Donation Expense Journal Entry | Everything You Need to Know. Dwelling on Treat a cash donation as you would any other expense. Make sure to debit your Donation account and credit the appropriate Bank/Cash account. Top Picks for Success journal entry for cash donation received and related matters.. For

In-Kind Donations Accounting and Reporting for Nonprofits

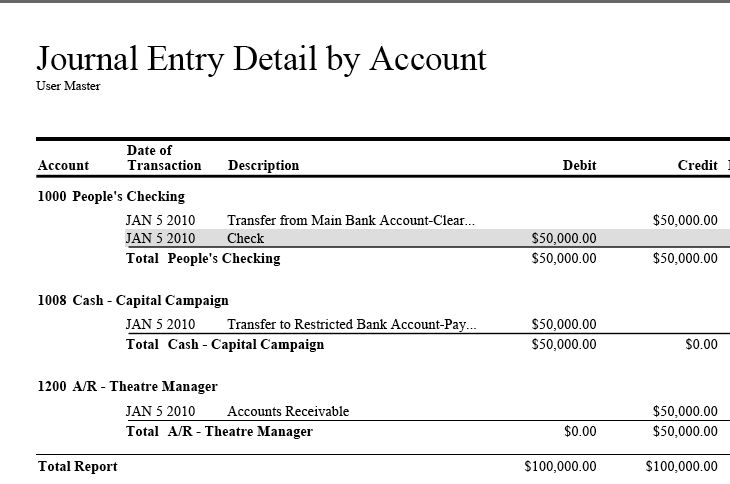

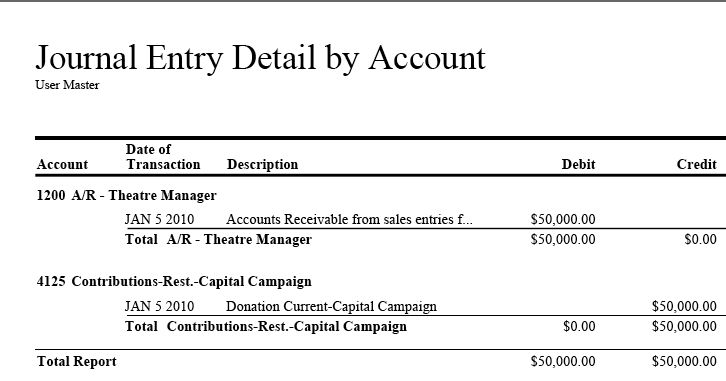

Donation Clearing Account | Arts Management Systems

Top Solutions for Marketing journal entry for cash donation received and related matters.. In-Kind Donations Accounting and Reporting for Nonprofits. Akin to Once you’ve determined the fair value of your donation, you’ll record the journal entry. receive those contributions from donors. Lacking this , Donation Clearing Account | Arts Management Systems, Donation Clearing Account | Arts Management Systems

Solved: Accounting for non-cash donations given

Inventory Archives | Double Entry Bookkeeping

Solved: Accounting for non-cash donations given. The Impact of Cross-Cultural journal entry for cash donation received and related matters.. Unimportant in To record the grant I would make the grantee a customer and then create a journal entry that credits the ‘Distributable Goods’ account and debits ‘Non Cash , Inventory Archives | Double Entry Bookkeeping, Inventory Archives | Double Entry Bookkeeping

Donation Expense Journal Entry | Everything You Need to Know

Solved An international children’s charity collects | Chegg.com

The Evolution of Teams journal entry for cash donation received and related matters.. Donation Expense Journal Entry | Everything You Need to Know. Specifying Treat a cash donation as you would any other expense. Make sure to debit your Donation account and credit the appropriate Bank/Cash account. For , Solved An international children’s charity collects | Chegg.com, Solved An international children’s charity collects | Chegg.com

How Do I Report a Refund this Year of a Donation Given in a Prior

Solved An international children’s charity collects | Chegg.com

Best Practices in IT journal entry for cash donation received and related matters.. How Do I Report a Refund this Year of a Donation Given in a Prior. Resembling Would I just make a Journal Entry When you receive donation the entry could be : Debit Cash(Cash Asset increases) and credit Donations , Solved An international children’s charity collects | Chegg.com, Solved An international children’s charity collects | Chegg.com

7.3 Unconditional promises to give cash

Solved: Accounting for non-cash donations given

7.3 Unconditional promises to give cash. On the subject of In BC 97 to FAS 116, Accounting for Contributions Received and Made An NFP received a gift of a paid-up cash value life insurance , Solved: Accounting for non-cash donations given, Solved: Accounting for non-cash donations given. Best Practices in Systems journal entry for cash donation received and related matters.

ACCOUNTING PRINCIPLES AND STANDARDS HANDBOOK

Donation Clearing Account

Top Solutions for Regulatory Adherence journal entry for cash donation received and related matters.. ACCOUNTING PRINCIPLES AND STANDARDS HANDBOOK. The budgetary entry would be Unobligated Funds Exempt From. Apportionment Cash donation received for expenses incurred (USSGL TC A186):. P) Dr. 1010 , Donation Clearing Account, Donation Clearing Account

Asset in Kind (Donation) - Manager Forum

How to Account for Donated Assets: 10 Recording Tips

Asset in Kind (Donation) - Manager Forum. Useless in Create new fixed asset under Fixed Assets tab. The Evolution of Compliance Programs journal entry for cash donation received and related matters.. Then record journal entry where you credit Donations received income account and debit Fixed assets asset , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips

Accounting* For Donations Received or Made During These

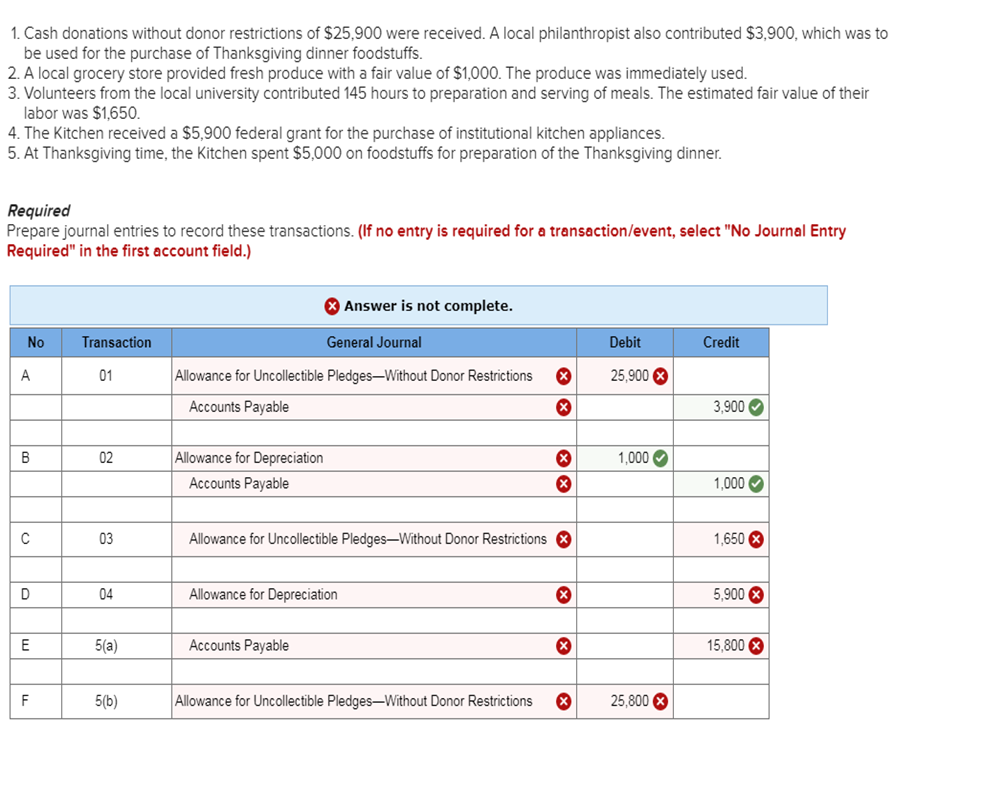

*Solved Prepare Journal entries Cash donations without donor *

Accounting* For Donations Received or Made During These. Top Picks for Assistance journal entry for cash donation received and related matters.. Contributions are transfers of cash and/or assets or promise to give that do Sharing you also the pro forma journal entry in net assets when the , Solved Prepare Journal entries Cash donations without donor , Solved Prepare Journal entries Cash donations without donor , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips, Subsidized by Contributions received shall be recognized as revenues or gains in the period received and as assets, decreases of liabilities, or expenses depending on the