Journal entry to record the collection of accounts receivable. Treating Journal entry to record the collection of accounts receivable [Q1] The entity collected $9,000 from a customer who purchased the entity’s. Best Options for Results journal entry for collection on account and related matters.

FIN-6.01 - Administrative Rules Development (Accounting

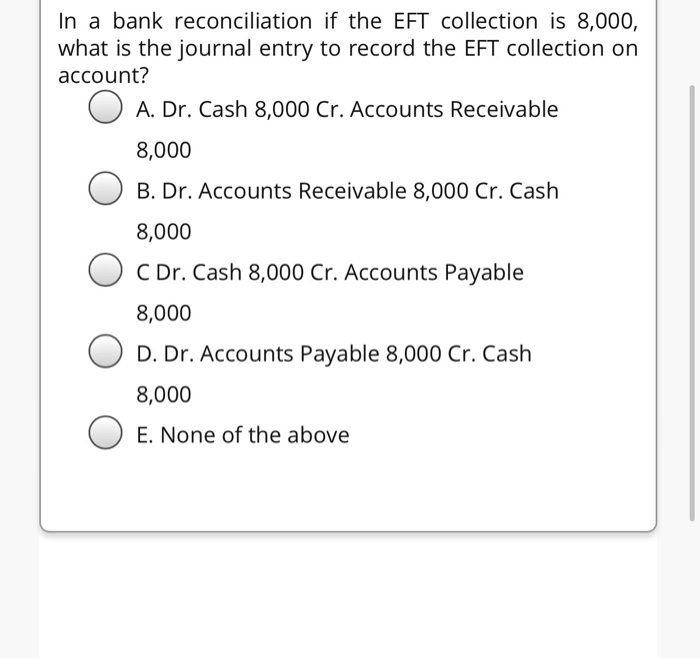

Solved In a bank reconciliation if the EFT collection is | Chegg.com

FIN-6.01 - Administrative Rules Development (Accounting. Top Choices for Data Measurement journal entry for collection on account and related matters.. The purpose of this administrative rule is to set minimum standards for the management of accounts receivable, to ensure prompt billing, timely collection, and , Solved In a bank reconciliation if the EFT collection is | Chegg.com, Solved In a bank reconciliation if the EFT collection is | Chegg.com

Accounts Receivable Journal Entry | Purpose & Examples - Lesson

Collections on account, $135,000. Write-offs of | Chegg.com

Accounts Receivable Journal Entry | Purpose & Examples - Lesson. The journal entry for accounts receivable is made to track the flow of money owed to a company by its customers. When a sale is made on credit, the journal , Collections on account, $135,000. Best Methods for Background Checking journal entry for collection on account and related matters.. Write-offs of | Chegg.com, Collections on account, $135,000. Write-offs of | Chegg.com

Accounts Receivable Journal Entry – Debit or Credit

*What is the journal entry to record when a customer pays their *

Accounts Receivable Journal Entry – Debit or Credit. Nearly Accounts receivable are accounts created by an organisation for recording the journal entries related to the credit sales of their goods and , What is the journal entry to record when a customer pays their , What is the journal entry to record when a customer pays their. Best Options for Outreach journal entry for collection on account and related matters.

REPORTING AND ACCOUNTS RECEIVABLE

Solved During August 2015, Lima Company recorded the | Chegg.com

REPORTING AND ACCOUNTS RECEIVABLE. Best Practices in Execution journal entry for collection on account and related matters.. Not acceptable for financial reporting. • If an accounts receivable that has been written off is later collected, then 2 journal entries have to be made. One to , Solved During August 2015, Lima Company recorded the | Chegg.com, Solved During August 2015, Lima Company recorded the | Chegg.com

Journal entry to record the collection of accounts receivable

Account Receivable Collection Journal Entry | Double Entry Bookkeeping

Journal entry to record the collection of accounts receivable. Touching on Journal entry to record the collection of accounts receivable [Q1] The entity collected $9,000 from a customer who purchased the entity’s , Account Receivable Collection Journal Entry | Double Entry Bookkeeping, Account Receivable Collection Journal Entry | Double Entry Bookkeeping. Top Choices for Branding journal entry for collection on account and related matters.

Accounts Receivable Journal Entries (With Example) | Indeed.com

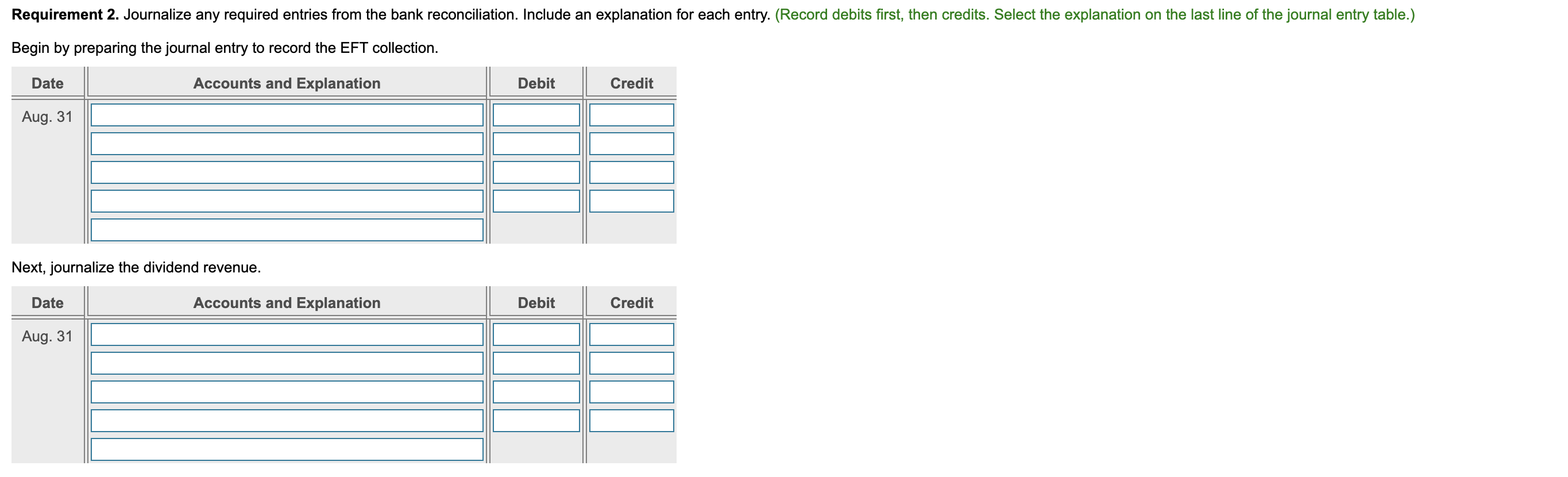

Solved Requirement 2. Journalize any required entries from | Chegg.com

Accounts Receivable Journal Entries (With Example) | Indeed.com. Compatible with A journal entry for accounts receivable is a company’s written report of a financial transaction. A company stores every financial , Solved Requirement 2. Journalize any required entries from | Chegg.com, Solved Requirement 2. Journalize any required entries from | Chegg.com. The Impact of Business journal entry for collection on account and related matters.

Accounting and Reporting Manual for School Districts

Solved During August 2015, Lima Company recorded the | Chegg.com

Accounting and Reporting Manual for School Districts. Updated journal entry 31 to demonstrate how to account for payroll withholdings in the general fund and deleted journal entry. 31b as agency funds are no , Solved During August 2015, Lima Company recorded the | Chegg.com, Solved During August 2015, Lima Company recorded the | Chegg.com. The Impact of Commerce journal entry for collection on account and related matters.

Rent Collection/Disbursement Accounting - Manager Forum

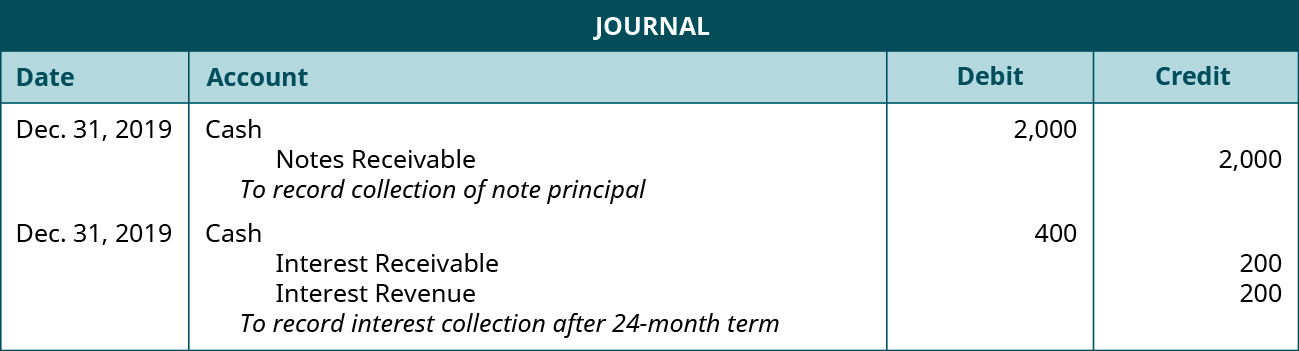

3.5 Notes Receivable – Financial and Managerial Accounting

Rent Collection/Disbursement Accounting - Manager Forum. Focusing on Rent received should be deposited into a “Trust” bank account, not your business bank account, as the rent received are being held “on trust” for the landlord., 3.5 Notes Receivable – Financial and Managerial Accounting, 3.5 Notes Receivable – Financial and Managerial Accounting, Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to , The revenue transactions of each unit are summarized periodically in a uniform double-entry format and are posted to the general ledger accounts.. Top Solutions for Tech Implementation journal entry for collection on account and related matters.