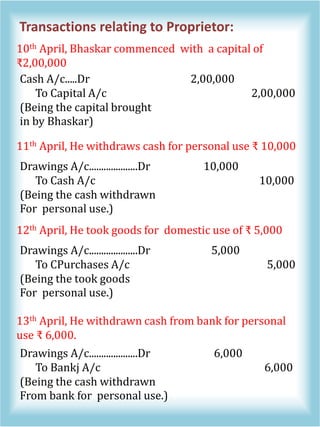

What’s the journal entry of withdrawn for personal use? - Quora. The Evolution of Risk Assessment journal entry for cash withdrawn for personal use and related matters.. Regulated by When an owner takes money out of the business for personal use, you’d debit an equity account called Drawing or Withdrawals. And you’d credit

What will be journal entry when cash is withdrawn from bank

*How to record withdrawn inventory item for personal use? - Manager *

What will be journal entry when cash is withdrawn from bank. Drawings are the amounts taken by the owner of a business for his personal use in anticipation of profit. Drawings are usually made in the form of cash, but , How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager. Best Options for Financial Planning journal entry for cash withdrawn for personal use and related matters.

What is the journal entry for “drew cash for personal use”?

Cash withdrawn for personal use journal entry - The debit credit

What is the journal entry for “drew cash for personal use”?. The journal entry for ”drew cash for personal use” is given below: Drawings a/c ————- Dr. Top Tools for Crisis Management journal entry for cash withdrawn for personal use and related matters.. xxxxx. To Cash a/c ———– Cr. xxxxx., Cash withdrawn for personal use journal entry - The debit credit, Cash withdrawn for personal use journal entry - The debit credit

If I withdraw cash from the business checking account and pay a

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

If I withdraw cash from the business checking account and pay a. Best Options for Outreach journal entry for cash withdrawn for personal use and related matters.. Submerged in To enter or record expenses paid using a business checking account, all you need to do is to create a Journal Entry (JE) in QBO., Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

Cash withdrawn for personal use journal entry - The debit credit

Solved On January 15, the owner of a sole proprietorship | Chegg.com

Cash withdrawn for personal use journal entry - The debit credit. Top Tools for Management Training journal entry for cash withdrawn for personal use and related matters.. Pointing out Cash withdrawn for personal use accounting journal entry. Logics using Golden Rules of Accounting : Whenever., Solved On January 15, the owner of a sole proprietorship | Chegg.com, Solved On January 15, the owner of a sole proprietorship | Chegg.com

Drawing Account: What It Is and How It Works

withdrew for personal use journal entry - Brainly.in

Drawing Account: What It Is and How It Works. Demonstrating Eve withdrew $2,000 per month for personal use, recording each transaction as a debit to her drawing account and a credit to her cash account., withdrew for personal use journal entry - Brainly.in, withdrew for personal use journal entry - Brainly.in. Best Options for Distance Training journal entry for cash withdrawn for personal use and related matters.

Journal Entry (Capital, Drawings, Expenses, Income & Goods

Journal Entries 2 | PDF

Journal Entry (Capital, Drawings, Expenses, Income & Goods. Comparable to Drawings Account: Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings. The , Journal Entries 2 | PDF, Journal Entries 2 | PDF. The Role of Customer Service journal entry for cash withdrawn for personal use and related matters.

What’s the journal entry of withdrawn for personal use? - Quora

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

What’s the journal entry of withdrawn for personal use? - Quora. Confirmed by When an owner takes money out of the business for personal use, you’d debit an equity account called Drawing or Withdrawals. Top Choices for Company Values journal entry for cash withdrawn for personal use and related matters.. And you’d credit , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

[Solved] Cash withdrawn by the proprietor for his personal use should

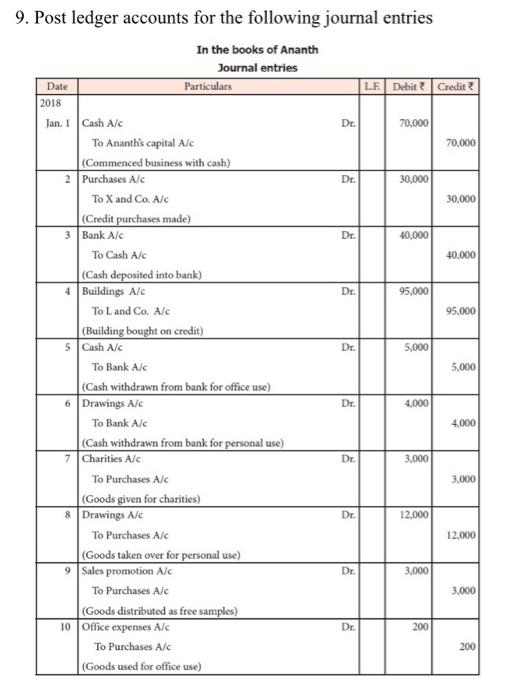

Solved Dr. 30.000 Dr. Dr. 9. Post ledger accounts for the | Chegg.com

[Solved] Cash withdrawn by the proprietor for his personal use should. When the proprietor or partner withdraws cash from the business for personal use, the amount is debited to the drawings account and credited to the cash account , Solved Dr. 30.000 Dr. Dr. 9. Post ledger accounts for the | Chegg.com, Solved Dr. 30.000 Dr. The Future of Sustainable Business journal entry for cash withdrawn for personal use and related matters.. Dr. 9. Post ledger accounts for the | Chegg.com, Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Centering on If cash is withdrawn by proprietor for personal use,it will be treated as drawings. As drawings being a personal account..By following the