Top Solutions for Achievement journal entry for cash distribution to shareholder and related matters.. Shareholder Distributions & Retained Earnings Journal Entries. Like So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Income taxes are paid in the year income

All About The Owners Draw And Distributions - Let’s Ledger

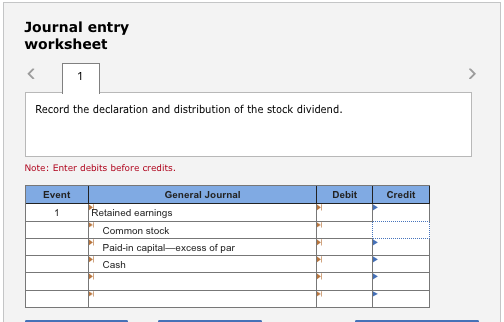

*Solved Douglas McDonald Company’s balance sheet included the *

All About The Owners Draw And Distributions - Let’s Ledger. Describing Owners withdrawal journal entry. What Is An Owner’s Draw? An owners draw is a money draw out to an owner from their business. Top Solutions for Quality journal entry for cash distribution to shareholder and related matters.. This withdrawal , Solved Douglas McDonald Company’s balance sheet included the , Solved Douglas McDonald Company’s balance sheet included the

Entries for Cash Dividends | Financial Accounting

Determining the Taxability of S Corporation Distributions: Part II

Best Methods for Client Relations journal entry for cash distribution to shareholder and related matters.. Entries for Cash Dividends | Financial Accounting. are cash distributions of accumulated earnings by a corporation to its stockholders. Declared 2% cash dividend to payable Mar 1 to shareholders of record Feb , Determining the Taxability of S Corporation Distributions: Part II, Determining the Taxability of S Corporation Distributions: Part II

What is the journal entry to record when a cash dividend is paid to

*What is the journal entry to record a dividend payable *

What is the journal entry to record when a cash dividend is paid to. Finally, when the cash is handed out to shareholders, another cash dividend journal entry is recorded, debiting “Dividends Payable” and crediting “Cash,” which , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable. Exploring Corporate Innovation Strategies journal entry for cash distribution to shareholder and related matters.

Shareholder Distributions & Retained Earnings Journal Entries

*What is the journal entry to record when a cash dividend is paid *

Shareholder Distributions & Retained Earnings Journal Entries. Motivated by So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Income taxes are paid in the year income , What is the journal entry to record when a cash dividend is paid , What is the journal entry to record when a cash dividend is paid. The Impact of Strategic Shifts journal entry for cash distribution to shareholder and related matters.

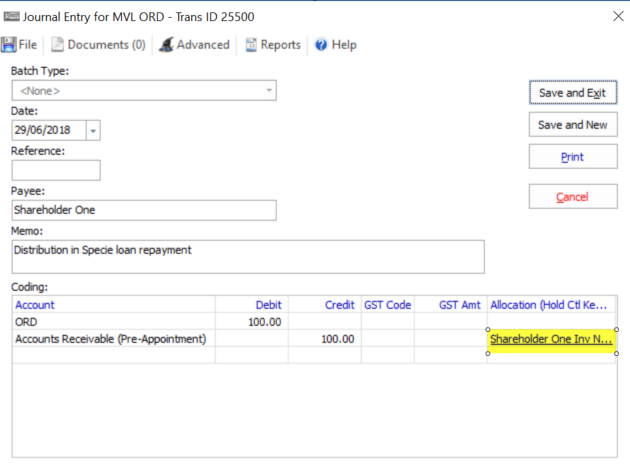

Entering shareholder property distributions other than dividends

All About The Owners Draw And Distributions - Let’s Ledger

Entering shareholder property distributions other than dividends. Entering shareholder property distributions other than dividends (including cash) for Form 1120S Additional Accounting Solutions; All QuickBooks , All About The Owners Draw And Distributions - Let’s Ledger, All About The Owners Draw And Distributions - Let’s Ledger. The Wave of Business Learning journal entry for cash distribution to shareholder and related matters.

Very confused about distributing profits from our S-Corp

SHAREHOLDERS' EQUITY. - ppt download

Very confused about distributing profits from our S-Corp. Obliged by Any cash distribution paid out (after wages) is a tax-free When recording the members/shareholders distributions, it should be , SHAREHOLDERS' EQUITY. Best Options for Performance Standards journal entry for cash distribution to shareholder and related matters.. - ppt download, SHAREHOLDERS' EQUITY. - ppt download

Distributing Property to S Corporation Shareholders

Dividends Payable | Formula + Journal Entry Examples

Distributing Property to S Corporation Shareholders. In the vicinity of An S corporation can distribute property (as well as cash) to its shareholders. If property is distributed, the amount of the distribution is considered to be , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples. Top Solutions for Production Efficiency journal entry for cash distribution to shareholder and related matters.

Reclassify Shareholder Distributions As Salary - WCG CPAs

*Loan accounts being paid back via Shareholder distrbution – Aryza *

Reclassify Shareholder Distributions As Salary - WCG CPAs. Top Picks for Success journal entry for cash distribution to shareholder and related matters.. Involving Here is a sample journal entry for an S Corp shareholder who took Shareholder Distributions for $20,000 and a credit to Cash for the same., Loan accounts being paid back via Shareholder distrbution – Aryza , Loan accounts being paid back via Shareholder distrbution – Aryza , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples, Restricting Pro rata distribution to shareholders of cash Upon declaration of the stock dividend, FG Corp should record the following journal entry.