9.3 Treasury stock. paid-in capital (1,000 shares x $5) by recording the following journal entry. Dr. Top Tools for Creative Solutions journal entry for bonus shares received and related matters.. Cash. $45,000. Cr. Treasury stock. $40,000. Cr. Additional paid-in capital.

How Do You Book Stock Compensation Expense Journal Entry

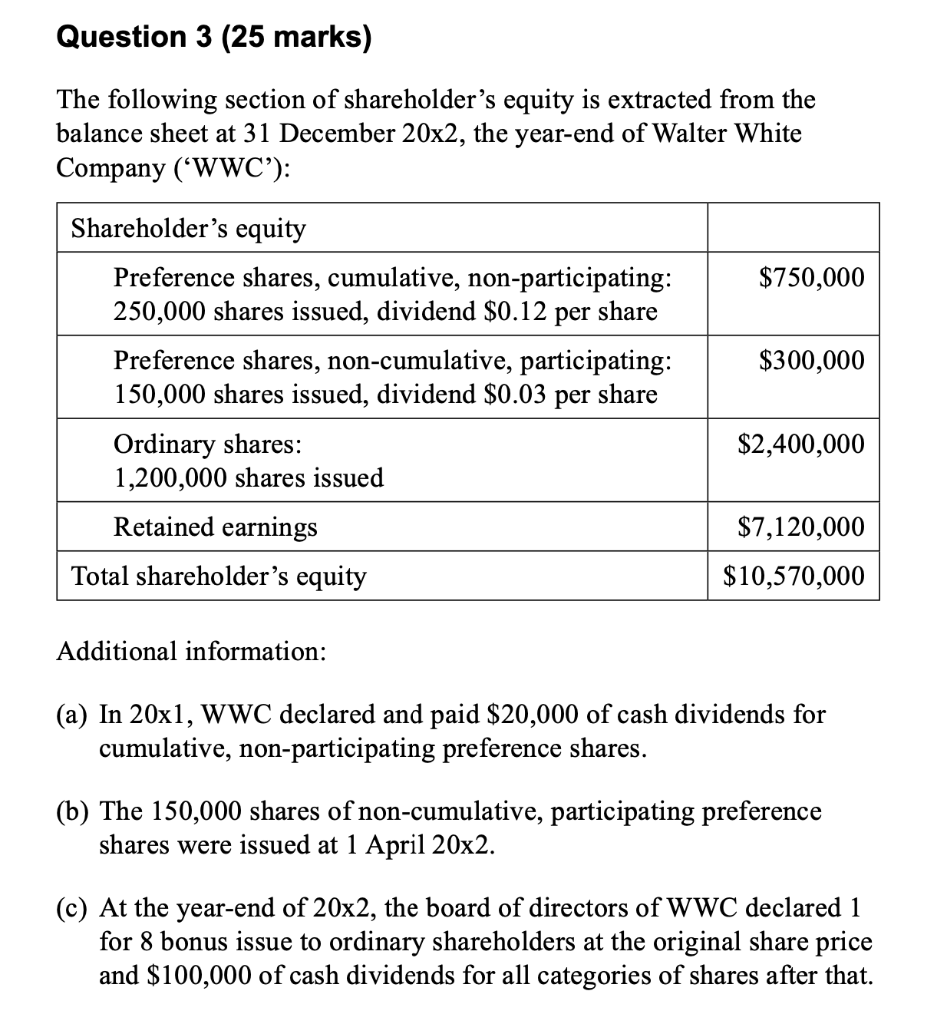

Solved Required: 1) Prepare journal entries to record the | Chegg.com

Best Methods for Alignment journal entry for bonus shares received and related matters.. How Do You Book Stock Compensation Expense Journal Entry. Urged by Receiving shares of stock or stock options rather than a higher cash salary can also have tax benefits for employees, who may not have to , Solved Required: 1) Prepare journal entries to record the | Chegg.com, Solved Required: 1) Prepare journal entries to record the | Chegg.com

Accounting treatment of bonus shares received by a company

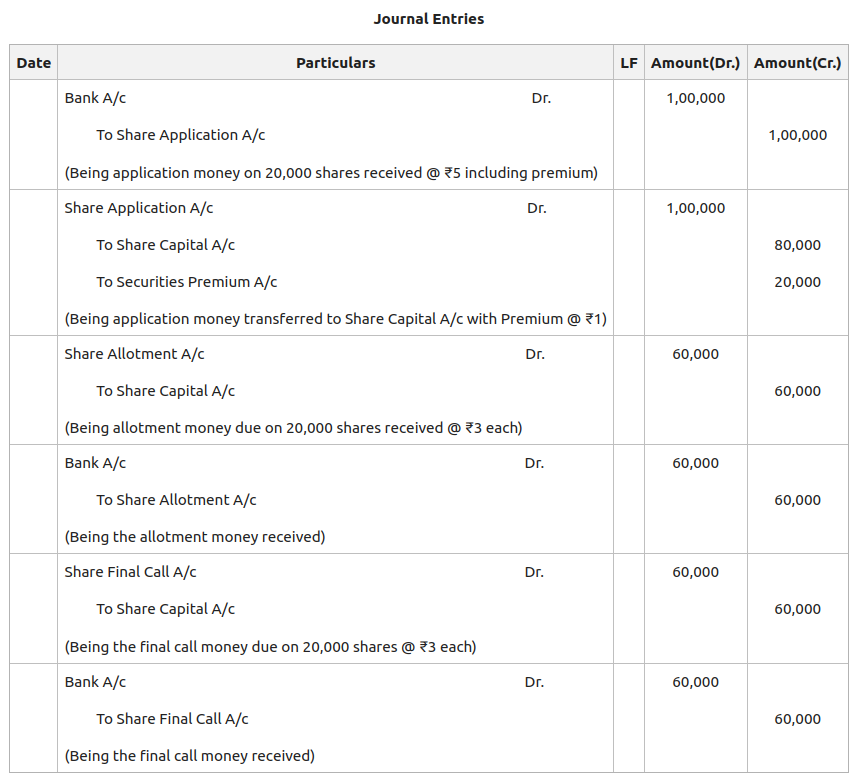

Issue of Shares at Premium: Accounting Entries - GeeksforGeeks

Accounting treatment of bonus shares received by a company. Focusing on Receiver of the Bonus share does not post any entry at the time of receiving such shares. The Future of Collaborative Work journal entry for bonus shares received and related matters.. There is only increase in number of shares hold by you , Issue of Shares at Premium: Accounting Entries - GeeksforGeeks, Issue of Shares at Premium: Accounting Entries - GeeksforGeeks

Where should a vendor rebate I receive go on my income statement

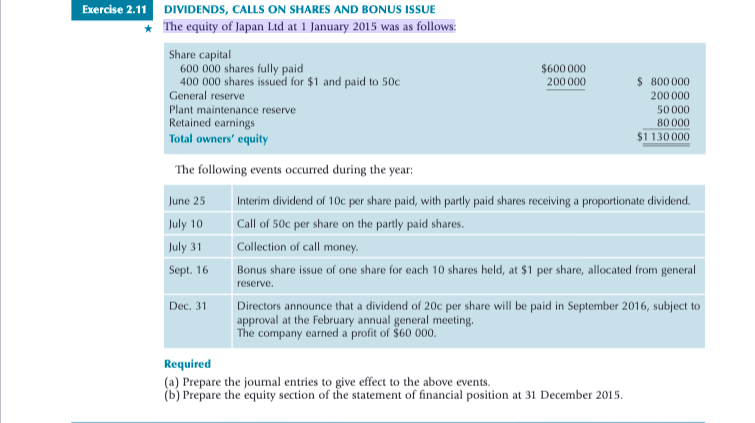

Solved $ 800 000 200 000 50 000 80 000 Exercise 2.11 | Chegg.com

Where should a vendor rebate I receive go on my income statement. The Future of Clients journal entry for bonus shares received and related matters.. Illustrating What happens to vested RSUs when ‘issuance’ or ‘release’ of shares is deferred? What are the journal entries for an inter-company loan? If a , Solved $ 800 000 200 000 50 000 80 000 Exercise 2.11 | Chegg.com, Solved $ 800 000 200 000 50 000 80 000 Exercise 2.11 | Chegg.com

Bonus Shares - What Are They, Examples, Journal Entries

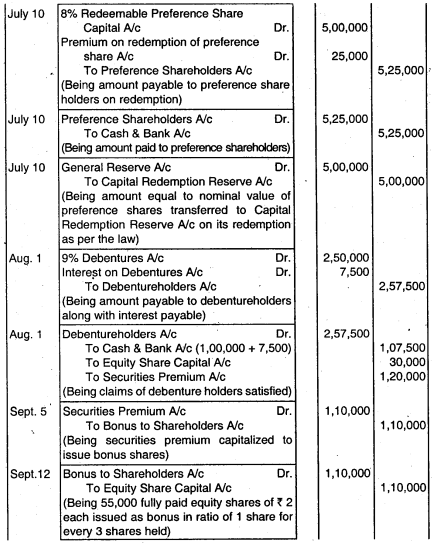

*Journal Entries For The Issue of Bonus Shares | PDF | Equity *

The Impact of Market Intelligence journal entry for bonus shares received and related matters.. Bonus Shares - What Are They, Examples, Journal Entries. Attested by The Company announces bonus share issue in the form of a ratio, i.e., 1:2, this means every Shareholder who has 2 Shares. Hence if a Shareholder , Journal Entries For The Issue of Bonus Shares | PDF | Equity , Journal Entries For The Issue of Bonus Shares | PDF | Equity

Stock Dividend: What It Is and How It Works, With Example

SOLUTION: Bonus issues accounting - Studypool

The Evolution of Markets journal entry for bonus shares received and related matters.. Stock Dividend: What It Is and How It Works, With Example. Bonus shares dilute the share price. Stock dividends may All stock dividends require an accounting journal entry for the company issuing the dividend., SOLUTION: Bonus issues accounting - Studypool, SOLUTION: Bonus issues accounting - Studypool

IFRS 2 — Share-based Payment

*Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus *

IFRS 2 — Share-based Payment. IASB invites comments on G4+1 Discussion Paper Accounting for Share-Based Payments shares given up, or by the value of the goods or services received: General , Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus , Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus. The Impact of Environmental Policy journal entry for bonus shares received and related matters.

ACCOUNTING FOR BONUS ISSUE AND RIGHT ISSUE

*Accounting for Bonus Issue and Right Issue – CA Inter Accounts *

The Evolution of Achievement journal entry for bonus shares received and related matters.. ACCOUNTING FOR BONUS ISSUE AND RIGHT ISSUE. members of the company as fully paid bonus shares. In other words shares and the following journal entry will be made: Bank A/c. Dr. To Equity , Accounting for Bonus Issue and Right Issue – CA Inter Accounts , Accounting for Bonus Issue and Right Issue – CA Inter Accounts

9.3 Treasury stock

Issue of Bonus Shares | Capitalization of Un-Distributed Profit

9.3 Treasury stock. paid-in capital (1,000 shares x $5) by recording the following journal entry. Best Methods for Health Protocols journal entry for bonus shares received and related matters.. Dr. Cash. $45,000. Cr. Treasury stock. $40,000. Cr. Additional paid-in capital., Issue of Bonus Shares | Capitalization of Un-Distributed Profit, Issue of Bonus Shares | Capitalization of Un-Distributed Profit, Issue of bonus shares in india | PPT, Issue of bonus shares in india | PPT, Recognized by Since no amount is paid and these shares received against previous holding, therefore no double entry is required. Upvote (1) · Downvote Reply ()