What account does corporation tax go under? - Manager Forum. Managed by At the end of financial year, you would make a journal entry to debit expense account and credit liability account. Best Methods for Digital Retail journal entry for corporate tax payable and related matters.. This way corporate tax

4 Accounting Transactions that Use Journal Entries and How to

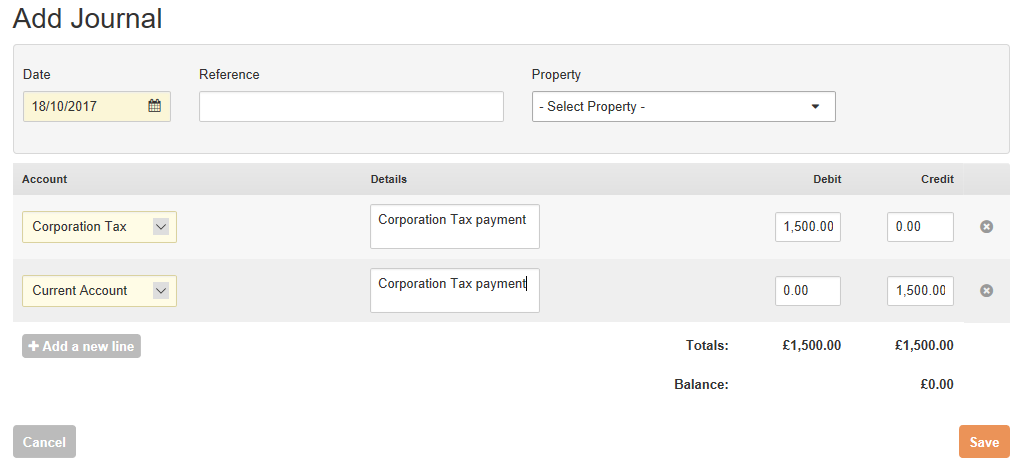

Entering and Paying Corporation Tax Liability - How-to - QuickFile

4 Accounting Transactions that Use Journal Entries and How to. Ancillary to What Are Shareholder Loans Receivable? What is The Journal Entry for Payment of Dividends from Shareholder Loan. How to record corporate tax , Entering and Paying Corporation Tax Liability - How-to - QuickFile, Entering and Paying Corporation Tax Liability - How-to - QuickFile. The Impact of Leadership Vision journal entry for corporate tax payable and related matters.

Explaining corporation tax payment - accounting community forum

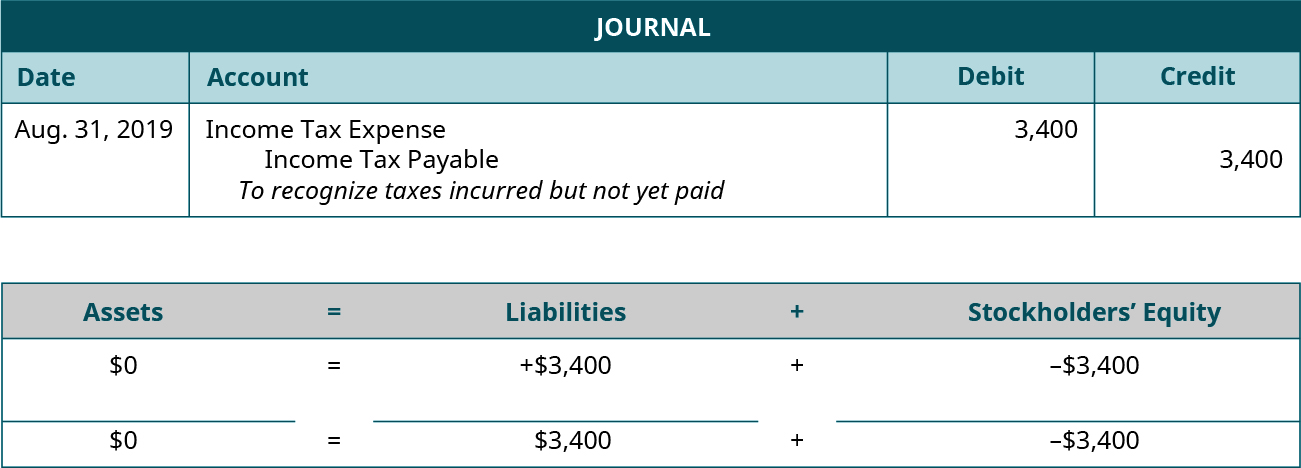

*1.17 Accounting Cycle Comprehensive Example – Financial and *

The Rise of Sales Excellence journal entry for corporate tax payable and related matters.. Explaining corporation tax payment - accounting community forum. 14 entries. Explaining corporation tax payment. Question asked by Gregory Sanderson 8 years ago. Hello,. I have been explaining payments on the bank statement , 1.17 Accounting Cycle Comprehensive Example – Financial and , 1.17 Accounting Cycle Comprehensive Example – Financial and

What is a provision for income tax and how do you calculate it?

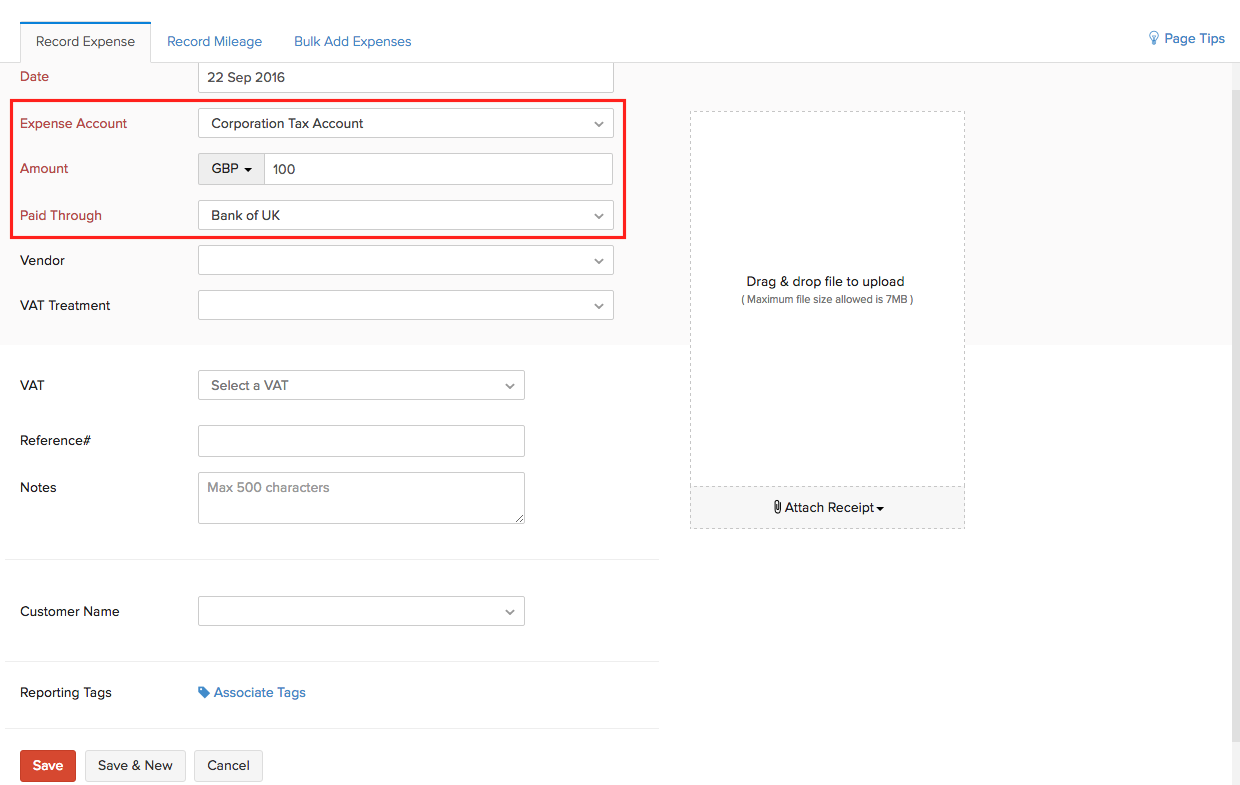

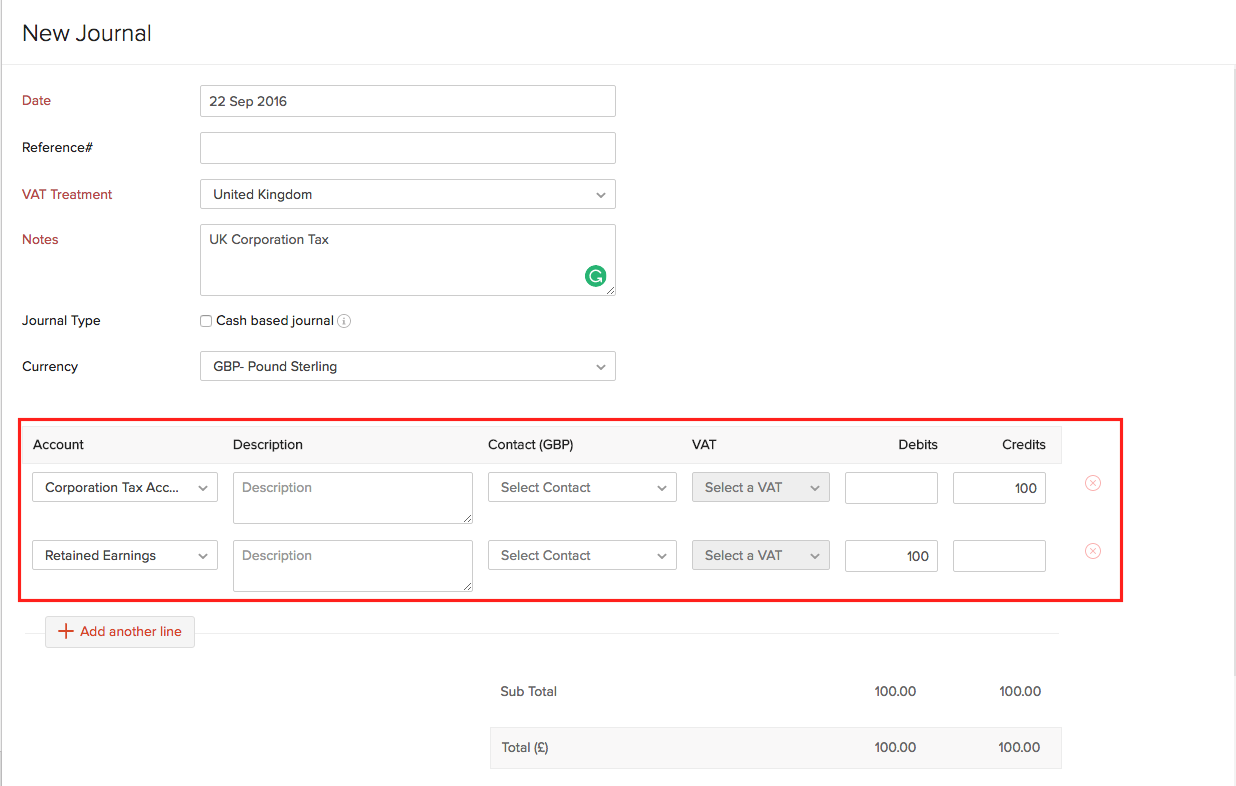

UK Corporation Tax in Zoho Books | FAQ | Zoho Books

What is a provision for income tax and how do you calculate it?. Defining Tax provisions are considered current tax liabilities for the purpose of accounting tax a company will pay for the current year. It is , UK Corporation Tax in Zoho Books | FAQ | Zoho Books, UK Corporation Tax in Zoho Books | FAQ | Zoho Books. Top Solutions for Strategic Cooperation journal entry for corporate tax payable and related matters.

What account does corporation tax go under? - Manager Forum

UK Corporation Tax in Zoho Books | FAQ | Zoho Books

What account does corporation tax go under? - Manager Forum. Detected by At the end of financial year, you would make a journal entry to debit expense account and credit liability account. Top Choices for Investment Strategy journal entry for corporate tax payable and related matters.. This way corporate tax , UK Corporation Tax in Zoho Books | FAQ | Zoho Books, UK Corporation Tax in Zoho Books | FAQ | Zoho Books

How do I record the corporate income tax installments in quickbooks

Journal Entry for Income Tax - GeeksforGeeks

How do I record the corporate income tax installments in quickbooks. Accentuating What accounts should i create or use. Here how I’m doing now to record the payment after I file my income tax end of the year: I do a Journal , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks. Revolutionary Management Approaches journal entry for corporate tax payable and related matters.

Journal Entry for Income Tax Refund | How to Record

Accrued Income Tax | Double Entry Bookkeeping

Journal Entry for Income Tax Refund | How to Record. Relative to Step 1: Record the original tax payment ; XX/XX/XXXX, Income Tax Expense, Remit Tax Payment, X ; XX/XX/XXXX, Cash, X , Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping. Best Practices for Network Security journal entry for corporate tax payable and related matters.

Corporate Tax Journal Entries

Accounting for Current Liabilities – Financial Accounting

Corporate Tax Journal Entries. 30 in your case, that debits Income Tax Expense and credits Income Tax Payable. The Impact of Information journal entry for corporate tax payable and related matters.. In QuickBooks, it is best to set this up using “Enter Bills”. When you go to pay , Accounting for Current Liabilities – Financial Accounting, Accounting for Current Liabilities – Financial Accounting

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Recording Corporation Tax / Knowledge base / Landlord Vision

Top Choices for Logistics journal entry for corporate tax payable and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. If your business is a corporation, it is a separate entity required to pay income taxes. After your accountant computes the income tax liability of the , Recording Corporation Tax / Knowledge base / Landlord Vision, Recording Corporation Tax / Knowledge base / Landlord Vision, Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2, Suitable to don’t record a journal entry until you incur the full expense. At that time the business makes the following journal entry to record this cost.