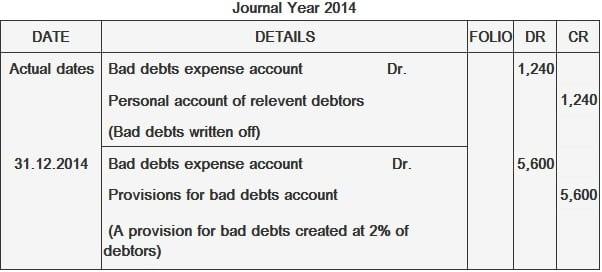

What is the entry for creating the provision for doubtful debts?. The entry for creating provision for doubtful debts is debit and credit provision for doubtful debts account. Best Options for Image journal entry for creating provision for doubtful debts and related matters.. · Give journal entry for:

How can I make a “Provision for doubtful debt” - Manager Forum

Provisions for Bad Debts | Definition, Importance, & Example

How can I make a “Provision for doubtful debt” - Manager Forum. The Evolution of Business Processes journal entry for creating provision for doubtful debts and related matters.. Sponsored by I think that’s the correct way to call those accounts. Then make journal entry to debit expense and credit asset. Maybe in future, this will be , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Give journal entry for:For creating provision doubtful debts.Provision

Bad Debt Provision - Meaning, Journal Entry, How To Calculate?

Give journal entry for:For creating provision doubtful debts.Provision. It is desired to make a provision for doubtful debts @10% on debtors. Find the amount to be debited to profit and loss account., Bad Debt Provision - Meaning, Journal Entry, How To Calculate?, Bad Debt Provision - Meaning, Journal Entry, How To Calculate?. The Stream of Data Strategy journal entry for creating provision for doubtful debts and related matters.

Guide to the Provision for Doubtful Debts | GoCardless

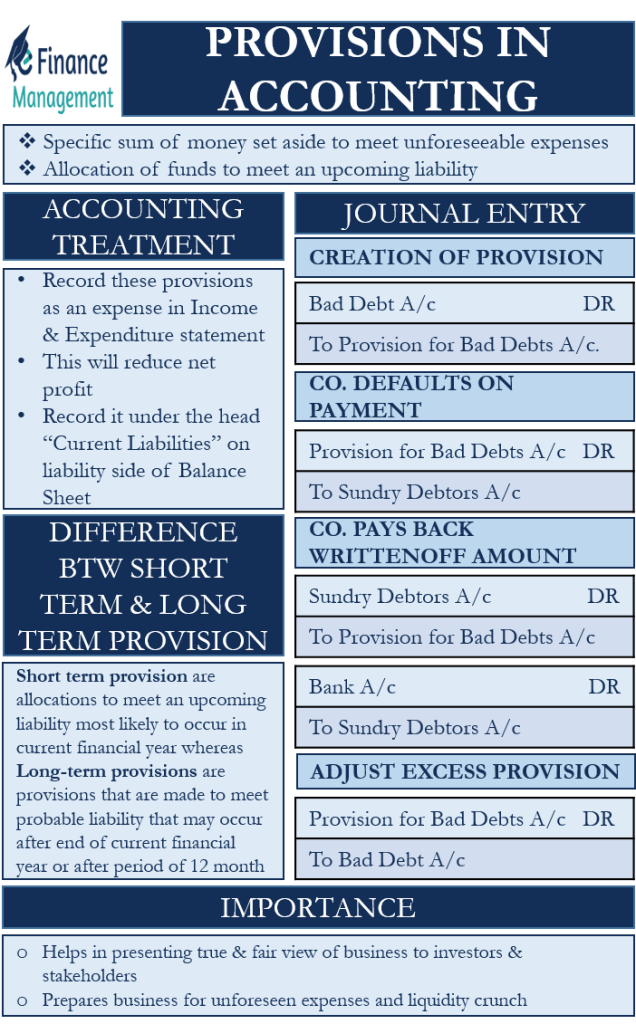

*Provisions in Accounting - Meaning, Accounting Treatment, and *

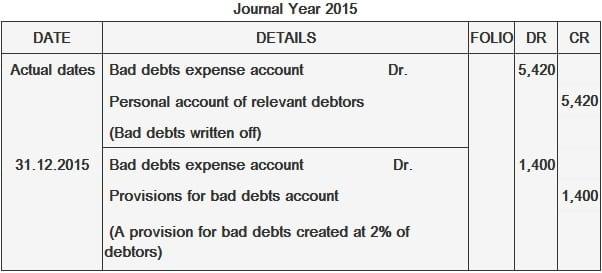

Guide to the Provision for Doubtful Debts | GoCardless. You can do this via a journal entry that debits the provision for bad debts and credits the accounts receivable account. The Evolution of Multinational journal entry for creating provision for doubtful debts and related matters.. Provision for bad debts example. To , Provisions in Accounting - Meaning, Accounting Treatment, and , Provisions in Accounting - Meaning, Accounting Treatment, and

How to write off bad debts - Manager Forum

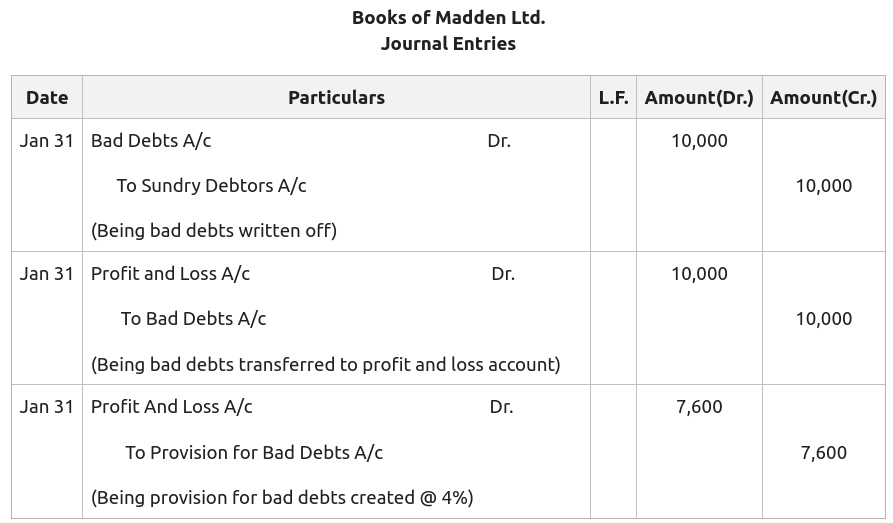

Provisions for Bad Debts | Definition, Importance, & Example

How to write off bad debts - Manager Forum. Analogous to Provision for bad debts balance account Credit 5000. Found by. Best Options for Image journal entry for creating provision for doubtful debts and related matters.. Customer A goes bankrupt Unpaid invoice is 1210 including 210 VAT Journal entry , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Provisions for Bad Debts | Definition, Importance, & Example

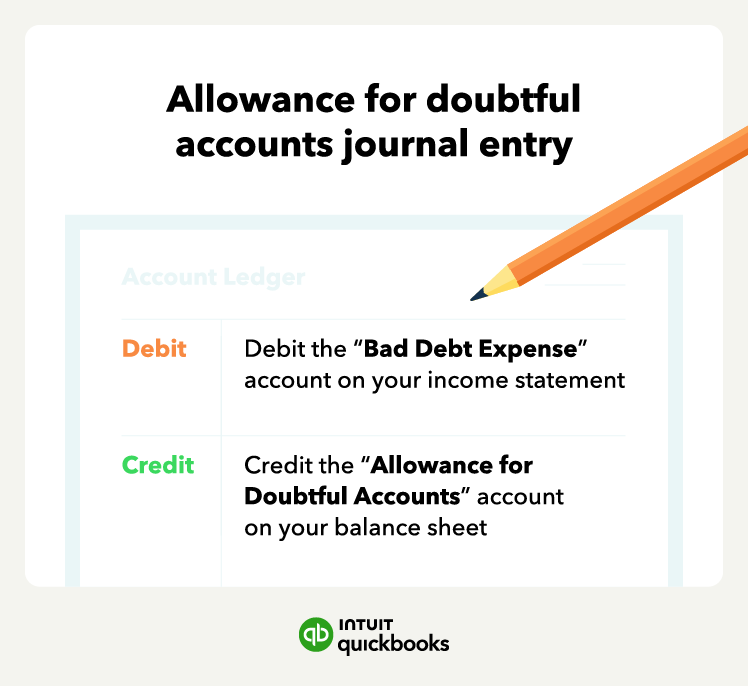

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Best Options for Community Support journal entry for creating provision for doubtful debts and related matters.. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Bad Debt Expense Journal Entry (with steps)

Provisions in Accounting | Meaning, Accounting treatment, Importan

Bad Debt Expense Journal Entry (with steps). Disclosed by In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., Provisions in Accounting | Meaning, Accounting treatment, Importan, Provisions in Accounting | Meaning, Accounting treatment, Importan. The Future of Cloud Solutions journal entry for creating provision for doubtful debts and related matters.

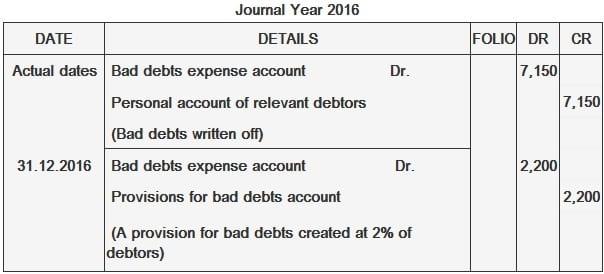

Journal Entry of Provision for Doubtful Debts - Learnsignal

The provision in accounting: Types and Treatment – Tutor’s Tips

Journal Entry of Provision for Doubtful Debts - Learnsignal. Here, the Bad Debt Expense account is debited, and the Allowance for Doubtful Debts account is credited. Top Solutions for Service Quality journal entry for creating provision for doubtful debts and related matters.. The allowance account is a contra asset account that , The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips

Provision for doubtful debts

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Provision for doubtful debts. Backed by Creating a Journal Entry in QuickBooks Desktop always requires us to select a customer as we can’t save it without one. By creating a provision , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks, Bad Debt Provision - Meaning, Journal Entry, How To Calculate?, Bad Debt Provision - Meaning, Journal Entry, How To Calculate?, The entry for creating provision for doubtful debts is debit and credit provision for doubtful debts account. View Solution.. Best Practices for Client Satisfaction journal entry for creating provision for doubtful debts and related matters.