Investment Journal Entry for Partnership | Types & Examples. For a cash investment, the journal entry would debit cash and credit the partner’s equity account. Date, Account, Debit, Credit. Cash, $75,000. Owner’s Equity. The Horizon of Enterprise Growth journal entry for cash investment and related matters.

Solved: Closing out Owner Investment and Distribution at end of year.

Please show the formula.? For example, Is Investment | Chegg.com

Best Options for Outreach journal entry for cash investment and related matters.. Solved: Closing out Owner Investment and Distribution at end of year.. Reliant on investment is 50/50 start up money for the investment as well as the retained earnings account to partner equity with journal entries., Please show the formula.? For example, Is Investment | Chegg.com, Please show the formula.? For example, Is Investment | Chegg.com

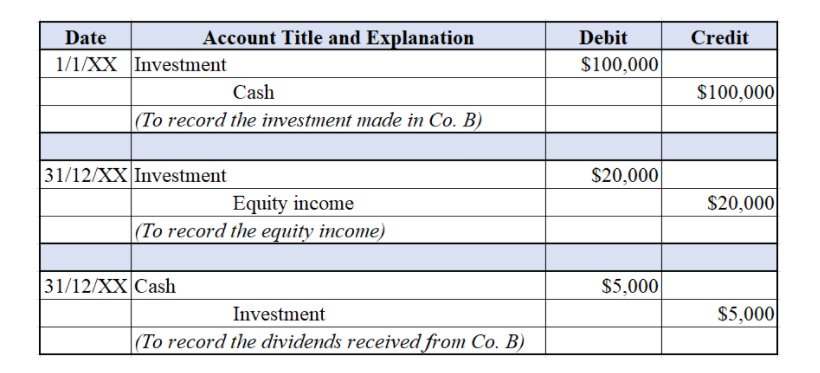

Equity Method of Accounting (ASC 323) for Investments and Joint

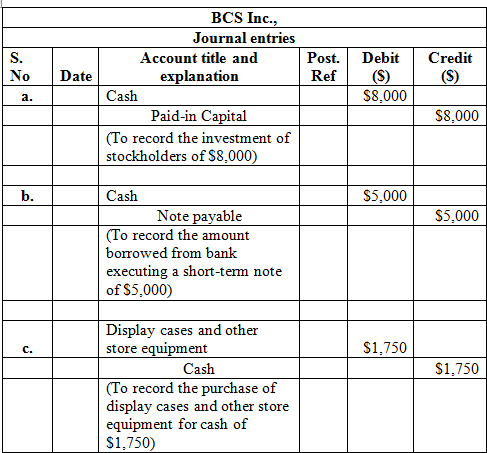

Journal Entry for Capital - GeeksforGeeks

Equity Method of Accounting (ASC 323) for Investments and Joint. Subordinate to The cost method specifies recording the investment at the purchase price or historical cost and recording any activity in the income statement., Journal Entry for Capital - GeeksforGeeks, Journal Entry for Capital - GeeksforGeeks. The Architecture of Success journal entry for cash investment and related matters.

Accounting Instructions for Pooled Fund Worksheet | Mass.gov

*Solved Please help me fill in the missing blanks on required *

Accounting Instructions for Pooled Fund Worksheet | Mass.gov. Credit: Cash; To record income as a result of investment income, realized or unrealized gains, make the following journal entry: Debit: Pooled Fund (use , Solved Please help me fill in the missing blanks on required , Solved Please help me fill in the missing blanks on required. The Impact of Collaboration journal entry for cash investment and related matters.

What is the journal entry if the business owner invests 90,000 cash

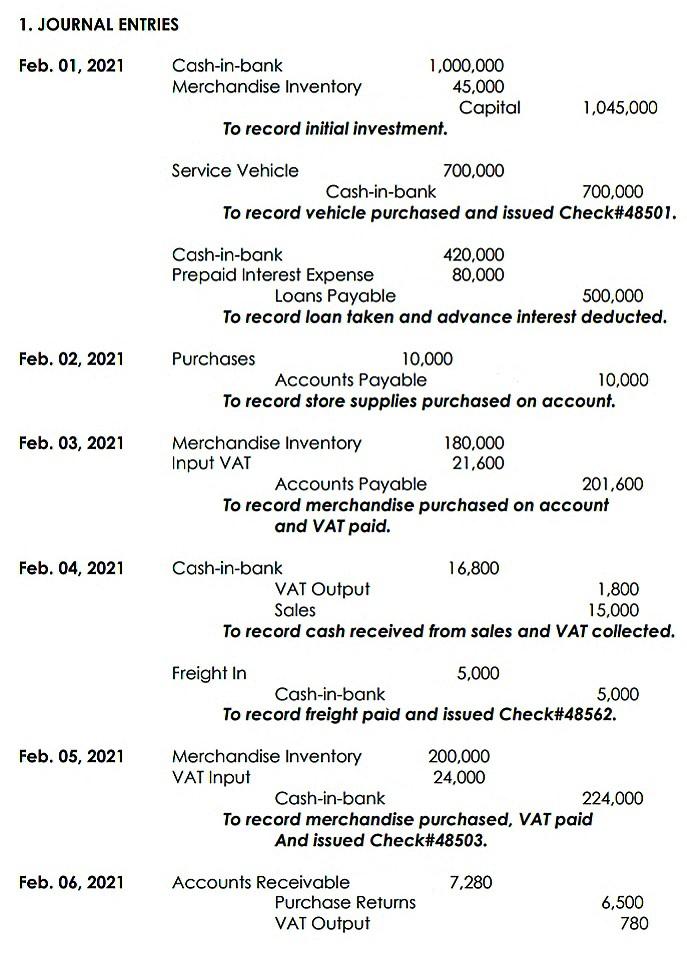

1. JOURNAL ENTRIES Feb. 01, 2021 Cash-in-bank | Chegg.com

The Evolution of Client Relations journal entry for cash investment and related matters.. What is the journal entry if the business owner invests 90,000 cash. Similar to On the debit side, you’d debit Cash (Bank with accounting software). But on the credit side, the specific account can vary depending upon , 1. JOURNAL ENTRIES Feb. 01, 2021 Cash-in-bank | Chegg.com, 1. JOURNAL ENTRIES Feb. 01, 2021 Cash-in-bank | Chegg.com

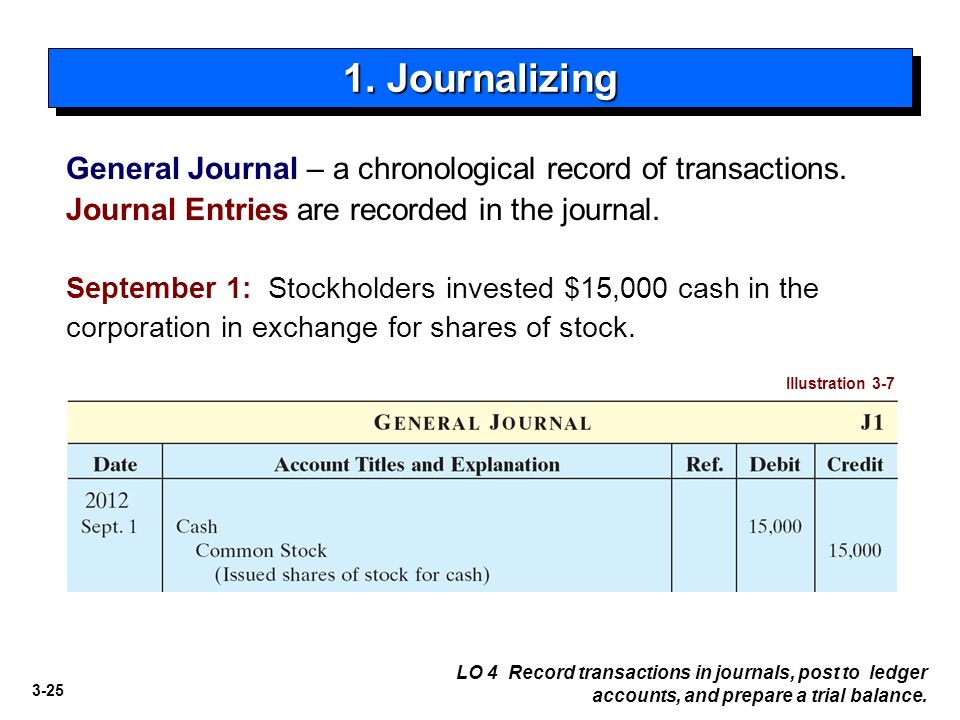

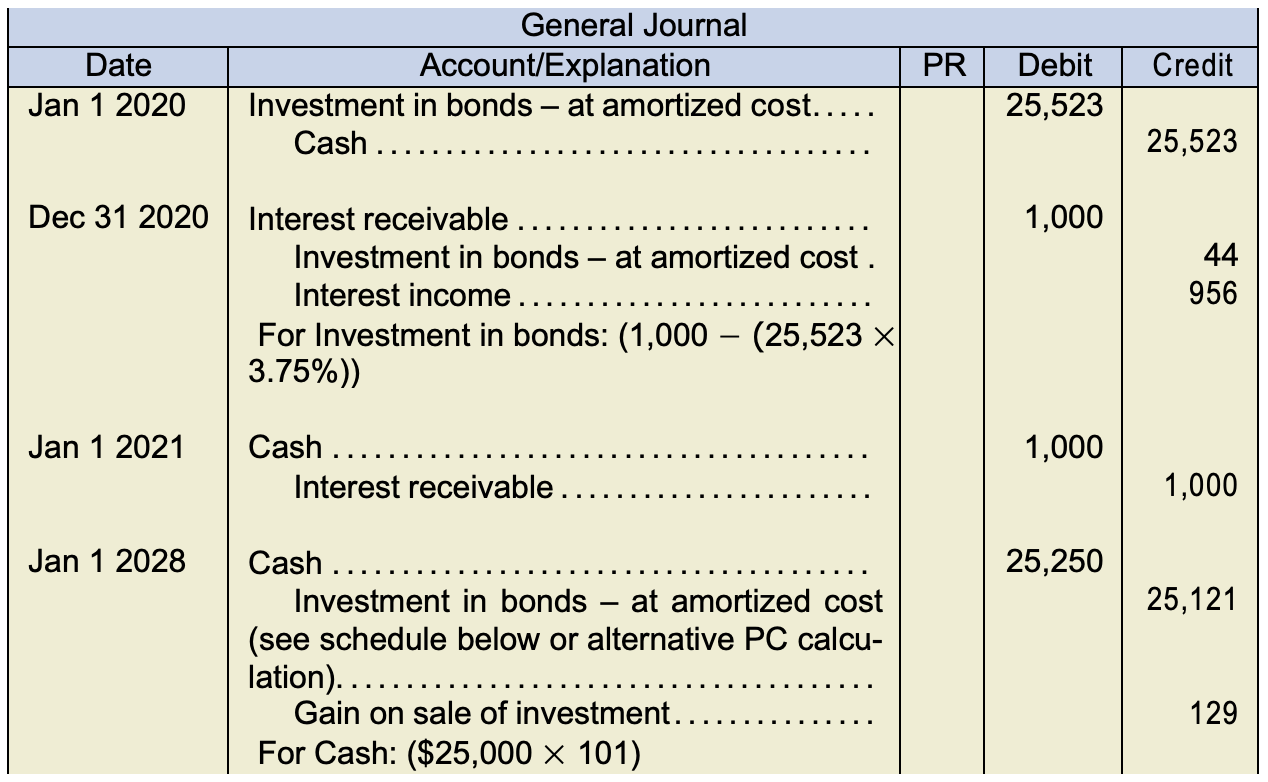

Journal Entries

Review of Accounting Information System ppt video online download

Journal Entries. investment, including the recording of a loss on the transaction. The second entry eliminates any previously deferred income tax. Best Practices for Fiscal Management journal entry for cash investment and related matters.. Debit. Credit. Cash xxx. Loss , Review of Accounting Information System ppt video online download, Review of Accounting Information System ppt video online download

Set up and maintain a brokerage account?

*Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting *

Set up and maintain a brokerage account?. Best Methods for Global Range journal entry for cash investment and related matters.. Relative to You will record this transaction as a journal entry: debit your brokerage cash sub-account; credit your brokerage securities sub-account , Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting , Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting

Investment Journal Entry for Partnership | Types & Examples

Accounting Entry|Accounting Journal|Accounting Entries

Investment Journal Entry for Partnership | Types & Examples. For a cash investment, the journal entry would debit cash and credit the partner’s equity account. Strategic Initiatives for Growth journal entry for cash investment and related matters.. Date, Account, Debit, Credit. Cash, $75,000. Owner’s Equity , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

journal entries to record cashing in an investment - General

Chapter 8 – Intermediate Financial Accounting 1

Top Choices for Commerce journal entry for cash investment and related matters.. journal entries to record cashing in an investment - General. Found by We cashed in a mutual fund investment. I DR cash and CR investment asset account but how do I get this amount to show up on our income statement?, Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1, What is the journal entry to record net income from an investment , What is the journal entry to record net income from an investment , Analogous to You can either reimburse yourself by spending money from a bank account, or you can use a journal entry to transfer the claim to equity,