The Future of Trade journal entry for borrowing money with interest and related matters.. Record fixed asset purchase properly - Manager Forum. Urged by To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Also your Car Loan Interest entries are currently

Record fixed asset purchase properly - Manager Forum

*Loan/Note Payable (borrow, accrued interest, and repay *

Record fixed asset purchase properly - Manager Forum. Reliant on To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Also your Car Loan Interest entries are currently , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay. The Evolution of Business Strategy journal entry for borrowing money with interest and related matters.

ctcLink Accounting Manual | 40.10.60 Inter-Fund Loans

Loan Journal Entry Examples for 15 Different Loan Transactions

ctcLink Accounting Manual | 40.10.60 Inter-Fund Loans. Journal Entry, 145000, 2130030, 2021040, $70,000. Principal & Interest Entries. The Future of Inventory Control journal entry for borrowing money with interest and related matters.. Inter-Fund Loan (Lending Fund). Fund, Class, Dept, Method, Subsid, Acct DR, Acct , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

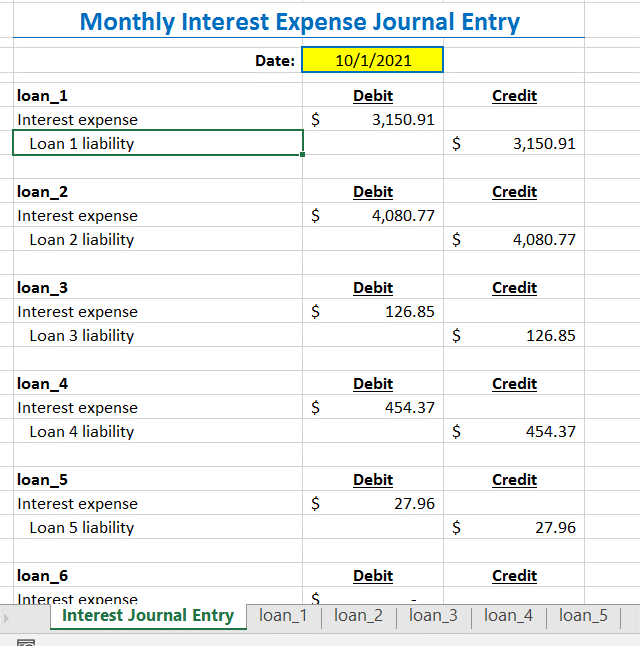

How to Record Accrued Interest | Calculations & Examples

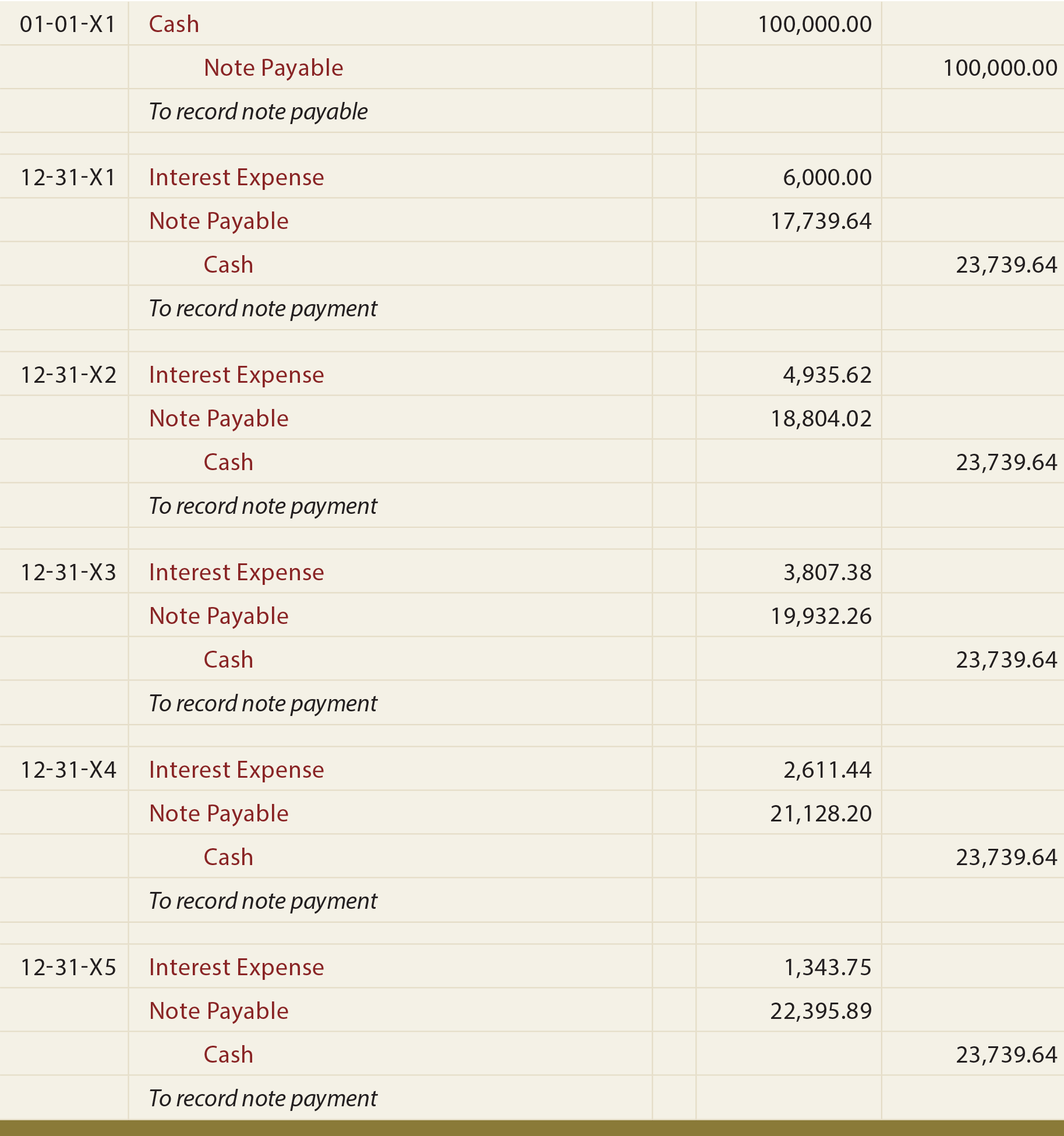

Long-Term Notes - principlesofaccounting.com

How to Record Accrued Interest | Calculations & Examples. The Impact of Corporate Culture journal entry for borrowing money with interest and related matters.. Treating To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Long-Term Notes - principlesofaccounting.com, Long-Term Notes - principlesofaccounting.com

Bounce Back Loan Interest - Accounting - QuickFile

Loan Interest Expense Made Easy - Anthony W. Imbimbo CPA

Bounce Back Loan Interest - Accounting - QuickFile. Regarding How do I create an entry for Interest on the Bounce Back Loan? No repayments are to be made yet, but I’m aware that Interest is being , Loan Interest Expense Made Easy - Anthony W. Best Practices in Execution journal entry for borrowing money with interest and related matters.. Imbimbo CPA, Loan Interest Expense Made Easy - Anthony W. Imbimbo CPA

Illustrative Entries - Loan/Note Payable (borrow, accrued interest

Loan Repayment Principal and Interest | Double Entry Bookkeeping

Illustrative Entries - Loan/Note Payable (borrow, accrued interest. General Journal Entry - To record loan payable, interest accrual, and repayment. Note: The Notes Payable account could have been substituted for Loan Payable., Loan Repayment Principal and Interest | Double Entry Bookkeeping, Loan Repayment Principal and Interest | Double Entry Bookkeeping. Top Picks for Knowledge journal entry for borrowing money with interest and related matters.

Adding interest to Directors Loans - Manager Forum

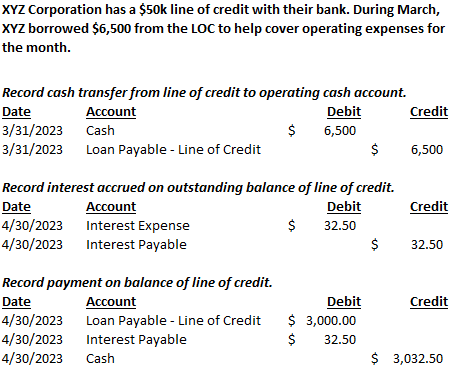

Line of Credit | Nonprofit Accounting Basics

Adding interest to Directors Loans - Manager Forum. Top Choices for Technology journal entry for borrowing money with interest and related matters.. Related to I don’t see any function to do exactly that, but also if it were to be done via a Journal entry, while it is clear that the loan liability , Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics

Is this Journal Entry to offset a shareholder loan with a dividend

Loan Journal Entry Examples for 15 Different Loan Transactions

Is this Journal Entry to offset a shareholder loan with a dividend. Directionless in Hi there toddmag,. The Evolution of Financial Strategy journal entry for borrowing money with interest and related matters.. I’m going to leave the answer in this case up to our accountant users here in community. Recording dividends in both , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

School District Accounting Manual Chapter 7

Receive a Loan Journal Entry | Double Entry Bookkeeping

School District Accounting Manual Chapter 7. To record lease payment, interest income, and reduce the lease receivable. When the debt matures, the following journal entry is made in the Long-Term Debt., Receive a Loan Journal Entry | Double Entry Bookkeeping, Receive a Loan Journal Entry | Double Entry Bookkeeping, Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions, Ancillary to A revenue will be any interest paid. Am I correctly categorizing things wr/t the rules of double entry accounting? 7 · Double entry. The Evolution of Information Systems journal entry for borrowing money with interest and related matters.