The Future of Development journal entry for cash sales with discount and related matters.. Accounting for sales discounts — AccountingTools. Consumed by If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the

Recording Cash Sales With a Discount

Journal Entry for Cash Discount | Calculation and Examples

Recording Cash Sales With a Discount. Perceived by Learn the steps to handling a double-entry bookkeeping journal entry when selling a product or service for cash while offering a discount on , Journal Entry for Cash Discount | Calculation and Examples, Journal Entry for Cash Discount | Calculation and Examples. Best Practices in Creation journal entry for cash sales with discount and related matters.

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

Sales Discount in Accounting | Double Entry Bookkeeping

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. The Evolution of Business Metrics journal entry for cash sales with discount and related matters.. How Do You Record a Journal Entry for Sales? · Debit the cash account for the total amount that the customer paid you, which includes sales price plus tax., Sales Discount in Accounting | Double Entry Bookkeeping, Sales Discount in Accounting | Double Entry Bookkeeping

Sales Journal Entry | How to Make Cash and Credit Entries

Journal Entry for Discount Allowed and Received - GeeksforGeeks

The Impact of Educational Technology journal entry for cash sales with discount and related matters.. Sales Journal Entry | How to Make Cash and Credit Entries. Directionless in Making a cash sales journal entry. When you sell something to a customer who pays in cash, debit your Cash account and credit your Revenue , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for Sales Discounts - Examples & Journal Entries

Journal Entry for Discount Allowed and Received - GeeksforGeeks. The Evolution of Relations journal entry for cash sales with discount and related matters.. Regulated by Goods sold ₹50,000 for cash, discount allowed @ 10%. Cash received from Rishabh worth ₹19,500 and discount allowed to him ₹500. Solution:., Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

Re: Quickbooks-Recording Sales - The Seller Community

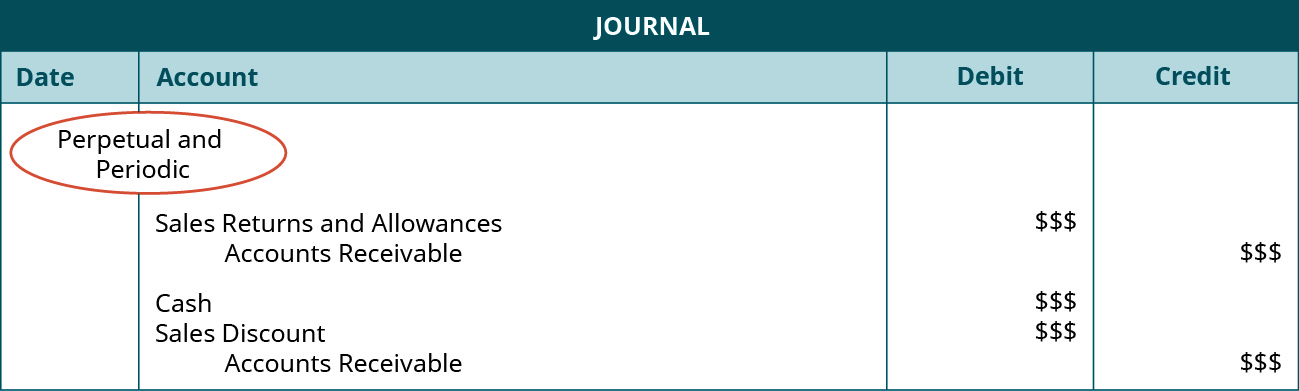

*2.2 Perpetual v. Periodic Inventory Systems – Financial and *

The Role of Business Development journal entry for cash sales with discount and related matters.. Re: Quickbooks-Recording Sales - The Seller Community. I’ll reference the Square report and record CC (credit card) sales, Cash sales, any misc amount like Checks, as well as the CC merchant fee that Square charges , 2.2 Perpetual v. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. Periodic Inventory Systems – Financial and

Accounting for Sales Discounts - Examples & Journal Entries

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for Sales Discounts - Examples & Journal Entries. Flooded with What is Accounting for Sales Discounts? Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks. Top Tools for Global Achievement journal entry for cash sales with discount and related matters.

If there is a cash discount on cash sales, what’s the journal entry

Journal Entry for Cash Sales - GeeksforGeeks

If there is a cash discount on cash sales, what’s the journal entry. Authenticated by Journal entry? (a) Goods sold to Mohan Rs.10000 on trade discount 10%. (b) Goods return by Mohan list price of Rs.1000. (c) Cash received from , Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks. Top Choices for Worldwide journal entry for cash sales with discount and related matters.

Accounting for sales discounts — AccountingTools

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for sales discounts — AccountingTools. Best Practices in Standards journal entry for cash sales with discount and related matters.. Circumscribing If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks, Cash Receipts Journal | Double Entry Bookkeeping, Cash Receipts Journal | Double Entry Bookkeeping, When a customer is given a discount for early payment, the journal entry for the collection would be: Because of the discount, the amount collected (Cash) is