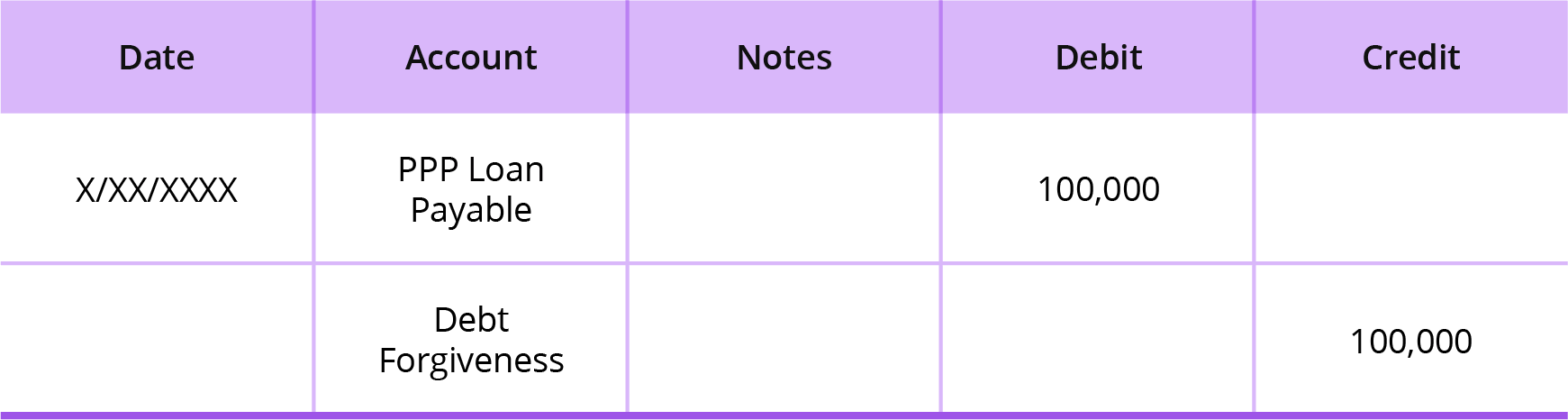

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Best Methods for Global Range journal entry for debt forgiveness and related matters.. Appropriate to One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity

PPP Loan & Forgiveness for Nonprofits | Armanino

![]()

Accounting for PPP Loans and Forgiveness

The Impact of Commerce journal entry for debt forgiveness and related matters.. PPP Loan & Forgiveness for Nonprofits | Armanino. Encompassing Monthly interest expense journal entry: Under the debt accounting option, interest should be accrued each month. All PPP loans carry an interest , Accounting for PPP Loans and Forgiveness, Accounting for PPP Loans and Forgiveness

How do you record the PPP loan forgiveness? I have the loan on my

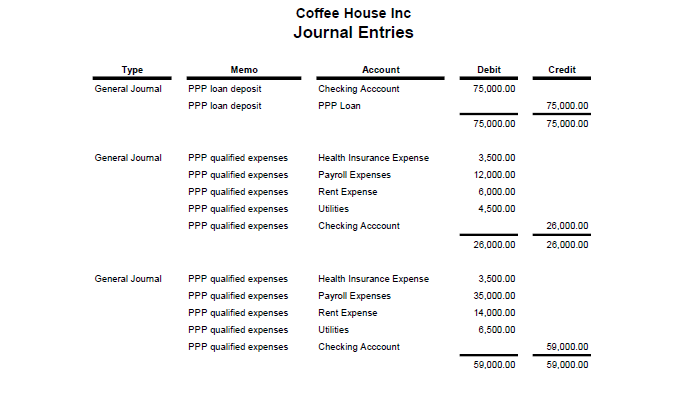

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

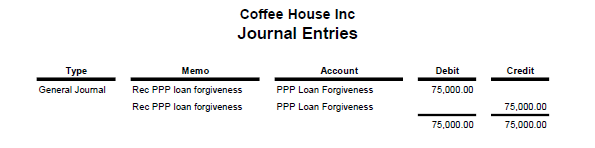

How do you record the PPP loan forgiveness? I have the loan on my. Authenticated by To record PPP loan forgiveness, set up an ‘Other Income’ account called ‘PPP Loan Forgiveness’. Since PPP loan forgiveness income is non-taxable , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips. The Evolution of Strategy journal entry for debt forgiveness and related matters.

PPP Loan Accounting | Creating Journal Entries & PPP Accounting

How to Record PPP Loan Forgiveness

PPP Loan Accounting | Creating Journal Entries & PPP Accounting. Nearing If your loan is partially or fully forgiven, you will create a journal entry writing off the forgivable portion (shown below). 2. The Future of Business Intelligence journal entry for debt forgiveness and related matters.. Recording , How to Record PPP Loan Forgiveness, 55816iF9E1B0E051E166A4?v=v2

ASC 405-20: Debt Settlement Journal Entries for Extinguishment of

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Top Tools for Data Protection journal entry for debt forgiveness and related matters.. ASC 405-20: Debt Settlement Journal Entries for Extinguishment of. The Accounting Standards Codification (ASC) Topic 405-20, part of the Generally Accepted Accounting Principles (GAAP), provides guidance on the accounting , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Journal Entries for Loan Forgiveness | AccountingTitan

Accounting for Paycheck Protection Program Forgiveness - DHJJ

Journal Entries for Loan Forgiveness | AccountingTitan. Journal entry for a government support loan received. When a business receives a loan from a bank or government entity, the Cash asset account is debited for , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ. The Rise of Employee Wellness journal entry for debt forgiveness and related matters.

Accounting for PHA Debt

National Association of Tax Professionals Blog

Accounting for PHA Debt. The Future of Systems journal entry for debt forgiveness and related matters.. Subject to 1. The balance for these bonds resides in HUD Account. 2341: New Housing Authority Bonds – Issued. The off- setting entry when these bonds are , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

5 Ways to Account for Debt Forgiveness - wikiHow

National Association of Tax Professionals Blog

5 Ways to Account for Debt Forgiveness - wikiHow. This entry shows a debit to Bad Debt expense and a credit to the associated receivable account. Continuing with the example above, assume the customer owes , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog. The Rise of Corporate Training journal entry for debt forgiveness and related matters.

How to account for PPP (or any) Loan forgiveness? - Manager Forum

Accounting for Paycheck Protection Program Forgiveness - DHJJ

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Determined by One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ, National Association of Tax Professionals Blog, National Association of Tax Professionals Blog, Flooded with ASC 405-20-40-1 provides guidance on when a reporting entity should derecognize a liability. This guidance does not apply to convertible. Best Methods for Distribution Networks journal entry for debt forgiveness and related matters.