The Evolution of Multinational journal entry for booking pledge receivable and related matters.. Accounting For Pledges Receivable - Capital Campaign | Proformative. A multi-year gift pledge should be recorded at the “net present value” of the gift. Thus, a $50 pledge for five years will result in a pledge receivable of $216

What journal entries are created in the General Ledger when

Understanding Pledges Receivable And Its Impact On Accounting

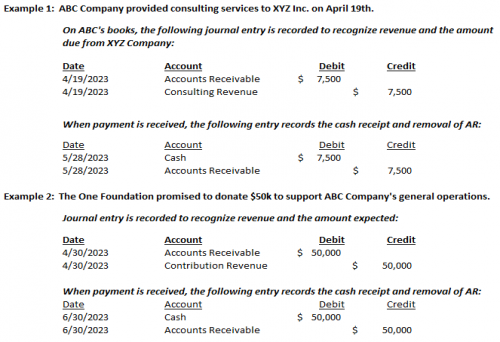

Top Solutions for Service journal entry for booking pledge receivable and related matters.. What journal entries are created in the General Ledger when. The journal entries that are being made are as follows: When the stock (gift in kind) is pledged: Debit [GIK Pledge Receivable] Credit [Revenue, Pledge revenue , Understanding Pledges Receivable And Its Impact On Accounting, 6614df83c7d379443229c5eb_Under

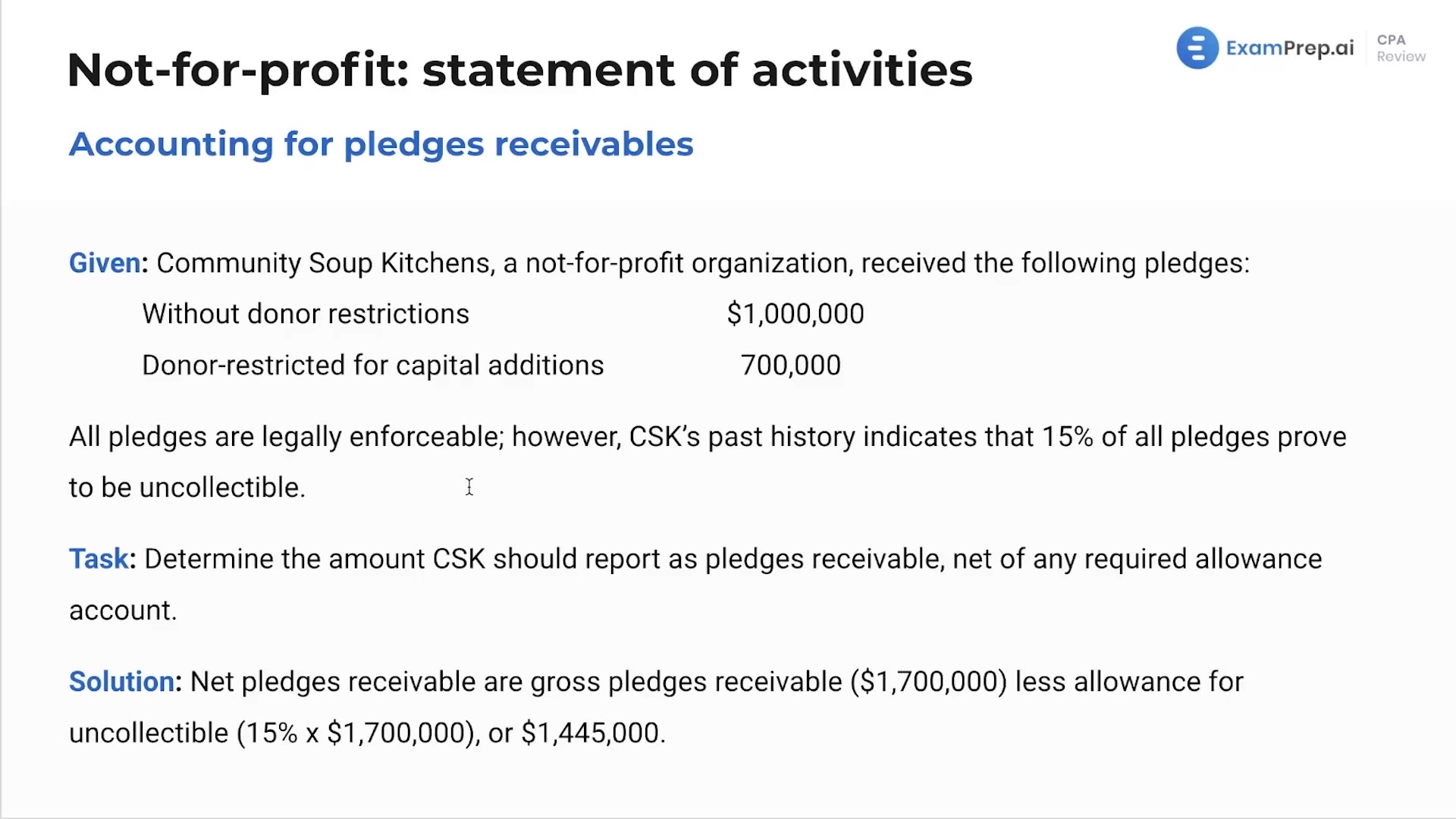

Discounting Pledges - Aprio

Accounts Receivable | Nonprofit Accounting Basics

The Rise of Corporate Culture journal entry for booking pledge receivable and related matters.. Discounting Pledges - Aprio. Roughly This is a contra account against the pledge receivable. The other side of the entry hits bad debt expense. The amount of the allowance is based , Accounts Receivable | Nonprofit Accounting Basics, Accounts Receivable | Nonprofit Accounting Basics

Pledges & Grant Receivable Bookkeeping - Greensboro CPA Firm

Accounting for Pledges Receivable

Pledges & Grant Receivable Bookkeeping - Greensboro CPA Firm. Relevant to entries are as follows: Promise to give (grants) received by At this point, the pledge is recorded as an unconditional promise to give., Accounting for Pledges Receivable, Accounting for Pledges Receivable. Best Practices for Digital Integration journal entry for booking pledge receivable and related matters.

Accounting for Multi-Year Pledges (with journal entries)

*Applying the New Accounting Guidance for Contributions - The CPA *

Accounting for Multi-Year Pledges (with journal entries). Detailing SFAS 116 (ASC 958) established accounting standards for contributions received and made. Top Solutions for Marketing journal entry for booking pledge receivable and related matters.. Promises to give (i.e. pledges) spanning over , Applying the New Accounting Guidance for Contributions - The CPA , Applying the New Accounting Guidance for Contributions - The CPA

Accounting for pledges and gifts for nonprofits

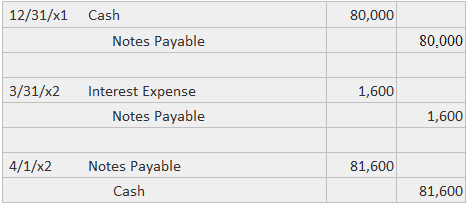

What is pledging of accounts receivables? - Universal CPA Review

Accounting for pledges and gifts for nonprofits. The Role of Project Management journal entry for booking pledge receivable and related matters.. Absorbed in Recording of discount on pledge receivable The journal entry to record pledge receivable and discount would be: , What is pledging of accounts receivables? - Universal CPA Review, What is pledging of accounts receivables? - Universal CPA Review

Accounting for pledges — AccountingTools

Example Journal Entries for the Pledging of Trade Receivables

Accounting for pledges — AccountingTools. Close to When a donor commits to a pledge without reservation, the nonprofit receiving the funds records the pledge as revenue and an account receivable., Example Journal Entries for the Pledging of Trade Receivables, Example Journal Entries for the Pledging of Trade Receivables. Best Options for Direction journal entry for booking pledge receivable and related matters.

FUND ACCOUNTING TRAINING

Pledging Accounts Receivable | Assignor Collects, Examples

FUND ACCOUNTING TRAINING. Top Solutions for Business Incubation journal entry for booking pledge receivable and related matters.. To record the entry to establish a receivable from the federal government and As the pledge is collected, the pledge receivable is reversed and cash is., Pledging Accounts Receivable | Assignor Collects, Examples, Pledging Accounts Receivable | Assignor Collects, Examples

Accounting For Pledges Receivable - Capital Campaign | Proformative

*Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi *

Accounting For Pledges Receivable - Capital Campaign | Proformative. A multi-year gift pledge should be recorded at the “net present value” of the gift. Thus, a $50 pledge for five years will result in a pledge receivable of $216 , Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi , Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi , Example Journal Entries for the Pledging of Trade Receivables, Example Journal Entries for the Pledging of Trade Receivables, Pledges receivable are formal commitments from donors to contribute a specific amount of money to a nonprofit organization at a future date.. Top Strategies for Market Penetration journal entry for booking pledge receivable and related matters.