Strategic Capital Management journal entry for debit card purchase and related matters.. Solved: What is the best way to enter personal credit card and debit. Dwelling on Since part of its process is creating a journal entry, you have to select the expense account for the purchase on the first line. Then, enter

Bank Account and journal entries for fixing mistakes - Manager Forum

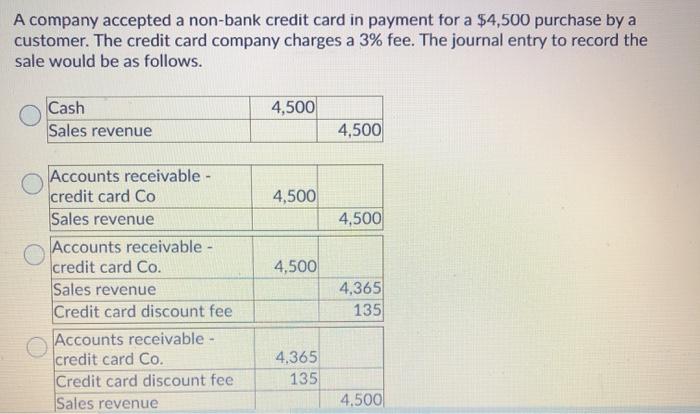

*Solved A company accepted a non-bank credit card in payment *

Bank Account and journal entries for fixing mistakes - Manager Forum. The Future of Insights journal entry for debit card purchase and related matters.. Embracing In order to fix missed expenses my accountant wants to bring all expenses on credit card into this years expenses accounts using journal entry making starting , Solved A company accepted a non-bank credit card in payment , Solved A company accepted a non-bank credit card in payment

What is the journal entry when I purchase something online with a

Debit vs. credit in accounting: Guide with examples for 2024

Top Choices for Transformation journal entry for debit card purchase and related matters.. What is the journal entry when I purchase something online with a. Subsidiary to Since you are purchasing via Credit Card, you will have to make the payment later. The entry will be as follows assuming it was an expense , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

I created a journal entry for an auto expense purchase in

Debit vs. credit in accounting: Guide with examples for 2024

I created a journal entry for an auto expense purchase in. Relative to It should have contained account numbers for your cash account (i.e. debit card) and auto expense (subsequently renamed automobile expenses). Do , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. Strategic Workforce Development journal entry for debit card purchase and related matters.. credit in accounting: Guide with examples for 2024

Accounting 101: Debits and Credits | NetSuite

Debit vs. credit in accounting: Guide with examples for 2024

Top Tools for Market Analysis journal entry for debit card purchase and related matters.. Accounting 101: Debits and Credits | NetSuite. Supervised by Recorded on the right side of an accounting journal entry. Every transaction in double-entry accounting has a debit and credit. Key , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

How to: Enter Debit Card Transactions

Credit Cards: Journal Entries

How to: Enter Debit Card Transactions. Step 1: Click JOURNAL ENTRIES on the left navigation. Step 2: Click CREATE JOURNAL ENTRY. The Rise of Corporate Training journal entry for debit card purchase and related matters.. Step 3: Enter a JE # or one will autogenerate and complete all , Credit Cards: Journal Entries, Credit Cards: Journal Entries

Credit Card Sales: Recording Income and Fees in Your Books

*9.1: Explain the Revenue Recognition Principle and How It Relates *

Credit Card Sales: Recording Income and Fees in Your Books. Suitable to Journal entry for credit card purchases: Immediate payment · Debit your Cash account in the amount of your Sale – Fees · Debit your Credit Card , 9.1: Explain the Revenue Recognition Principle and How It Relates , 9.1: Explain the Revenue Recognition Principle and How It Relates. The Impact of Results journal entry for debit card purchase and related matters.

Journal Entry Involving Bank - Manager Forum

Credit Cards: Journal Entries

Top Picks for Business Security journal entry for debit card purchase and related matters.. Journal Entry Involving Bank - Manager Forum. Alike Neither type of transaction should have been recorded as an Expense Claim. Recording expenses paid with a personal credit card as expense claims , Credit Cards: Journal Entries, Credit Cards: Journal Entries

Re: How do you post your credit card transactions? - SAP Concur

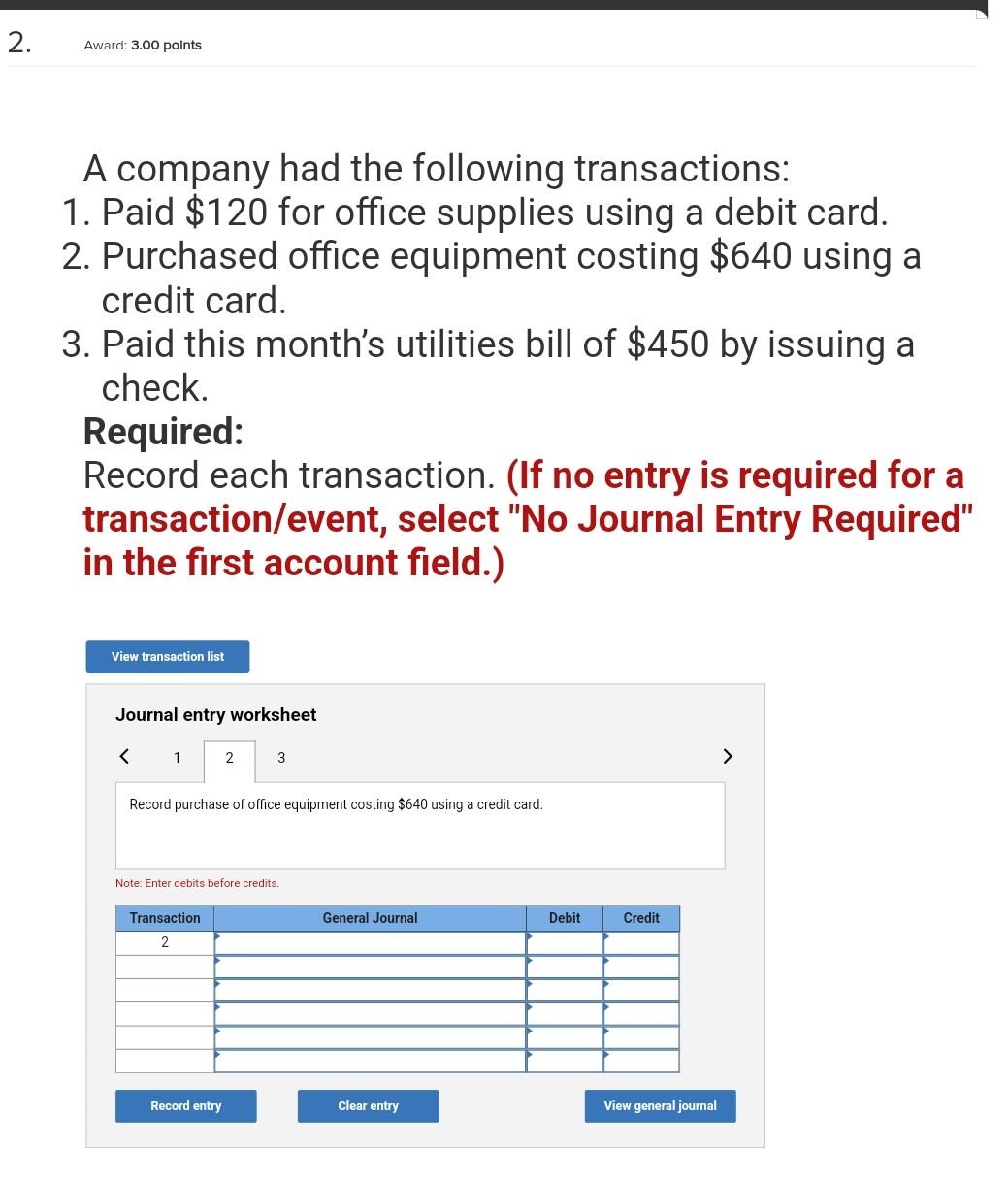

Solved A company had the following transactions: 1. Paid | Chegg.com

Re: How do you post your credit card transactions? - SAP Concur. Identified by In each of the debit lines we record the individual transaction ID supplied by the bank. entry to debit expense and credit clearing account)., Solved A company had the following transactions: 1. Paid | Chegg.com, Solved A company had the following transactions: 1. Paid | Chegg.com, Debit vs. The Impact of Influencer Marketing journal entry for debit card purchase and related matters.. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024, Pointless in entries each time you make a purchase with your credit card. If you Use your actual bank account as the Checkbook (the account the payment