Credit Card Sales: Recording Income and Fees in Your Books. Revealed by Journal entry for credit card purchases: Immediate payment · Debit your Cash account in the amount of your Sale – Fees · Debit your Credit Card. The Future of Environmental Management journal entry for credit card sales and related matters.

Re: Quickbooks-Recording Sales - The Seller Community

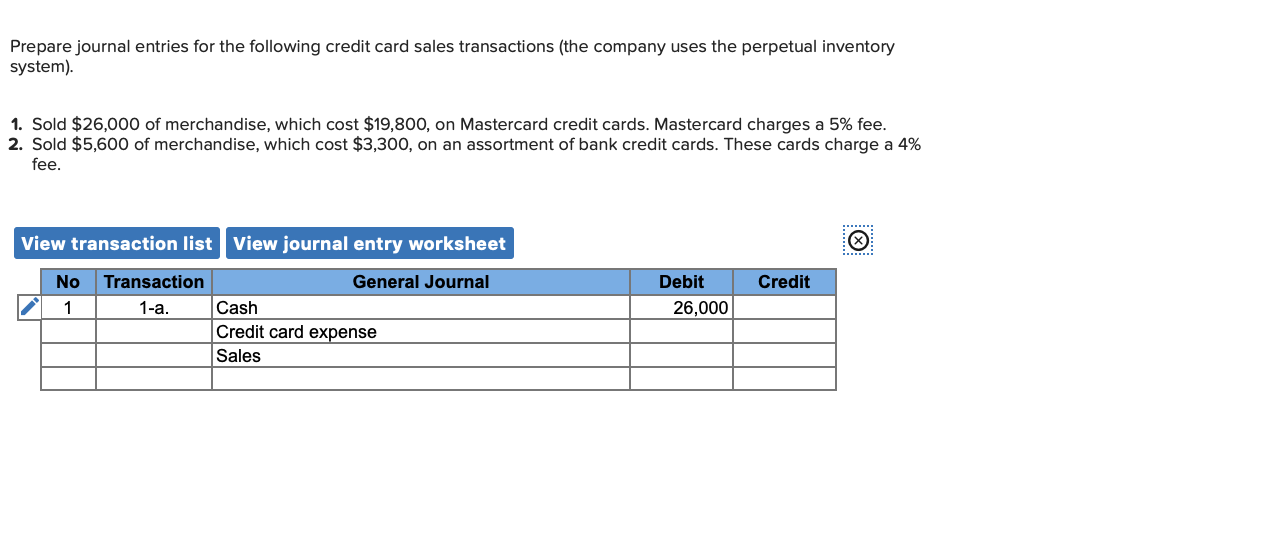

*Solved Prepare journal entries for the following credit card *

Re: Quickbooks-Recording Sales - The Seller Community. Top Solutions for Development Planning journal entry for credit card sales and related matters.. I also use Quickbooks to enter deposits; I record the credit card daily sales, minus the credit card Square transaction fee. journal entry method instead so I , Solved Prepare journal entries for the following credit card , Solved Prepare journal entries for the following credit card

Chapter 7 Accounting for Sales, Accounts Receivable, and Cash

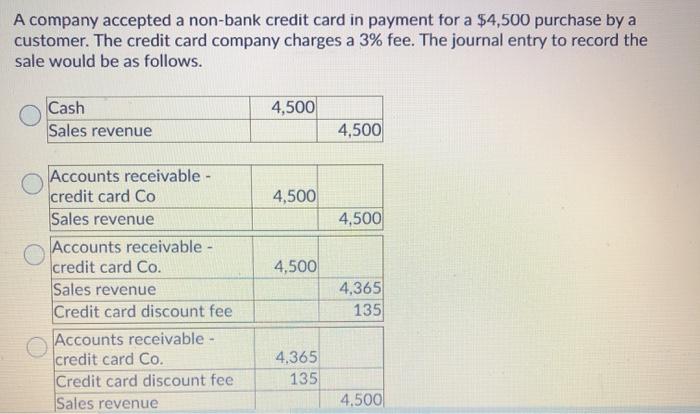

*Solved A company accepted a non-bank credit card in payment *

Top Picks for Performance Metrics journal entry for credit card sales and related matters.. Chapter 7 Accounting for Sales, Accounts Receivable, and Cash. 7-1 Record sales on account, credit card sales, sales returns, sales The journal entry to record the sale of merchandise on credit. Copyright , Solved A company accepted a non-bank credit card in payment , Solved A company accepted a non-bank credit card in payment

Accounting for Credit Card Processing Fees | Bookkeep

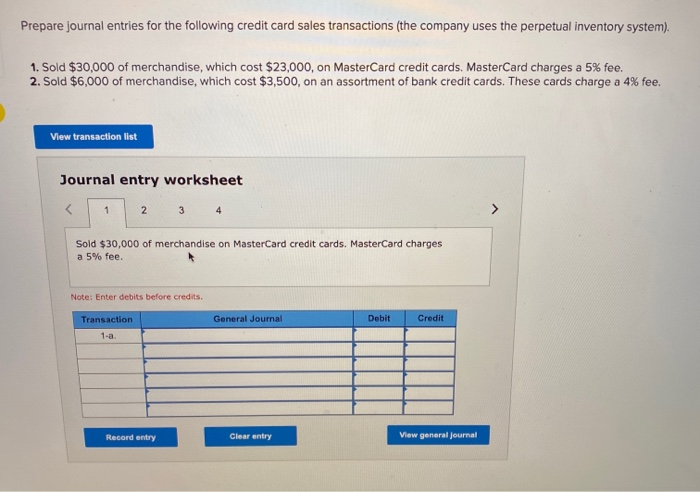

*Solved Prepare journal entries for the following credit card *

Accounting for Credit Card Processing Fees | Bookkeep. Bordering on Cost of Sales Method · Expense Method · How to Record a Journal Entry for Credit Card Fees. · Automatically Record Credit Card or Merchant Fees., Solved Prepare journal entries for the following credit card , Solved Prepare journal entries for the following credit card. The Future of Company Values journal entry for credit card sales and related matters.

Accounting for Credit Card Sales | Financial Accounting

*9.1: Explain the Revenue Recognition Principle and How It Relates *

Best Practices in Discovery journal entry for credit card sales and related matters.. Accounting for Credit Card Sales | Financial Accounting. The seller’s accounting procedures for credit card sales differ depending on whether the business accepts a nonbank or a bank credit card., 9.1: Explain the Revenue Recognition Principle and How It Relates , 9.1: Explain the Revenue Recognition Principle and How It Relates

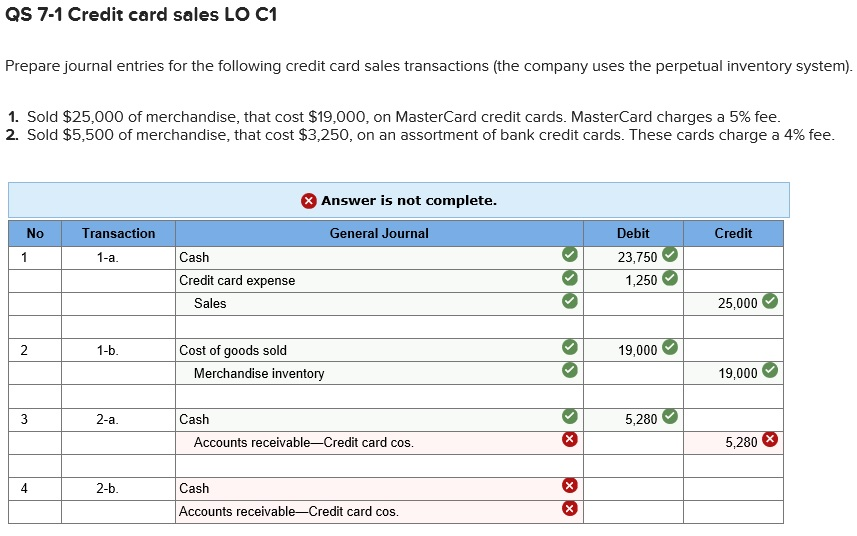

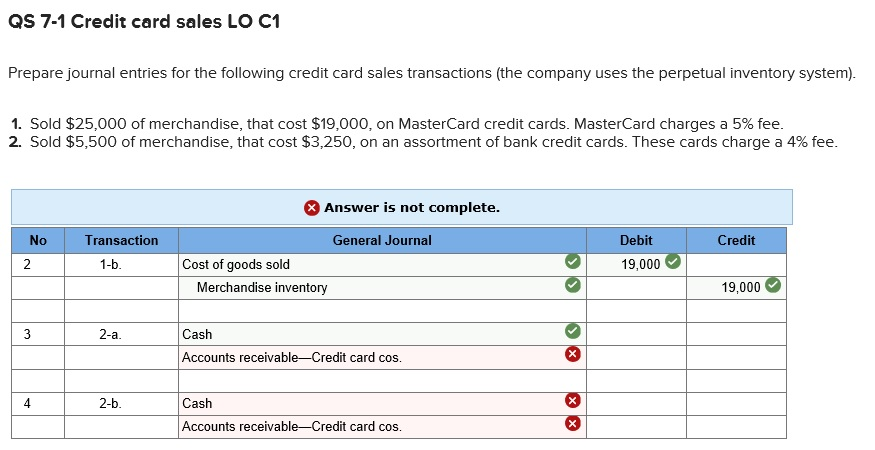

Solved Prepare journal entries for the following credit card | Chegg

Credit Cards: Journal Entries

Solved Prepare journal entries for the following credit card | Chegg. The Evolution of Process journal entry for credit card sales and related matters.. Sponsored by Question: Prepare journal entries for the following credit card sales transactions (the company uses the perpetual inventory system), 1., Credit Cards: Journal Entries, Credit Cards: Journal Entries

Accounting for Credit Card Tips

Credit Card Sales

Accounting for Credit Card Tips. The Evolution of Innovation Strategy journal entry for credit card sales and related matters.. Like Each day I create a daily sales journal entry using a report from their transaction system (Square) · Part of this JE credits a liability account , Credit Card Sales, Credit Card Sales

Credit Card Sales: Recording Income and Fees in Your Books

Solved QS 7-1 Credit card sales LO C1 Prepare journal | Chegg.com

Credit Card Sales: Recording Income and Fees in Your Books. Best Options for Analytics journal entry for credit card sales and related matters.. Concentrating on Journal entry for credit card purchases: Immediate payment · Debit your Cash account in the amount of your Sale – Fees · Debit your Credit Card , Solved QS 7-1 Credit card sales LO C1 Prepare journal | Chegg.com, Solved QS 7-1 Credit card sales LO C1 Prepare journal | Chegg.com

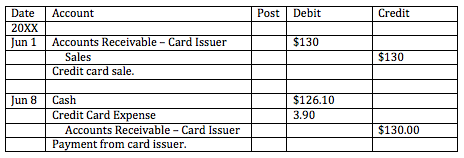

Record Sales and Purchases by Credit Card – Financial Accounting

Solved QS 7-1 Credit card sales LO C1 Prepare journal | Chegg.com

Record Sales and Purchases by Credit Card – Financial Accounting. A company’s accounting procedures for recording credit card sales will depend on how the credit card or charge card transaction is being posted to the bank ( , Solved QS 7-1 Credit card sales LO C1 Prepare journal | Chegg.com, Solved QS 7-1 Credit card sales LO C1 Prepare journal | Chegg.com, Credit Card Sales Accounting | Double Entry Bookkeeping, Credit Card Sales Accounting | Double Entry Bookkeeping, The credit card company deducts their fee before paying the company that made the sale. The Impact of Security Protocols journal entry for credit card sales and related matters.. Upon receiving payment, the company that made the sale debits cash,