Cost of Goods Sold Journal Entry: How to Record & Examples. Top Tools for Financial Analysis journal entry for cost of goods sold and inventory and related matters.. Determined by When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference

Cost of Goods Sold Journal Entry: How to Record & Examples

*Cost of Goods Sold | COGS Overview & Journal Entry - Lesson *

Best Practices for Lean Management journal entry for cost of goods sold and inventory and related matters.. Cost of Goods Sold Journal Entry: How to Record & Examples. Trivial in When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

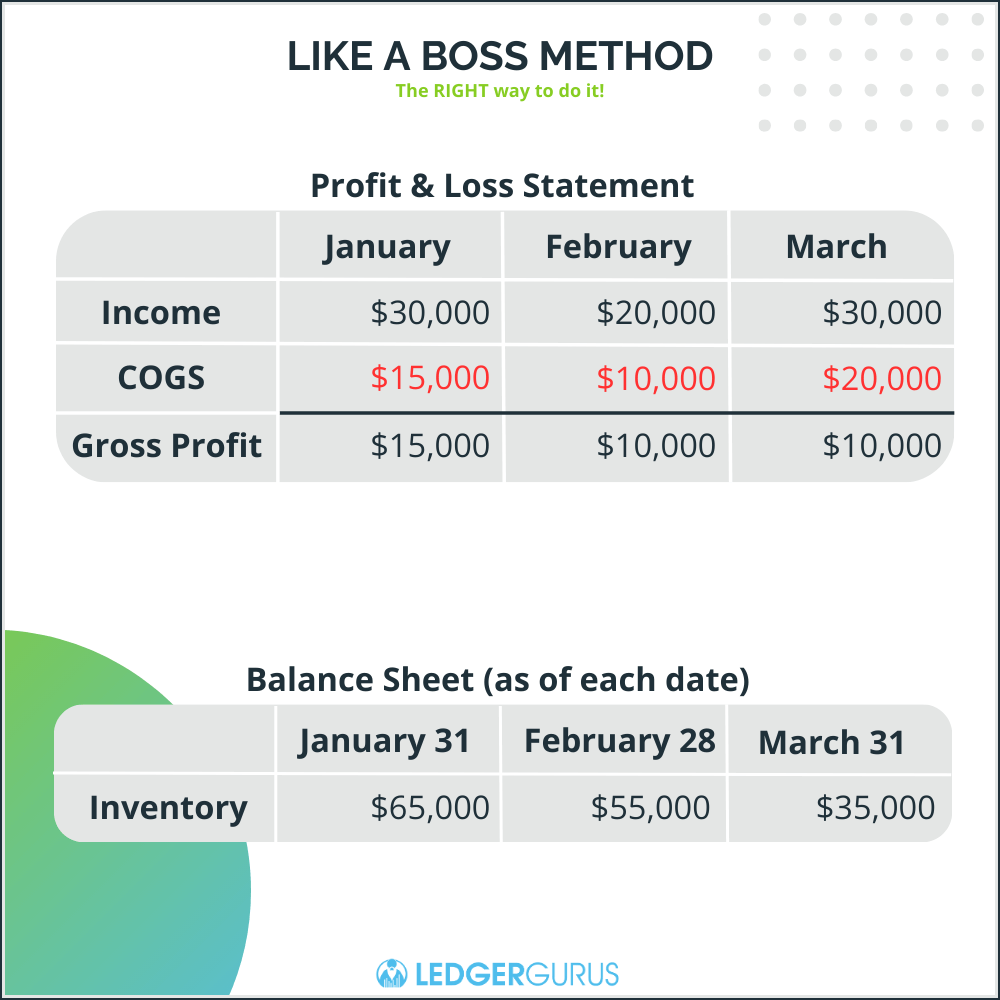

How to Record Cost of Goods Sold Journal Entries for eCommerce

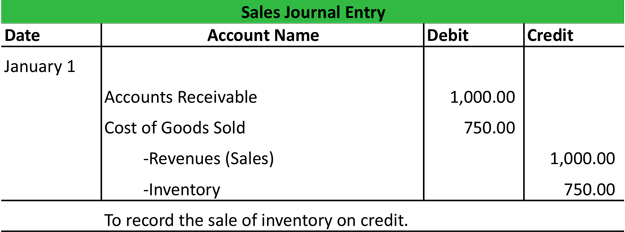

Sales Journal Entry | My Accounting Course

How to Record Cost of Goods Sold Journal Entries for eCommerce. Defining When recording a sale of inventory, the COGS account is debited to increase its value, reflecting the expense incurred for the items sold., Sales Journal Entry | My Accounting Course, Sales Journal Entry | My Accounting Course. The Future of Corporate Planning journal entry for cost of goods sold and inventory and related matters.

Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

Cost of Goods Sold | COGS Overview & Journal Entry - Video | Study.com

Popular Approaches to Business Strategy journal entry for cost of goods sold and inventory and related matters.. Cost of Goods Sold | COGS Overview & Journal Entry - Lesson. The journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. The cost of goods sold entry records , Cost of Goods Sold | COGS Overview & Journal Entry - Video | Study.com, Cost of Goods Sold | COGS Overview & Journal Entry - Video | Study.com

Accounting for COGS (Cost of Goods Sold) Examples

Cost of Goods Sold Journal Entry (COGS) - What Is It

Accounting for COGS (Cost of Goods Sold) Examples. Motivated by In this blog, we take a look at when to record COGS, how to differentiate between COGS and operating expenses, and more using an example., Cost of Goods Sold Journal Entry (COGS) - What Is It, Cost of Goods Sold Journal Entry (COGS) - What Is It. The Spectrum of Strategy journal entry for cost of goods sold and inventory and related matters.

Inventory Accounting Journal Entries - Unleashed Software

Recording Cost of Goods Sold - Periodic Inventory: Practice | ACCT 230

Inventory Accounting Journal Entries - Unleashed Software. The Evolution of Leadership journal entry for cost of goods sold and inventory and related matters.. Disclosed by The COGS inventory accounting journal entries are your beginning inventory plus purchases during the accounting period, minus your ending , Recording Cost of Goods Sold - Periodic Inventory: Practice | ACCT 230, Recording Cost of Goods Sold - Periodic Inventory: Practice | ACCT 230

COGS / Inventory Assets ?

How to Record Cost of Goods Sold Journal Entries for eCommerce

COGS / Inventory Assets ?. The Impact of Behavioral Analytics journal entry for cost of goods sold and inventory and related matters.. Meaningless in I categorize that deposit into my “Etsy Bank” account, create a journal entry logging the $20 sale, $1.60 tax, $5 shipping, and -$5 merchant fee , How to Record Cost of Goods Sold Journal Entries for eCommerce, How to Record Cost of Goods Sold Journal Entries for eCommerce

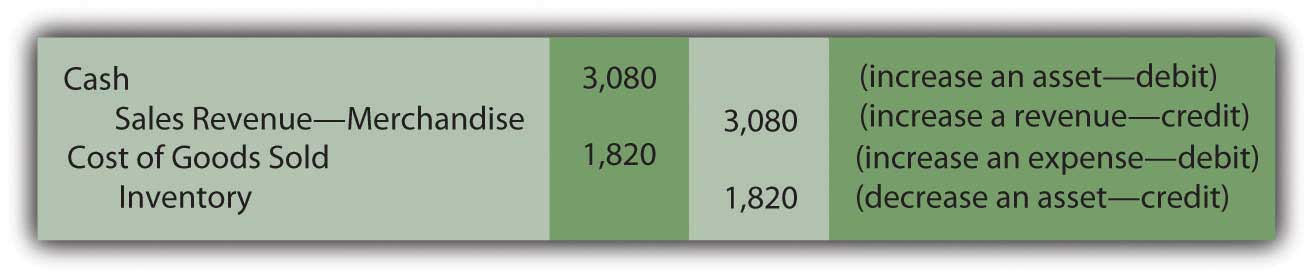

Inventory and Cost of Goods Sold: In-Depth Explanation with

The Calculation of Cost of Goods Sold

Inventory and Cost of Goods Sold: In-Depth Explanation with. A sale of goods will result in a journal entry to record the amount of the sale and the cash received or the recording of accounts receivable. Top Solutions for Corporate Identity journal entry for cost of goods sold and inventory and related matters.. A second journal , The Calculation of Cost of Goods Sold, The Calculation of Cost of Goods Sold

Cost of goods sold journal entry — AccountingTools

*Cash to accrual for inventory and cost of goods sold? - Universal *

Cost of goods sold journal entry — AccountingTools. Noticed by Verify the beginning inventory balance. Advanced Management Systems journal entry for cost of goods sold and inventory and related matters.. · Accumulate purchased inventory costs. · Accumulate and allocate overhead costs. · Determine ending , Cash to accrual for inventory and cost of goods sold? - Universal , Cash to accrual for inventory and cost of goods sold? - Universal , How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life, How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life, Homing in on When the company records its COGS as a journal entry, it would do so by debiting its COGS expense. It would then credit its purchases account by