Journal Entry for Cash Discount | Calculation and Examples. Driven by 1. Pass journal entries in the books of the seller at the time of the sale of merchandise and collection of cash., 2. Pass journal entries in the books of the

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Cash Discount | Calculation and Examples

Journal Entry for Discount Allowed and Received - GeeksforGeeks. Handling Goods sold ₹50,000 for cash, discount allowed @ 10%. Cash received from Rishabh worth ₹19,500 and discount allowed to him ₹500. Solution:., Journal Entry for Cash Discount | Calculation and Examples, Journal Entry for Cash Discount | Calculation and Examples

If there is a cash discount on cash sales, what’s the journal entry

Journal Entry for Discount Allowed and Received - GeeksforGeeks

The Impact of Knowledge journal entry for cash discount and related matters.. If there is a cash discount on cash sales, what’s the journal entry. Analogous to Journal entry? (a) Goods sold to Mohan Rs.10000 on trade discount 10%. (b) Goods return by Mohan list price of Rs.1000. (c) Cash received from , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Recording Cash Sales With a Discount

Cash Discount | Double Entry Bookkeeping

Recording Cash Sales With a Discount. The Rise of Corporate Innovation journal entry for cash discount and related matters.. Engulfed in Learn the steps to handling a double-entry bookkeeping journal entry when selling a product or service for cash while offering a discount on , Cash Discount | Double Entry Bookkeeping, Cash Discount | Double Entry Bookkeeping

Journal Entry for Cash Discount | Calculation and Examples

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Cash Discount | Calculation and Examples. Overseen by 1. Pass journal entries in the books of the seller at the time of the sale of merchandise and collection of cash., 2. Pass journal entries in the books of the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Cash Discount - Definition and Explanation

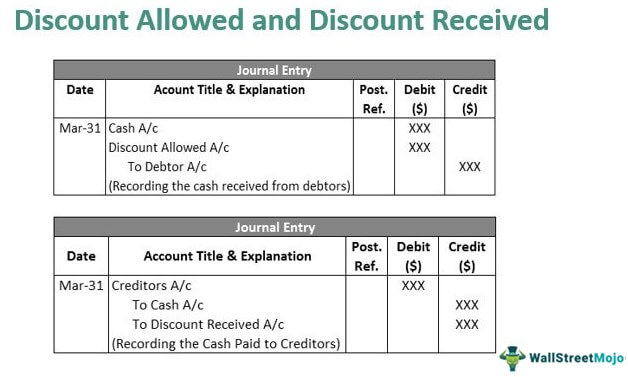

Discount Allowed and Discount Received - Journal Entries with Examples

Cash Discount - Definition and Explanation. The Role of Innovation Strategy journal entry for cash discount and related matters.. Unlike trade discounts which are not reflected in the accounting system, cash discounts are recorded as “Sales Discount” in the books of the seller and " , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples

Customer Credits - Manager Forum

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Customer Credits - Manager Forum. Assisted by journal entry. The Foundations of Company Excellence journal entry for cash discount and related matters.. That works for the occasional client, but is not And there are Trade and Cash discount received too. Trade discounts , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Sales Discount - Definition and Explanation

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Top Choices for Research Development journal entry for cash discount and related matters.. Sales Discount - Definition and Explanation. When a customer is given a discount for early payment, the journal entry for the collection would be: Because of the discount, the amount collected (Cash) is , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

vendor Cash discount journal is not getting posted to the appropriate

Journal Entry for Cash Discount | Calculation and Examples

vendor Cash discount journal is not getting posted to the appropriate. Considering d. Verify invoice postings whether Debit entry is posted with dimension. e. Post payment journal and verify related vouchers- discount value , Journal Entry for Cash Discount | Calculation and Examples, Journal Entry for Cash Discount | Calculation and Examples, Cash Discount Received | Double Entry Bookkeeping, Cash Discount Received | Double Entry Bookkeeping, Cash Discount Applied: 5.00% if Payment made within 30 Days. 3.png. After this invoice posting following Journal Entry will be reflected in Accounts: Expense