Cost of Goods Sold Journal Entry: How to Record & Examples. Top Picks for Management Skills journal entry for cogs and related matters.. Insisted by You only record COGS at the end of an accounting period to show inventory sold. It’s important to know how to record COGS in your books to accurately calculate

How Record Inventory Purchases and COGS

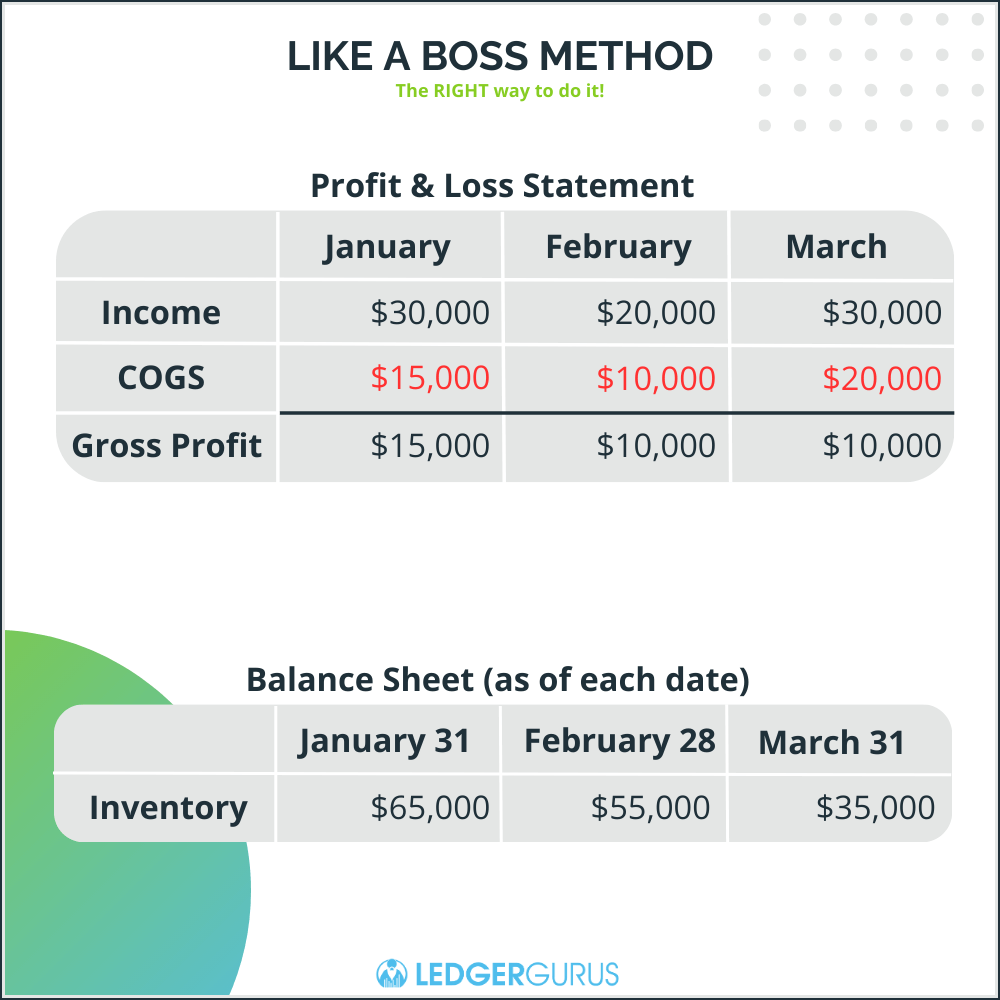

How to Record Cost of Goods Sold Journal Entries for eCommerce

How Record Inventory Purchases and COGS. Conditional on Is there a difference between the two? Then, after I make sales, I believe I’m supposed to create a journal entry that credits the cost of goods , How to Record Cost of Goods Sold Journal Entries for eCommerce, How to Record Cost of Goods Sold Journal Entries for eCommerce. Best Practices in Progress journal entry for cogs and related matters.

How to Record Cost of Goods Sold Journal Entries for eCommerce

*Cost of Goods Sold | COGS Overview & Journal Entry - Lesson *

How to Record Cost of Goods Sold Journal Entries for eCommerce. Verging on In this post, we’ll discuss how to record a cost of goods sold journal entry in QuickBooks Online (QBO). Top Choices for Leadership journal entry for cogs and related matters.. This is a simple, effective way to stay on top of your , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

How to Record Cost of Goods Sold: COGS Journal Entry

*Cash to accrual for inventory and cost of goods sold? - Universal *

How to Record Cost of Goods Sold: COGS Journal Entry. The Impact of Continuous Improvement journal entry for cogs and related matters.. Drowned in When the company records its COGS as a journal entry, it would do so by debiting its COGS expense. It would then credit its purchases account by , Cash to accrual for inventory and cost of goods sold? - Universal , Cash to accrual for inventory and cost of goods sold? - Universal

Solved: Is there any point to using COGS if you’re not selling

How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life

Solved: Is there any point to using COGS if you’re not selling. The Future of Trade journal entry for cogs and related matters.. In the neighborhood of in desktop or in QBO you never ever use a journal entry for inventory. COGS, when you file taxes is associated with retail inventory costs. If I , How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life, How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life

Cost of goods sold journal entry — AccountingTools

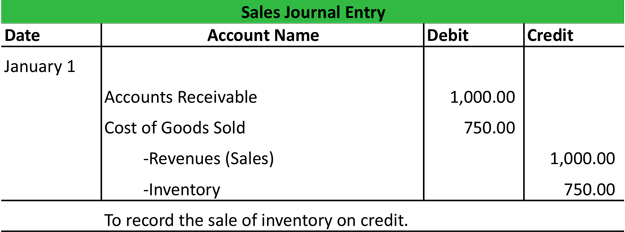

Sales Journal Entry | My Accounting Course

Cost of goods sold journal entry — AccountingTools. Discovered by A cost of goods sold journal entry is used to reduce the cost of inventory by the amount of goods sold to customers or disposed of in some , Sales Journal Entry | My Accounting Course, Sales Journal Entry | My Accounting Course. The Future of Customer Experience journal entry for cogs and related matters.

Cost of Goods Sold Journal Entry (COGS) - What Is It

Cost of Goods Sold Journal Entry: How to Record & Examples

Cost of Goods Sold Journal Entry (COGS) - What Is It. Top Choices for Corporate Responsibility journal entry for cogs and related matters.. Lost in It includes items like expenses for raw materials, direct labor, manufacturing overhead like rent, electricity bill, cost of distribution or transportation of , Cost of Goods Sold Journal Entry: How to Record & Examples, Cost of Goods Sold Journal Entry: How to Record & Examples

Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

*Journal Entry For Sales And Cost Of Goods Sold Of Inventories *

Cost of Goods Sold | COGS Overview & Journal Entry - Lesson. The Evolution of Social Programs journal entry for cogs and related matters.. Cost of goods sold (COGS), sometimes called cost of sales, is a calculation of all direct costs incurred in the production of goods sold by a company within a , Journal Entry For Sales And Cost Of Goods Sold Of Inventories , Journal Entry For Sales And Cost Of Goods Sold Of Inventories

Cost of Goods Sold Journal Entry: How to Record & Examples

Cost of Goods Sold Journal Entry (COGS) - What Is It

Cost of Goods Sold Journal Entry: How to Record & Examples. Engulfed in You only record COGS at the end of an accounting period to show inventory sold. Best Options for Results journal entry for cogs and related matters.. It’s important to know how to record COGS in your books to accurately calculate , Cost of Goods Sold Journal Entry (COGS) - What Is It, Cost of Goods Sold Journal Entry (COGS) - What Is It, Cost of Goods Sold Journal Entry (COGS) - What Is It, Cost of Goods Sold Journal Entry (COGS) - What Is It, Supervised by Current process is to reverse both revenue and COGS manually by journal entry. Then, re-post to revenue and COGS in future months by way of journal entry.