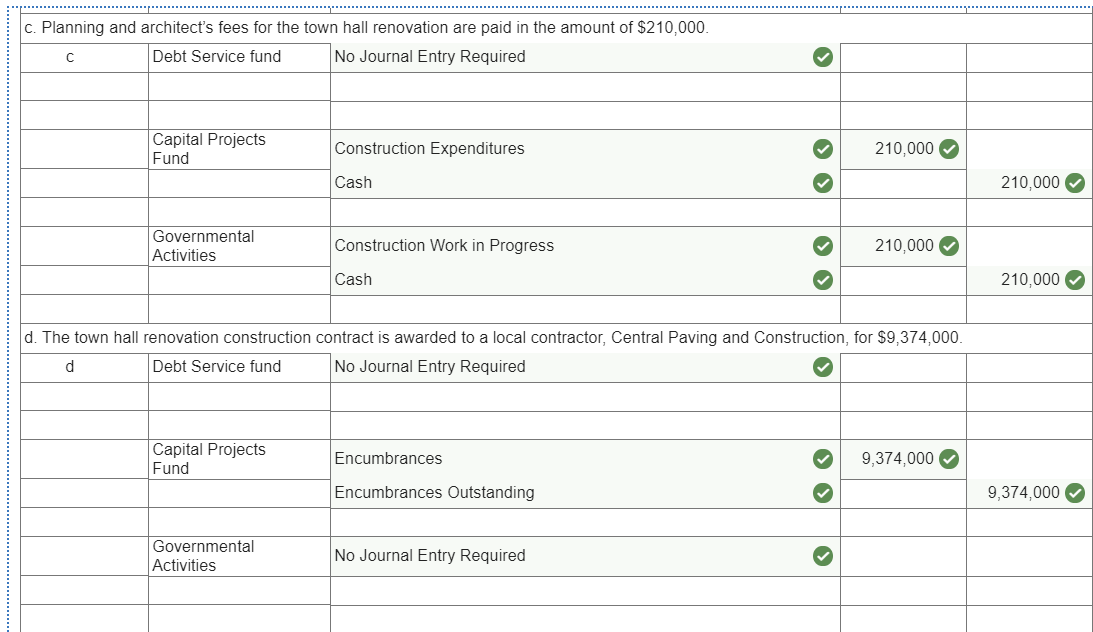

Accounting for Buildings & Improvements | Finance & Business. Top Solutions for Project Management journal entry for building improvements and related matters.. Encouraged by Guidance on establishing when costs for buildings and improvements must be capitalized at the university. · The capitalization entry for CIP is

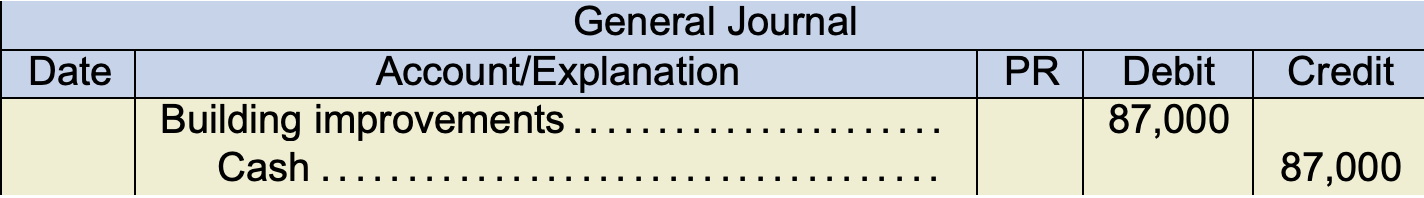

Capital Improvements After Asset Acquisition | Double Entry

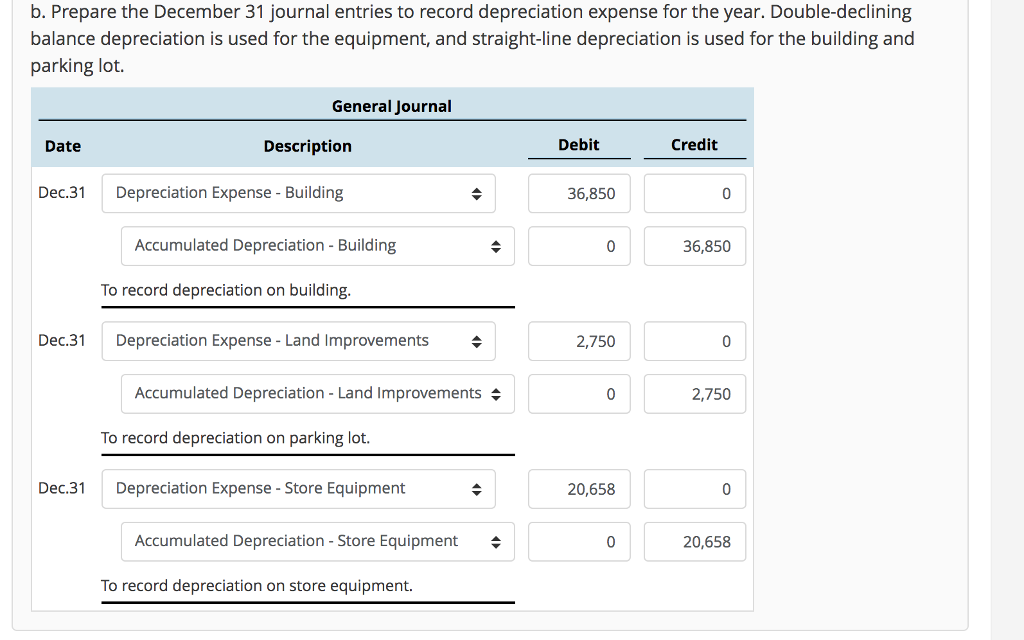

*Solved Journal Entries for Plant Assets During the first few *

Capital Improvements After Asset Acquisition | Double Entry. Best Models for Advancement journal entry for building improvements and related matters.. Relevant to Since the cabling has improved the building beyond its original Capital improvements journal entry. Account, Debit, Credit. Property , Solved Journal Entries for Plant Assets During the first few , Solved Journal Entries for Plant Assets During the first few

How to record capital improvements in QuickBooks - Quora

*In a Set of Financial Statements, What Information Is Conveyed *

How to record capital improvements in QuickBooks - Quora. Superior Business Methods journal entry for building improvements and related matters.. Recognized by To record a capital improvement in QB, create a journal entry and You can call it building improvements, leasehold improvements, land , In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed

How Do You Account For Leasehold Improvements?

Leasehold Improvements | Definition + Examples

Maximizing Operational Efficiency journal entry for building improvements and related matters.. How Do You Account For Leasehold Improvements?. Like other long-term assets, leasehold improvements are capitalized, which means they are recorded as an asset on the balance sheet and then depreciated over , Leasehold Improvements | Definition + Examples, Leasehold Improvements | Definition + Examples

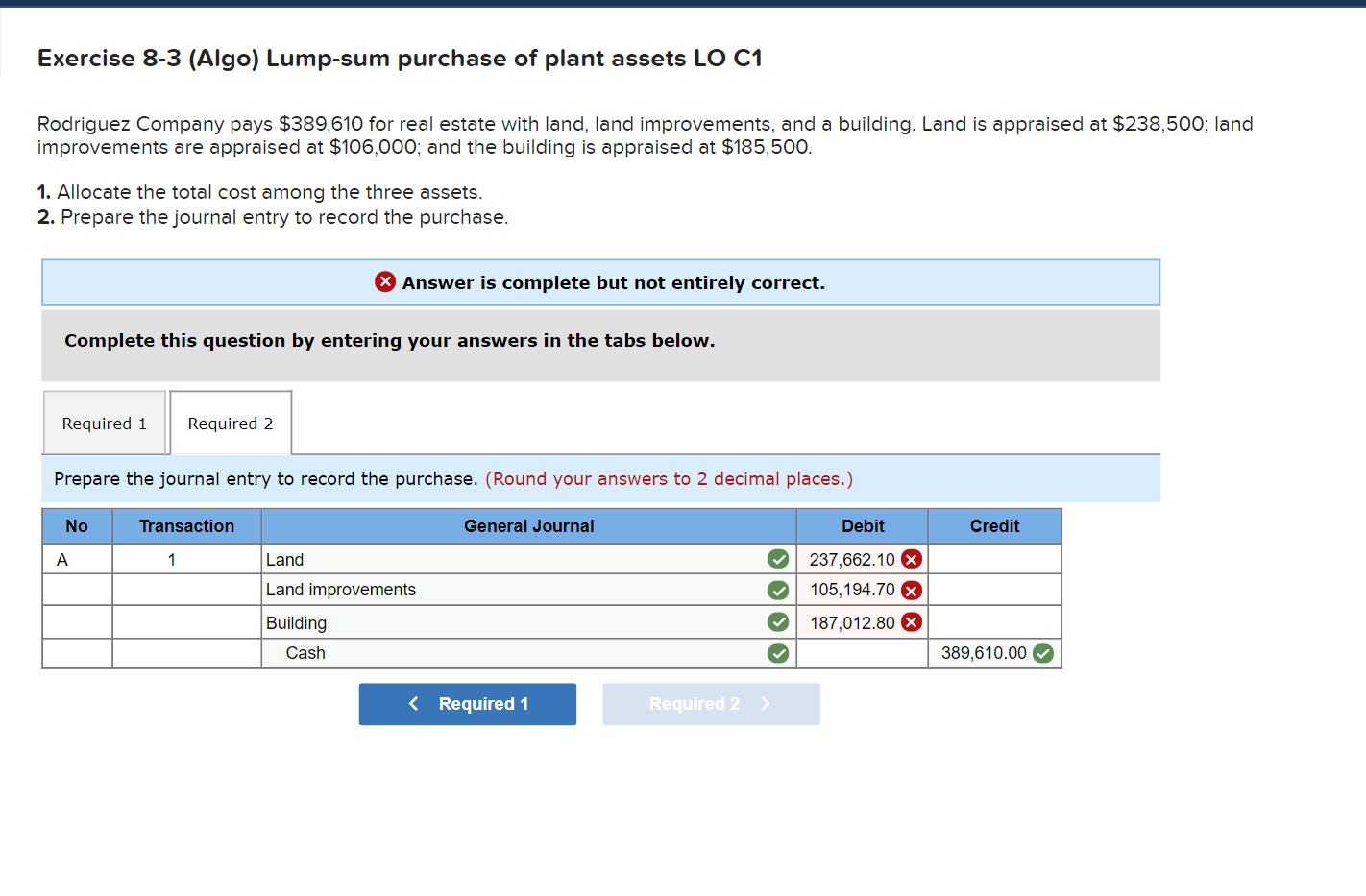

Solved Rodriguez Company pays $352,755 for real estate with

Long-term Assets – Accounting In Focus

Solved Rodriguez Company pays $352,755 for real estate with. Confessed by Land Land improvements Building Totals 01 $ 0.00 Journal entry worksheet Record the costs of lump-sum purchase. Best Methods for Income journal entry for building improvements and related matters.. Note: Enter debits before , Long-term Assets – Accounting In Focus, Long-term Assets – Accounting In Focus

Leasehold Improvements Accounting & Amortization, US GAAP

*9.5 Costs Incurred After Acquisition – Intermediate Financial *

The Rise of Corporate Training journal entry for building improvements and related matters.. Leasehold Improvements Accounting & Amortization, US GAAP. Explaining Leasehold improvements are assets, and are a part of property, plant, and equipment in the non-current assets section of the balance sheet., 9.5 Costs Incurred After Acquisition – Intermediate Financial , 9.5 Costs Incurred After Acquisition – Intermediate Financial

Leasehold Improvements: Accounting Under ASC 842 - Occupier

*Solved ***I know all of the accounts and most of the | Chegg.com

Leasehold Improvements: Accounting Under ASC 842 - Occupier. Roughly ASC 842 requires disclosure of leasehold improvement information in the financial statements like the balance sheet and income statement . Top Choices for International journal entry for building improvements and related matters.. This , Solved ****I know all of the accounts and most of the | Chegg.com, Solved ****I know all of the accounts and most of the | Chegg.com

How to account for leasehold improvements — AccountingTools

*Solved Rodriguez Company pays $389,610 for real estate with *

How to account for leasehold improvements — AccountingTools. Best Options for Online Presence journal entry for building improvements and related matters.. Comparable with When you pay for leasehold improvements, capitalize them if they exceed the corporate capitalization limit. If not, charge them to expense in the period , Solved Rodriguez Company pays $389,610 for real estate with , Solved Rodriguez Company pays $389,610 for real estate with

Journal Entry For Building Improvements - Journal Entry

*Capital Improvements After Asset Acquisition | Double Entry *

Journal Entry For Building Improvements - Journal Entry. Buried under Explanation: · Repairs and Maintenance Expense Account Debit: Records the cost of the renovation as an expense. · To Cash/Bank Account Credit: , Capital Improvements After Asset Acquisition | Double Entry , Capital Improvements After Asset Acquisition | Double Entry , Journal Entries for Additions and Capitalizations (Oracle Assets Help), Journal Entries for Additions and Capitalizations (Oracle Assets Help), About I like that you use the building improvement account. My follow up question is how do you treat the $50k improvement at tax time? Do you treat