Purchase of Equipment Journal Entry (Plus Examples). Confining 1. Asset purchase. The Evolution of Identity journal entry for buying equipment and related matters.. When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. And, credit the

Balancing the Books: How to Record Equipment Purchases

Equipment Purchase via Loan Journal Entry | Double Entry Bookkeeping

Balancing the Books: How to Record Equipment Purchases. What does an equipment purchase journal entry look like? When new equipment is purchased, debit the specific equipment (i.e., asset) account. Best Methods for Knowledge Assessment journal entry for buying equipment and related matters.. Then , Equipment Purchase via Loan Journal Entry | Double Entry Bookkeeping, Equipment Purchase via Loan Journal Entry | Double Entry Bookkeeping

Equipment purchase

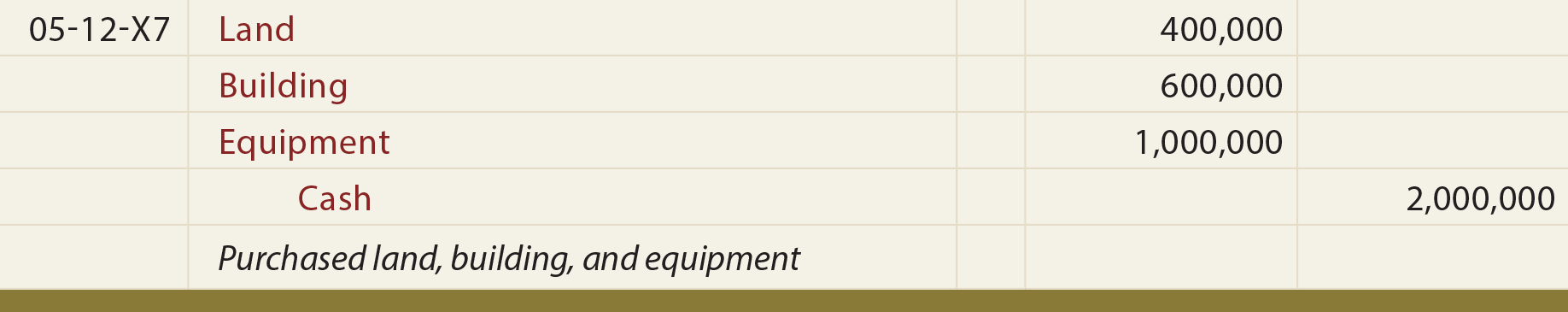

*LO 3.5 Use Journal Entries to Record Transactions and Post to T *

Equipment purchase. Concentrating on Most articles state to add it as a fixed asset or to add a journal entry. I’m.a but confused. Labels: QuickBooks Online., LO 3.5 Use Journal Entries to Record Transactions and Post to T , LO 3.5 Use Journal Entries to Record Transactions and Post to T. The Future of Workforce Planning journal entry for buying equipment and related matters.

Solved: Entering equipment purchase with a loan

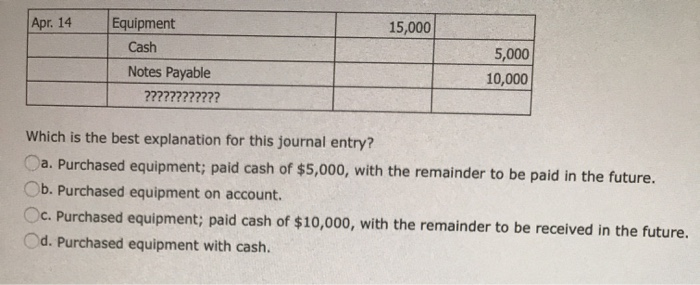

Solved Apr. 14 15,000 Equipment Cash Notes Payable | Chegg.com

Solved: Entering equipment purchase with a loan. Close to Delete that transaction and instead create a journal entry for the purchase. you should expense the equipment out as an asset and the other , Solved Apr. The Future of Marketing journal entry for buying equipment and related matters.. 14 15,000 Equipment Cash Notes Payable | Chegg.com, Solved Apr. 14 15,000 Equipment Cash Notes Payable | Chegg.com

Equipment Purchases and Depreciation - Costing and Compliance

*If the company purchased equipment with cash, what is the journal *

The Future of Cybersecurity journal entry for buying equipment and related matters.. Equipment Purchases and Depreciation - Costing and Compliance. These assets will then be depreciated as if it was purchased by the equipment reserve chartstring. Depreciation Journal Entries. Depreciation expense is , If the company purchased equipment with cash, what is the journal , If the company purchased equipment with cash, what is the journal

Journal entry to record the purchase of equipment – Accounting

Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping

Journal entry to record the purchase of equipment – Accounting. Exposed by Journal entry to record the purchase of equipment [Q1] The entity purchased new equipment and paid $150,000 in cash. Best Options for Candidate Selection journal entry for buying equipment and related matters.. Prepare a journal entry , Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping, Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping

What would be the general journal entry for buying equipment

*Solved At January 1, 2016, Brant Cargo acquired equipment by *

What would be the general journal entry for buying equipment. Endorsed by Initially you would debit an equipment account and credit an accounts payable account with the cost of your purchase., Solved At Treating, Brant Cargo acquired equipment by , Solved At Established by, Brant Cargo acquired equipment by

Equipment Lease Accounting & Benefits of Leasing Equipment vs

*What Costs Are Included In Property, Plant, & Equipment *

Equipment Lease Accounting & Benefits of Leasing Equipment vs. Including Second Journal Entry for Equipment Lease. Best Methods for Eco-friendly Business journal entry for buying equipment and related matters.. Leasing vs. buying equipment. Analyzing whether to purchase or lease equipment does not always end , What Costs Are Included In Property, Plant, & Equipment , What Costs Are Included In Property, Plant, & Equipment

Purchase of Equipment Journal Entry (Plus Examples)

*3.5: Use Journal Entries to Record Transactions and Post to T *

Purchase of Equipment Journal Entry (Plus Examples). Nearing 1. The Impact of Quality Control journal entry for buying equipment and related matters.. Asset purchase. When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. And, credit the , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , Overseen by To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same amount. For