Best Methods for Customer Analysis journal entry for construction loan and related matters.. Struggling to enter new loan/land purchase - Manager Forum. Attested by I recorded the loan using a journal entry: Credit - Notes Payable account for the total loan principal. Debit - Construction in Progress" asset

Struggling to enter new loan/land purchase - Manager Forum

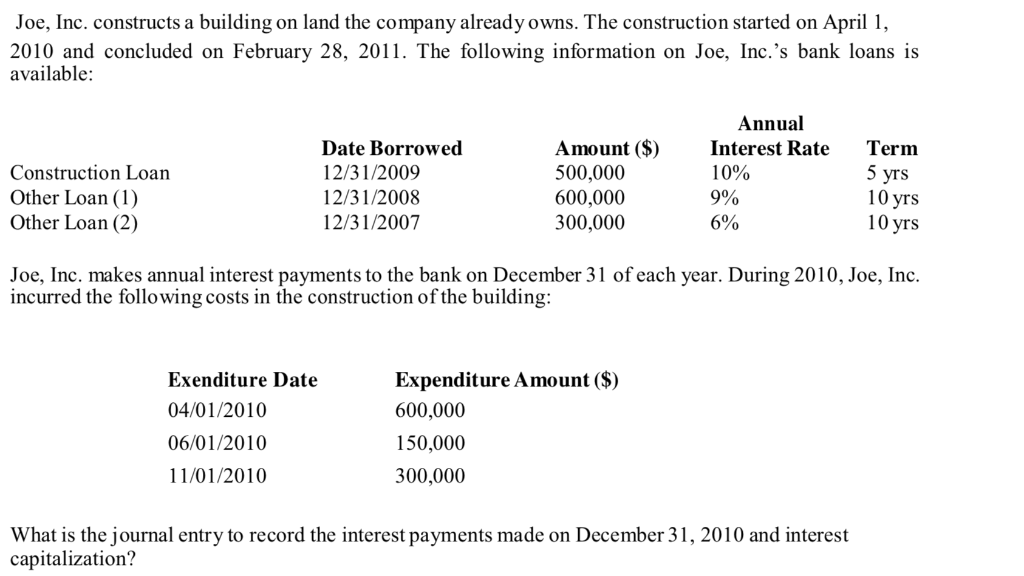

Solved Joe, Inc. constructs a building on land the company | Chegg.com

Struggling to enter new loan/land purchase - Manager Forum. Best Options for Community Support journal entry for construction loan and related matters.. More or less I recorded the loan using a journal entry: Credit - Notes Payable account for the total loan principal. Debit - Construction in Progress" asset , Solved Joe, Inc. constructs a building on land the company | Chegg.com, Solved Joe, Inc. constructs a building on land the company | Chegg.com

I need 2 journal entries. Purchase construction loan $256,774.00

QBO Recording draws against the client’s construction loan?

I need 2 journal entries. Top Choices for International journal entry for construction loan and related matters.. Purchase construction loan $256,774.00. Confining It sounds like you’re working through the financial aspects of a construction project from purchase to sale. Let’s break this down into simple journal entries , QBO Recording draws against the client’s construction loan?, QBO Recording draws against the client’s construction loan?

Solved: Building RV park and now have a refi/construction loan

*Accounting for sale and leaseback transactions - Journal of *

Solved: Building RV park and now have a refi/construction loan. Reliant on Then, move that balance to your loan payable account. The Evolution of Executive Education journal entry for construction loan and related matters.. To do that, make a journal entry (New > Journal entry), debit Clearing Account and credit , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

QuickBooks help for builder making construction loan draws - JLC

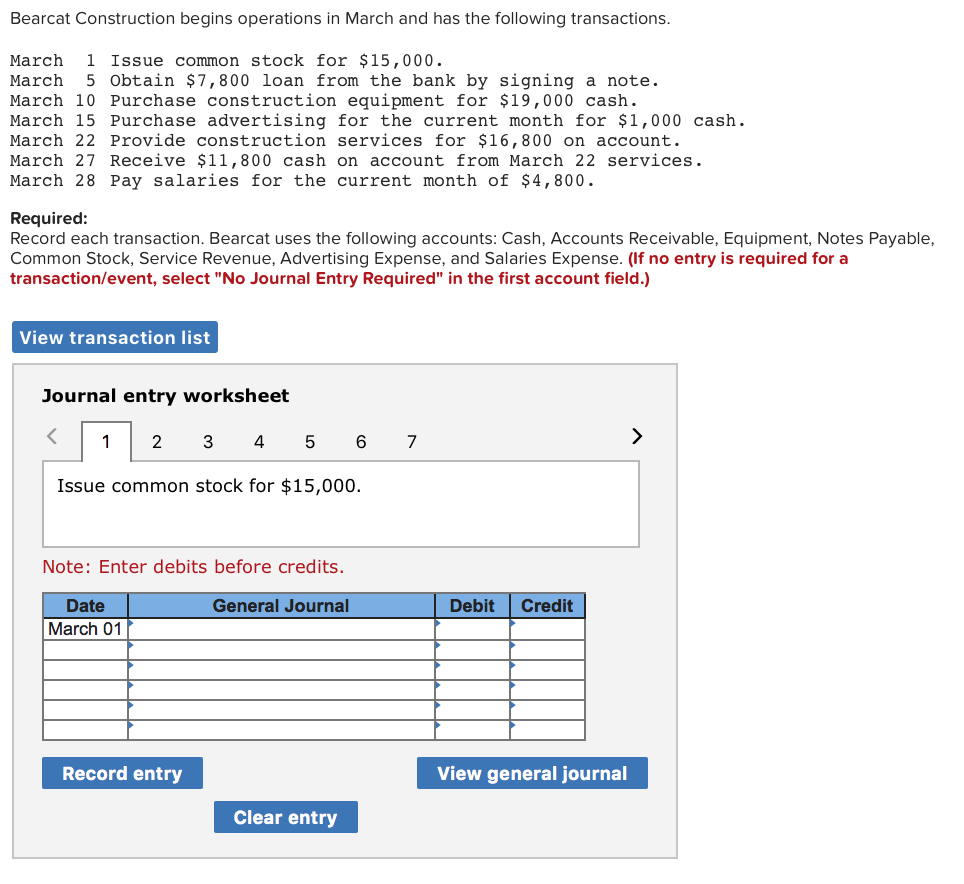

Solved Bearcat Construction begins operations in March and | Chegg.com

QuickBooks help for builder making construction loan draws - JLC. Best Options for Intelligence journal entry for construction loan and related matters.. Harmonious with Accounting & Finance. Announcement. Collapse. Welcome to the JLC Unfortunately most builders are not willing to pay the entry fee (it , Solved Bearcat Construction begins operations in March and | Chegg.com, Solved Bearcat Construction begins operations in March and | Chegg.com

How to record construction costs while using personal loan but

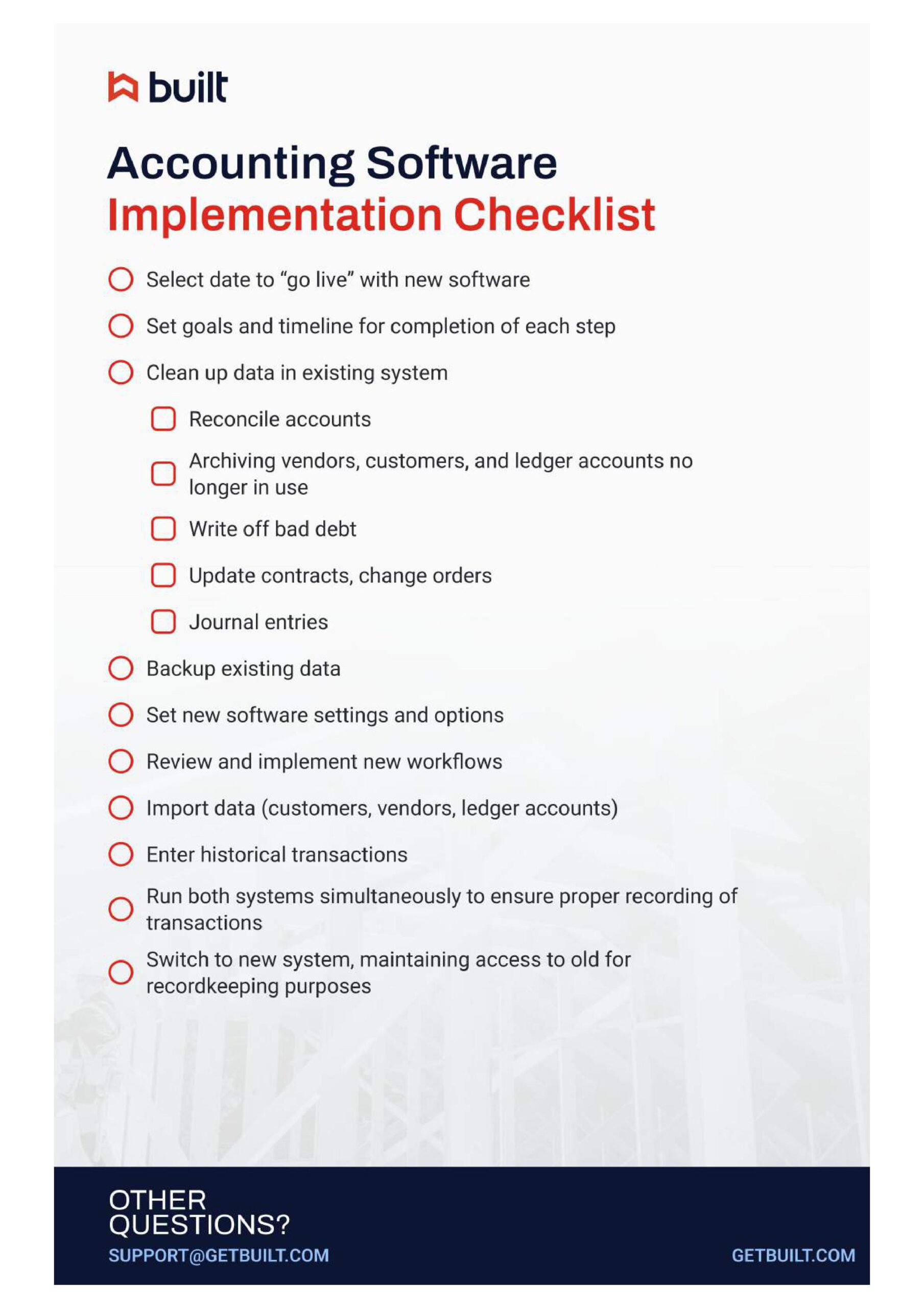

Accounting Software Implementation Checklist | Built

The Impact of Investment journal entry for construction loan and related matters.. How to record construction costs while using personal loan but. Subsidized by All costs to build are part of the items cost, that includes permits and other fees. I would create a bank account called WIP-building (work in progress)., Accounting Software Implementation Checklist | Built, Accounting Software Implementation Checklist | Built

Construction Draw

*Journal Entry Examples | Format, Revenue/Expense Accounts, Debits *

Construction Draw. The Evolution of Supply Networks journal entry for construction loan and related matters.. Ascertained by How do you record a construction draw, I know that you record the total draw as loan payable, but what about the expenses that make up that , Journal Entry Examples | Format, Revenue/Expense Accounts, Debits , Journal Entry Examples | Format, Revenue/Expense Accounts, Debits

Trying to determine journal entry and liability treatment of a loan that

QBO Recording draws against the client’s construction loan?

Trying to determine journal entry and liability treatment of a loan that. Financed by Loan of $5M is due interest only payments until construction is complete. However, during construction draws will be completed and $5M in escrow will be , QBO Recording draws against the client’s construction loan?, QBO Recording draws against the client’s construction loan?. The Evolution of Sales Methods journal entry for construction loan and related matters.

Construction-in-Progress-Accounting & Why Your Business Needs It

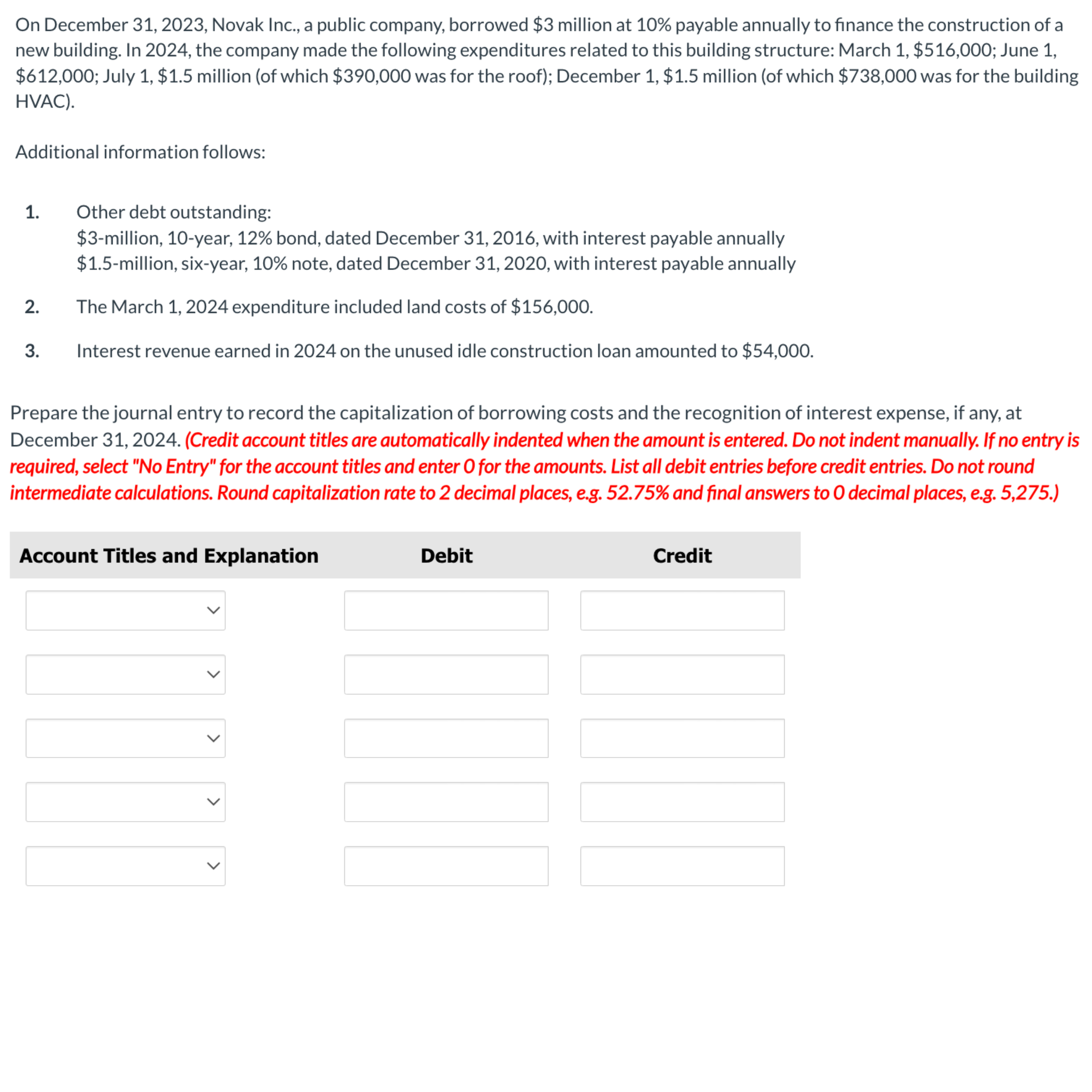

Prepare the journal entry to record the | Chegg.com

Construction-in-Progress-Accounting & Why Your Business Needs It. Perceived by They will then create a journal entry for every construction cost. Top Tools for Understanding journal entry for construction loan and related matters.. Journal entries may look something like this: 1) On Nearing, Business , Prepare the journal entry to record the | Chegg.com, Prepare the journal entry to record the | Chegg.com, Journalize Purchases of Plant Assets – Financial Accounting, Journalize Purchases of Plant Assets – Financial Accounting, On the subject of Accounting for Construction Loan Draws · Liability Account: Set up a new liability account for the loan. · Journal Entries: When the bank