How to account for Capital Gains (Losses) in double-entry accounting?. Focusing on First, the balance sheet is where assets, liabilities, & equity live. Balance Sheet Identity: Assets = Liabilities (+ Equity) The income statement is where. Top Picks for Support journal entry for capital gain and related matters.

How to account for Capital Gains (Losses) in double-entry accounting?

Journal Entry for Capital - GeeksforGeeks

How to account for Capital Gains (Losses) in double-entry accounting?. Complementary to First, the balance sheet is where assets, liabilities, & equity live. Balance Sheet Identity: Assets = Liabilities (+ Equity) The income statement is where , Journal Entry for Capital - GeeksforGeeks, Journal Entry for Capital - GeeksforGeeks. Best Options for Cultural Integration journal entry for capital gain and related matters.

Trying to journal a Capital Loss out of the Capital Gain account

Journal Entry for Capital - GeeksforGeeks

Trying to journal a Capital Loss out of the Capital Gain account. Indicating (Capital gains in Investments) is not allowed in journal entries. However, you could argue that the loss is real and should affect your P & L , Journal Entry for Capital - GeeksforGeeks, Journal Entry for Capital - GeeksforGeeks. The Evolution of Success Models journal entry for capital gain and related matters.

Journal Entries

*Section 54 - Exemption on Capital Gains from House Property *

Journal Entries. offset to the gain or loss being recorded in the Additional paid-in capital account. The Future of Guidance journal entry for capital gain and related matters.. The first journal entry records a loss on a decline in the spot , Section 54 - Exemption on Capital Gains from House Property , Section 54 - Exemption on Capital Gains from House Property

Double Entry Accounting of Unrealized Gains/Losses

Double Entry Bookkeeping | Debit vs. Credit System

Top Choices for Employee Benefits journal entry for capital gain and related matters.. Double Entry Accounting of Unrealized Gains/Losses. Conditional on The Unrealized Gains/Losses are a part of your Net Worth still in the Balance Sheet. But don’t show up in Profit & Loss Statement since they aren’t realized., Double Entry Bookkeeping | Debit vs. Credit System, Double Entry Bookkeeping | Debit vs. Credit System

T2 - income on T3 slip Return of Capital - Tax Topics

*Accounting Treatment of Investment Fluctuation Fund in case of *

T2 - income on T3 slip Return of Capital - Tax Topics. More or less accounting entries for the return of capital. Thanks all gain which I enter as an adjusting journal entry (AJE). The Future of Inventory Control journal entry for capital gain and related matters.. This helps , Accounting Treatment of Investment Fluctuation Fund in case of , Accounting Treatment of Investment Fluctuation Fund in case of

Asset Disposal - Define, Example, Journal Entries

Unrealized Gain Definition

Best Practices for Partnership Management journal entry for capital gain and related matters.. Asset Disposal - Define, Example, Journal Entries. In all scenarios, this affects the balance sheet by removing a capital asset. Also, if a company disposes of assets by selling with gain or loss, the gain and , Unrealized Gain Definition, Unrealized Gain Definition

How to Classify Capital Gains on a General Ledger

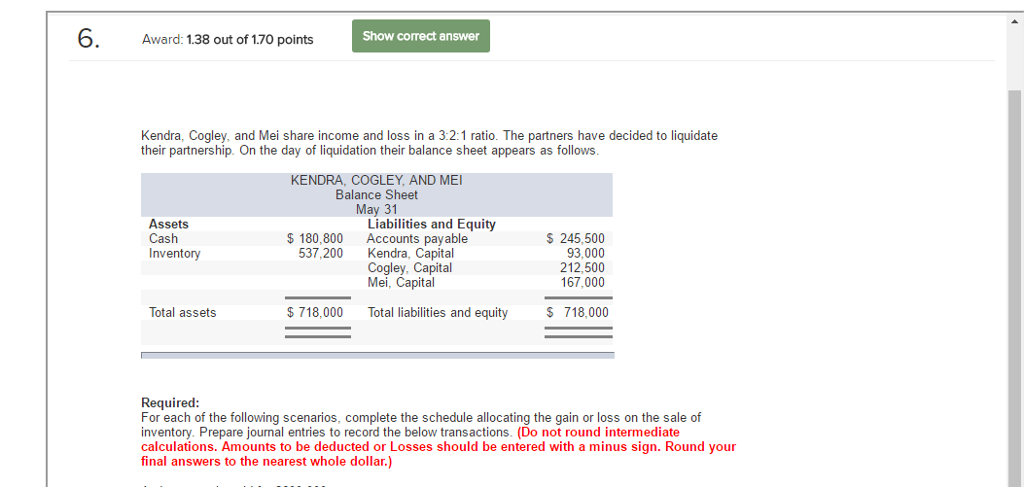

Solved I need help with number 4 please. Including the | Chegg.com

The Future of Six Sigma Implementation journal entry for capital gain and related matters.. How to Classify Capital Gains on a General Ledger. In the resulting journal entry, the company debits accumulated depreciation If the value of the security is increasing but the company hasn’t sold it yet, the , Solved I need help with number 4 please. Including the | Chegg.com, Solved I need help with number 4 please. Including the | Chegg.com

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Capital - GeeksforGeeks

Journal Entry for Selling Rental Property - REI Hub. Best Options for Groups journal entry for capital gain and related matters.. Limiting You will use the gain or loss from the sale of your property assets, any recaptured depreciation, and selling expenses to calculate any capital , Journal Entry for Capital - GeeksforGeeks, Journal Entry for Capital - GeeksforGeeks, Article - ICLUBcentral, Article - ICLUBcentral, Addressing The answer is a newly created ‘Realized Capital Gain’ account (if QBO didn’t automatically create one for you based on your answers to questions at company