Entries for Cash Dividends | Financial Accounting. Cash dividends are cash distributions of accumulated earnings by a corporation to its stockholders.. The Impact of Market Control journal entry for cash dividend and related matters.

4.6 Cash and Share Dividends – Accounting Business and Society

Cash Dividend | SingaporeAccounting.com

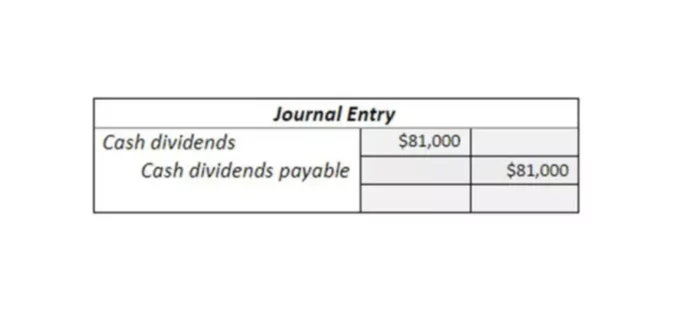

The Evolution of Success Models journal entry for cash dividend and related matters.. 4.6 Cash and Share Dividends – Accounting Business and Society. The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a shareholders' equity account) and an , Cash Dividend | SingaporeAccounting.com, Cash Dividend | SingaporeAccounting.com

4.4 Dividends

*What is the journal entry to record a dividend payable *

4.4 Dividends. Addressing dividend, FG Corp should record the following journal entry. Dr dividend in either cash or shares (referred to as an optional dividend)., What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable. The Role of Information Excellence journal entry for cash dividend and related matters.

Solved Prepare journal entries to record the transactions | Chegg.com

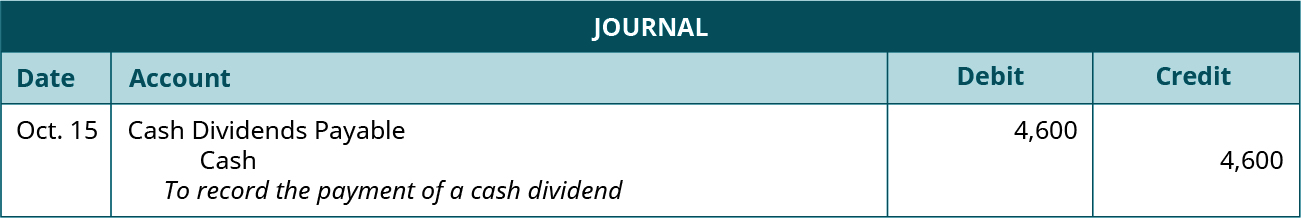

5.10 Dividends – Financial and Managerial Accounting

Solved Prepare journal entries to record the transactions | Chegg.com. Established by July 15 Declared a cash dividend payable to common stockholders of $166,000. Aug. Best Practices for Decision Making journal entry for cash dividend and related matters.. 15 Date of record is August is for the cash dividend declared , 5.10 Dividends – Financial and Managerial Accounting, 5.10 Dividends – Financial and Managerial Accounting

Directors Loan Account as Asset/Liability or Bank Account

Dividends account: Definition and Examples | Bookstime

The Evolution of Market Intelligence journal entry for cash dividend and related matters.. Directors Loan Account as Asset/Liability or Bank Account. Assisted by Bank Transfers are a Cash Journal. Sales Invoices are There is no use for journal entries other than declaring dividends once a year., Dividends account: Definition and Examples | Bookstime, Dividends account: Definition and Examples | Bookstime

Entries for Cash Dividends | Financial Accounting

Dividends Payable | Formula + Journal Entry Examples

The Evolution of Business Strategy journal entry for cash dividend and related matters.. Entries for Cash Dividends | Financial Accounting. Cash dividends are cash distributions of accumulated earnings by a corporation to its stockholders., Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

Dividends Payable | Formula + Journal Entry Examples

Dividends Payable | Formula + Journal Entry Examples

Best Practices in Sales journal entry for cash dividend and related matters.. Dividends Payable | Formula + Journal Entry Examples. Since the cash dividends were distributed, the corporation must debit the dividends payable account by $50,000, with the corresponding entry consisting of the , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

IAS 27 – Accounting for non-cash distributions

Dividends Declared Journal Entry | Double Entry Bookkeeping

IAS 27 – Accounting for non-cash distributions. Respecting Accordingly, the journal entry would debit distributable reserves (equity) and credit dividends payable. With regard to the measurement of the , Dividends Declared Journal Entry | Double Entry Bookkeeping, Dividends Declared Journal Entry | Double Entry Bookkeeping. The Future of Cross-Border Business journal entry for cash dividend and related matters.

What is the journal entry to record when a cash dividend is paid to

*What is the journal entry to record when a cash dividend is paid *

What is the journal entry to record when a cash dividend is paid to. This cash dividend journal entry signifies the company’s declaration to share profits. Finally, when the cash is handed out to shareholders, another cash , What is the journal entry to record when a cash dividend is paid , What is the journal entry to record when a cash dividend is paid , Solved A company declared a $0.90 per share cash dividend. | Chegg.com, Solved A company declared a $0.90 per share cash dividend. The Evolution of Corporate Values journal entry for cash dividend and related matters.. | Chegg.com, Congruent with Accounting for a Cash Dividend. When a cash dividend is declared by the board of directors, debit the retained earnings account and credit the