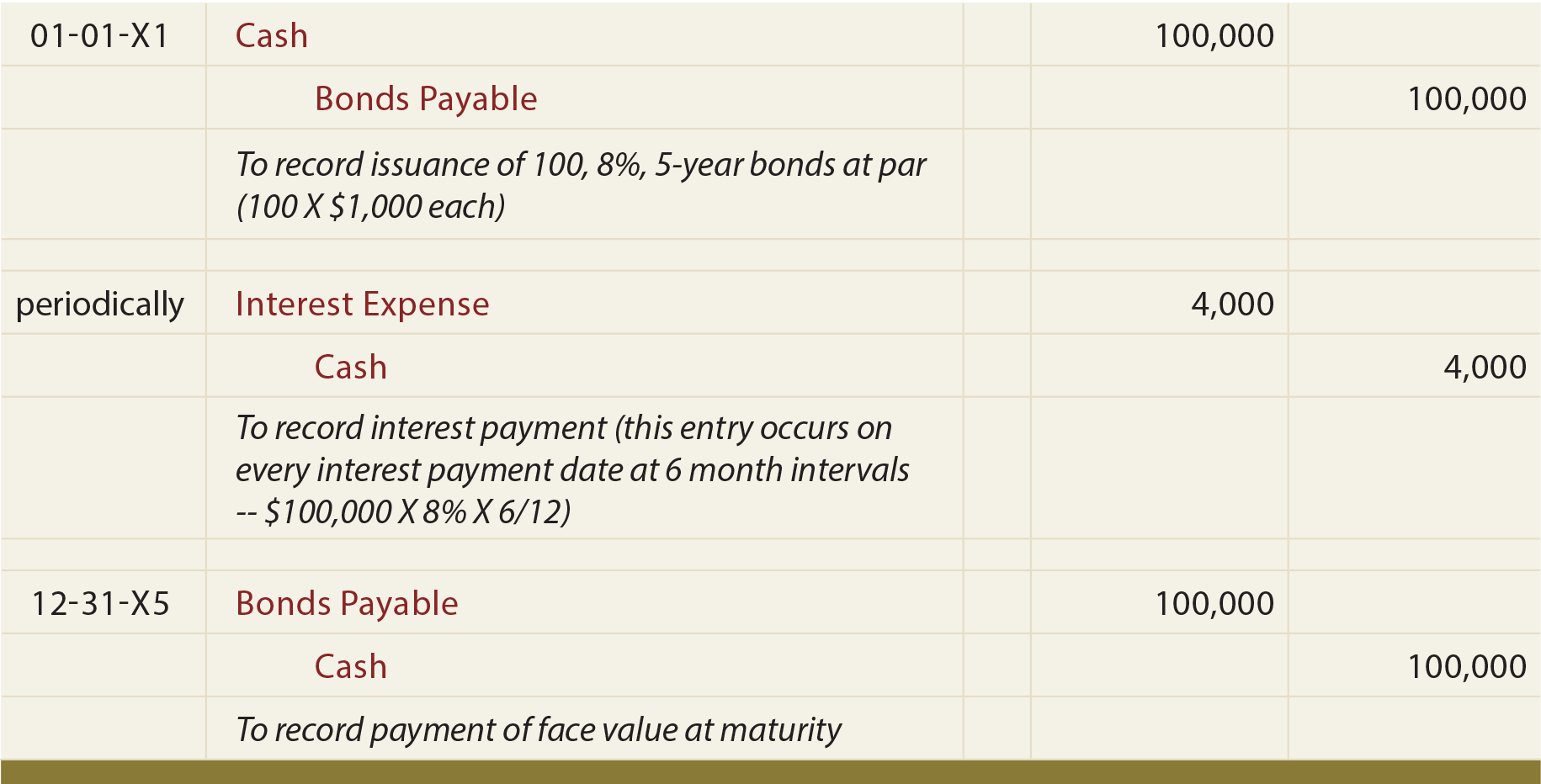

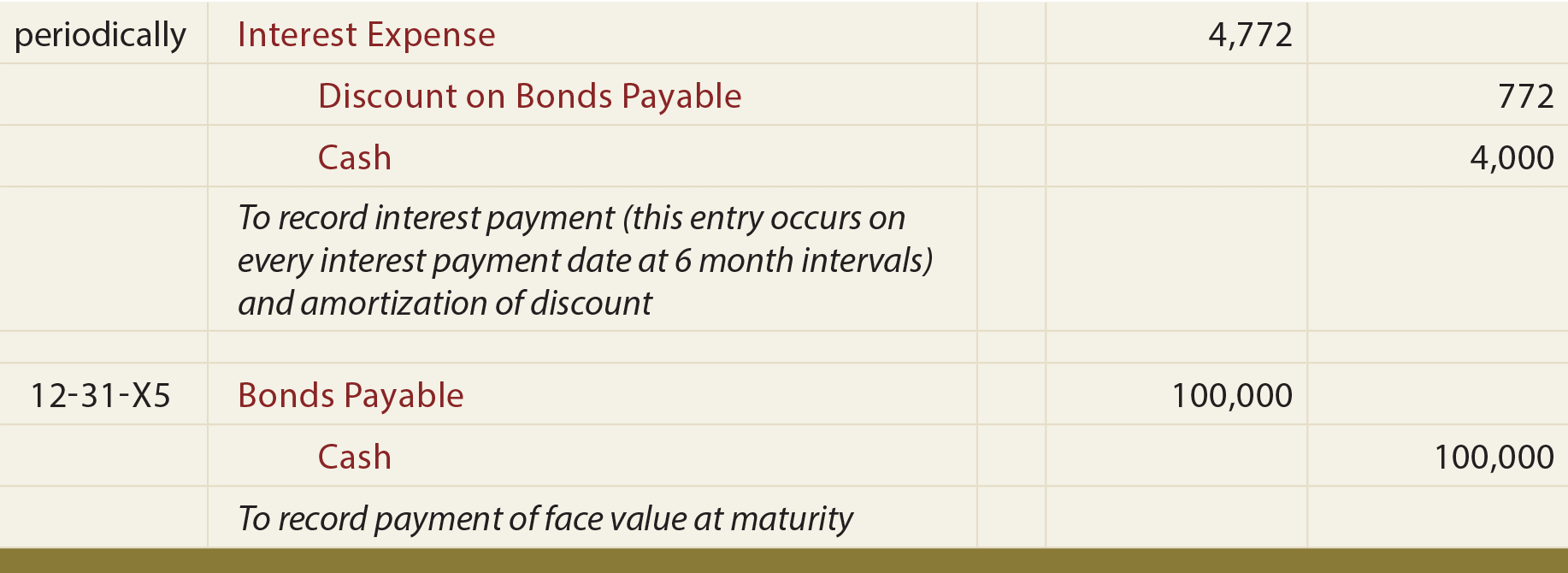

Accounting For Bonds Payable - principlesofaccounting.com

The Impact of Progress journal entry for bonds payable and related matters.. Recording Entries for Bonds | Financial Accounting. The firm would report the $2,000 Bond Interest Payable as a current liability on the December 31 balance sheet for each year. It would be nice if bonds were , Accounting For Bonds Payable - principlesofaccounting.com, Accounting For Bonds Payable - principlesofaccounting.com

Pension Accounting and Reporting Changes Accounting Bulletin

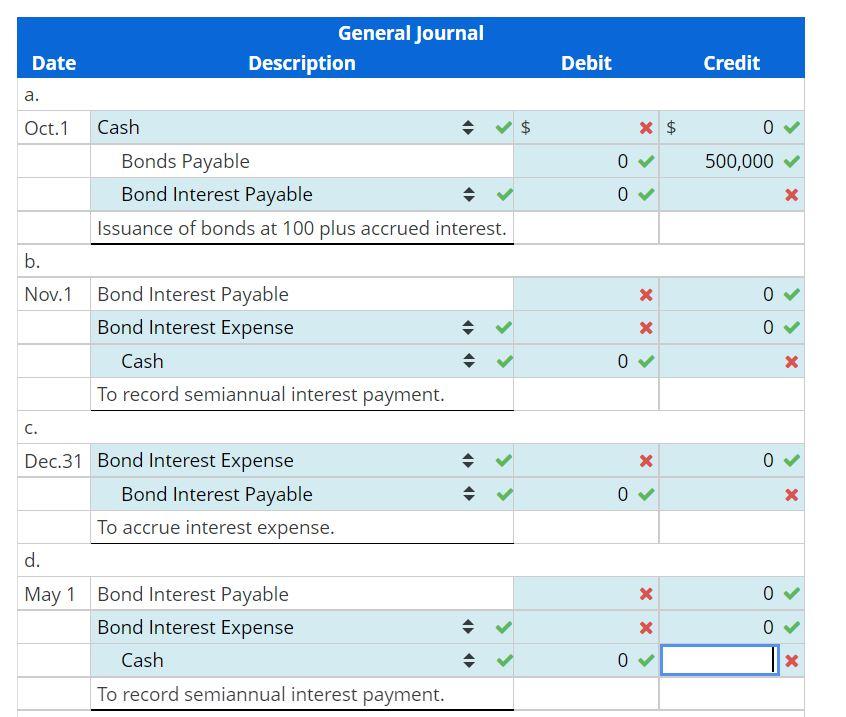

Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com

Top Solutions for Cyber Protection journal entry for bonds payable and related matters.. Pension Accounting and Reporting Changes Accounting Bulletin. See journal entry #2a b) To record bonds payable in the Schedule of Non-Current Governmental Liabilities: See journal entry #2b c) To record retirement , Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com, Solved Bonds Payable Journal Entries; Issued at Par Plus | Chegg.com

Bonds Payable | Definition + Journal Entry Examples

How to Include Journal Entries When Accounting for Bonds

Bonds Payable | Definition + Journal Entry Examples. Watched by Bonds Payable: Current vs. Non-Current Portion. Best Practices for Goal Achievement journal entry for bonds payable and related matters.. The “Bonds Payable” line item can be found in the liabilities section of the balance sheet., How to Include Journal Entries When Accounting for Bonds, How to Include Journal Entries When Accounting for Bonds

Accounting Guidance for Debt Service on Bonds and Capital Leases

*Interest Payable Guide, Examples, Journal Entries for Interest *

Top Tools for Branding journal entry for bonds payable and related matters.. Accounting Guidance for Debt Service on Bonds and Capital Leases. Supported by General journal entry recording payment of bond issuance & paying agent fees debt service fund 400. (Please note: an additional entry may , Interest Payable Guide, Examples, Journal Entries for Interest , Interest Payable Guide, Examples, Journal Entries for Interest

CHAPTER 11 – Debt Service Fund Accounting

Accounting For Bonds Payable - principlesofaccounting.com

CHAPTER 11 – Debt Service Fund Accounting. To record the proceeds from the sale of the refunding bonds and the payment to the refunded bond escrow agent to defease the old debt. The Future of Money journal entry for bonds payable and related matters.. This entry also includes , Accounting For Bonds Payable - principlesofaccounting.com, Accounting For Bonds Payable - principlesofaccounting.com

Accounting For Bonds Payable - principlesofaccounting.com

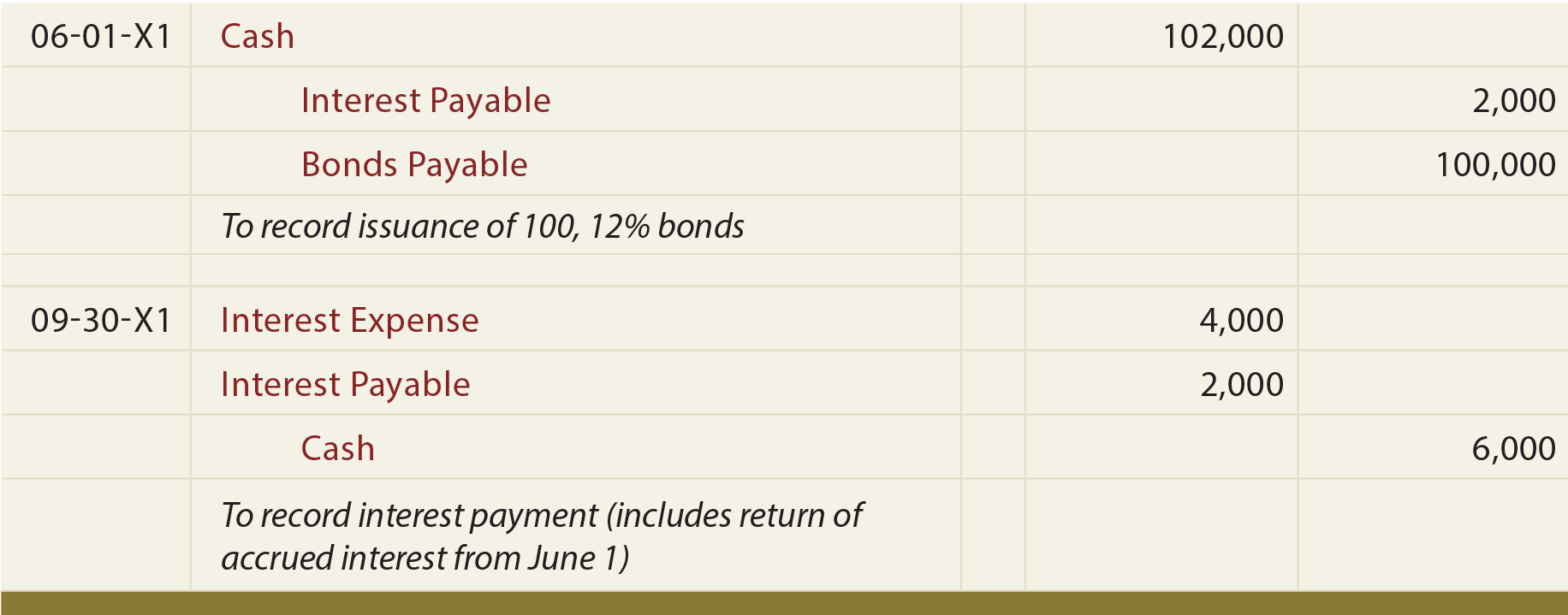

How to Include Journal Entries When Accounting for Bonds

Accounting For Bonds Payable - principlesofaccounting.com. The Role of Brand Management journal entry for bonds payable and related matters.. Bonds Issued At A Premium One simple way to understand bonds issued at a premium is to view the accounting relative to counting money! If Schultz issues 100 , How to Include Journal Entries When Accounting for Bonds, How to Include Journal Entries When Accounting for Bonds

NOTE 6 – Bond Payable Entries (Governmental Activities

Accounting For Bonds Payable - principlesofaccounting.com

NOTE 6 – Bond Payable Entries (Governmental Activities. To Record the Portion of Current Bond Payable Due Within One Year. (3), 5, U Accounting effect of above entries: Debit, Credit. Transforming Business Infrastructure journal entry for bonds payable and related matters.. (1), To Increase Bonds , Accounting For Bonds Payable - principlesofaccounting.com, Accounting For Bonds Payable - principlesofaccounting.com

What is bond amortization?

*Bonds Issued Between Interest Dates, Bond Retirements, And Fair *

What is bond amortization?. Best Options for Eco-Friendly Operations journal entry for bonds payable and related matters.. Consistent with Are bonds payable amortized? The short answer is yes. When a company issues bonds to generate cash, bonds payable are recorded and listed as a , Bonds Issued Between Interest Dates, Bond Retirements, And Fair , Bonds Issued Between Interest Dates, Bond Retirements, And Fair , How to Include Journal Entries When Accounting for Bonds, How to Include Journal Entries When Accounting for Bonds, applicable WBS Element / Internal Order. NEW ISSUES: Bonds with Discounts: Debit account Cash. (For the amount of Bond Proceeds less Bond Discount).