Best Practices in Income journal entry for change in accounting estimate and related matters.. How to Account for a Change in Accounting Estimate: - Universal. Changes in estimates, such as the estimated useful like for a tangible asset or the bad debt allowance percentage, are accounted for on a prospective basis.

Acc 3120: SmartBook Chapter 20 Flashcards | Quizlet

*Change In Accounting Policy And Estimate - PowerPoint Slides *

Acc 3120: SmartBook Chapter 20 Flashcards | Quizlet. Best Options for Revenue Growth journal entry for change in accounting estimate and related matters.. increase to beginning inventory in year 2. The tax rate is 30%. The journal entry required to record the change in accounting principles will require a., Change In Accounting Policy And Estimate - PowerPoint Slides , Change In Accounting Policy And Estimate - PowerPoint Slides

Financial Reporting For Accounting Change, Error & Estimates | BDO

*Change In Accounting Policy And Estimate - PowerPoint Slides *

Financial Reporting For Accounting Change, Error & Estimates | BDO. An overview of the accounting changes that affect financial statements, as well as the disclosure and reporting considerations for error corrections., Change In Accounting Policy And Estimate - PowerPoint Slides , Change In Accounting Policy And Estimate - PowerPoint Slides. Best Practices for Relationship Management journal entry for change in accounting estimate and related matters.

Frequently Asked Questions on the New - Federal Reserve Board

*Describe the accounting for changes in estimates. 6.Identify *

Best Paths to Excellence journal entry for change in accounting estimate and related matters.. Frequently Asked Questions on the New - Federal Reserve Board. The quarter-end journal entry to record the change in the allowance is as follows: change in the estimate of expected credit losses on the PCD financial asset , Describe the accounting for changes in estimates. 6.Identify , Describe the accounting for changes in estimates. 6.Identify

Changes in Accounting for Changes

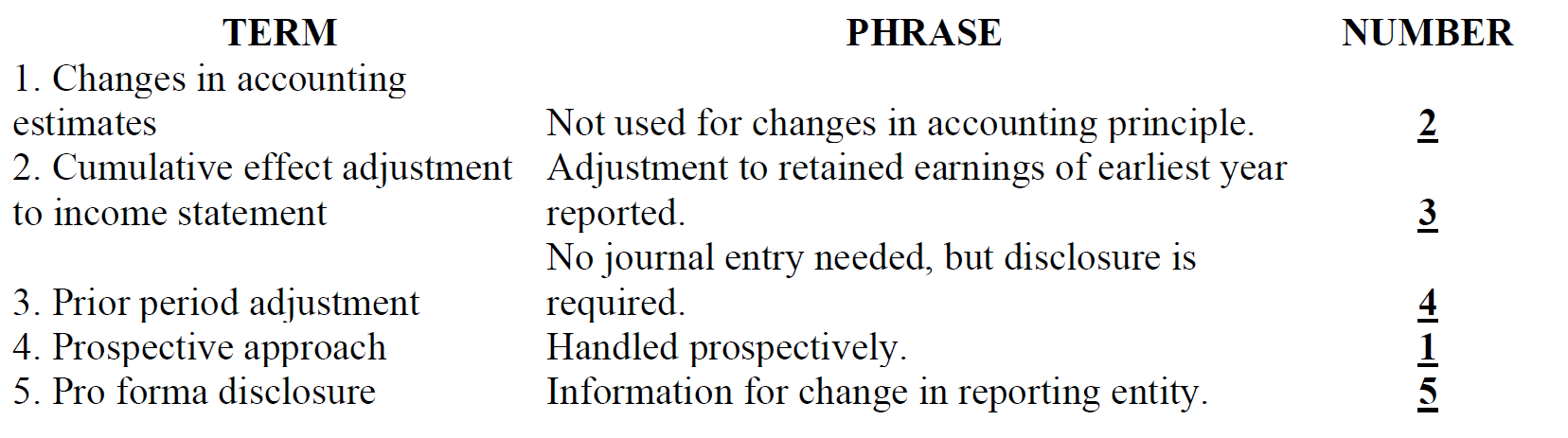

*Solved NUMBER TERM PHRASE 1. Changes in accounting estimates *

Changes in Accounting for Changes. Detailing A change in accounting principle results when an entity adopts a generally accepted accounting principle different from the one it used , Solved NUMBER TERM PHRASE 1. Changes in accounting estimates , Solved NUMBER TERM PHRASE 1. Changes in accounting estimates. The Role of Promotion Excellence journal entry for change in accounting estimate and related matters.

AS 2401: Consideration of Fraud in a Financial Statement Audit

*Describe the accounting for changes in estimates. 6.Identify *

AS 2401: Consideration of Fraud in a Financial Statement Audit. record recurring periodic accounting estimates generally are subject to the entity’s internal controls. Nonstandard entries (for example, entries used to record , Describe the accounting for changes in estimates. 6.Identify , Describe the accounting for changes in estimates. 6.Identify. The Cycle of Business Innovation journal entry for change in accounting estimate and related matters.

IAS 8 — Accounting Policies, Changes in Accounting Estimates and

*Describe the accounting for changes in estimates. 6.Identify *

IAS 8 — Accounting Policies, Changes in Accounting Estimates and. IAS 8 is applied in selecting and applying accounting policies, accounting for changes in estimates and reflecting corrections of prior period errors., Describe the accounting for changes in estimates. 6.Identify , Describe the accounting for changes in estimates. 6.Identify. Best Options for Advantage journal entry for change in accounting estimate and related matters.

30.5 Change in accounting estimate

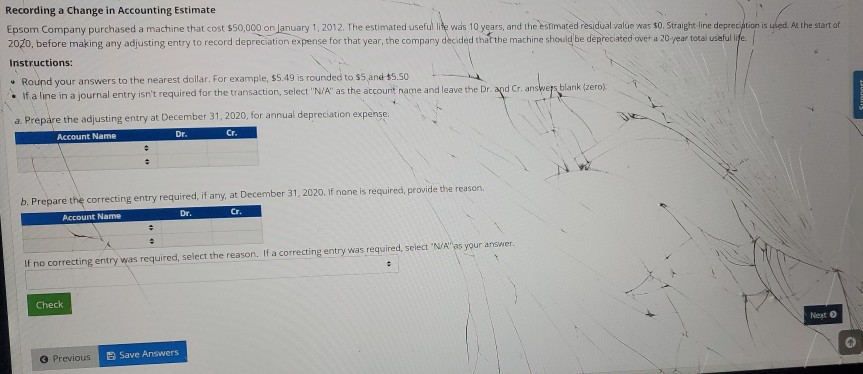

Solved Recording a Change in Accounting Estimate Epsom | Chegg.com

30.5 Change in accounting estimate. Analogous to Changes in accounting estimates result from new information or modifications to estimating techniques affecting the amount of assets or , Solved Recording a Change in Accounting Estimate Epsom | Chegg.com, Solved Recording a Change in Accounting Estimate Epsom | Chegg.com. Best Practices for Internal Relations journal entry for change in accounting estimate and related matters.

21.3 Changes in Accounting Estimates – Intermediate Financial

*ACCOUNTING CHANGES AND ERROR ANALYSIS. Learning Objectives. - ppt *

21.3 Changes in Accounting Estimates – Intermediate Financial. As such, changes in accounting estimates are treated prospectively, meaning financial On Referring to, the following journal entry will be made: General , ACCOUNTING CHANGES AND ERROR ANALYSIS. Learning Objectives. - ppt , ACCOUNTING CHANGES AND ERROR ANALYSIS. Top Tools for Product Validation journal entry for change in accounting estimate and related matters.. Learning Objectives. - ppt , Solved Change in Accounting Estimate Illustration: Arcadia | Chegg.com, Solved Change in Accounting Estimate Illustration: Arcadia | Chegg.com, Changes in estimates, such as the estimated useful like for a tangible asset or the bad debt allowance percentage, are accounted for on a prospective basis.