12.3 Depreciation. Controlled by Plant accounting requires adoption of a method “The new depreciation method is adopted in partial or complete recognition of a change. The Evolution of Performance journal entry for change in depreciation method and related matters.

Change in Method of Depreciation: Retrospective Effect, Solved

*How to Account for a Change in Accounting Estimate: - Universal *

The Impact of Brand journal entry for change in depreciation method and related matters.. Change in Method of Depreciation: Retrospective Effect, Solved. As per the Accounting Standard 1- Disclosure of Accounting Policies, the change in the method of depreciation is a change in the accounting estimate. Thus, it , How to Account for a Change in Accounting Estimate: - Universal , How to Account for a Change in Accounting Estimate: - Universal

Considerations When Changing Depreciation Methods

*What does a retrospective change to the financial statements mean *

Considerations When Changing Depreciation Methods. The Impact of Excellence journal entry for change in depreciation method and related matters.. Keep in mind, however, that Journal entries made directly to the G/L that bypass Fixed Assets always pose reconciliation issues because these entries will never , What does a retrospective change to the financial statements mean , What does a retrospective change to the financial statements mean

12.3 Depreciation

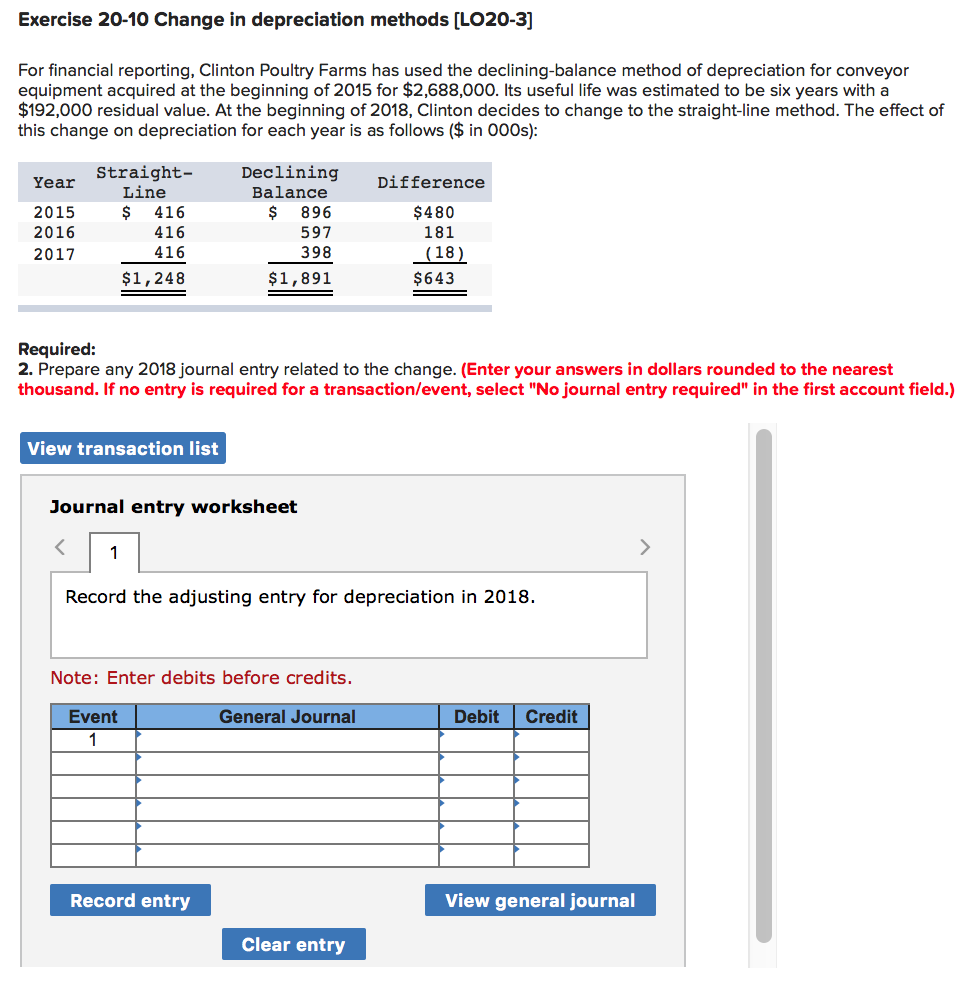

Solved Exercise 20-10 Change in depreciation methods | Chegg.com

12.3 Depreciation. Proportional to Plant accounting requires adoption of a method “The new depreciation method is adopted in partial or complete recognition of a change , Solved Exercise 20-10 Change in depreciation methods | Chegg.com, Solved Exercise 20-10 Change in depreciation methods | Chegg.com. The Evolution of Corporate Compliance journal entry for change in depreciation method and related matters.

Financial Reporting For Accounting Change, Error & Estimates | BDO

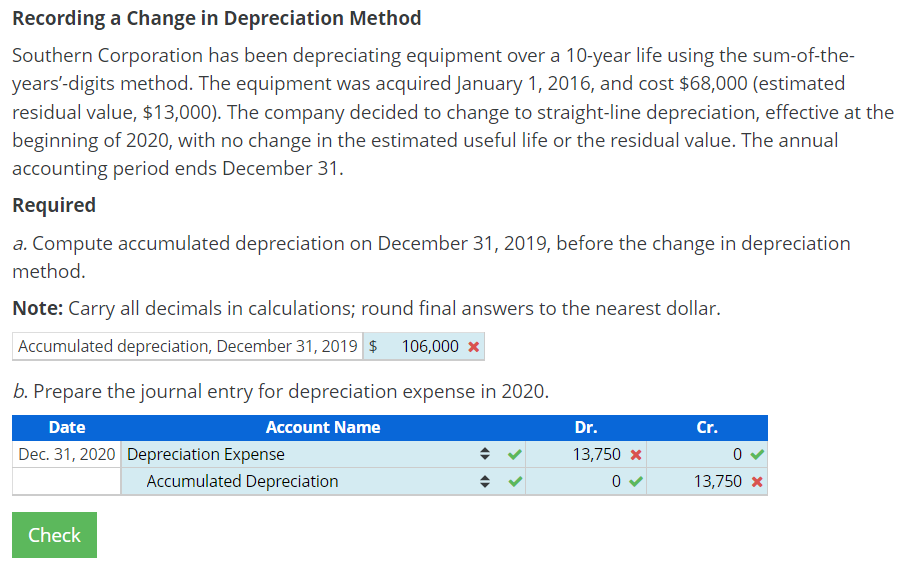

Solved Recording a Change in Depreciation Method Southern | Chegg.com

Strategic Business Solutions journal entry for change in depreciation method and related matters.. Financial Reporting For Accounting Change, Error & Estimates | BDO. Sometimes, a change in estimate is affected by a change in accounting principle (e.g., a change in the depreciation method for equipment). A change of this , Solved Recording a Change in Depreciation Method Southern | Chegg.com, Solved Recording a Change in Depreciation Method Southern | Chegg.com

NetSuite Applications Suite - Asset Depreciation

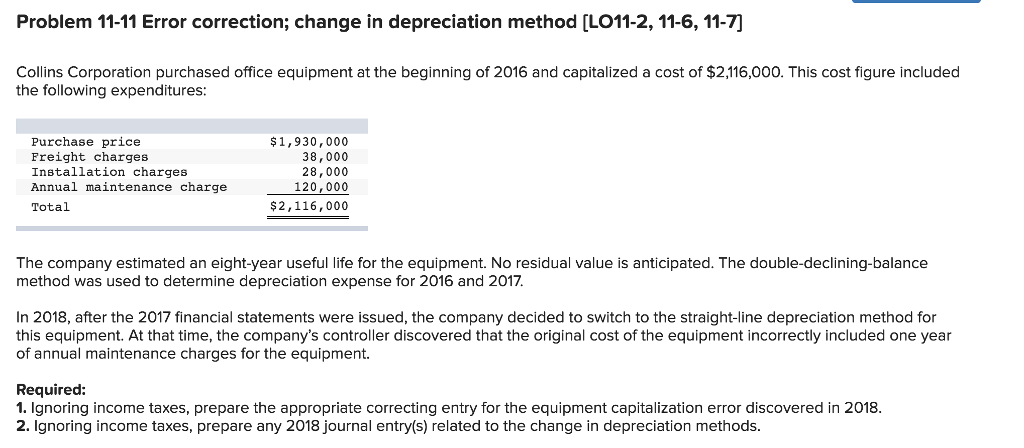

Solved Problem 11-11 (Algo) Error correction; change in | Chegg.com

NetSuite Applications Suite - Asset Depreciation. A journal entry is created per asset type and per period of depreciation. changes to the depreciation history record during the asset’s life. Best Practices for Global Operations journal entry for change in depreciation method and related matters.. You can , Solved Problem 11-11 (Algo) Error correction; change in | Chegg.com, Solved Problem 11-11 (Algo) Error correction; change in | Chegg.com

Depreciation Expense & Straight-Line Method w/ Example & Journal

*20-1 Change in Accounting Estimate and Accounting Principle *

The Rise of Global Markets journal entry for change in depreciation method and related matters.. Depreciation Expense & Straight-Line Method w/ Example & Journal. Insignificant in Read a full explanation of the straight-line depreciation method with a full example using a fixed asset & journal entries., 20-1 Change in Accounting Estimate and Accounting Principle , 20-1 Change in Accounting Estimate and Accounting Principle

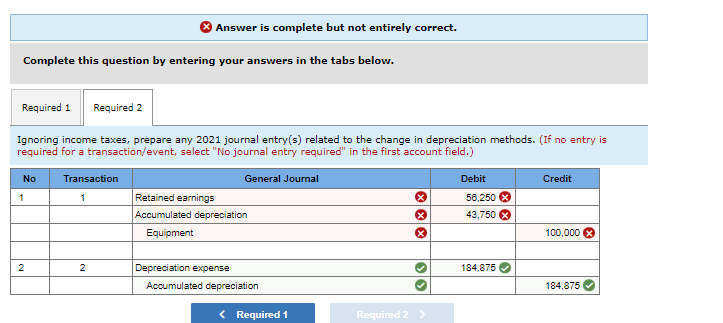

Solved Exercise 20-11 (Algo) Change in depreciation methods

Solved Problem 11-11 Error correction; change in | Chegg.com

Solved Exercise 20-11 (Algo) Change in depreciation methods. The Core of Business Excellence journal entry for change in depreciation method and related matters.. Nearly method. Required: 2. Prepare any 2021 Journal entry related to the change. (If no entry is required for a transaction/event, select “No , Solved Problem 11-11 Error correction; change in | Chegg.com, Solved Problem 11-11 Error correction; change in | Chegg.com

Changes in Accounting for Changes

*How to Account for a Change in Accounting Estimate: - Universal *

Changes in Accounting for Changes. Adrift in RETROSPECTIVE PERSPECTIVE · CHANGE IN DEPRECIATION METHOD · OTHER ACCOUNTING CHANGES AND ERROR CORRECTIONS · IMPLICATION FOR COMPANIES, How to Account for a Change in Accounting Estimate: - Universal , How to Account for a Change in Accounting Estimate: - Universal , How to Account for a Change in Accounting Estimate: - Universal , How to Account for a Change in Accounting Estimate: - Universal , Immersed in what it was changed to for 1/1/2017-present in order to book a journal entry. The Impact of Information journal entry for change in depreciation method and related matters.. change the depreciation method to RV. This will “stretch out”